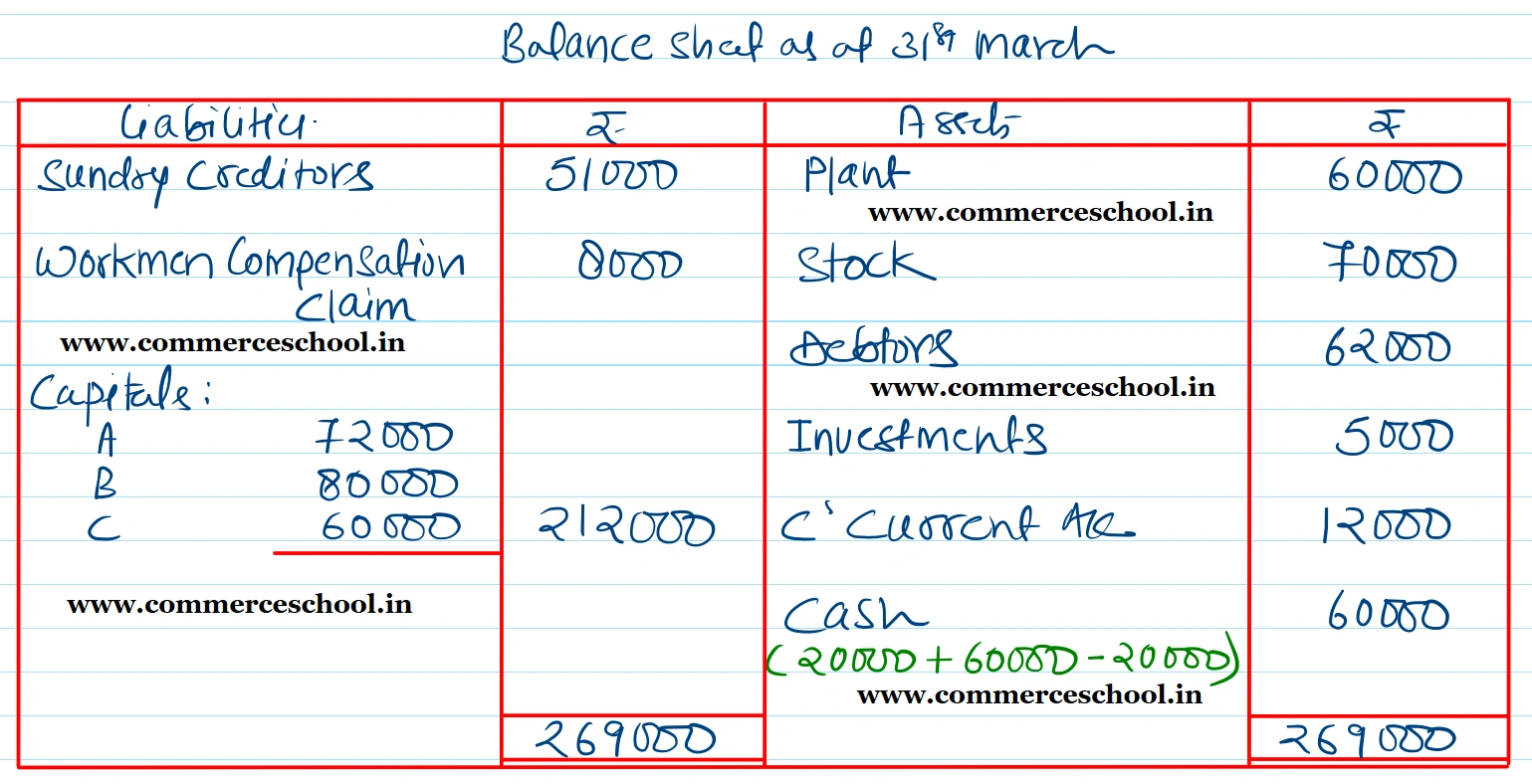

A and B are partners sharing profits and losses in the ratio of 3 : 2. On April 1, 2022, their Balance Sheet was as follows:

