A and B were in partnership sharing profits and losses in the ratio of 3 : 1. On 1st April, 2024 they admit C as a partner on the following terms: (a) That C brings ₹ 1,00,000 as his capital and ₹ 50,000 for goodwill, half of which to be withdrawn by A and B

A and B were in partnership sharing profits and losses in the ratio of 3 : 1. On 1st April, 2024 they admit C as a partner on the following terms:

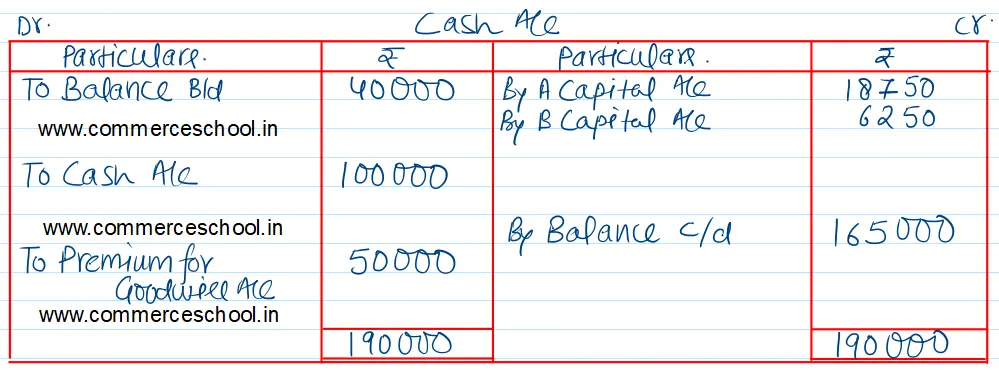

(a) That C brings ₹ 1,00,000 as his capital and ₹ 50,000 for goodwill, half of which to be withdrawn by A and B.

(b) That the value of land and buildings to be appreciated by 15 percent and that of stocks and machinery & fixtures to be reduced by 7 and 5 percent respectively.

(c) That provision for doubtful debts be made at 5 percent.

(d) That ₹ 15,000 be provided for an unforeseen liability.

(e) That C to be given 1/5th share and the profit sharing ratio between A and B to remain the same.

(f) That ₹ 11,000 is to be received as commission, hence to be accounted for.

The Balance Sheet of the old partnership as at 31st March, 2024 stood as:

