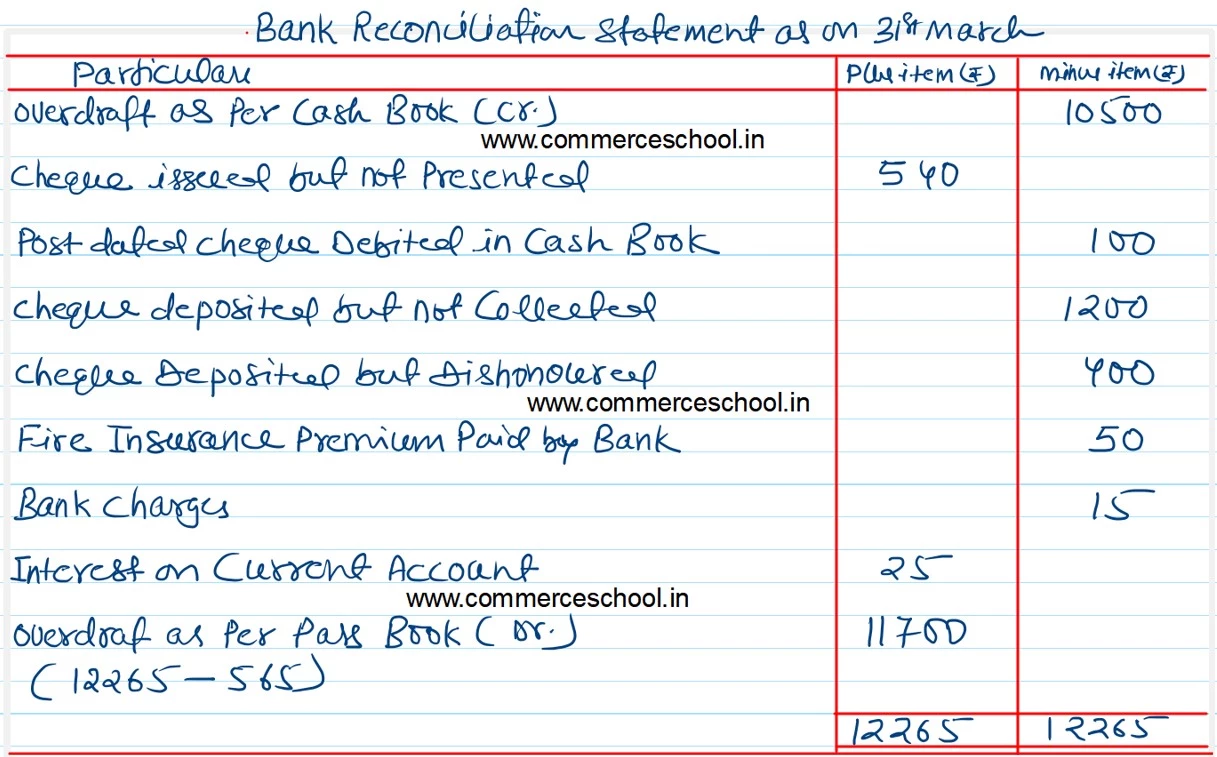

On 31st March, 2023, a merchant’s Cash Book showed a credit bank balance of ₹ 10,500 but due to the following reasons the Pass Book showed a difference:

Prepare Bank Reconciliation Statement from the following:

On 31st March, 2023, a merchant’s Cash Book showed a credit bank balance of ₹ 10,500 but due to the following reasons the Pass Book showed a difference:

(i) A cheque of ₹ 540 issued to Mohan has not been presented for payment.

(ii) A post-dated cheque for ₹ 100 has been debited in the Bank column of the Cash Book but under no circumstances was it possible to present it.

(iii) Four cheques of ₹ 1,200 sent to the bank have not been collected so far. A cheque of ₹ 400 deposited in the bank has been dishonoured.

(iv) As per instructions, the bank paid ₹ 50 as Fire Insurance premium but the entry has not been made in the Cash Book.

(v) There was a debit in the Pass Book of ₹ 15 in respect of bank charges and a credit of ₹ 25 for interest on Current Account but no record exists in the Cash Book

(vi) Cheque of ₹ 5,000 dated 15th April, 2022 issued to M & Co. was dishonoured being post dated. It was also not recorded in the Books of account yet.

[Overdraft as per Pass Book – ₹ 11,700.]