A and B are partners sharing profits in the proportion of 3 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

A and B are partners sharing profits in the proportion of 3 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Sundry Creditors Outstanding Salaries General Reserve Capitals: A B |

63,000 4,000 10,000

50,000 30,000 |

Cash at Bank Sundry Debtors 30,000 Less: provision 1,000 Stock Trade Marks Building |

5,000

29,000 40,000 8,000 75,000 |

| 1,57,000 | 1,57,000 |

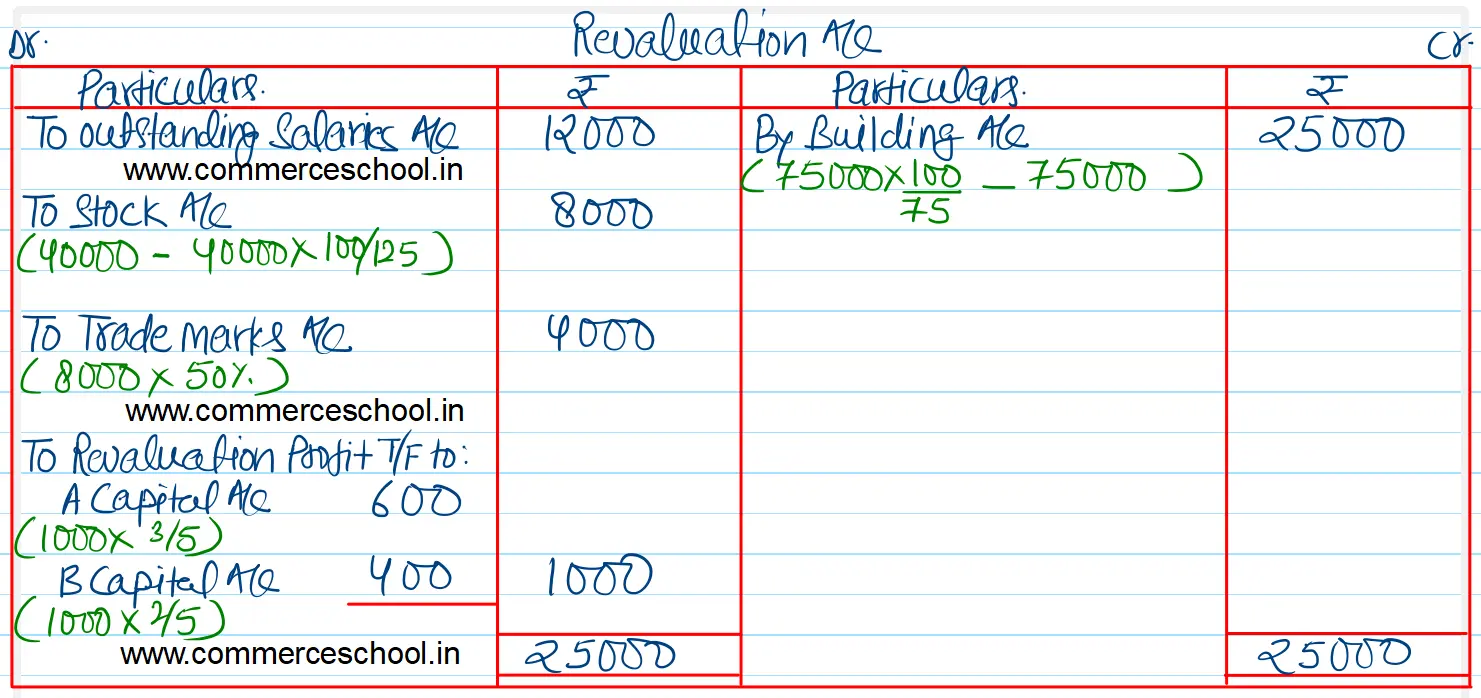

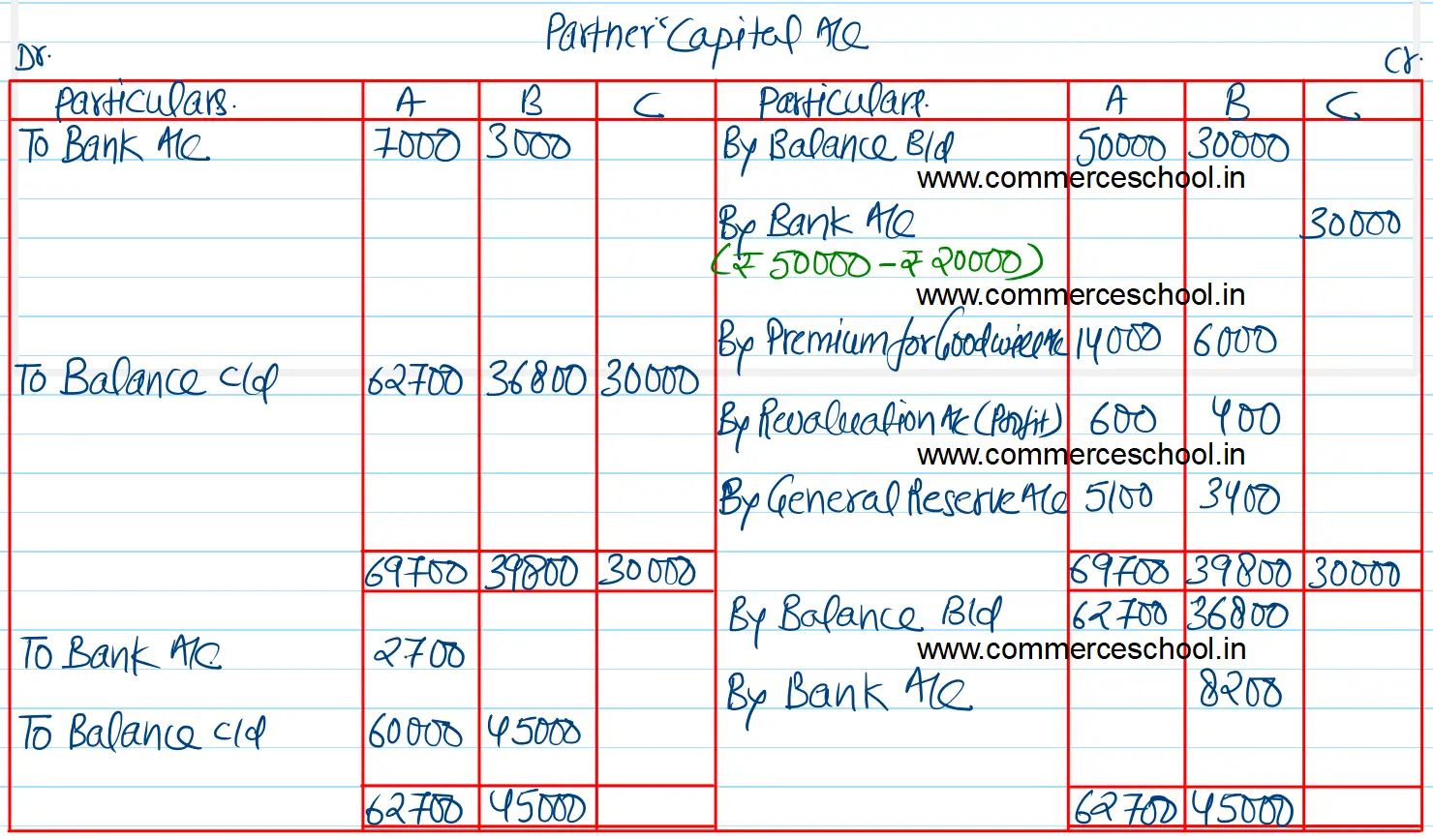

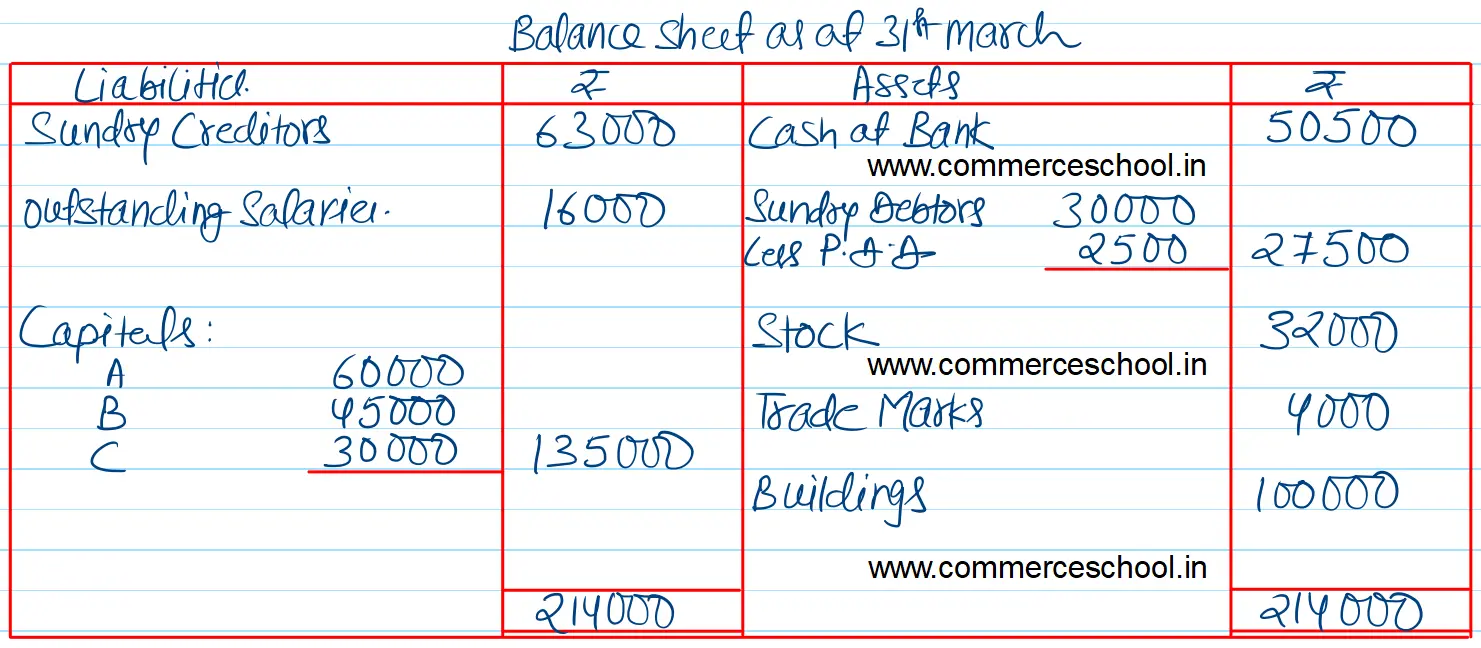

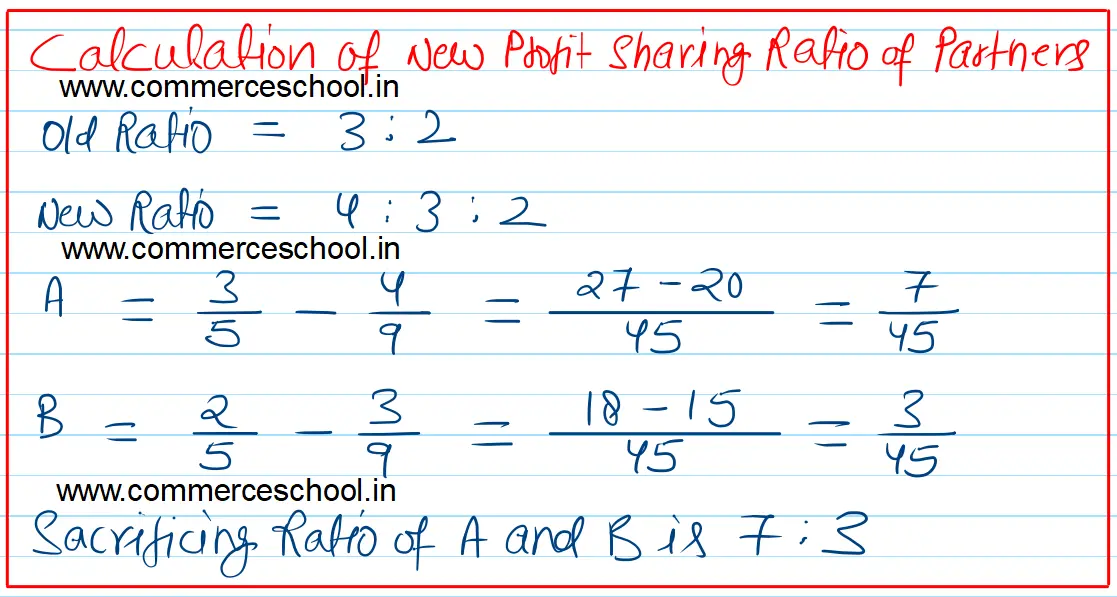

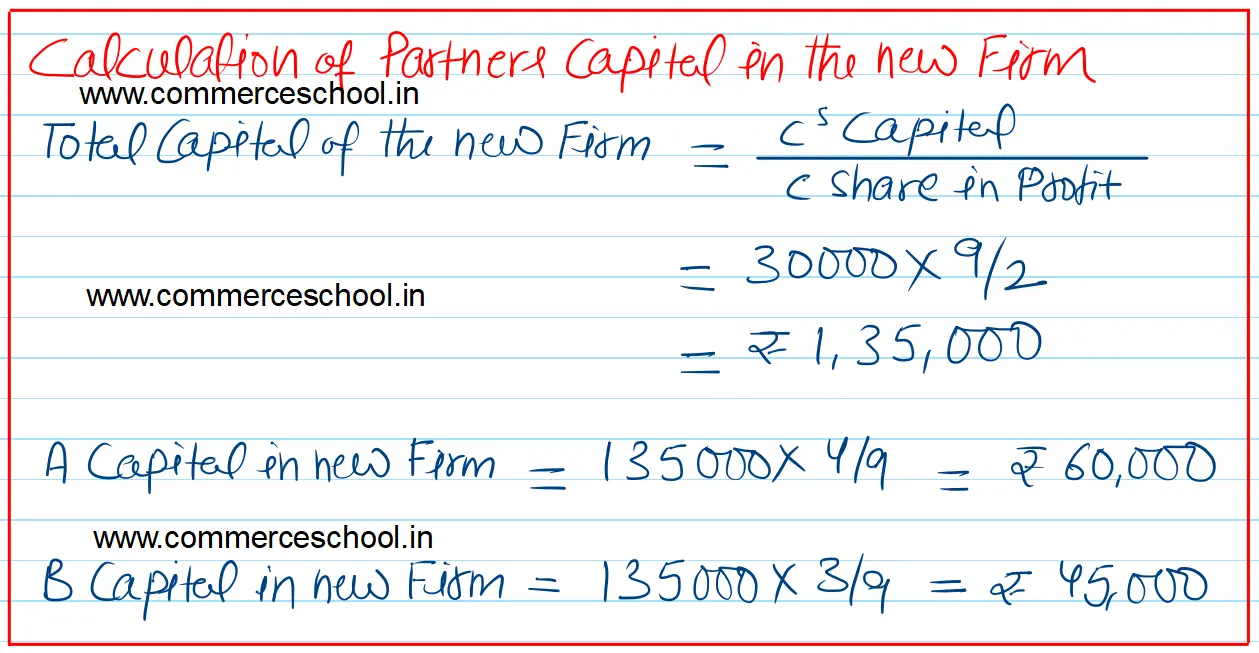

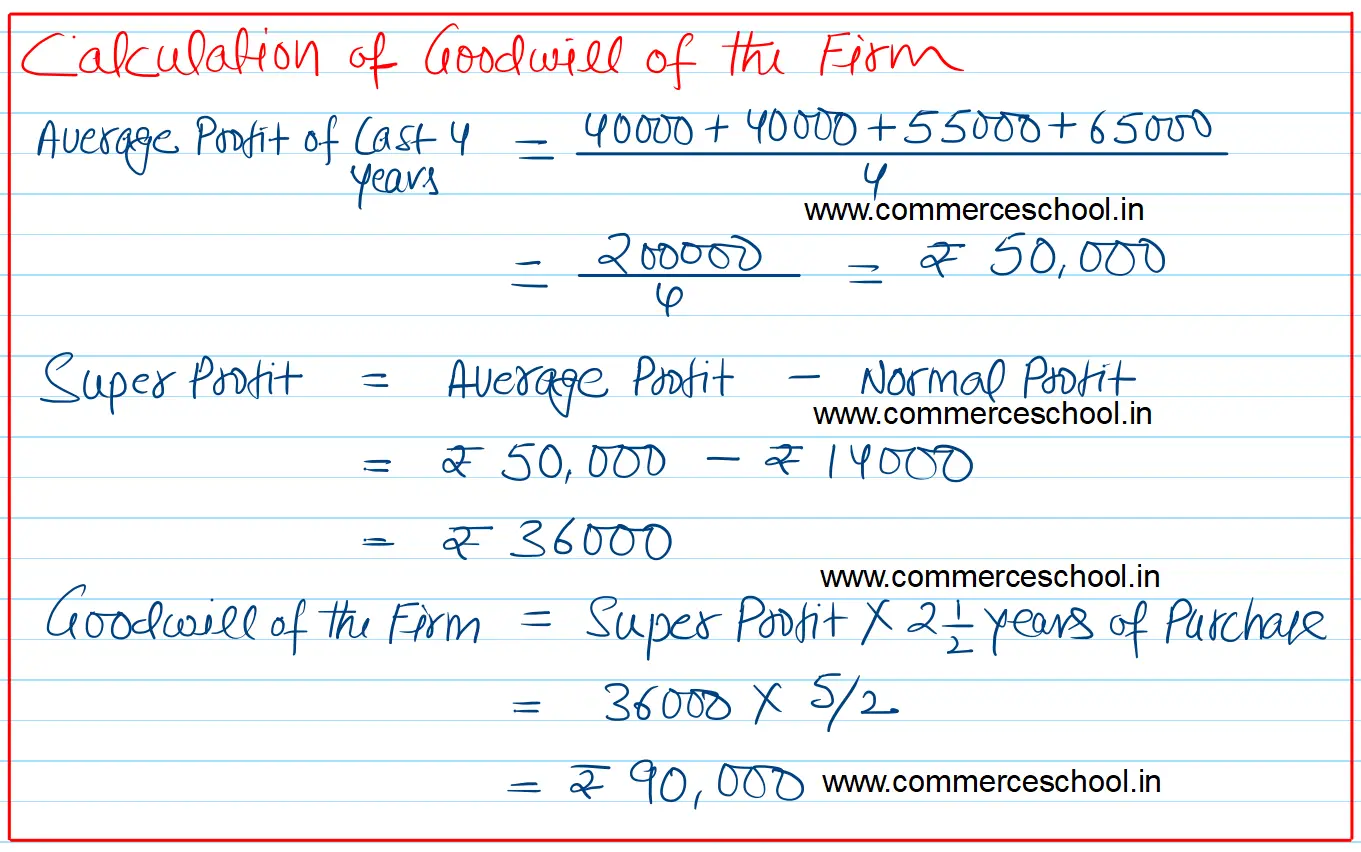

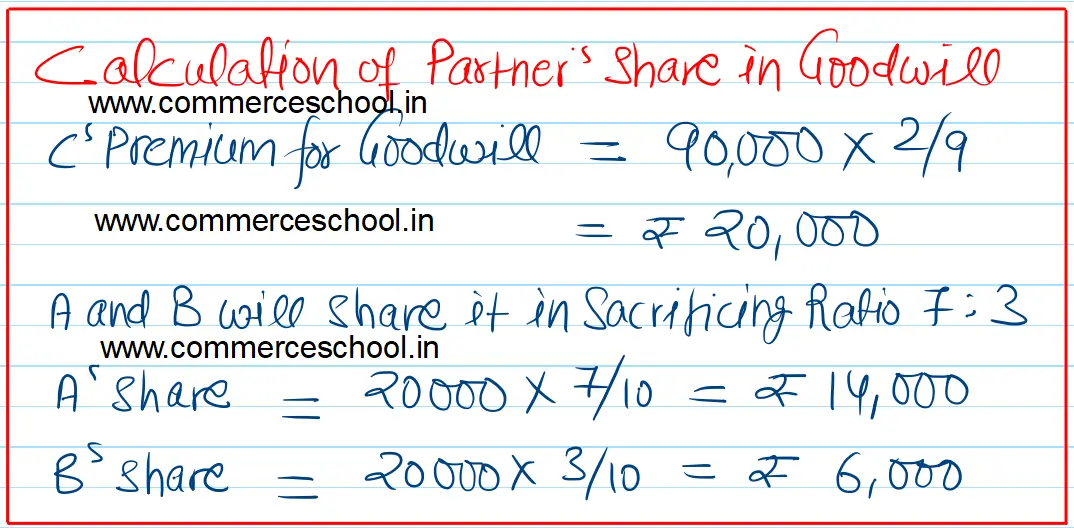

