A and B are partners sharing profits and losses in 3 : 2. They admit C into partnership for 1/5th share in the profits. C pays in cash ₹ 40,000 for his capital. Goodwill of the firm is valued at ₹ 25,000 but C is unable to bring his share of goodwill in cash

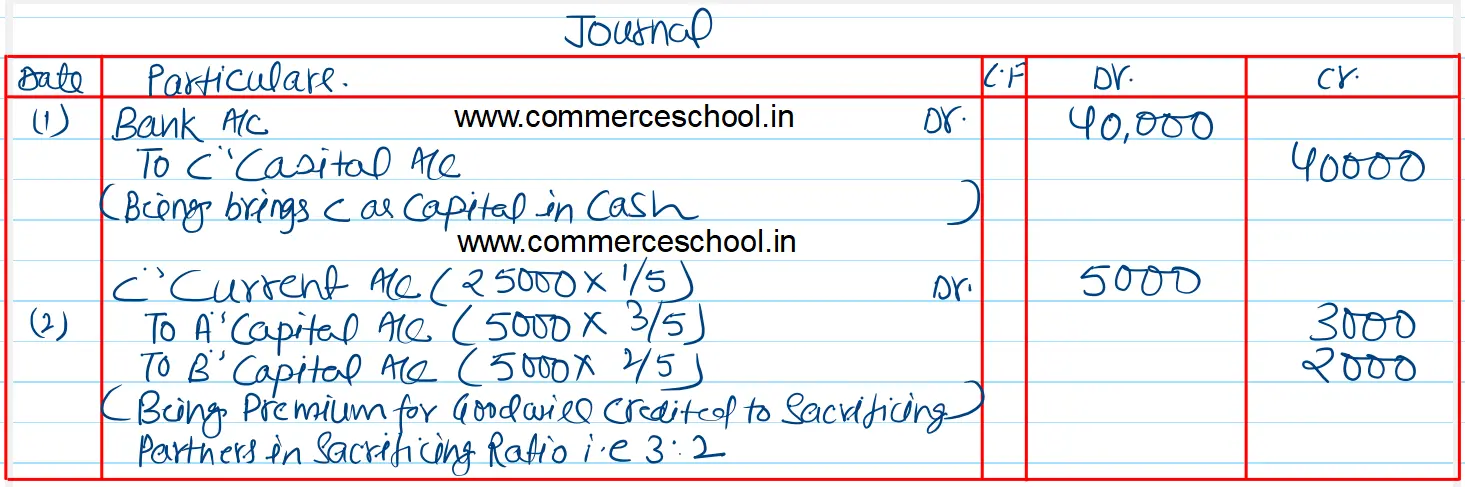

A and B are partners sharing profits and losses in 3 : 2. They admit C into partnership for 1/5th share in the profits. C pays in cash ₹ 40,000 for his capital. Goodwill of the firm is valued at ₹ 25,000 but C is unable to bring his share of goodwill in cash. Pass the necessary journal entries.

[Ans. C’s Current A/c will be debited by ₹ 5,000 and Capital Accounts of A and B will be credited in their sacrificing ratio.]

Anurag Pathak Answered question

Solution:-

Note:-

1. As C does not bring premium for goodwill in cash, adjustment would be made through c’s current account.

2. In the absence of extra information, the sacrificing ratio is always equal to the old ratio.

Anurag Pathak Answered question