A and B are partners sharing profits and losses in the ratio of 3 : 2. On April 1, 2022, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 51,000 | Goodwill | 15,000 |

| Workmen Compensation Reserve | 4,000 | Plant | 75,000 |

|

Capitals: A B |

1,00,000 1,20,000 |

Patents | 8,000 |

| Stock | 80,000 | ||

| Debtors | 62,000 | ||

| Cash | 20,000 | ||

| Profit & Loss Account | 15,000 | ||

| 2,75,000 | 2,75,000 |

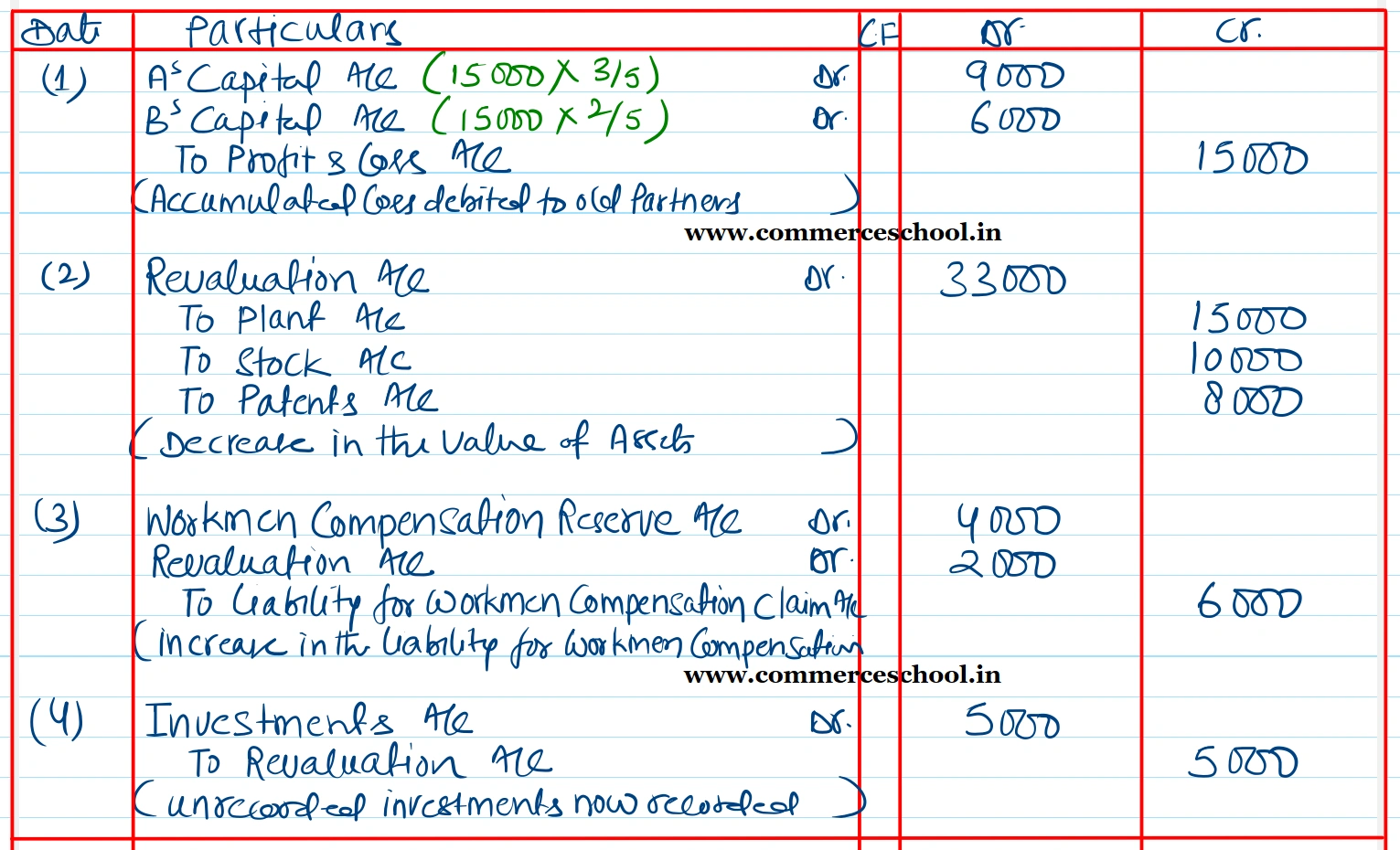

On this date they agree to admit C on the following terms:

