A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st April, 2017 they admitted C as a new partner for 1/4 share in the profits of the firm

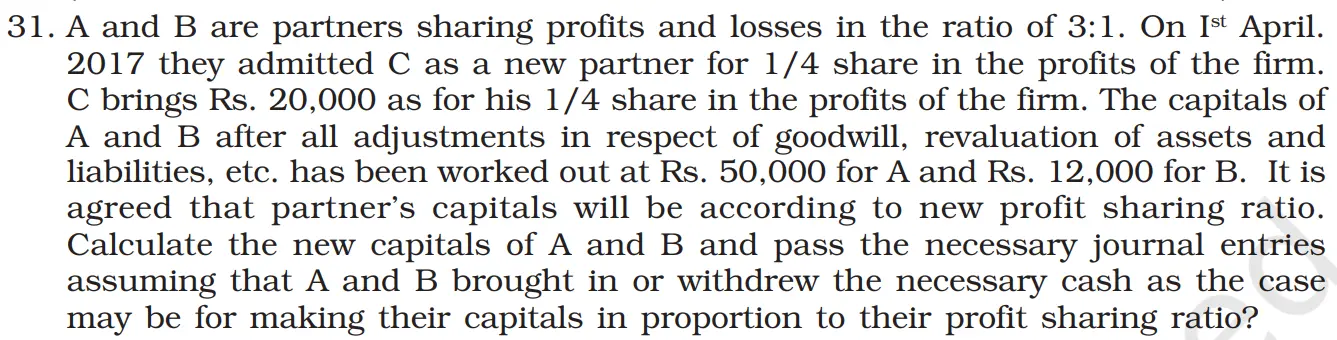

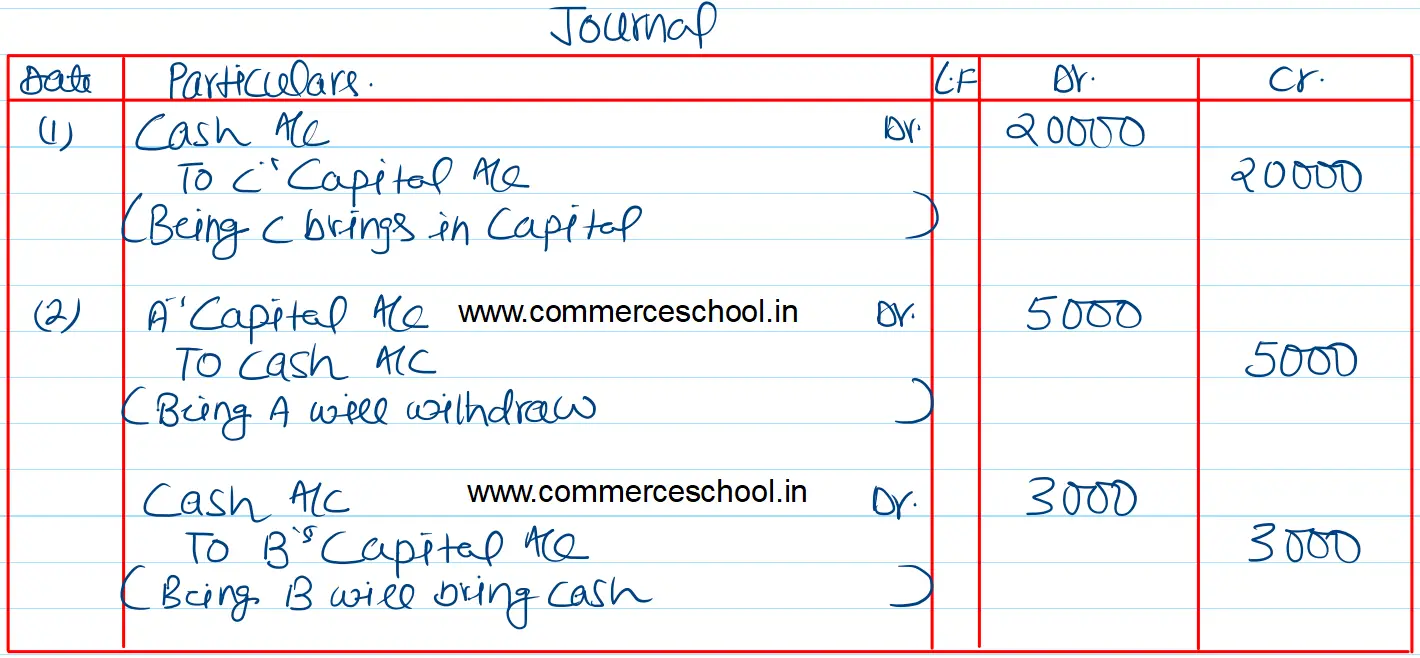

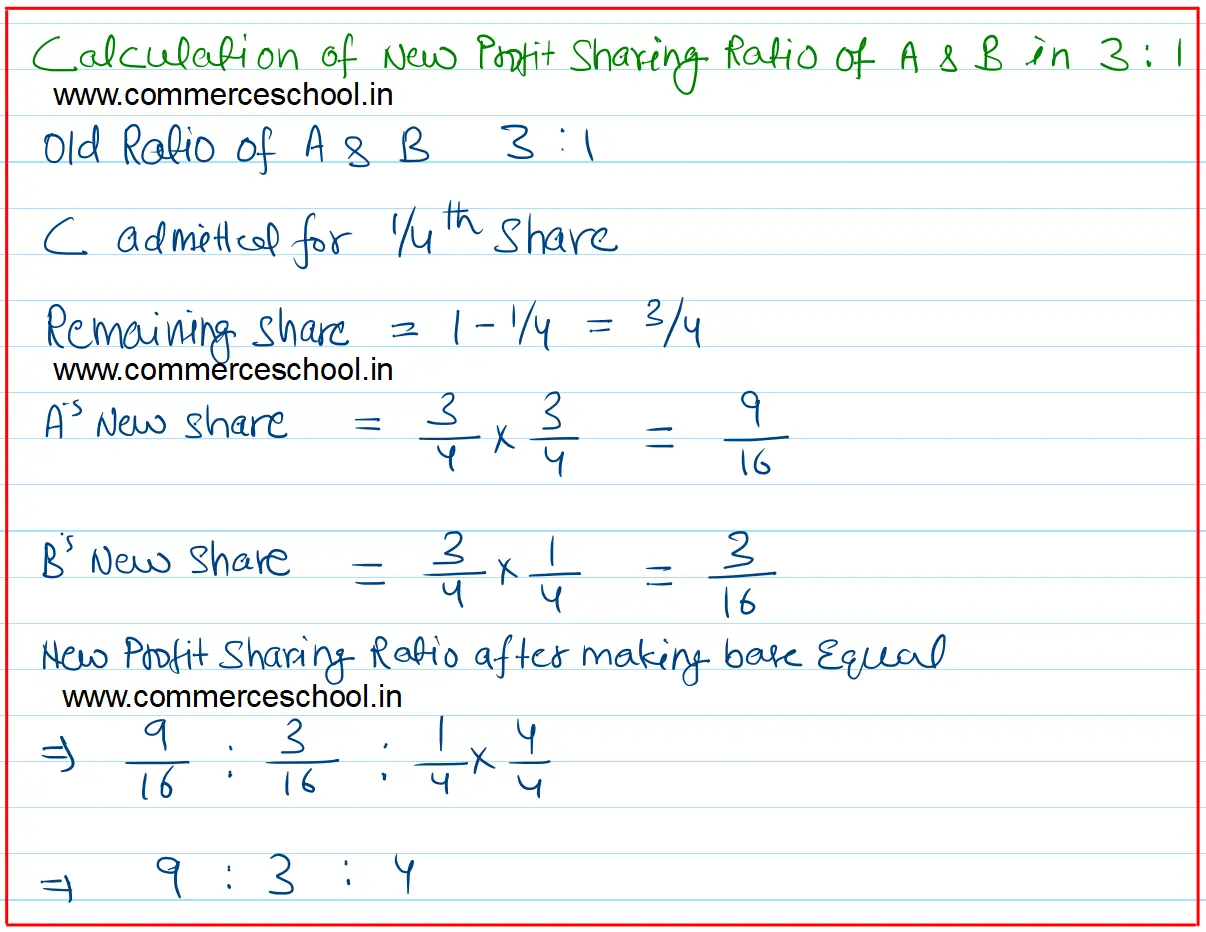

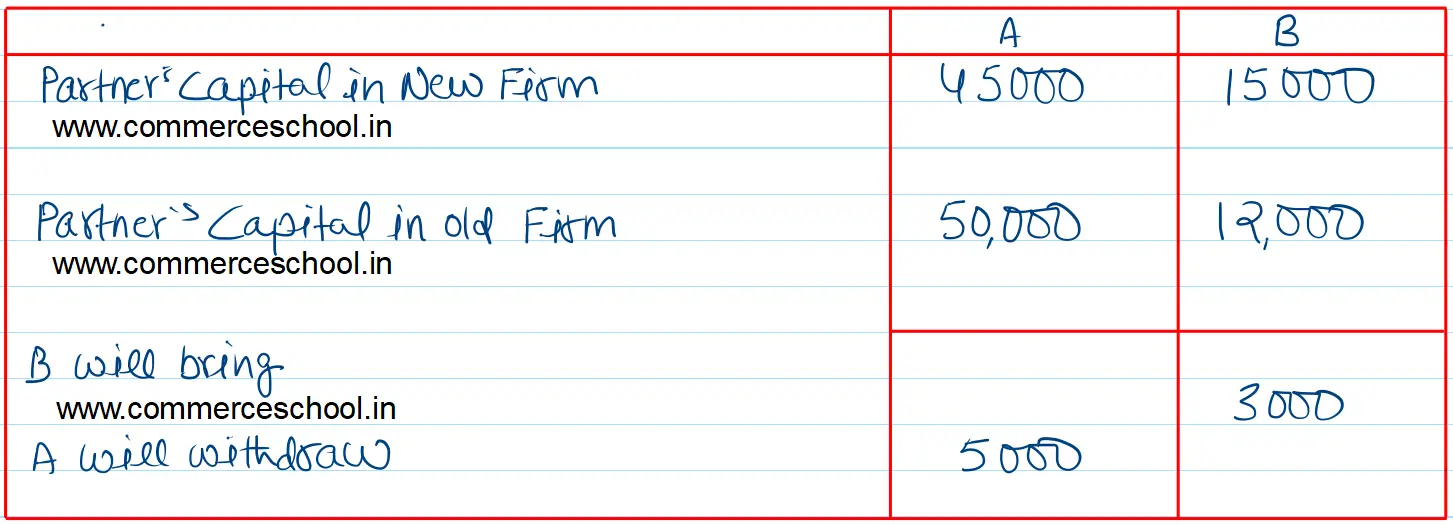

A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st April, 2017 they admitted C as a new partner for 1/4 share in the profits of the firm. C brings Rs. 20,000 as for his 1/4 share in the profits of the firm. The capitals of A and B after all adjustments in respect of goodwill, revaluation of assets and liabilities, etc. has been worked out at Rs. 50,000 for A and Rs. 12,000 for B. It is agreed that partner’s capitals will be according to new profit sharing ratio. Calculate the new capitals of A and B and pass the necessary journal entries assuming that A and B brought in or withdrew the necessary cash as the case may be for making their capitals in proportion to their profit sharing ratio?