They agree to admit C as a new partner on the following terms: (1) C will be given 2/9th share of profit and he will bring ₹ 50,000 for his share of capital and goodwill. (2) Goodwill of the firm will be calculated at 2 and 1/2 year’s purchase of the average super profits of last four years. Profits of the last four years are ₹ 40,000; ₹ 40,000; ₹ 55,000 and ₹ 65,000 respectively. Normal profits that can be earned with the capital employed are ₹ 14,000. (3) Half the amount of goodwill is withdrawn by old partners. (4) 15% of the general reserve is to remain as a provision against doubtful debts. (5) Outstanding salaries be increased to ₹ 16,000, Stock is overvalued by 25% and Building is undervalued by 25%. Trade Marks be written off by 50%. (6) New profit sharing ratio of partners will be 4 : 3 : 2 and the capital accounts of A and B will be adjusted on the basis of C’s Capital by bringing in or withdrawing cash, as the case may be. Prepare necessary accounts and the opening balance Sheet of the firm. [Ans. Gain on Revaluation ₹ 1,000; Capitals A ₹ 60,000, B ₹ 45,000; and C ₹ 30,000; Bank Balance ₹ 50,500; A withdraws ₹ 2,700 and B brings in ₹ 8,200; Balance Sheet Total ₹ 2,14,000. Sacrifice Ratio 7 : 3. Premium for goodwill brought in by C ₹ 20,000.]