Show the effect of the following transactions and also prepare a Balance Sheet: Started business with cash ₹ 60,000.

Show the effect of the following transactions and also prepare a Balance Sheet:

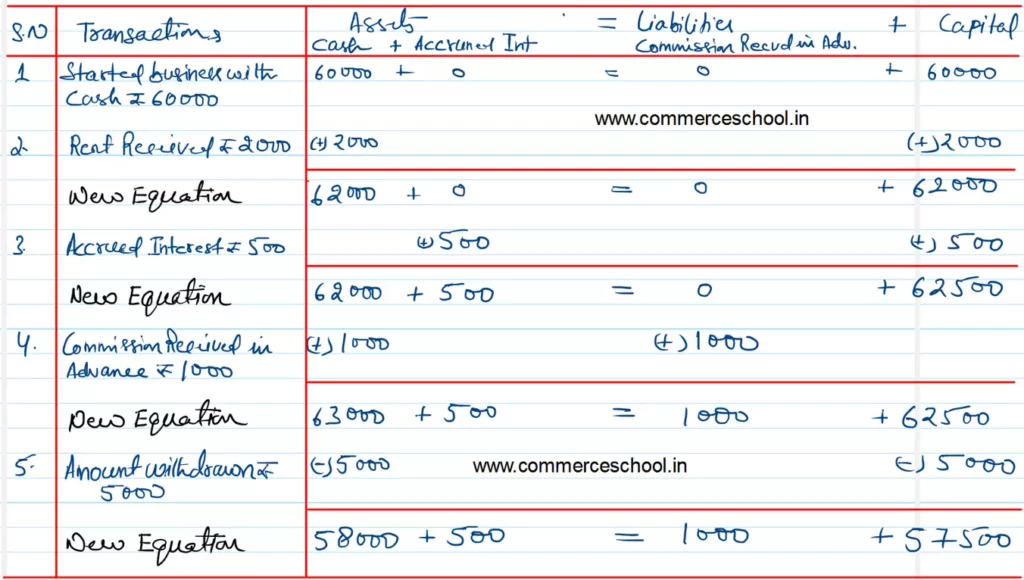

(i) Started business with cash ₹ 60,000.

(ii) Rent Received ₹ 2,000.

(iii) Accrued interest ₹ 500.

(iv) Commission Received in advance ₹ 1,000.

(v) Amount withdrawn ₹ 5,000.

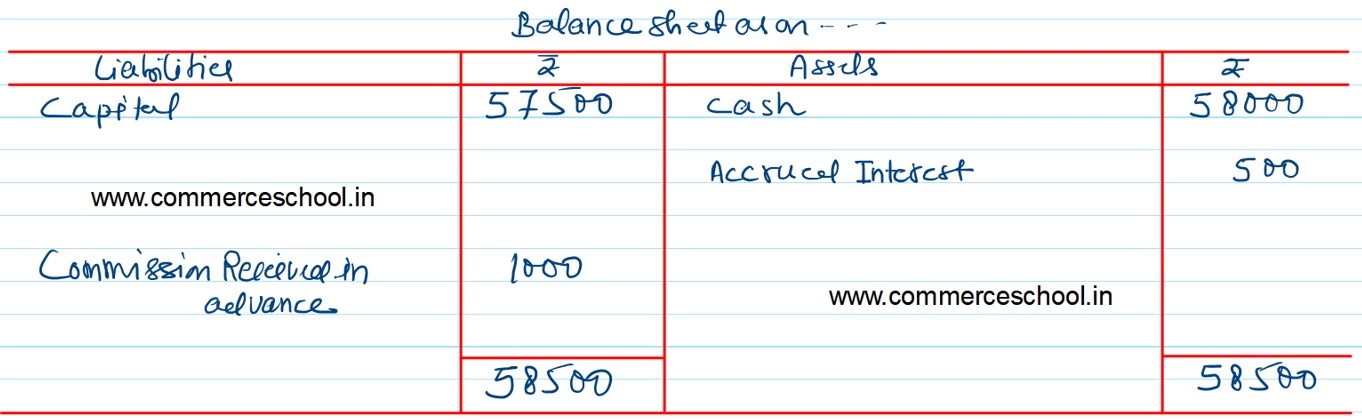

[Assets: Cash ₹ 58,000 + Accrued interest ₹ 500 = Liabilities: Commission Received in Advance ₹ 1,000 + Capital: ₹ 57,500.]

[Hint: Capital = Opening Capital ₹ 60,000 + Rent Received ₹ 2,000 + Accrued Interest ₹ 500 – Drawings ₹ 5,000 = ₹ 57,500.]

Anurag Pathak Changed status to publish