A and B are partners in a business sharing profits and losses in the ratio of 3 : 2. Their capitals on 31st March, 2024, after the adjustment of net profits and drawings amounted to ₹ 2,00,000 and ₹ 1,50,000 respectively

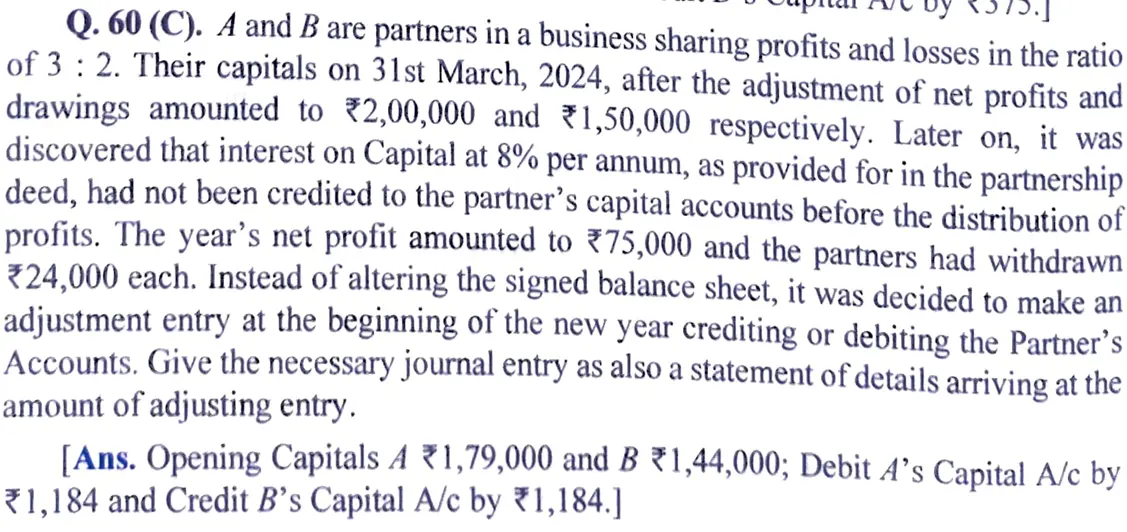

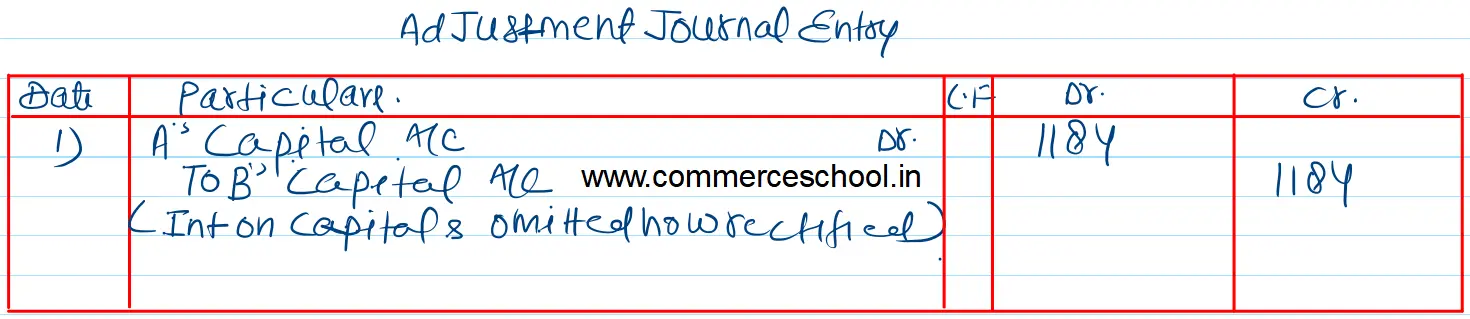

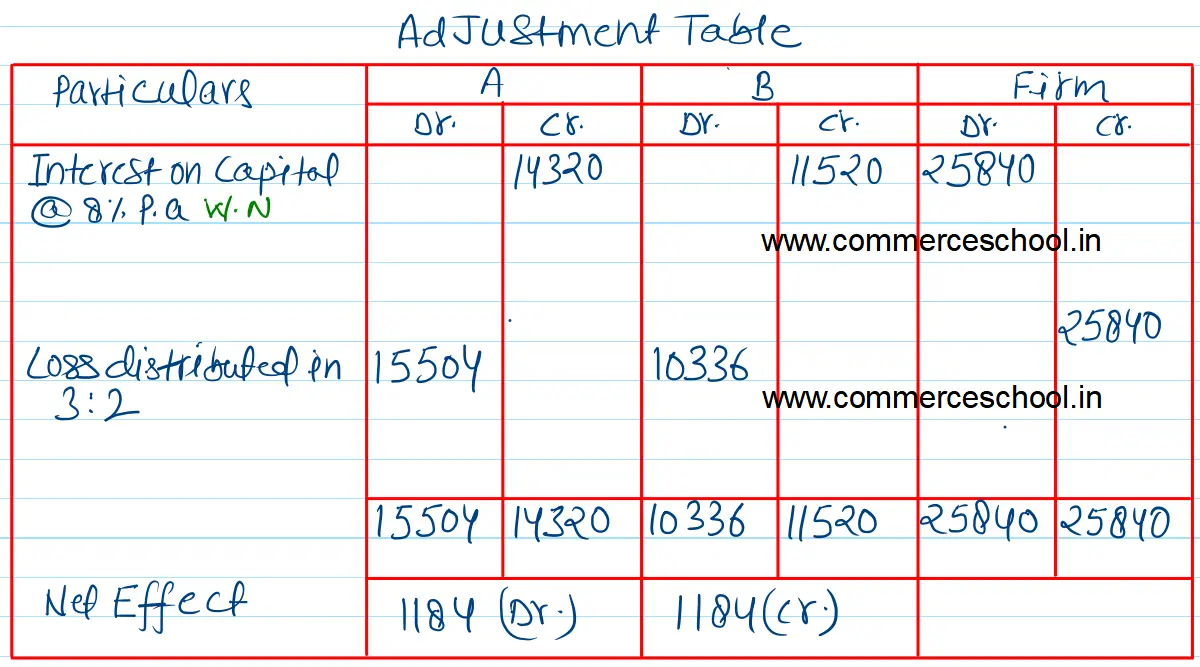

A and B are partners in a business sharing profits and losses in the ratio of 3 : 2. Their capitals on 31st March, 2024, after the adjustment of net profits and drawings amounted to ₹ 2,00,000 and ₹ 1,50,000 respectively. Later on, it was discovered that interest on Capital at 8% per annum, as provided