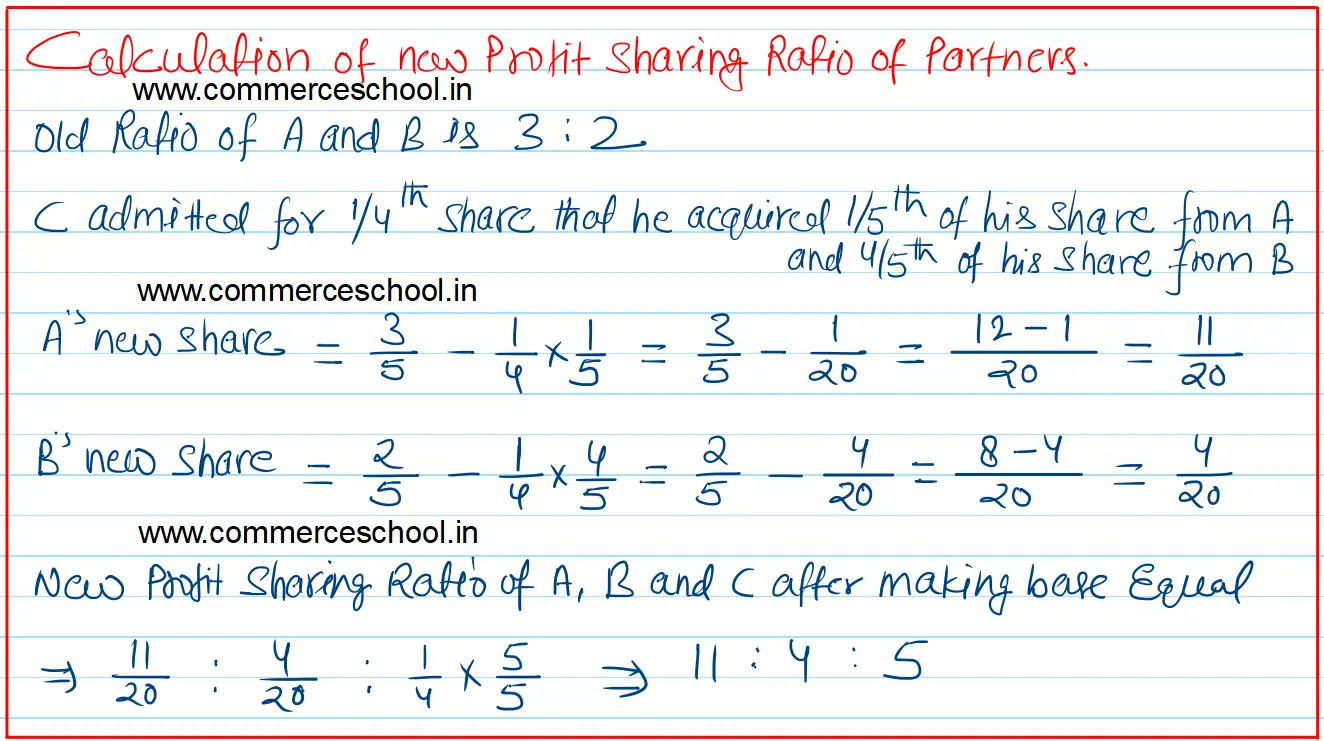

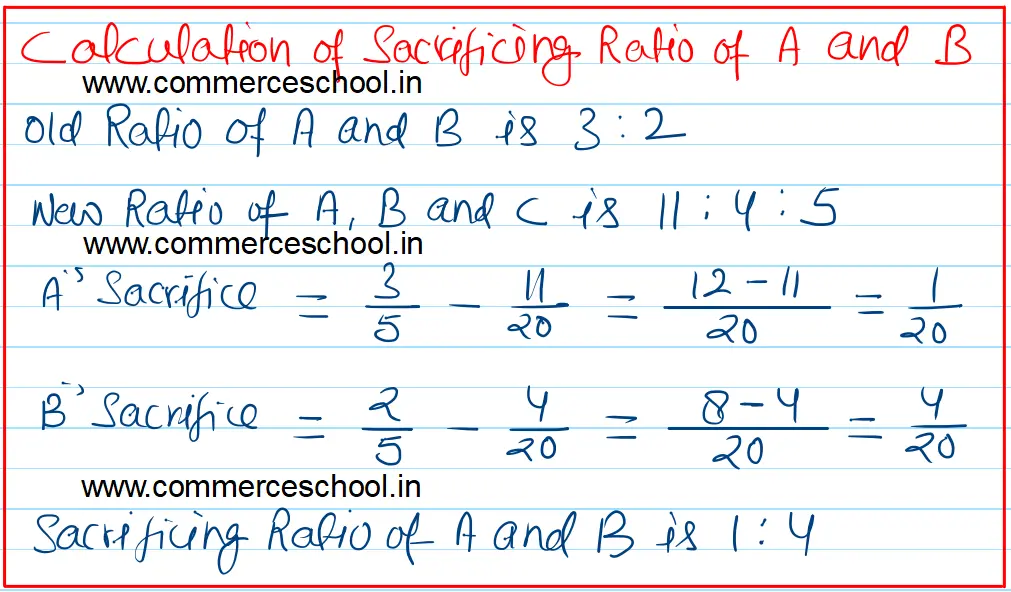

A and B are partners sharing profits in the ratio of 3 : 2. On 1st April, 2022 they admit C as a new partner for 1/4th share. C acquires 1/5th of his share from A

A and B are partners sharing profits in the ratio of 3 : 2. On 1st April, 2022 they admit C as a new partner for 1/4th share. C acquires 1/5th of his share from A.

