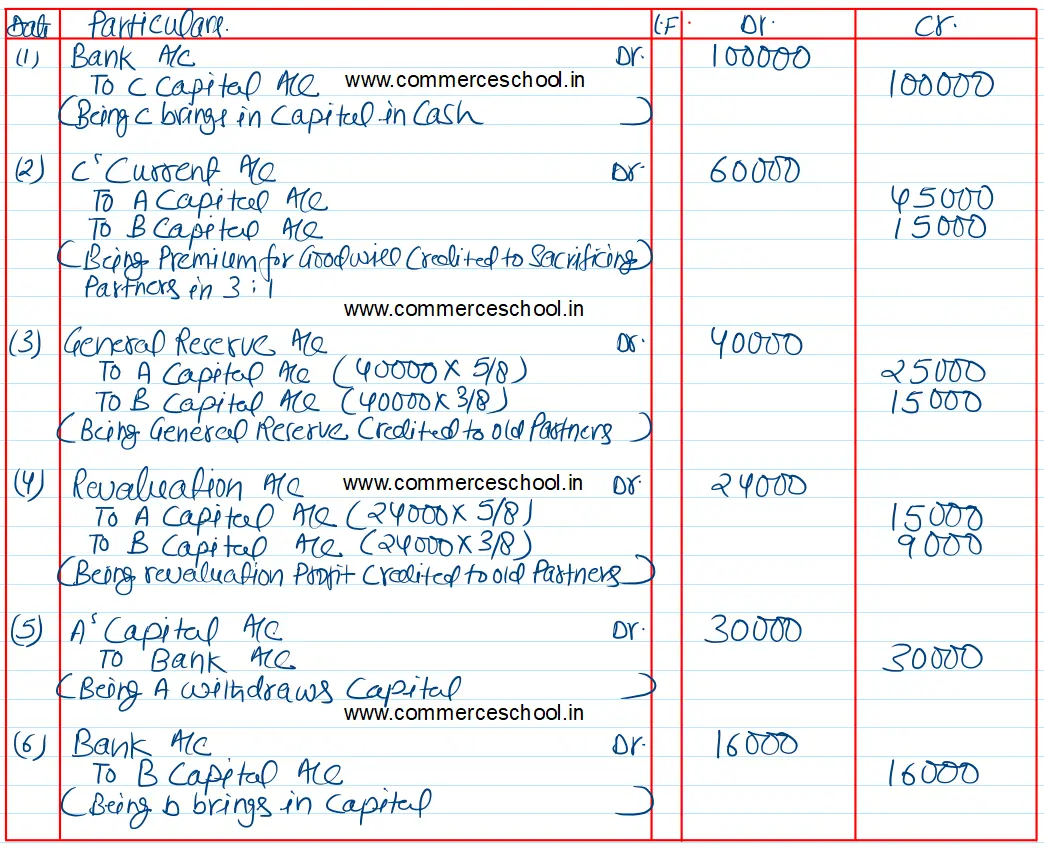

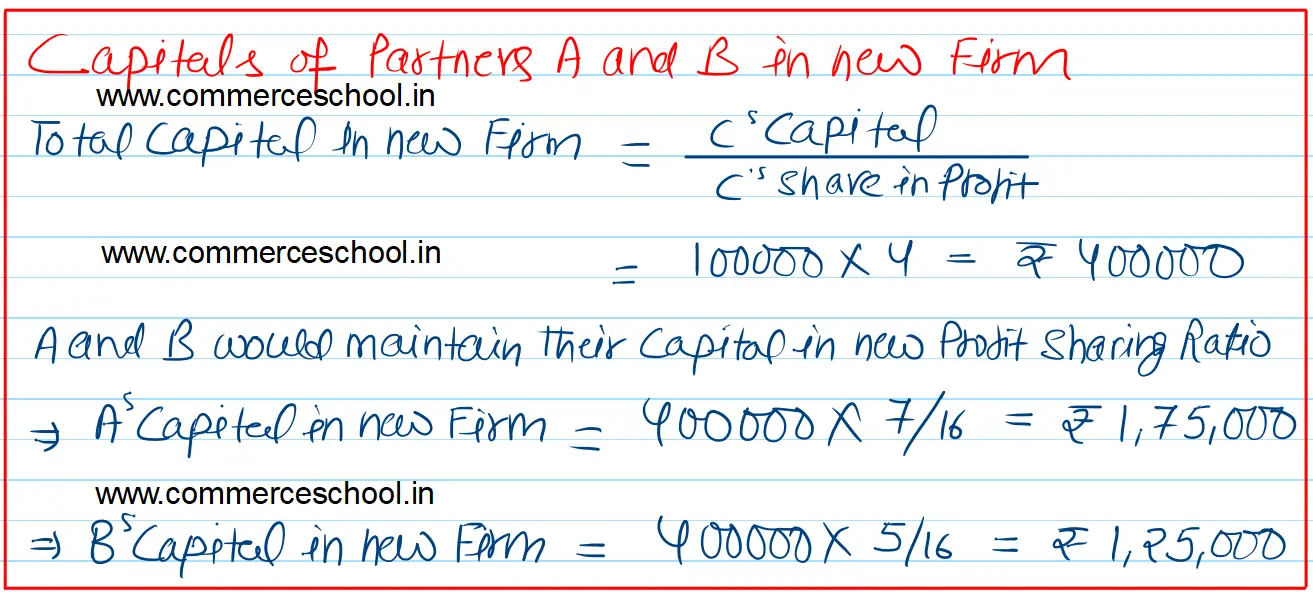

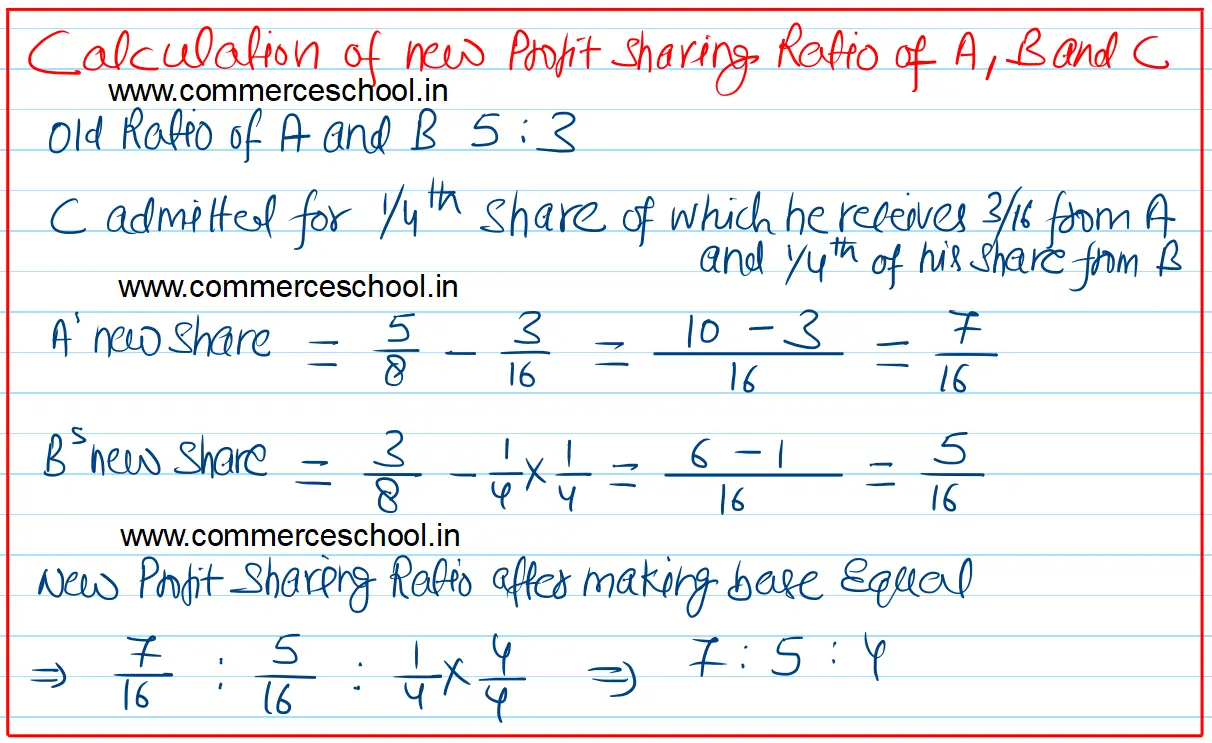

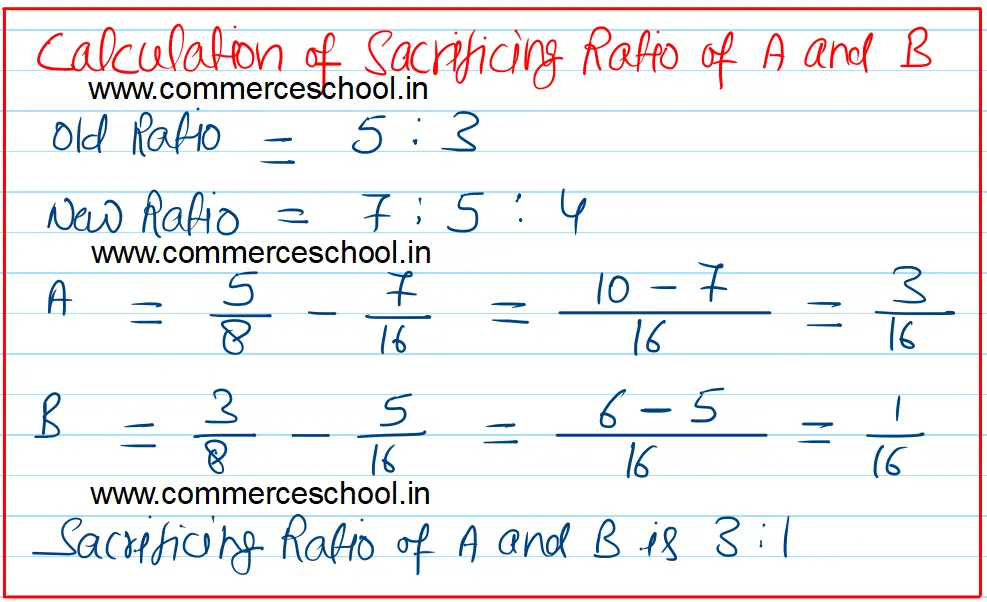

A and B are partners sharing profits in the ratio of 5 : 3. C was admitted for 1/4th share in profits. C acquires this share as 3/16 from A and 1/4th of his share from B. C brings in ₹ 1,00,000 as his capital

A and B are partners sharing profits in the ratio of 5 : 3. C was admitted for 1/4th share in profits. C acquires this share as 3/16 from A and 1/4th of his share from B. C brings in ₹ 1,00,000 as his capital.