for in the partnership deed, had not been credited to the partner’s capital accounts before the distribution of profits. The year’s net profit amounted to ₹ 75,000 and the partners had withdrawn ₹ 24,000 each. Instead of altering the signed balance sheet, it was decided to make an adjustment entry at the beginning of the new year crediting or debiting the Partner’s Accounts. Give the necessary journal entry as also a statement of details arriving at the amount of adjusting entry.

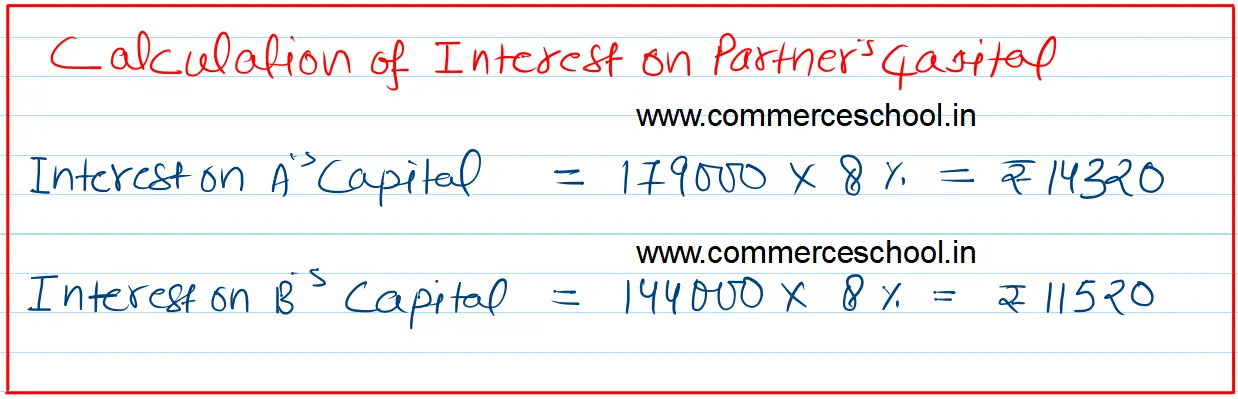

[Ans. Opening Capitals A ₹ 1,79,000 and B ₹ 1,44,000; Debit A’s Capital A/c by ₹ 1,184 and Credit B’s Capital A/c by ₹ 1,184.]