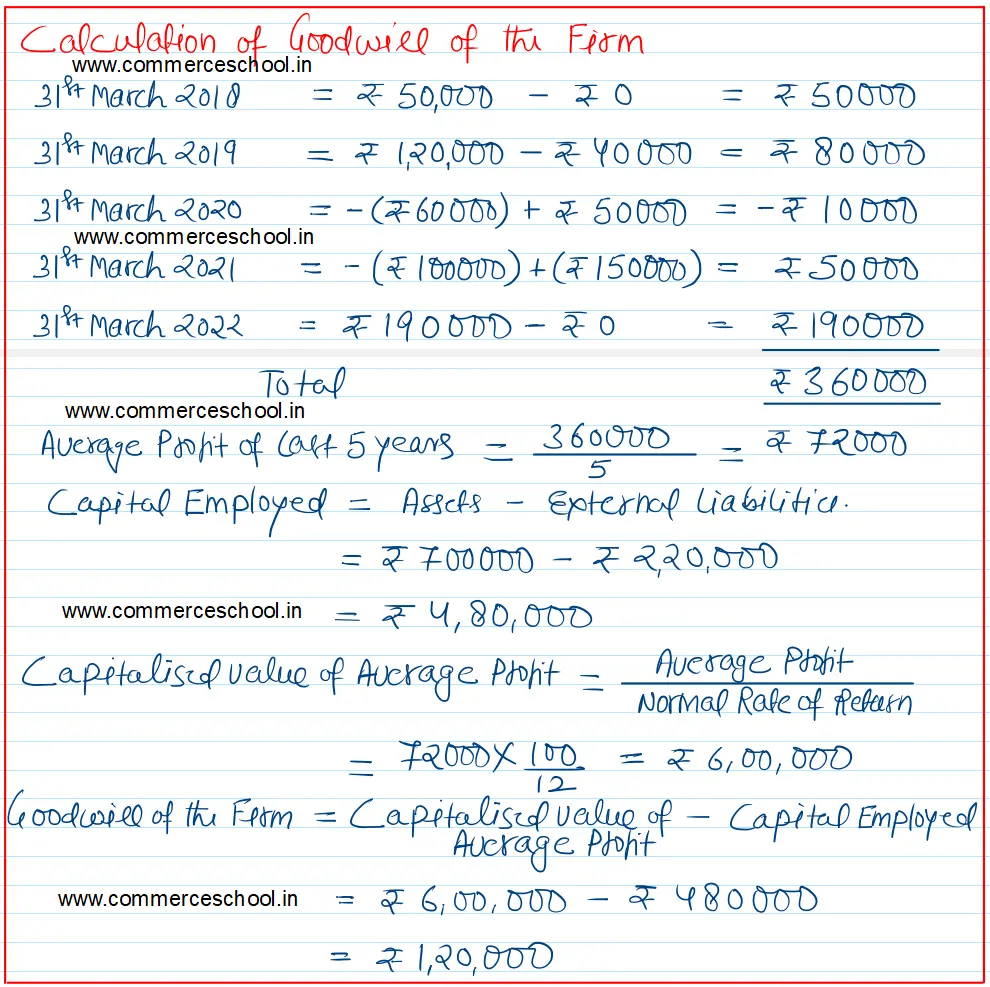

Goodwill on C’s admission is to be valued on the basis of capitalisation of average profits of the last five years. Profits were:

Year ended

On 1st April, 2022, the firm had assets of ₹ 7,00,000 and external liabilities of ₹ 2,20,000.

The normal rate of return on capital is 12%.