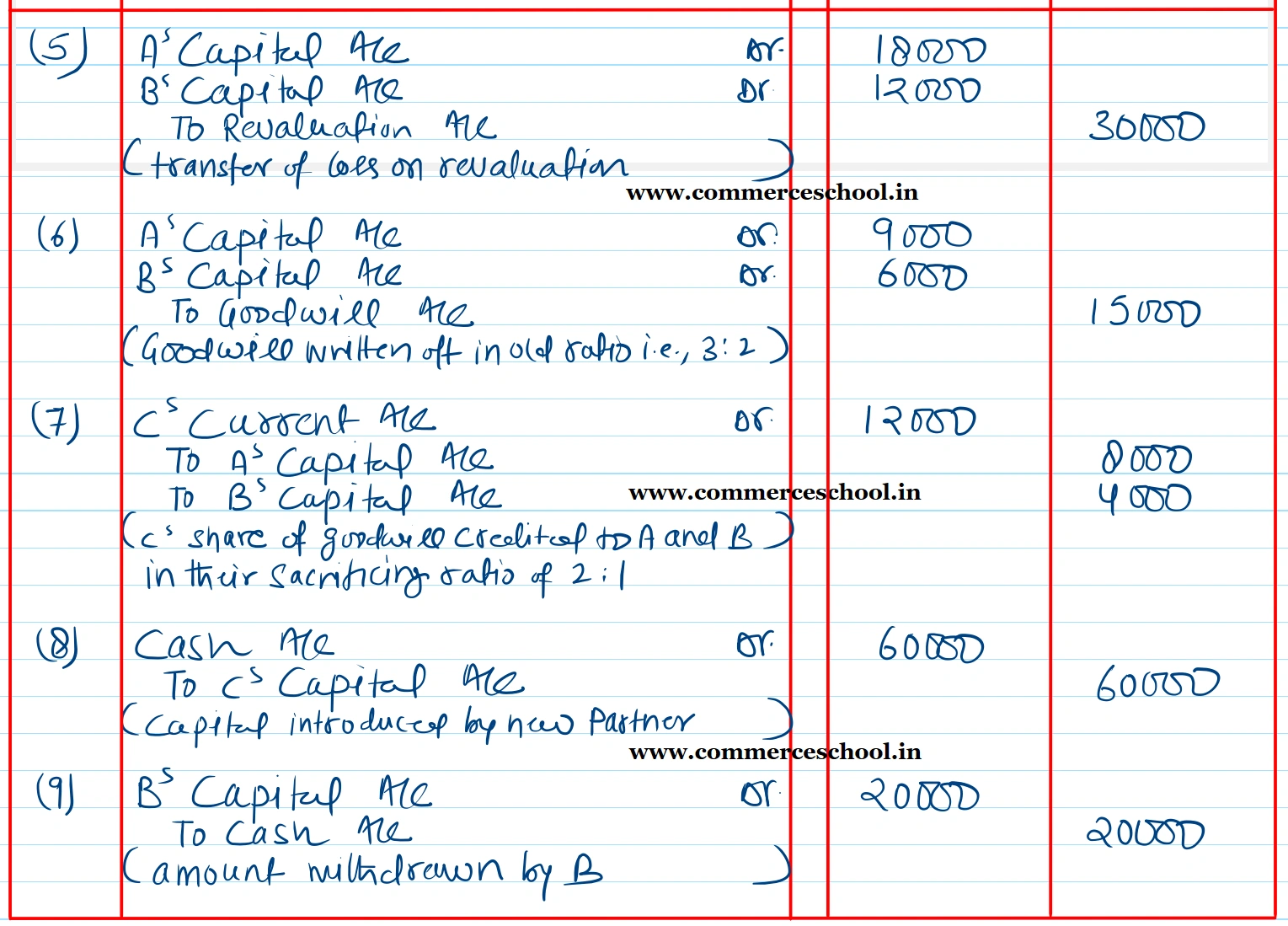

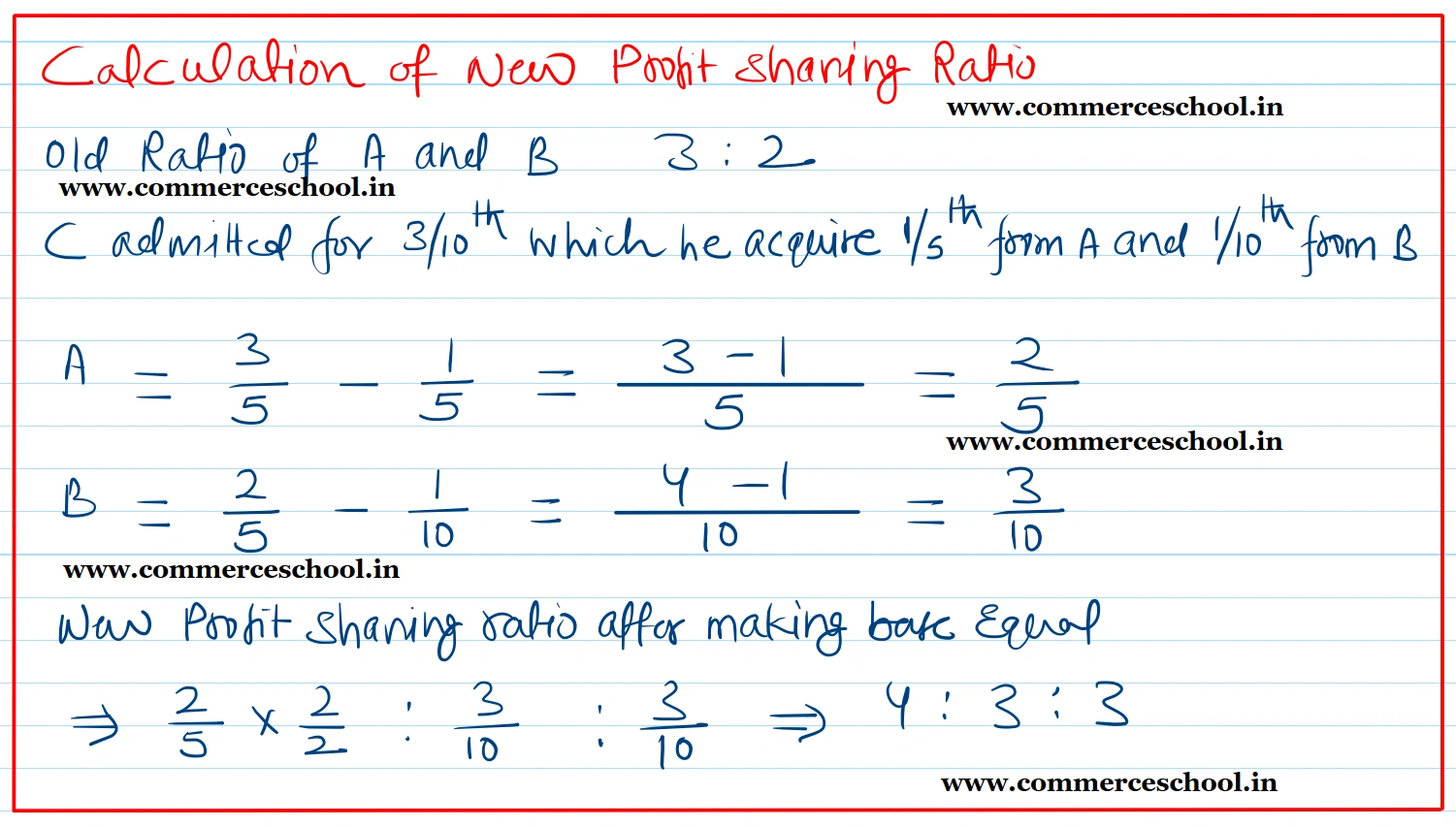

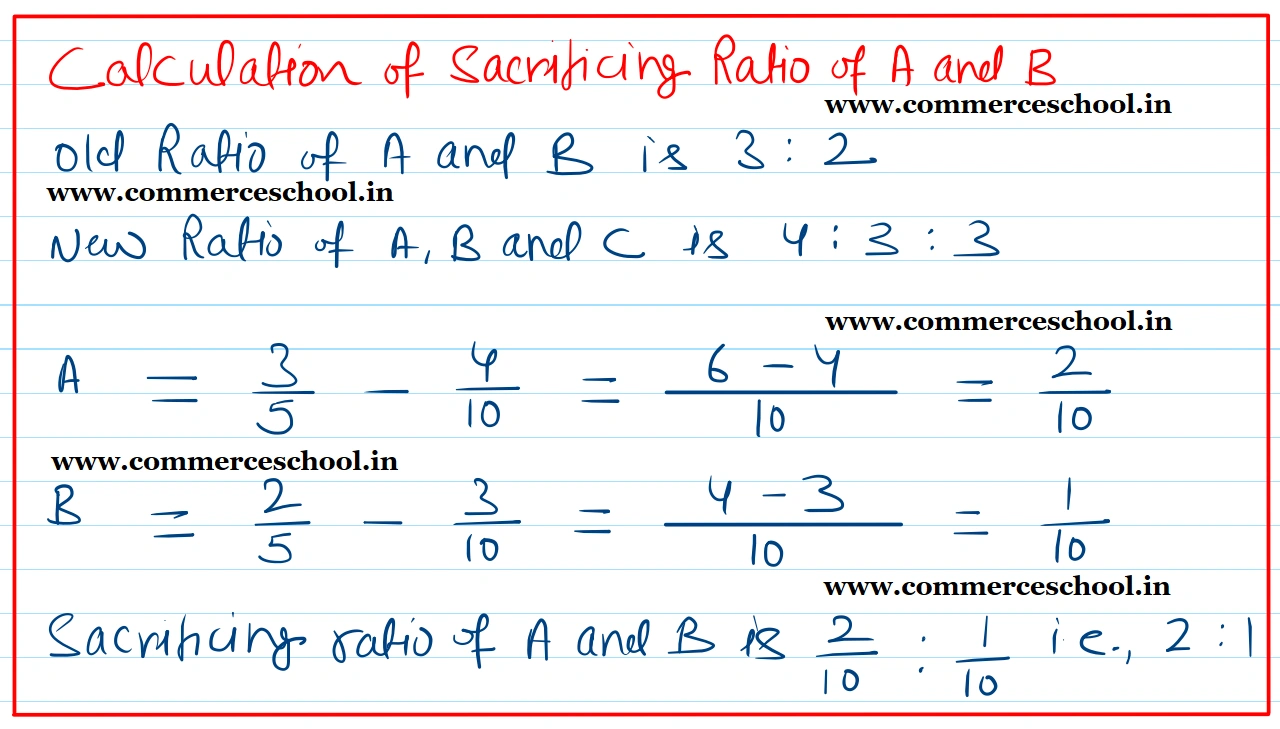

(i) C will be entitled to 3/10 share in the profits which he acquires 1/5 from A and 1/10 from B. He will bring in ₹ 60,000 as his capital.

