A and B are carrying on business in partnership and sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 stood as:

A and B are carrying on business in partnership and sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 stood as:

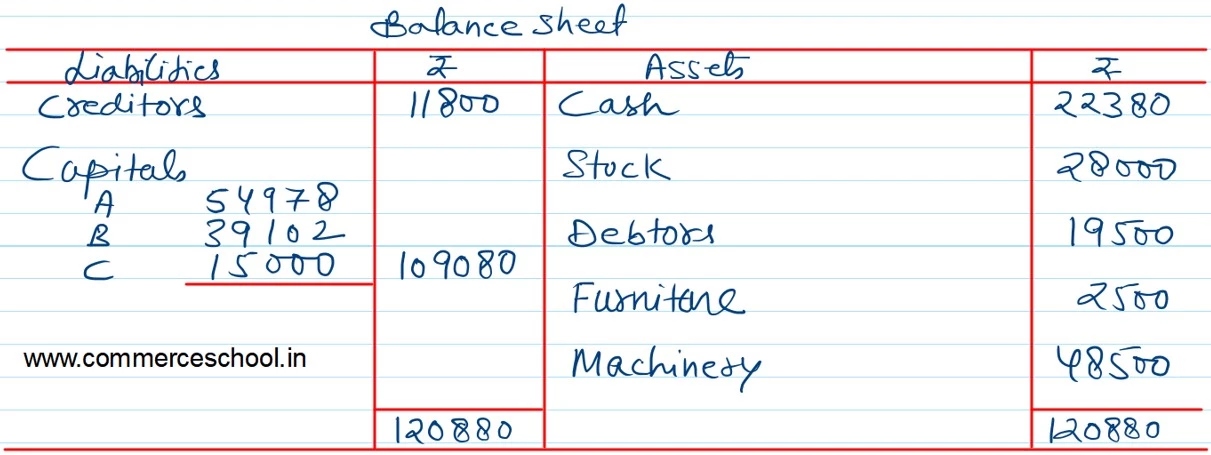