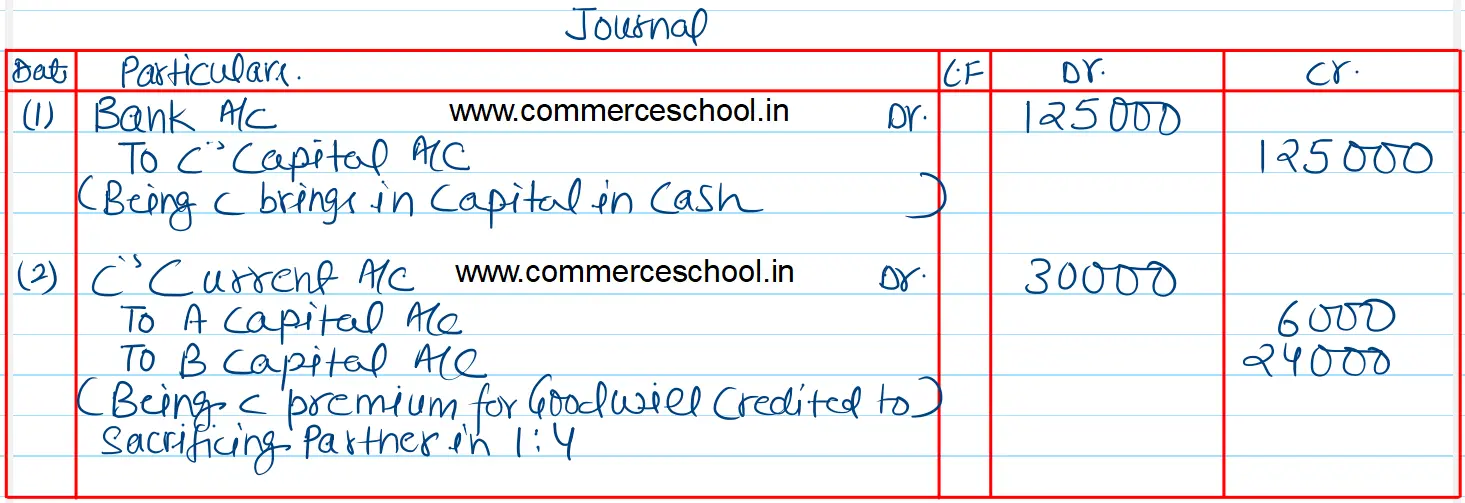

C brings in ₹ 1,25,000 for his capital but is unable to bring his share of goodwill in cash.

(i) You are required to calculate C’s share of goodwill,

(ii) Pass necessary journal entries, and

(iii) Calculate new profit sharing ratios.

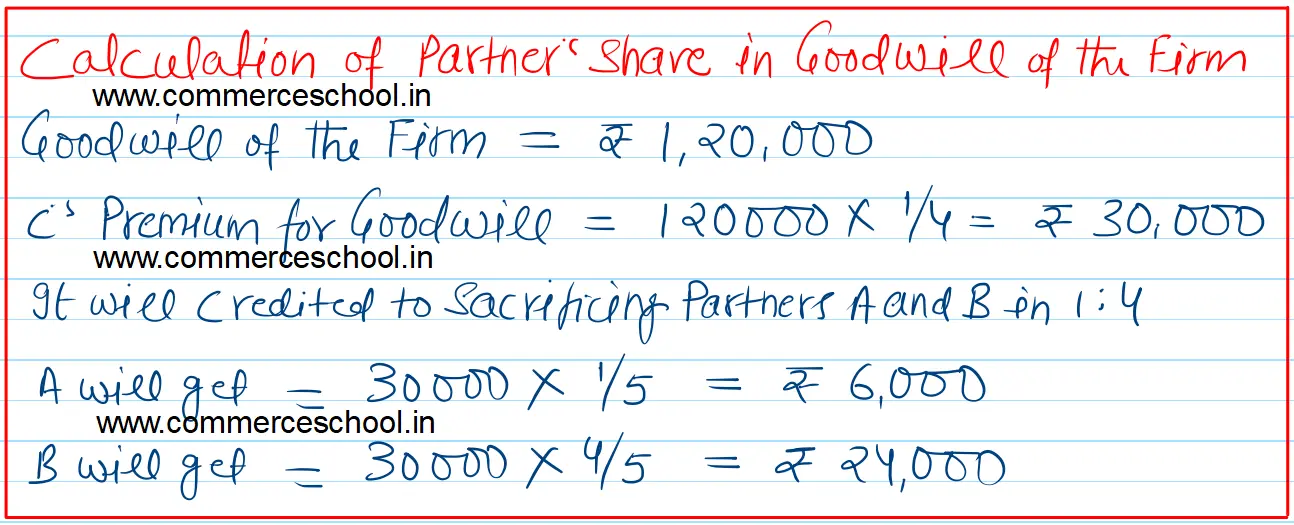

[Ans. C’s share of Goodwill ₹ 30,000; Sacrificing Ratio 1 : 4; New Profit Sharing Ratio = 11 : 4 : 5]

Hint. C acquires 1/5th of his share from A and remaining 4/5th of his share from B.

| 31st March, 2018 | Profit ₹ 50,000 |

| 31st March, 2019 | Profit ₹ 1,20,000 (including gain of ₹ 40,000 from sale of fixed assets) |

| 31st March, 2020 | Loss ₹ 60,000 (after charging Loss by Fire ₹ 50,000) |

| 31st March, 2021 | Loss ₹ 1,00,000 (after charging voluntary retirement compensation paid ₹ 1,50,000) |

| 31st March, 2022 | profit ₹ 1,90,000 |

Anurag Pathak Answered question