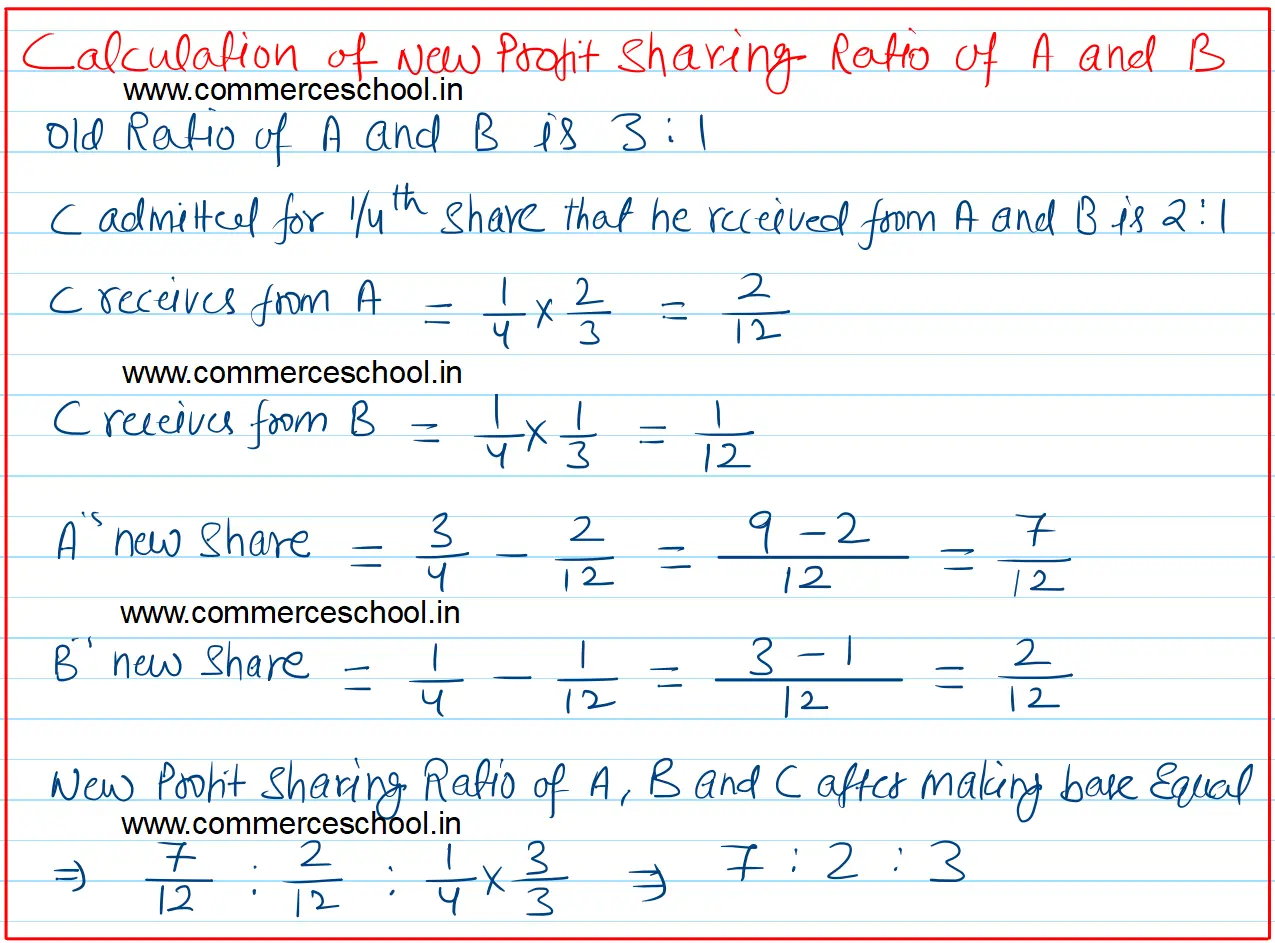

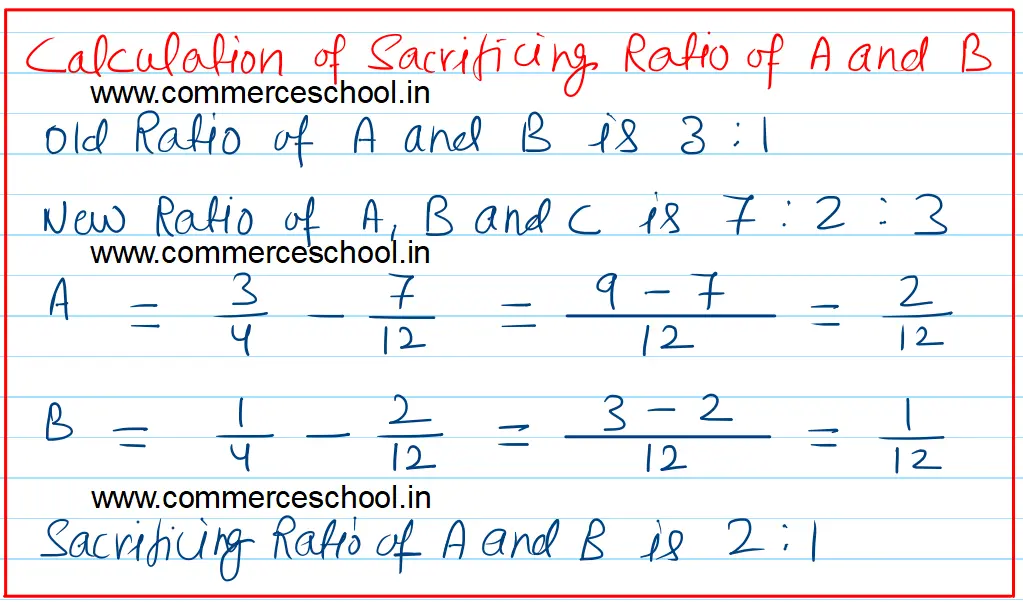

A and B are partners sharing profits in the ratio of 3 : 1. They admitted C as a partner by giving him 1/4th share of profits which he acquired from A and B in the ratio of 2 : 1. C brings in ₹ 1,00,000 as Capital and ₹ 36,000 as goodwill in cash

A and B are partners sharing profits in the ratio of 3 : 1. They admitted C as a partner by giving him 1/4th share of profits which he acquired from A and B in the ratio of 2 : 1. C brings in ₹ 1,00,000 as Capital and ₹ 36,000 as goodwill in cash. At the time of admission of C, general reserve appeared in their balance sheet at ₹ 50,000.

