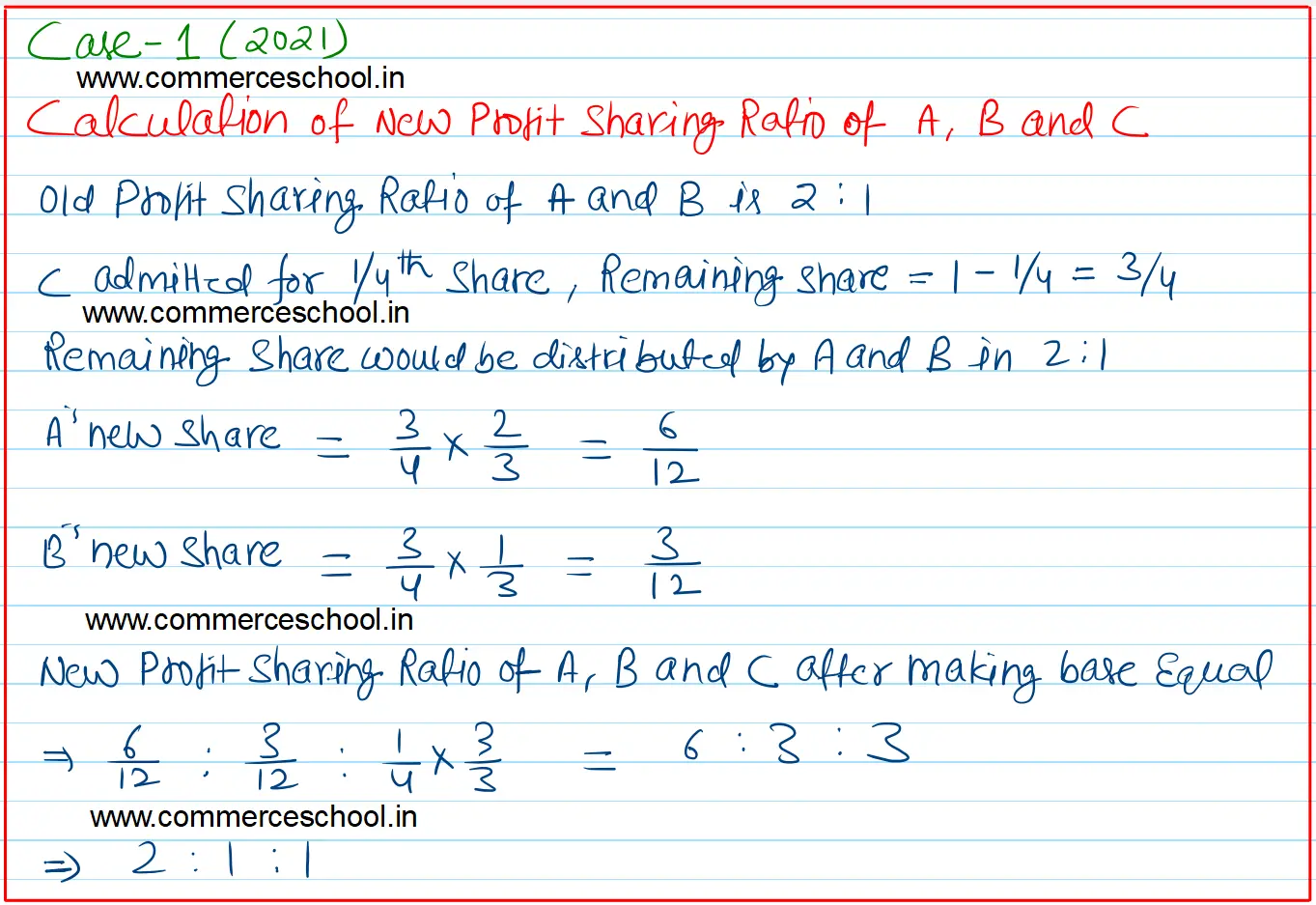

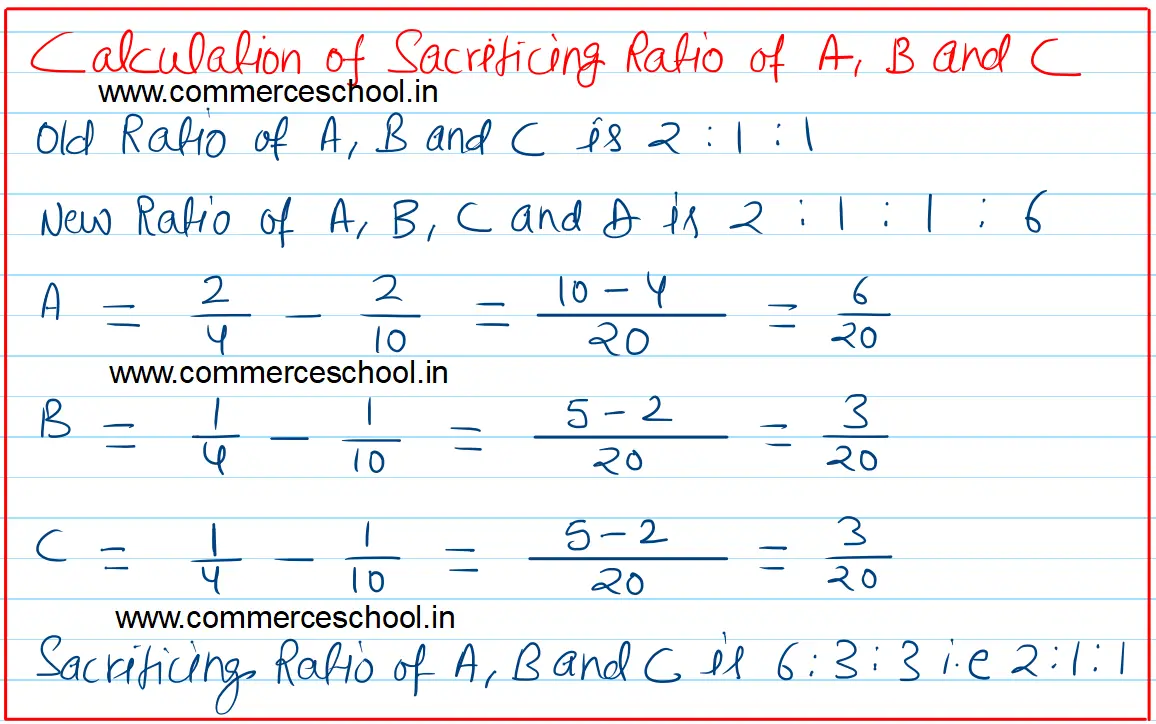

A and B are partners sharing profits and losses as 2 : 1. On 1st April, 2021 they admit C as a partner for 1/4th share who pays ₹ 4,50,000 as goodwill privately. On 1st April, 2022, they take D as a partner for 3/5th share who brings ₹ 4,00,000 as goodwill

