Following balances appear in the books of Kaushal Traders as on 1st April, 2022:

Following balances appear in the books of Kaushal Traders as on 1st April, 2022:

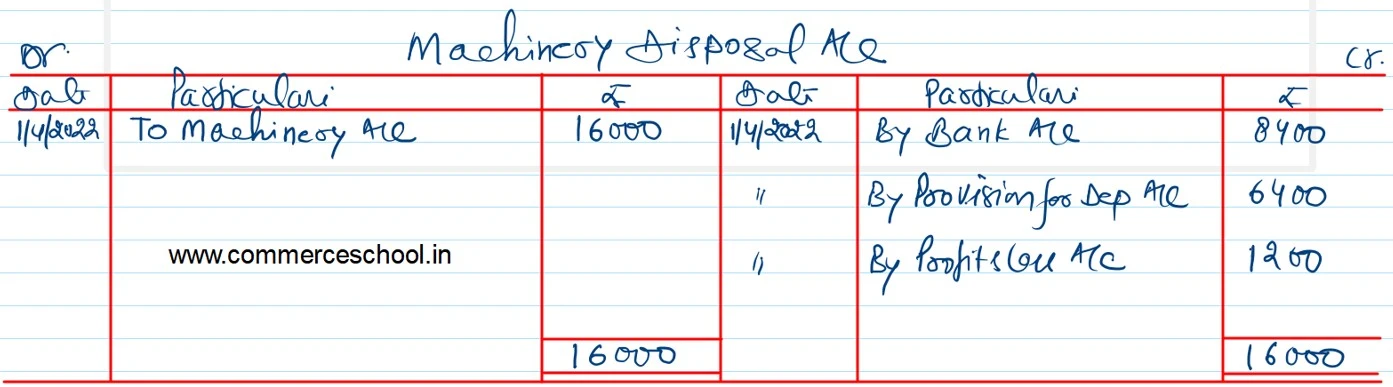

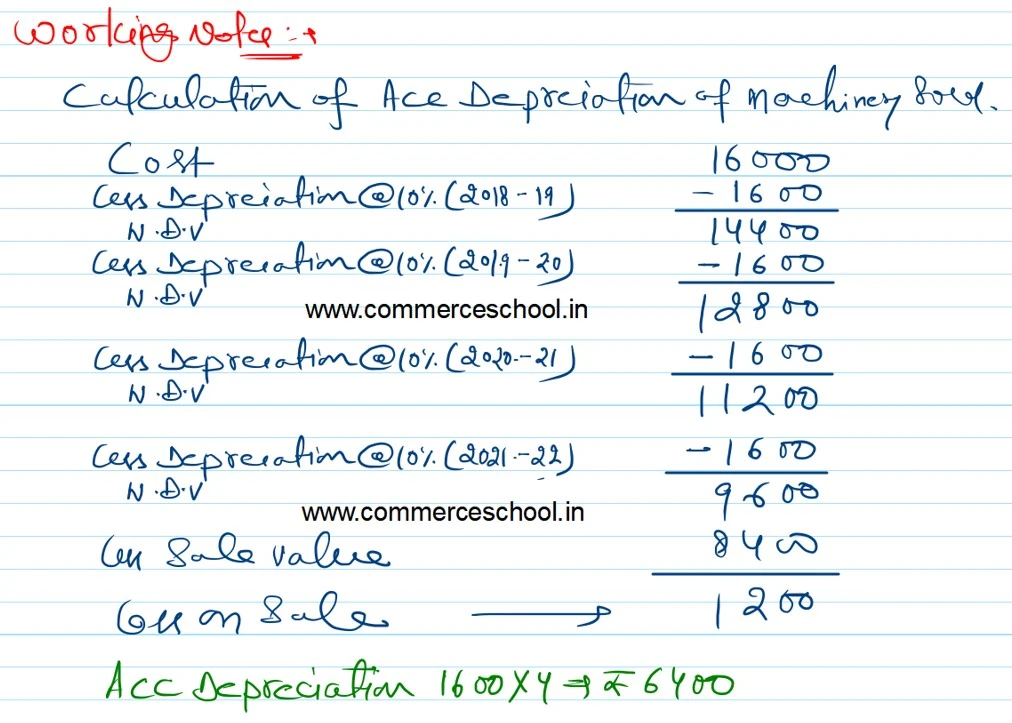

On 1st April, 2022, they decided to dispose off a machinery for ₹ 8,400 which was purchased on 1st April, 2018 for ₹ 16,000.