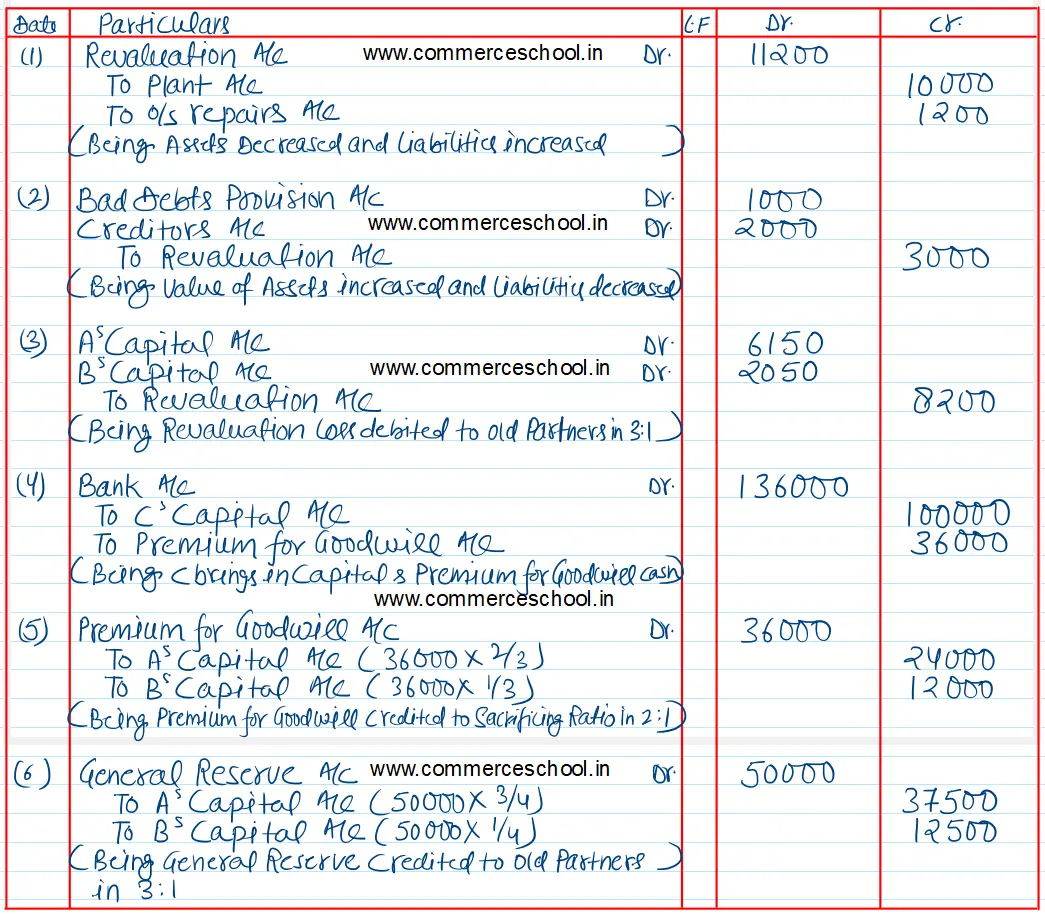

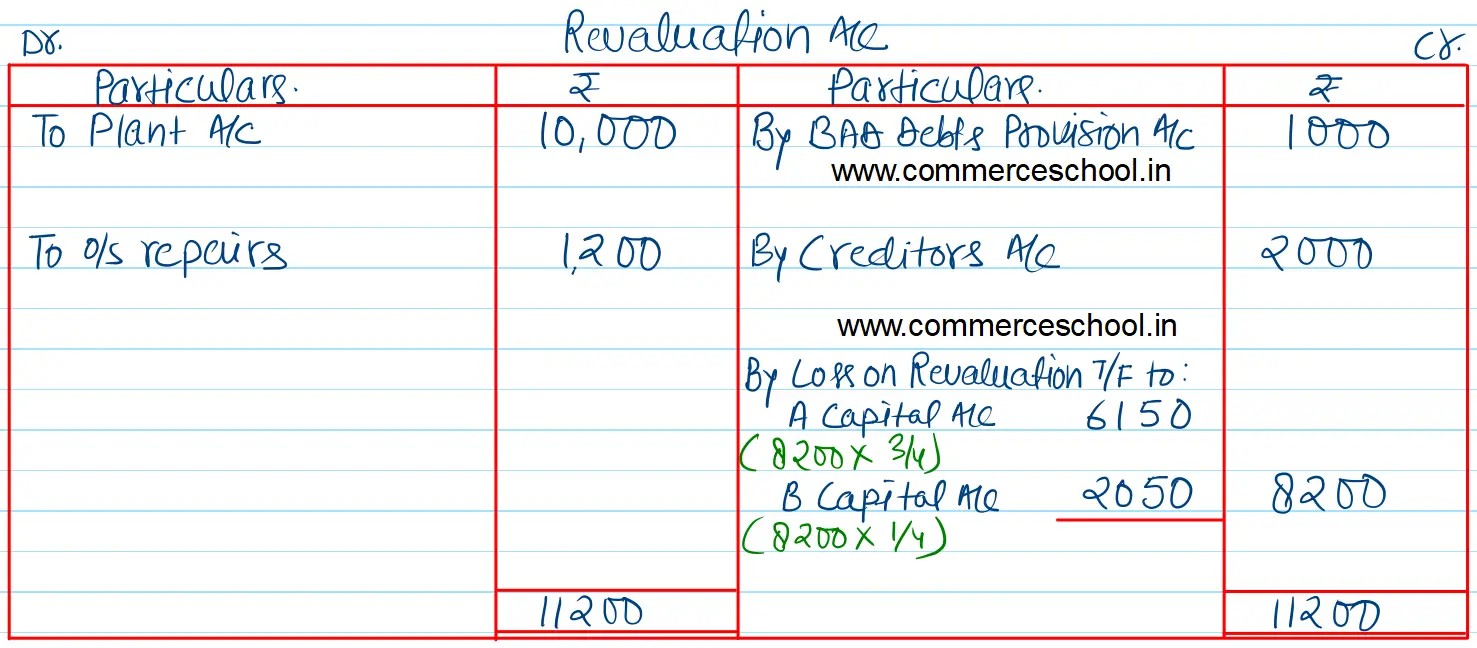

Following revaluations are also made:

I. Value of Plant is to be reduced by ₹ 10,000.

II. Bad Debts Provision is to be reduced from ₹ 4,000 to ₹ 3,000.

III. ₹ 2,000 Out of total Creditors of ₹ 20,000 are not to be paid.

IV. There is an outstanding bill for repairs for ₹ 1,200.

Pass necessary journal entries and prepare a Revaluation Account. Also Calculate the new profit sharing ratios.

[Ans. Loss on Revaluation ₹ 8,200; New Ratio 7 : 2 : 3. Premium for goodwill will be distributed in sacrifice ratio, i.e., 2 : 1.]