A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2023, their Balance Sheet was as follows:

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Loan by Mrs. A Loan by B Reserve A’s Capital B’s Capital |

38,000 10,000 15,000 5,000 10,000 8,000 |

Cash at Bank

Stock Debtors Furniture Plant Investments Profit & Loss A/c |

11,500 6,000 19,000 4,000 28,000 10,000 7,500 |

| 86,000 | 86,000 |

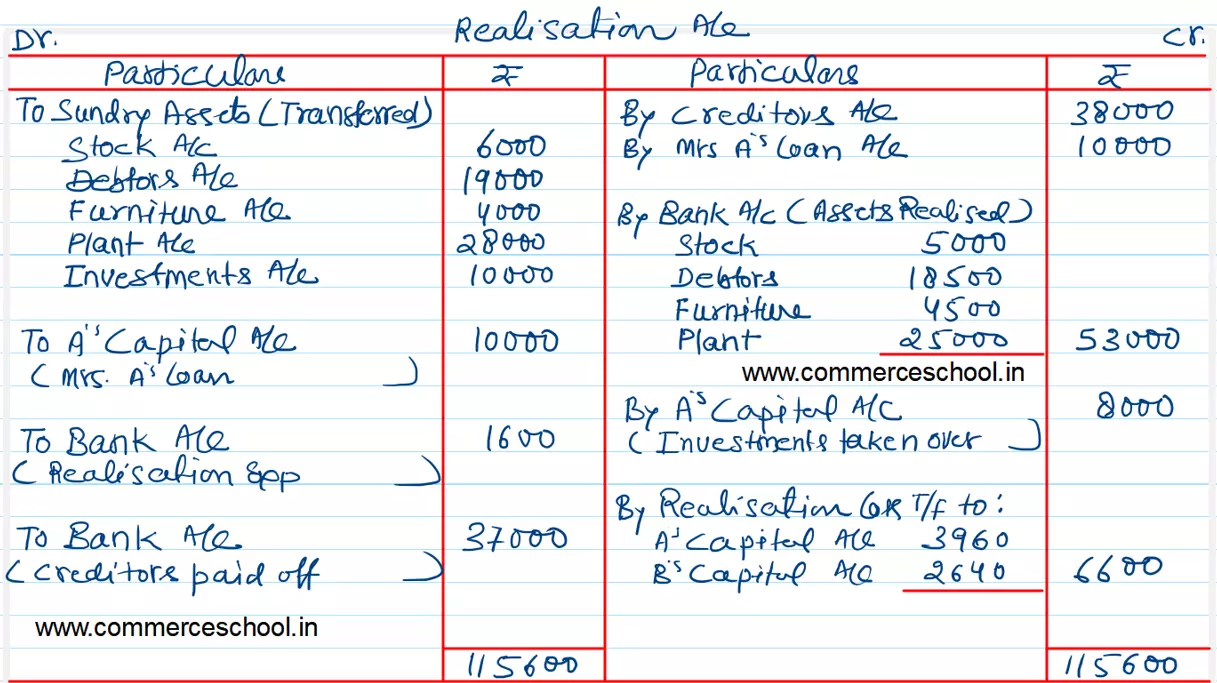

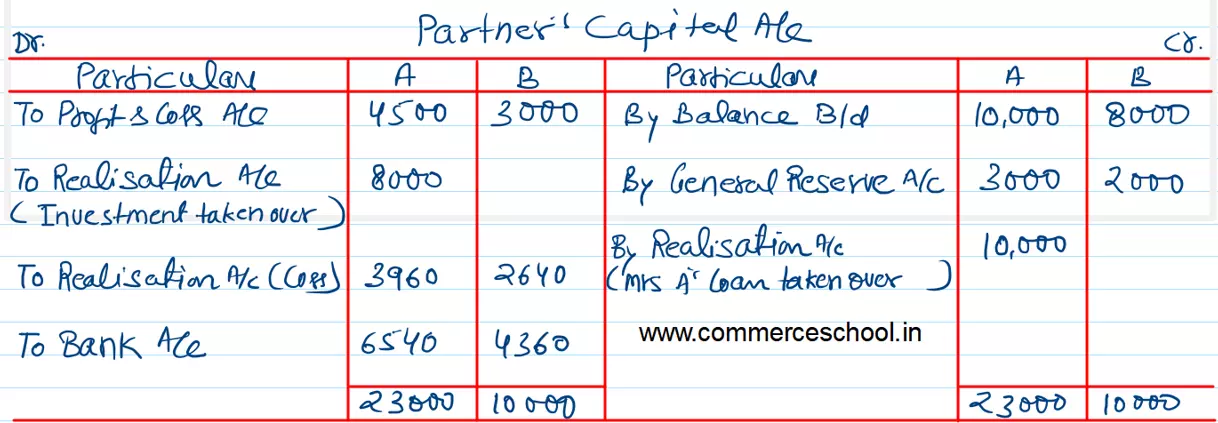

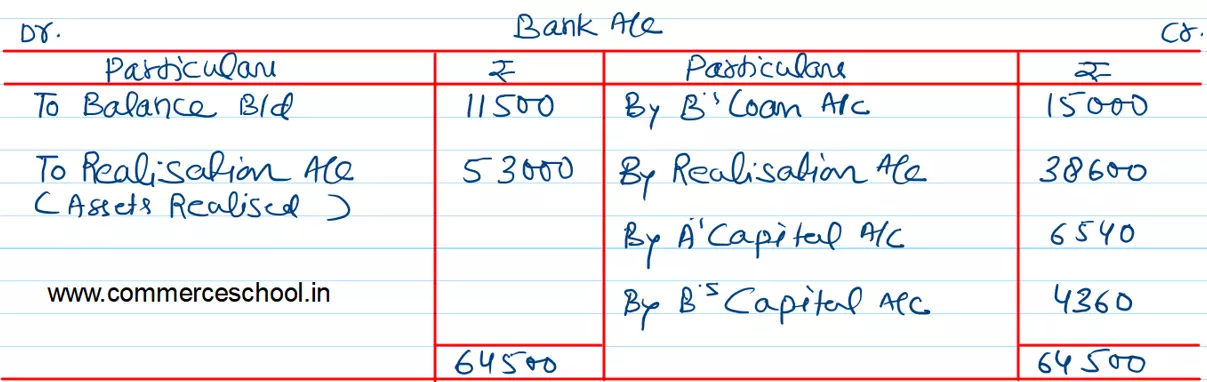

The firm was dissolved on 31st March, 2023 and both the partners agreed to the following:

(a) A took investments at an agreed value of ₹ 8,000. He also agreed to settle Loan by Mrs. A.

(b) Other assets realised as: Stock – ₹ 5,000; Debtors – ₹ 18,500; Furniture – ₹ 4,500; Plant – ₹ 25,000.

(c) Expenses of realistion came to ₹ 1,600.

(d) Creditors agreed to accept ₹ 37,000 in full settlement of their claims.

Prepare Realisaiton Account, Partner’s Capital Accounts and Bank Account.

[Ans.: Loss on Realisation – ₹ 6,600; A to be paid – ₹ 6,540; B to be paid – ₹ 4,360; Total of Bank Account – ₹ 64,500.]