| Liabilities | ₹ | Assets | ₹ |

| Creditors

General Reserve A’s Capital B’s Capital |

11,800 20,000 51,450 36,750 |

Cash

Stock Debtors Furniture Machinery Goodwill |

1,500 28,000 19,500 2,500 48,500 20,000 |

| 1,20,000 | 1,20,000 |

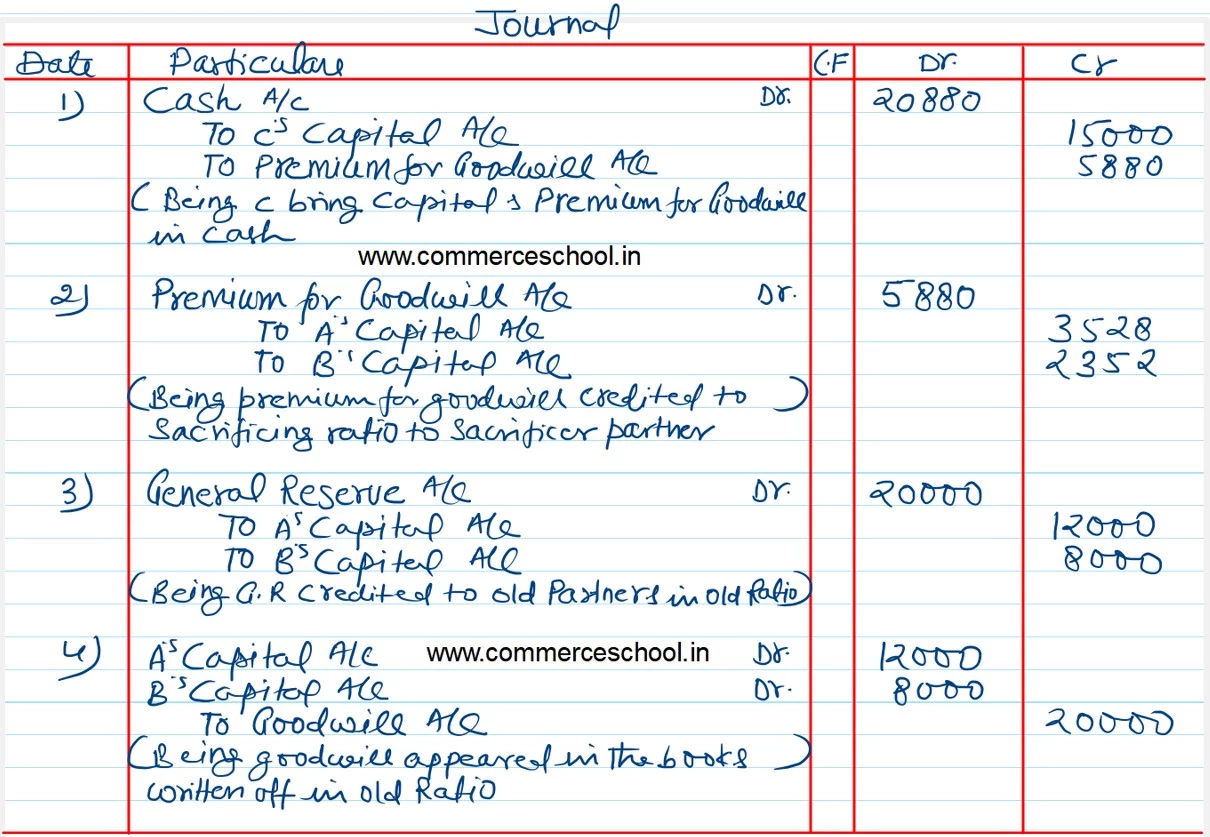

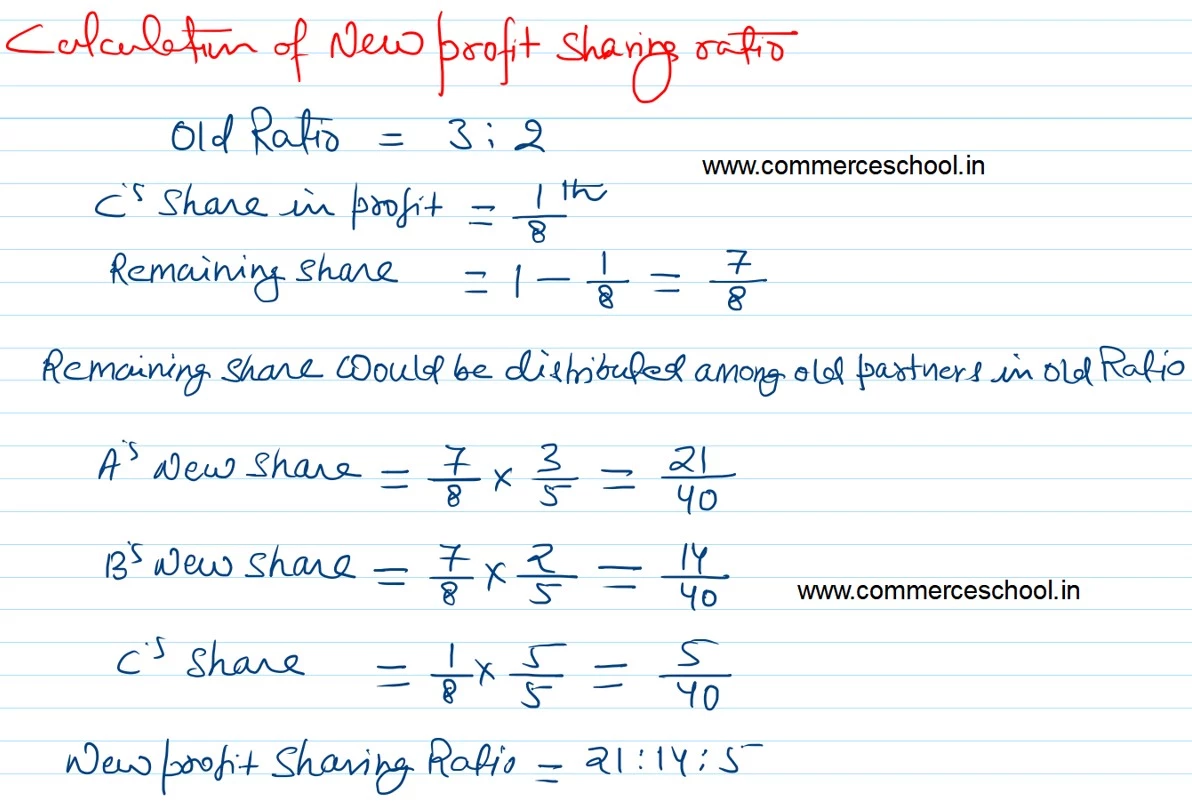

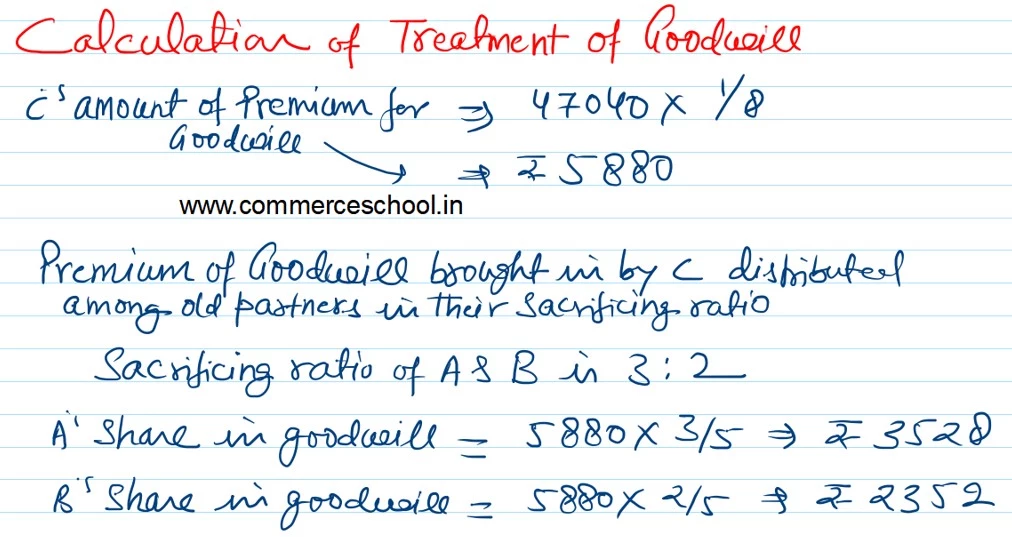

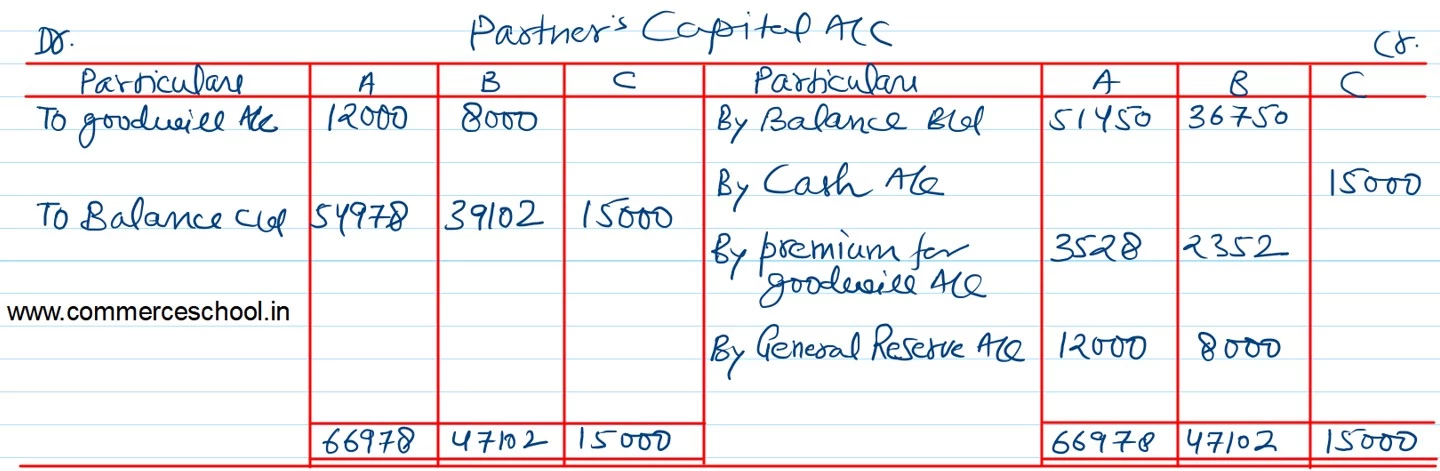

They admit C into partnership on 1st April, 2023 and give him 1/8th share in future profits on the following terms:

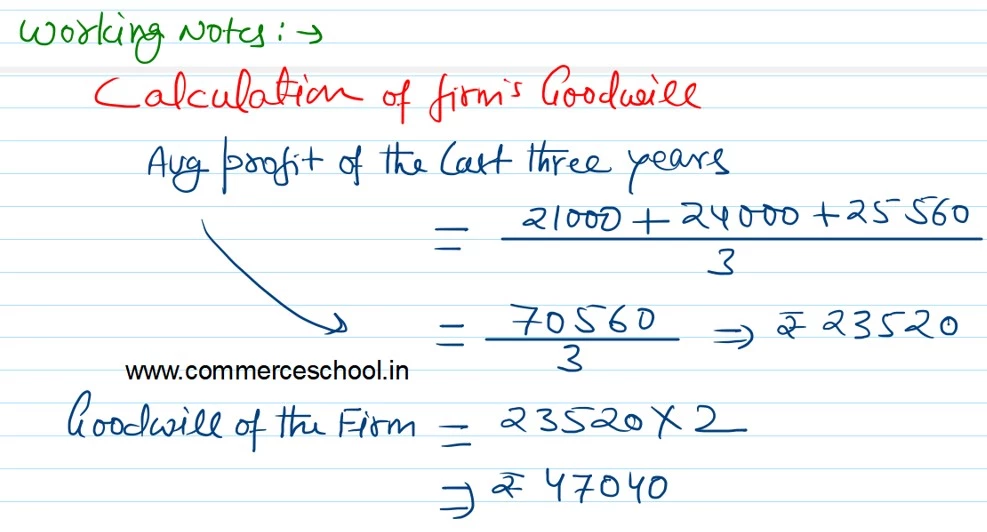

a) Goodwill of the firm be valued at twice the average of the last three year’s profits which amounted to ₹ 21,000; ₹ 24,000 and ₹ 25,560.

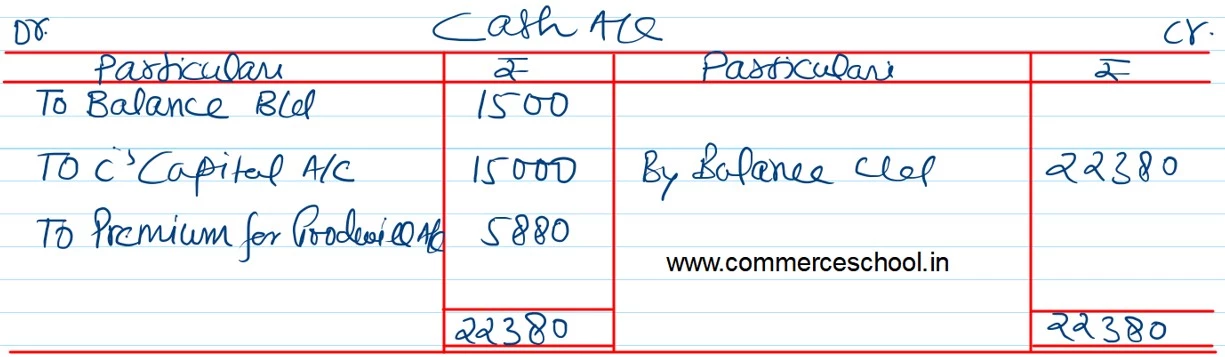

b) C is to bring cash for the amount of his share of goodwill.

c) C is to bring cash ₹ 15,000 as his capital.

Pass Journal entries recording these transactions, draw out the Balance Sheet of the new firm and determine new profit sharing ratio.