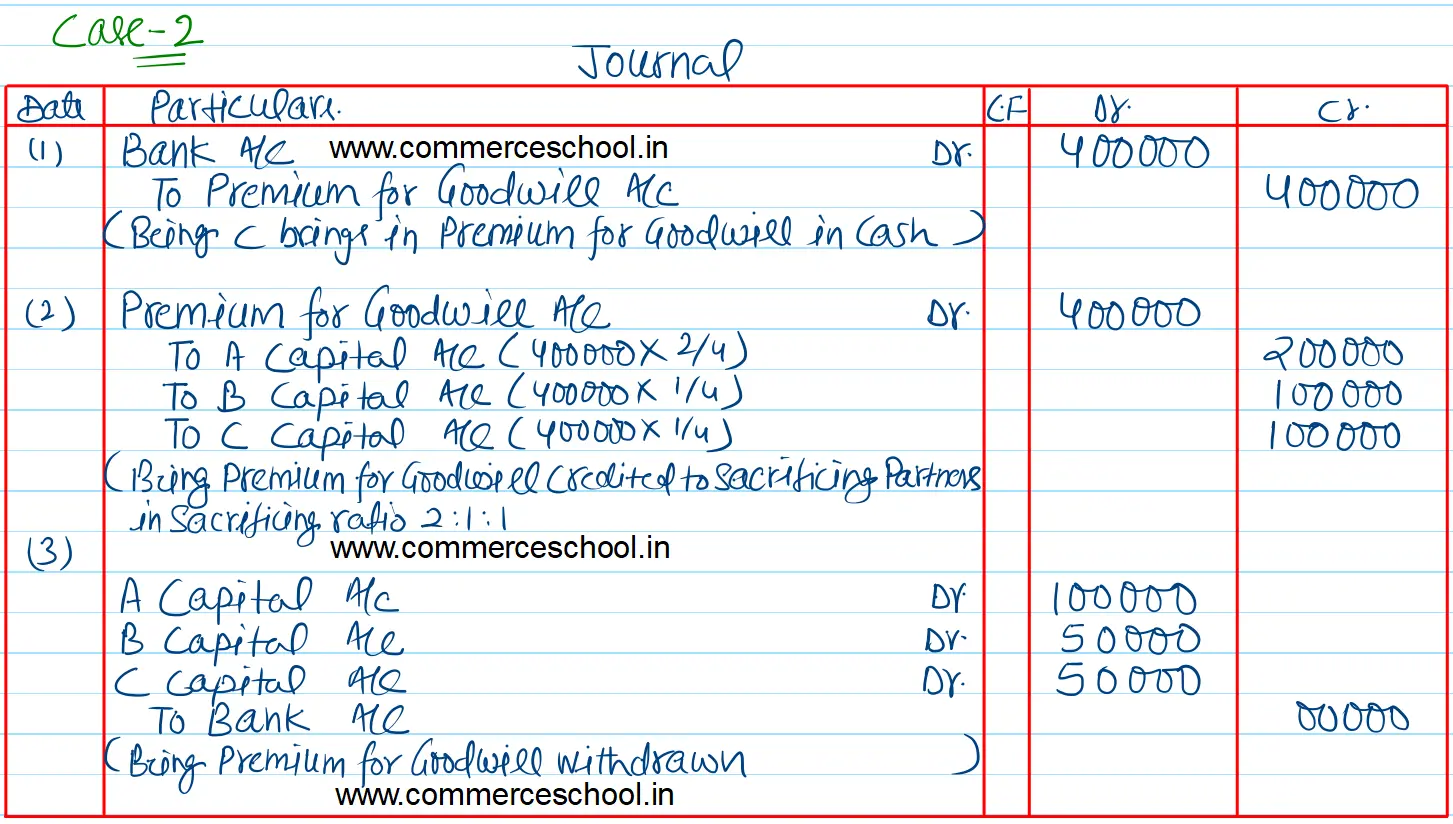

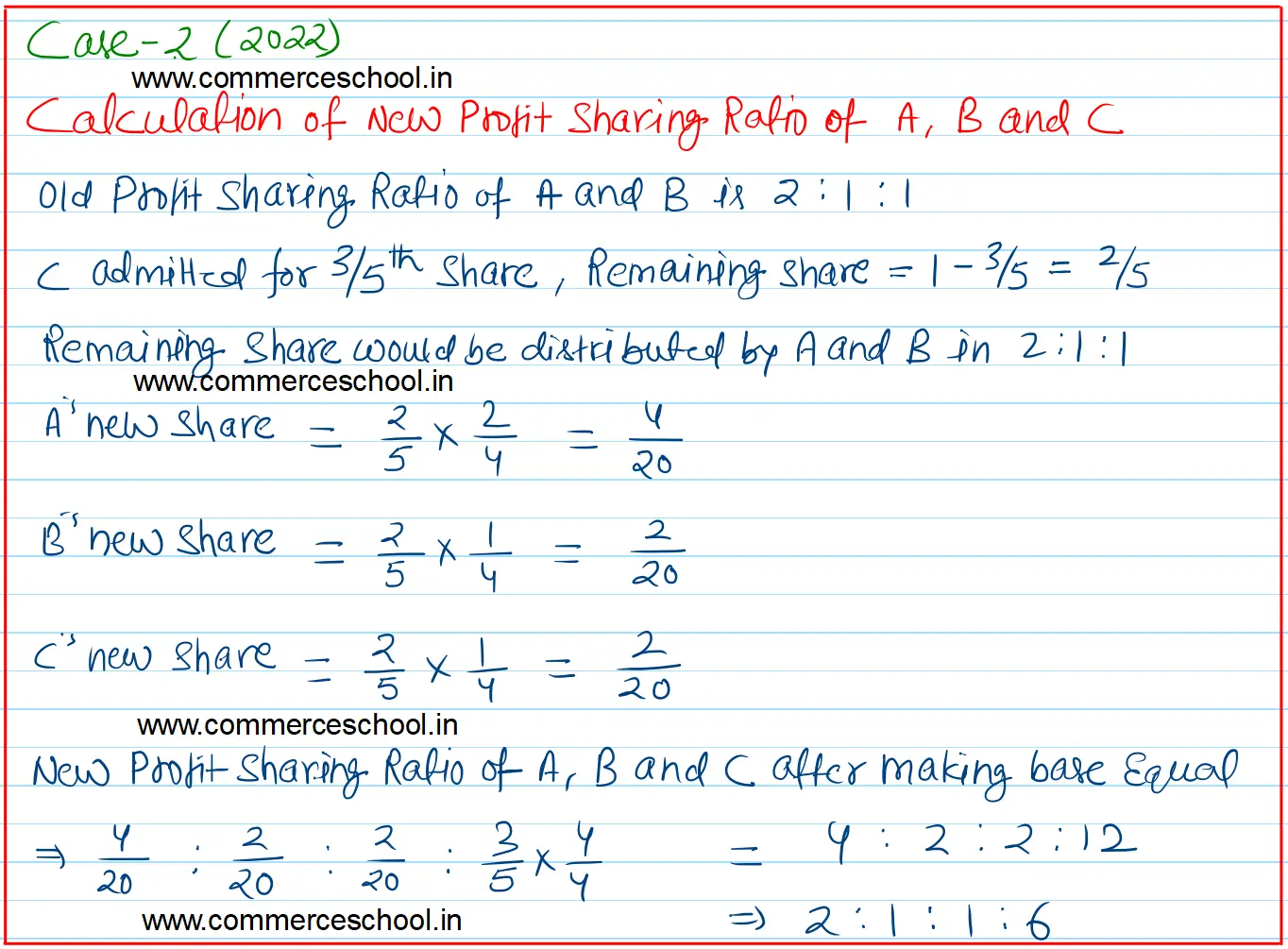

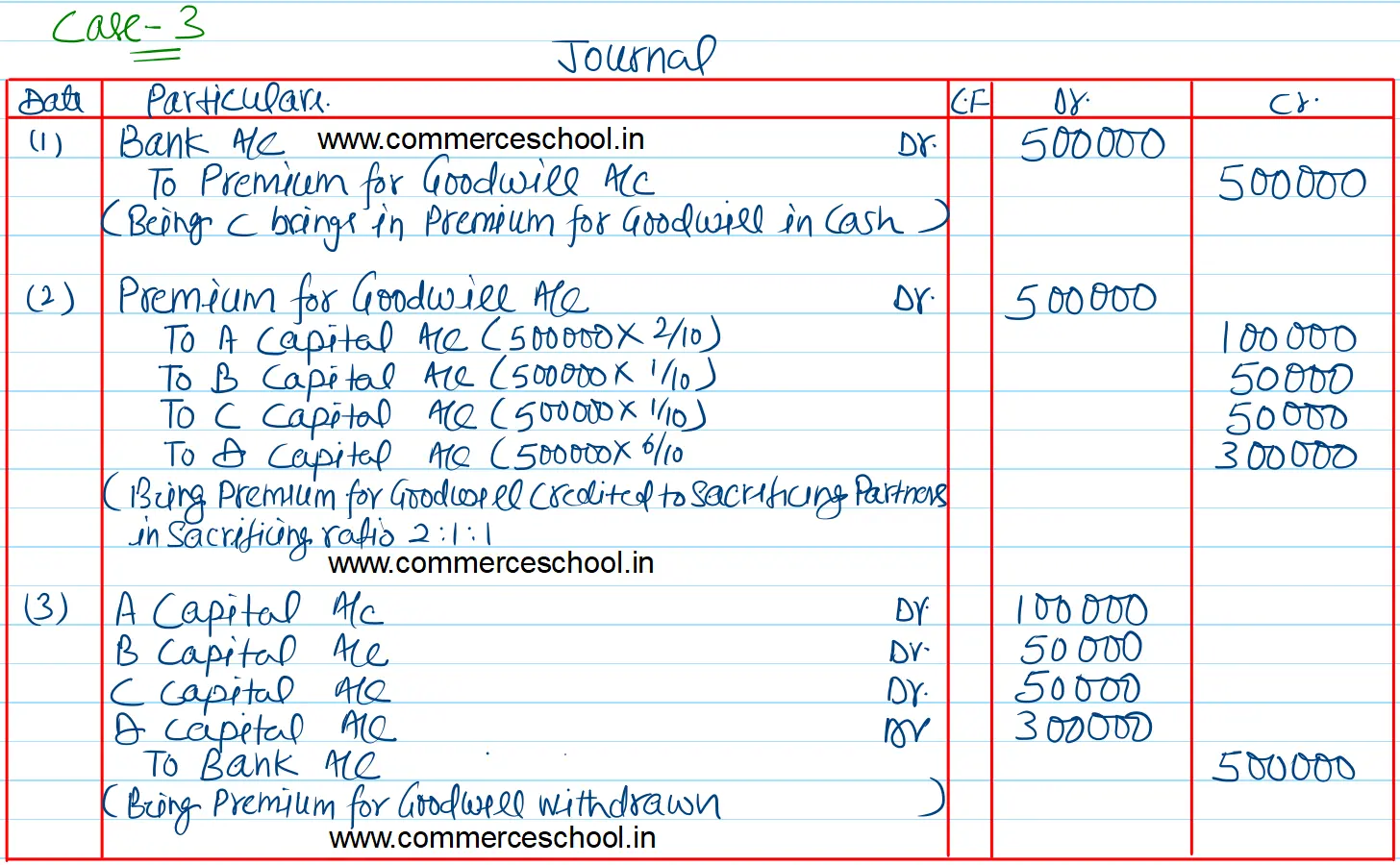

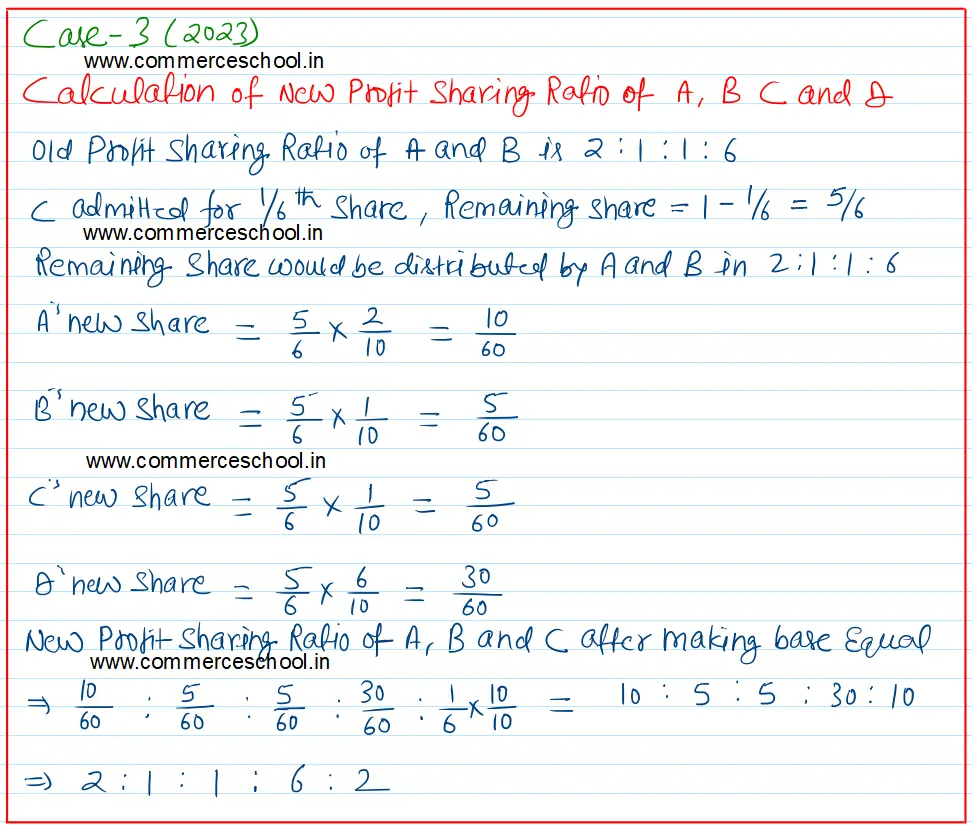

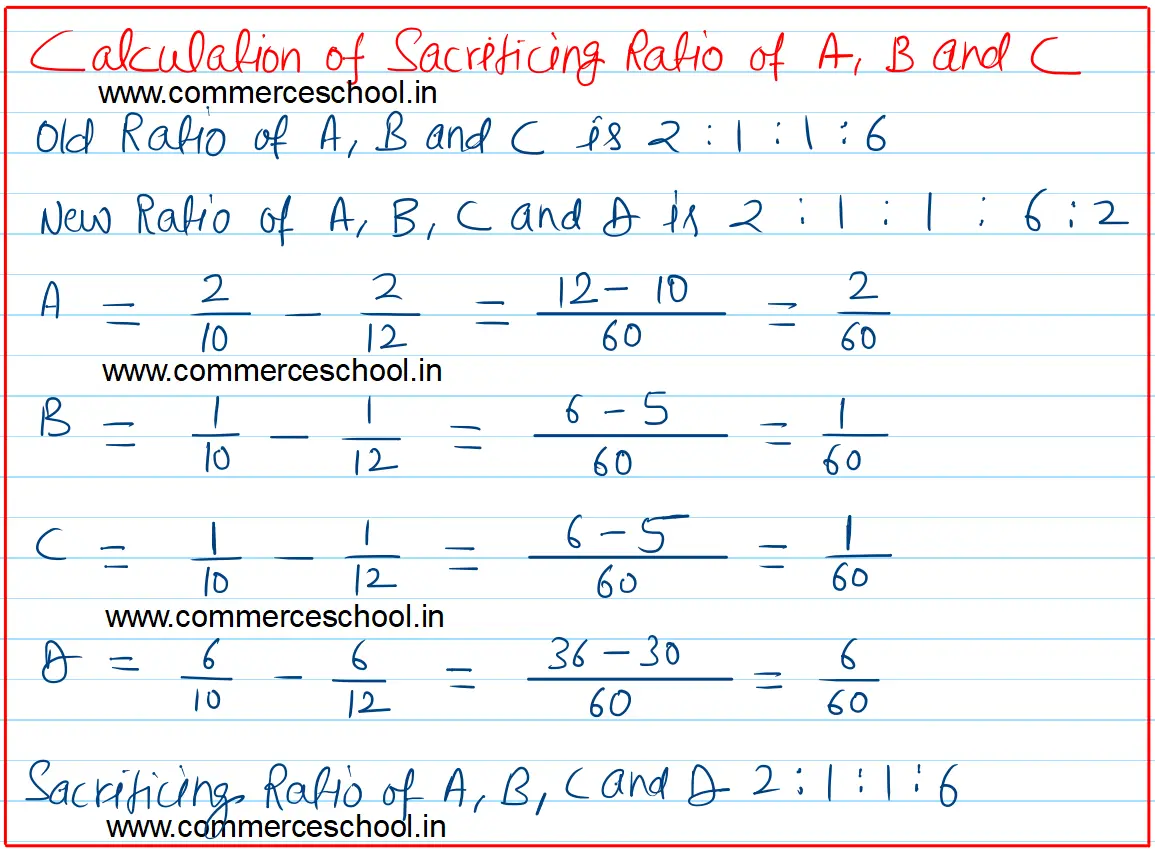

A and B are partners sharing profits and losses as 2 : 1. On 1st April, 2021 they admit C as a partner for 1/4th share who pays ₹ 4,50,000 as goodwill privately. On 1st April, 2022, they take D as a partner for 3/5th share who brings ₹ 4,00,000 as goodwill, out of which half is withdrawn by the existing partners. On 1st April, 2023, E is admitted as a partner for 1/6th share who brings ₹ 5,00,000 as goodwill which is retained in the business.

Journalise the above transactions in the books of the firm.

[Ans. New profit sharing ratios : 2021 – 2 : 1 : 1; 2022 – 2 : 1 : 1 : 6, and 2023 – 2 : 1 : 1 : 6 : 2.]

Anurag Pathak Answered question