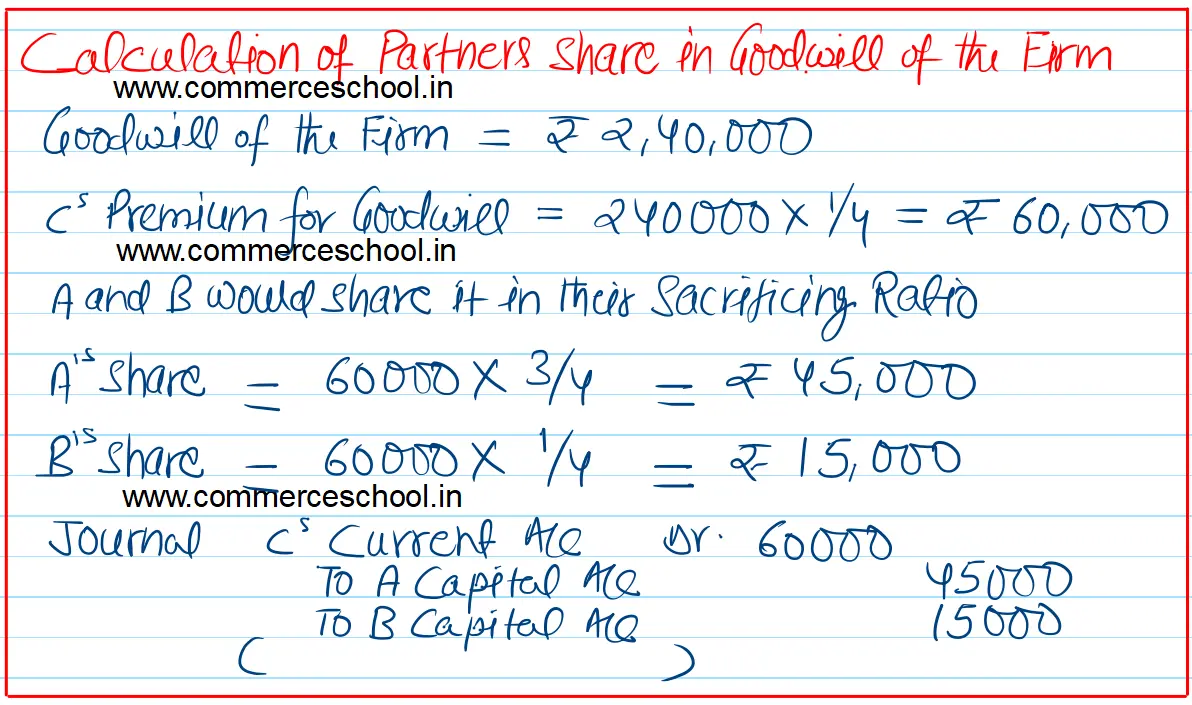

At the time of C’s admission:

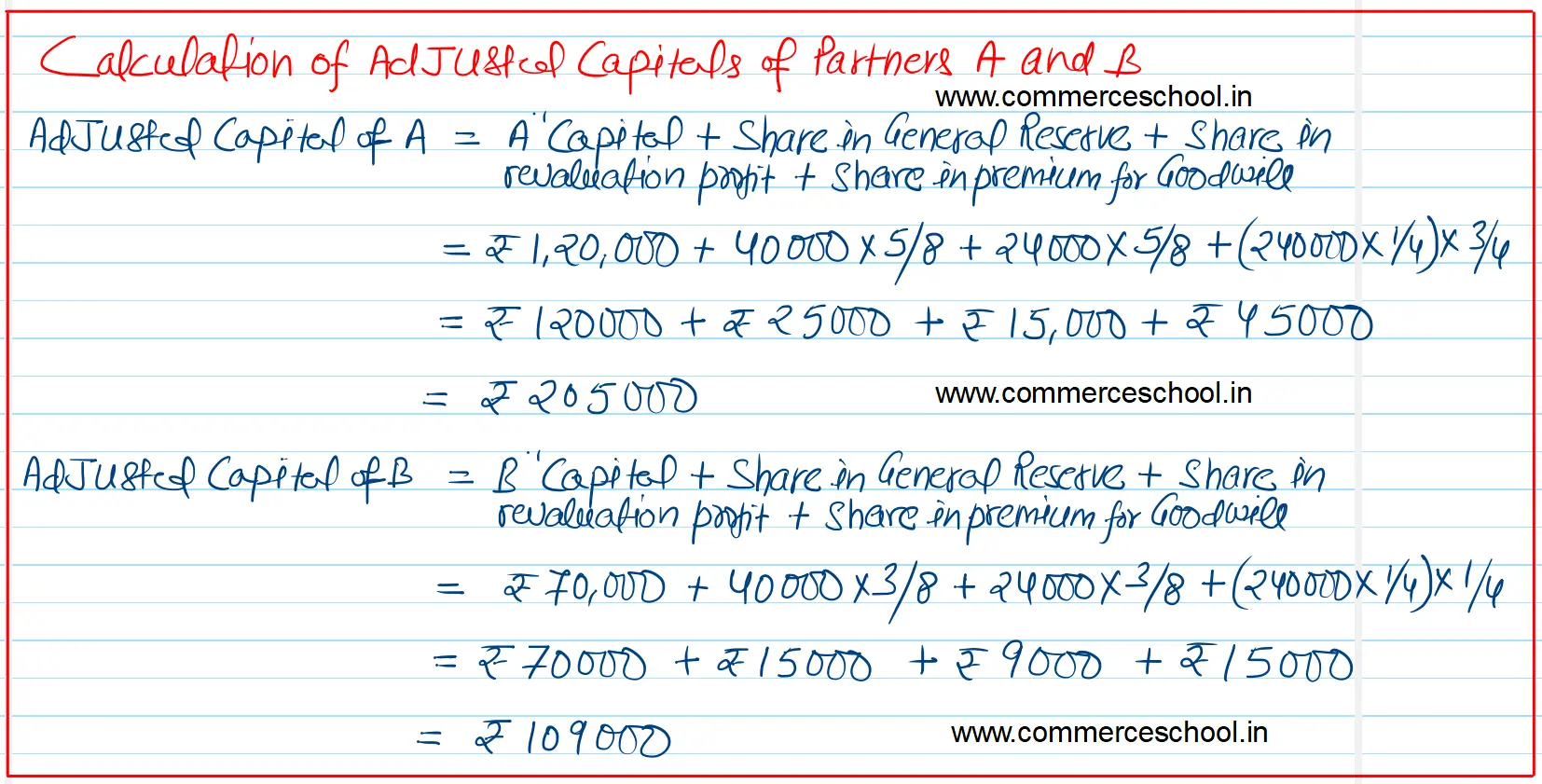

(i) The firm’s goodwill was valued at ₹ 2,40,000.

(ii) General Reserve was ₹ 40,000.

(iii) Profit on revaluation of assets and liabilities was ₹ 24,000.

Before any adjustments were made, the Capitals of A and B were ₹ 1,20,000 and ₹ 70,000 respectively.

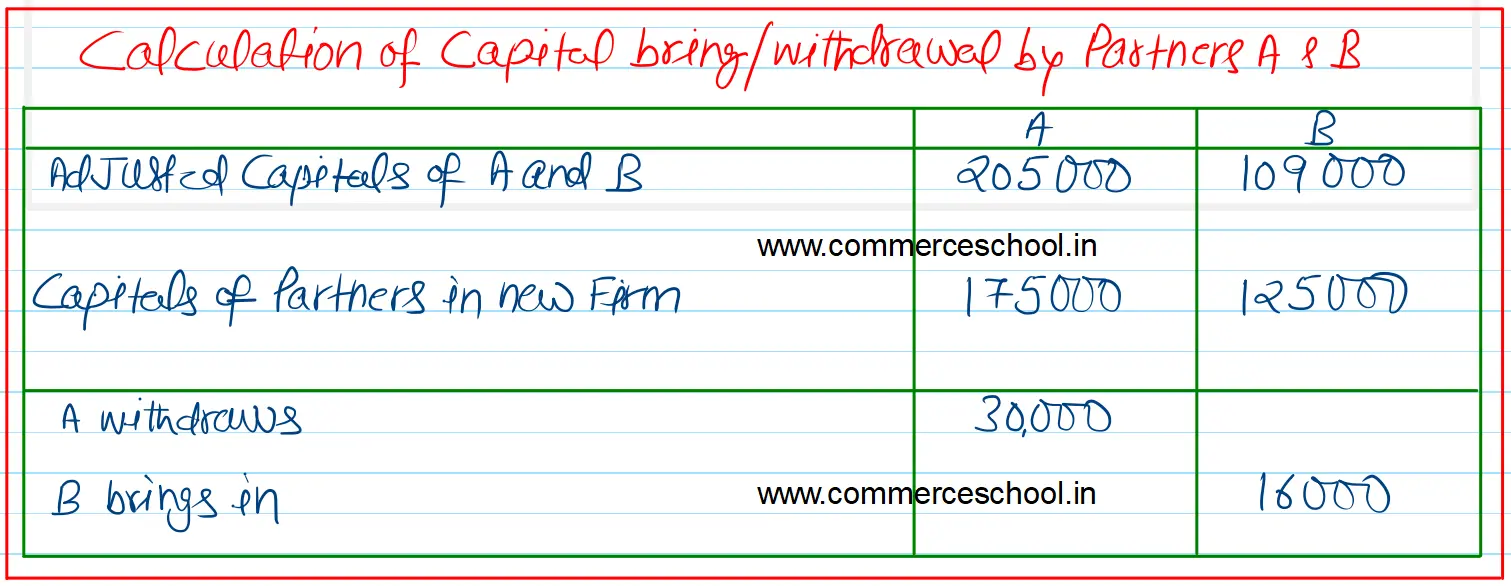

It is decided that after C’s admission, the Capitals of A and B be adjusted on the basis of C’s Capital, any excess or shortfall to be adjusted by withdrawing or bringing in Cash by the old partners. You are required to pass necessary journal entries on C’s admission.

[Ans. Capitals after adjustment for goodwill, general reserve and profit on revaluation: A ₹ 2,05,000 and B ₹ 1,09,000; Final Capitals A ₹ 1,75,000 and B ₹ 1,25,000; A withdraws ₹ 30,000 and B brings in ₹ 16,000.]