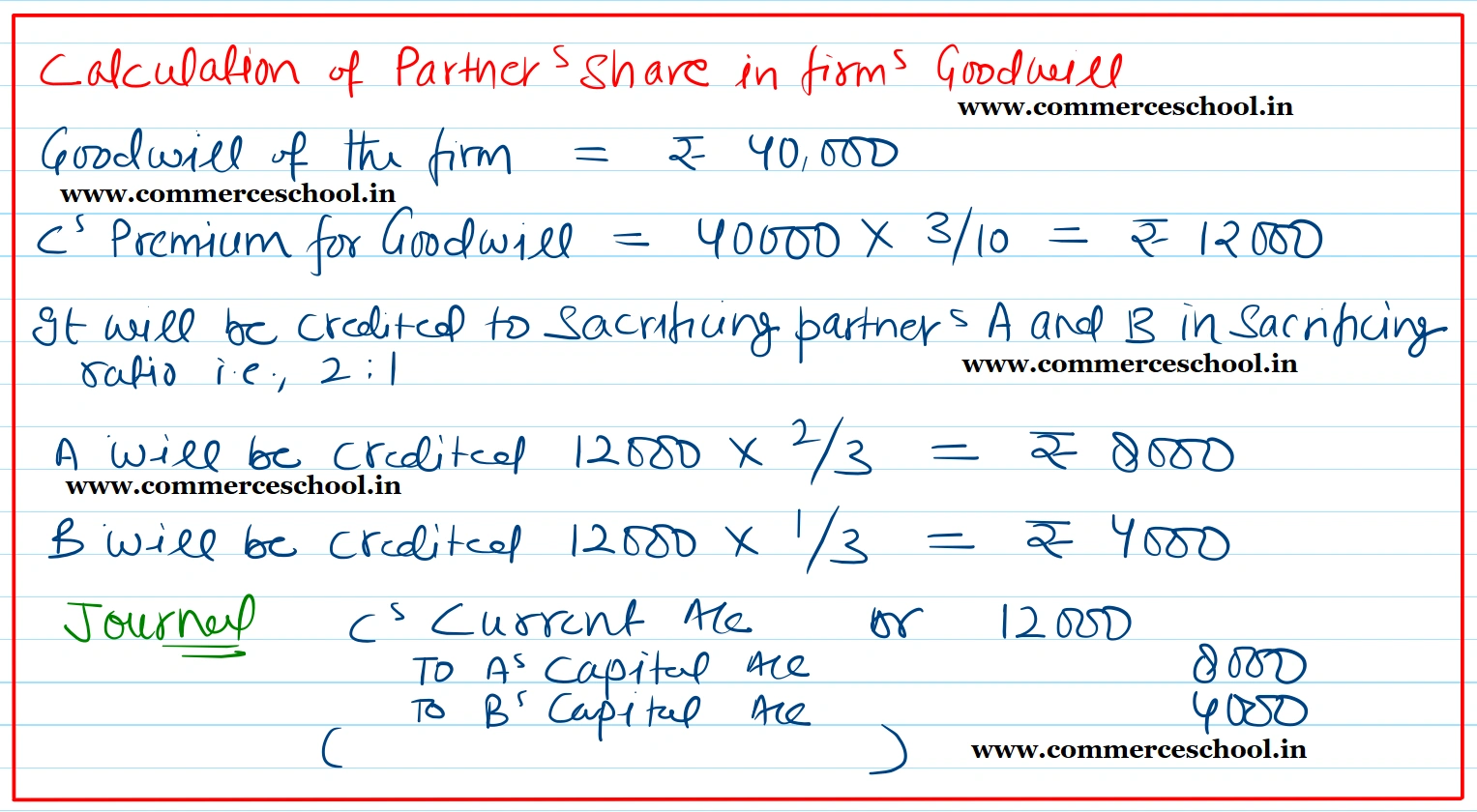

(ii) Goodwill of the firm was valued at ₹ 40,000.