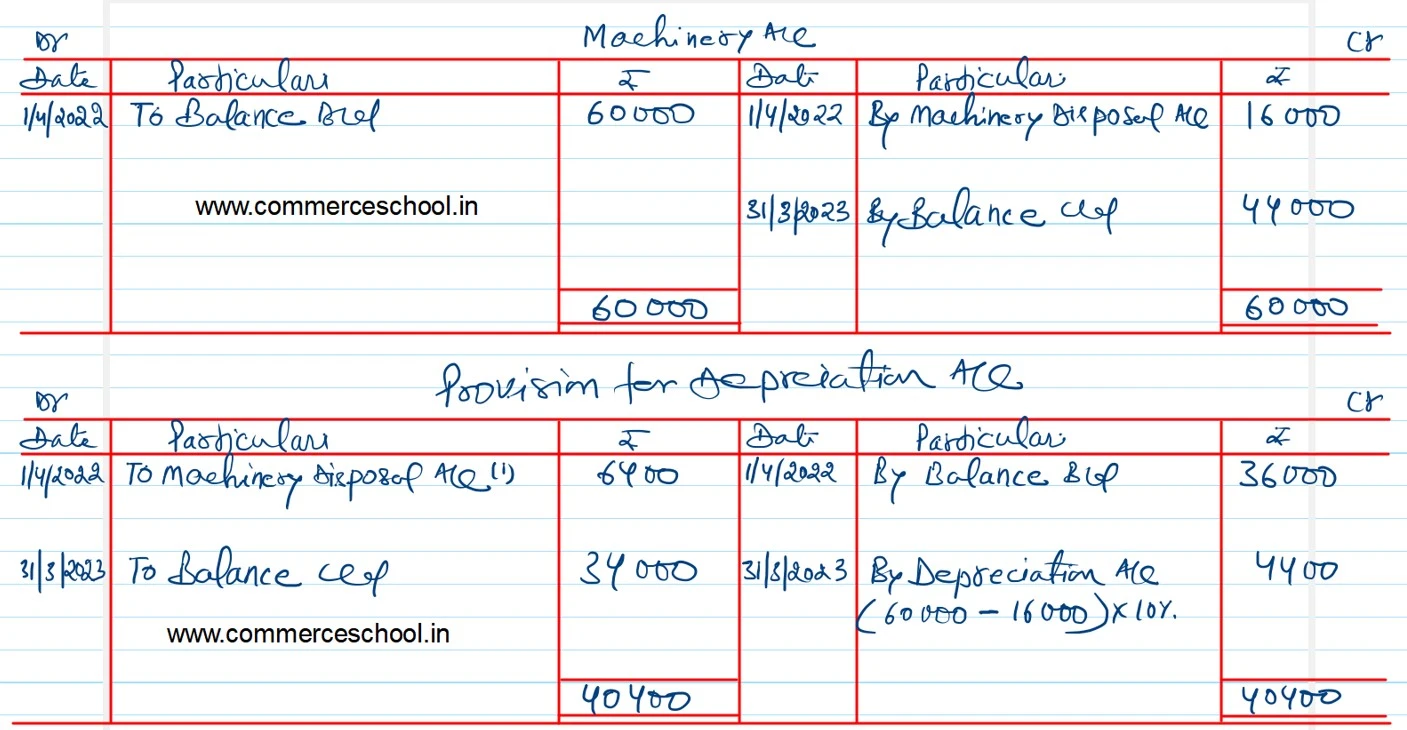

You are required to prepare the Machinery Account, Provision for Depreciation Account and Machinery Disposal Account for the year ended 31st March, 2023. Depreciation was charged at 10% p.a. on Cost following Straight Line Method.

[Balance of Machinery A/c (31st March, 2023) – ₹ 44,000; Provision for Depreciation A/c (31st March, 2023) – ₹ 34,000; Loss on Sale of Machinery – ₹ 1,200.]

| 2022 1st April | Machinery A/c Provision for Depreciation A/c | 60,000 36,000 |

Anurag Pathak Changed status to publish