A and B are partners sharing profits and loss in the ratio of their capitals which were ₹ 6,00,000 and ₹ 4,00,000 respectively on 1st April 2023. The partnership deed provides that:

A and B are partners sharing profits and loss in the ratio of their capitals which were ₹ 6,00,000 and ₹ 4,00,000 respectively on 1st April 2023. The partnership deed provides that:

(i) Both partners will get monthly salary of ₹ 20,000 each;

(ii) Interest on capital will allowed @ 8% p.a.

(iii) A will get a quarterly rent of ₹ 24,000 for the use of his property by the firm.

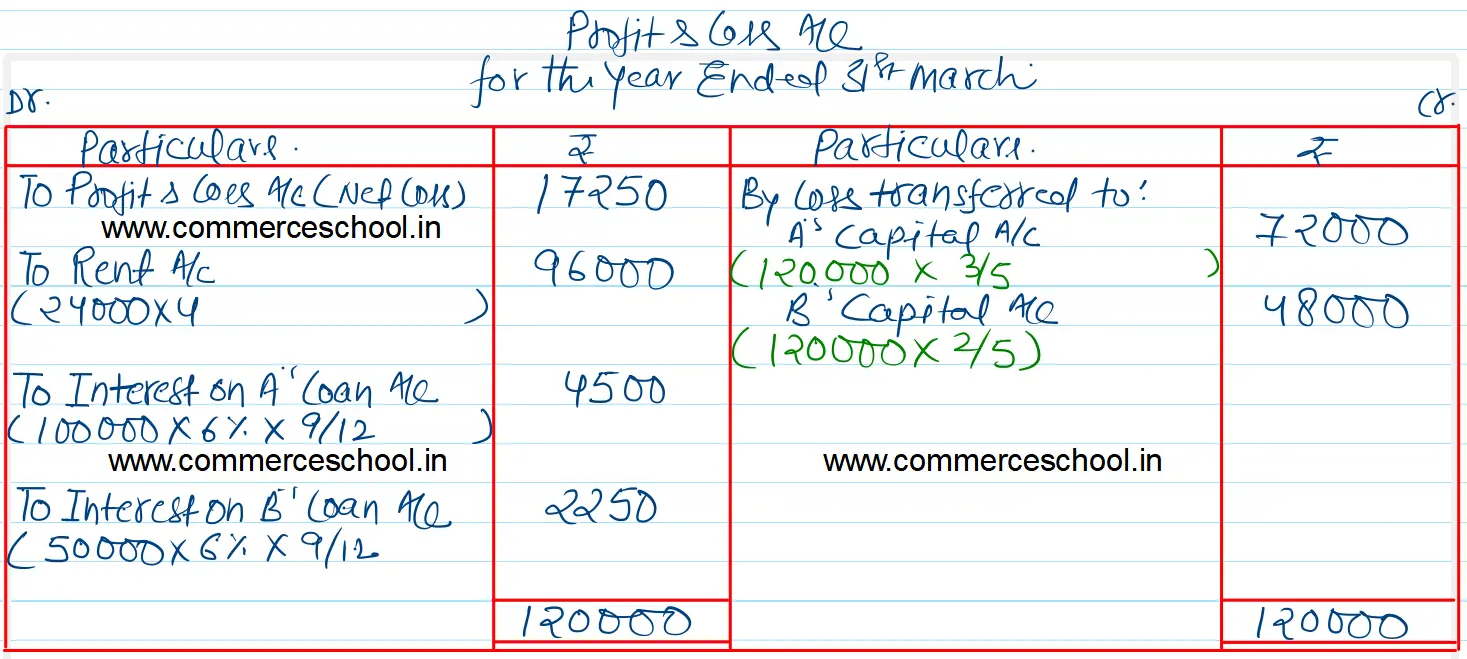

On 1st July, 2023 A and B granted loans of ₹ 1,00,000 and ₹ 50,000 respectively to the firm. During the year ended 31st March 2024, the firm incurred a loss of ₹ 17,250 before any adjustment is made as per partnership deed.

Prepare an account showing the distribution of profit/loss.

[Ans. Share of Loss : A ₹ 72,000 and B ₹ 48,000.]

Anurag Pathak Answered question