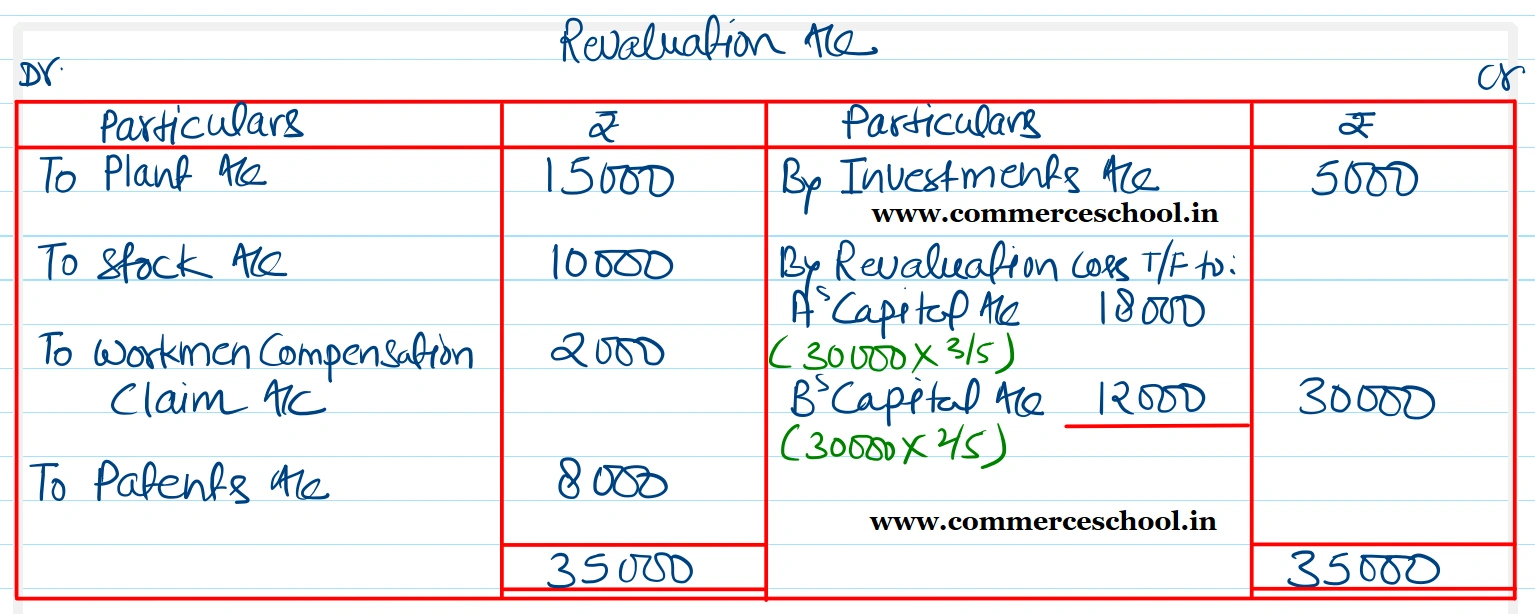

(iii) Plant is valued at ₹ 60,000 and Stock at ₹ 70,000.

