Following balances appear in the books of Priyank Brothers:

Following balances appear in the books of Priyank Brothers:

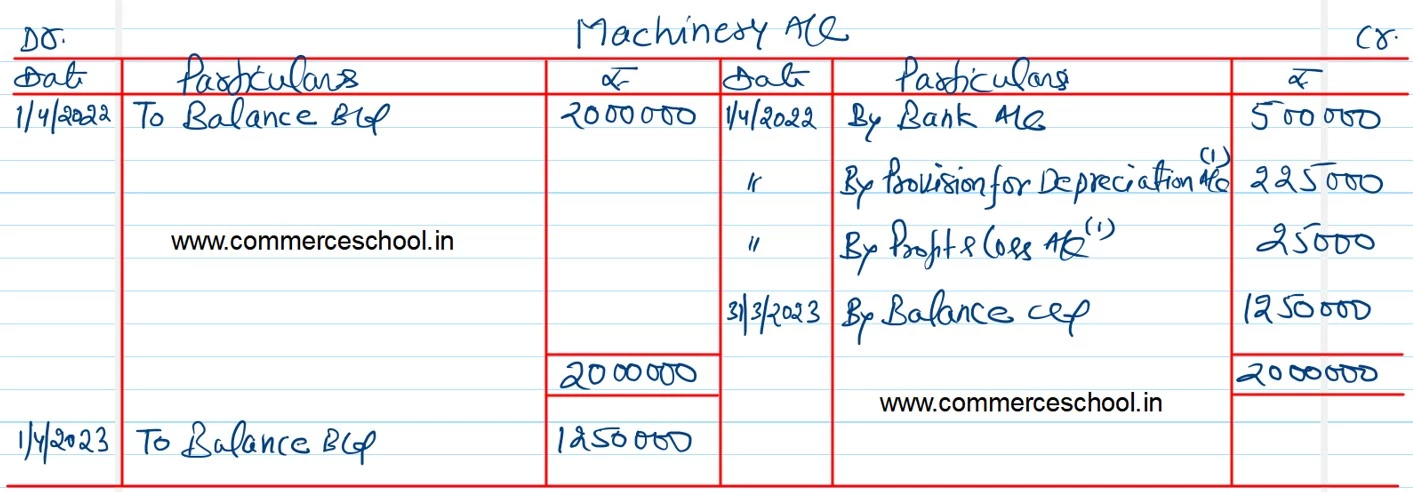

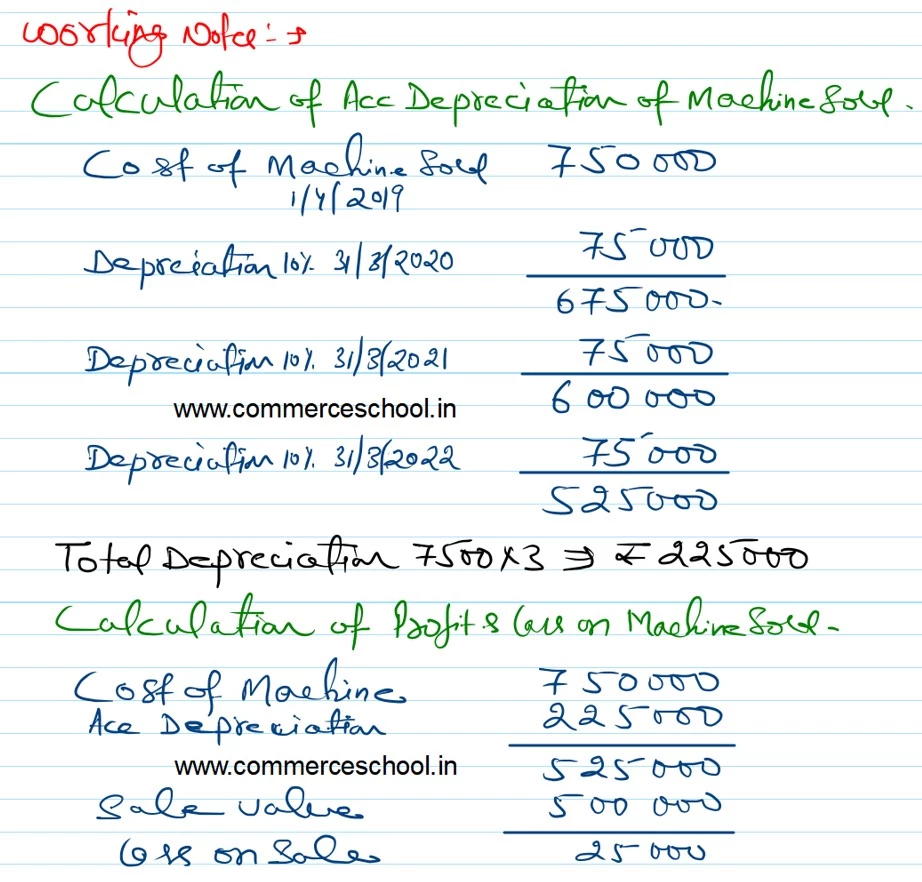

On 1st April, 2022, they decide to sell a machine for ₹ 5,00,000. This machine was purchased for ₹ 7,50,000 on 1st April, 2019. Prepare the Machinery Account and Provision for Depreciation Account for the year ended 31st March, 2023 assuming that the firm has been charging Depreciation @ 10% p.a. on the Straight Line Method.

[Loss on Sale of Machinery – ₹ 25,000; Balance of Machinery A/c (31.3.2023) – ₹ 12,50,000; Provision for Depreiciation A/c – ₹ 7,00,000.]

| 1st April, 2022 | Machinery A/c Provision for Depreciation A/c | 20,00,000 8,00,000 |

Anurag Pathak Changed status to publish