(iv) Claim on account of Workmen’s Compensation is ₹ 6,000.

(v) Patnets should be written off

(vi) Investments of ₹ 5,000 which did not appear in the books should be duly recorded.

(vii) B is to withdraw ₹ 20,000 in cash.

Given Journal entries and the Balance Sheet of the new firm.

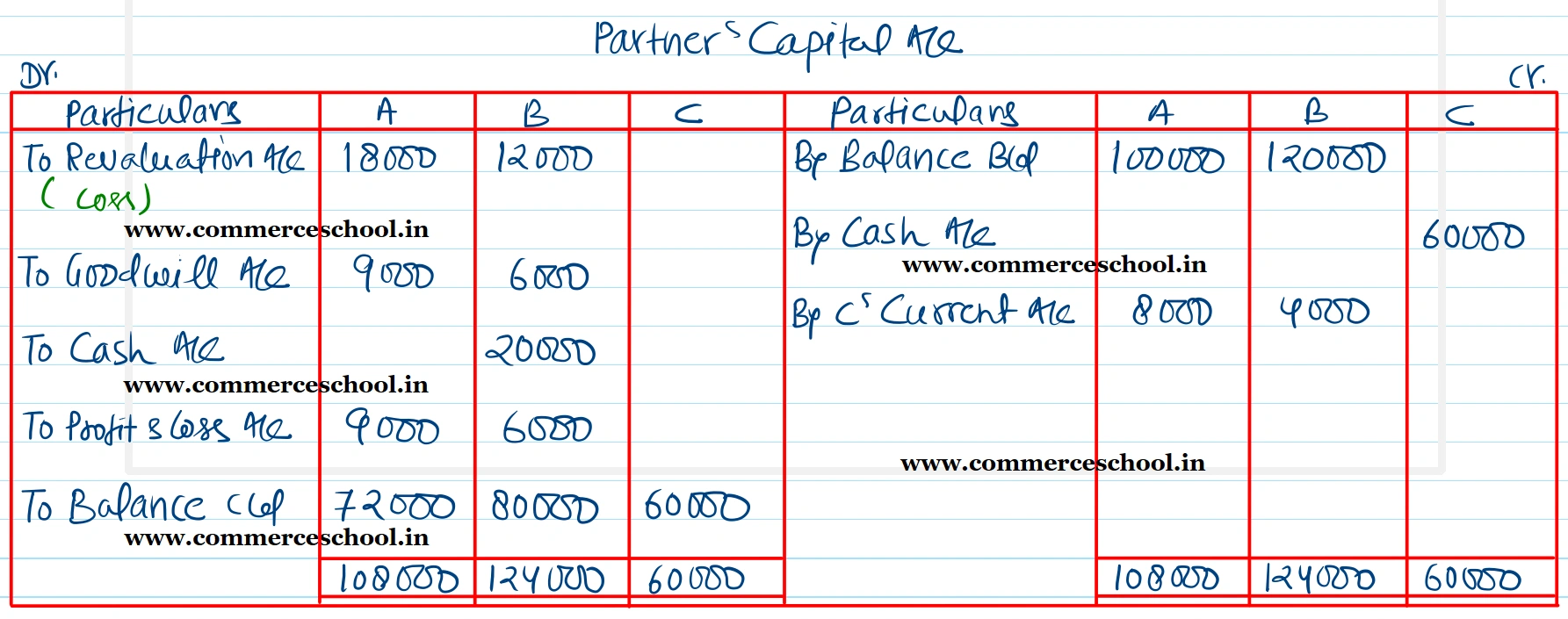

[Ans. Loss on Revaluation ₹ 30,000; C’s Current A/c (Dr.) ₹ 12,000; Capitals Accounts A ₹ 72,000; B ₹ 80,000 and C ₹ 60,000; B/S Total ₹ 2,69,000; Sacrificing Ratio 2 : 1.]