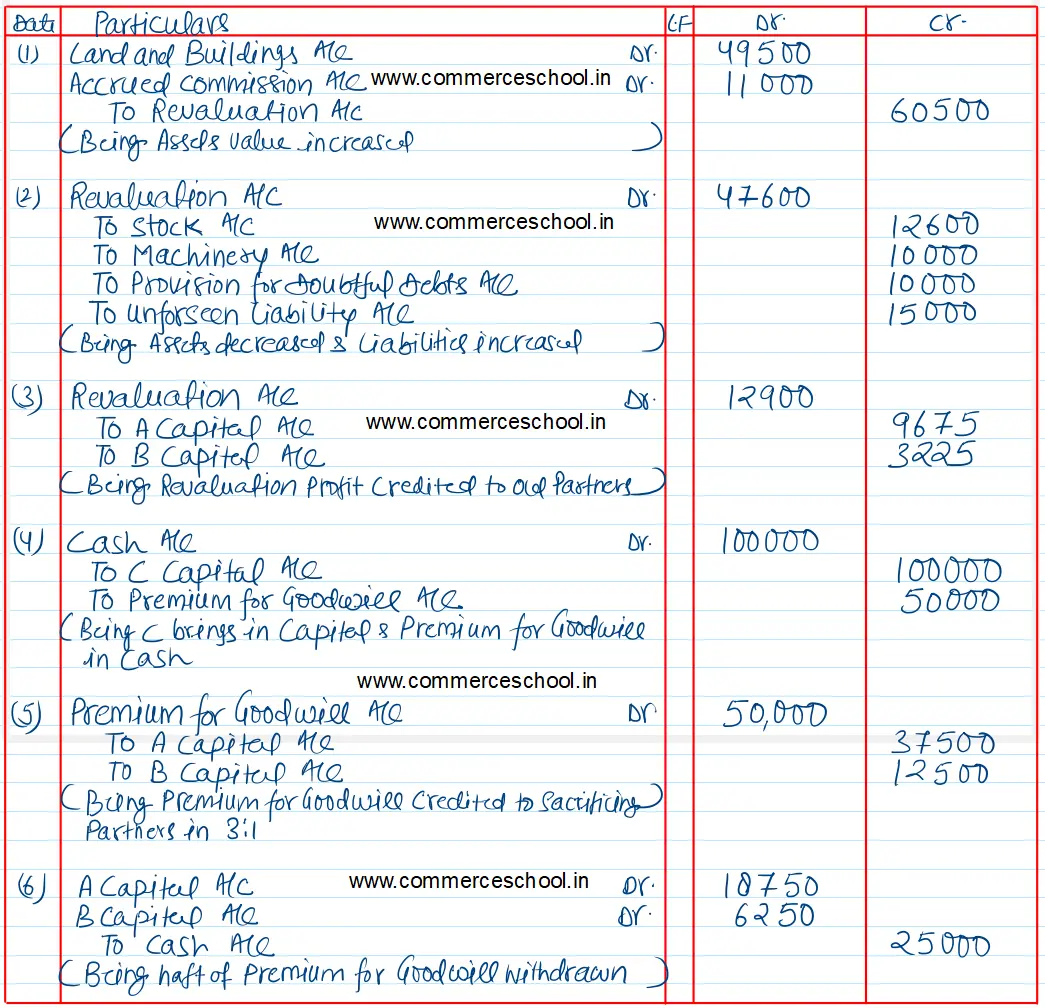

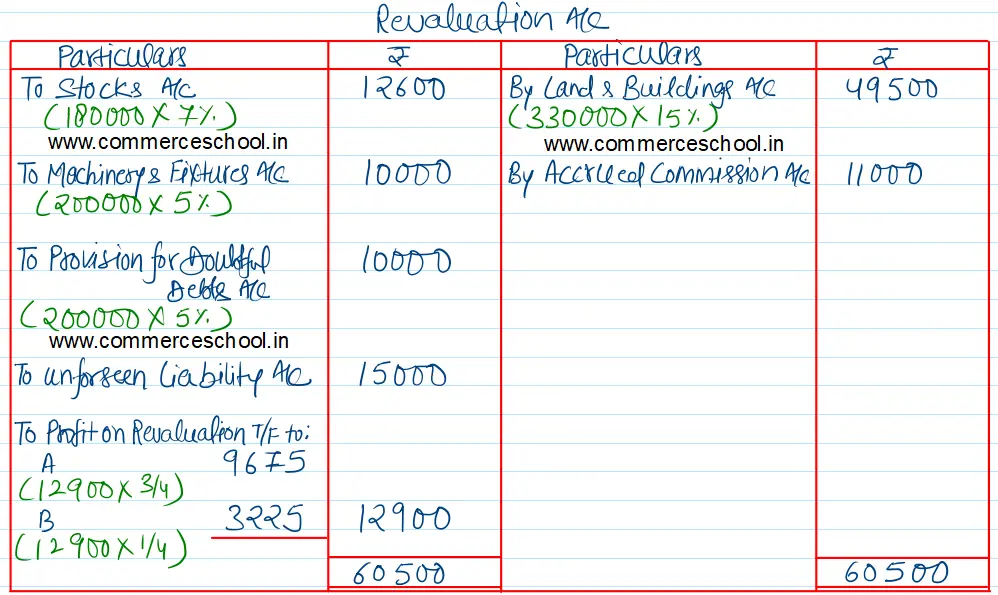

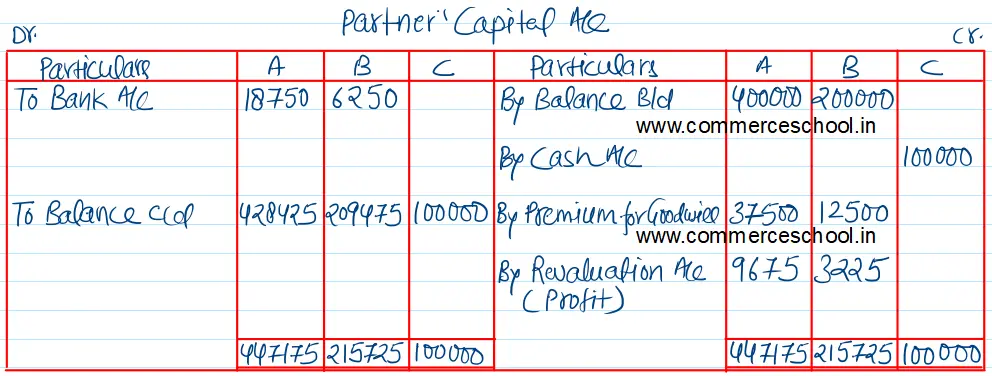

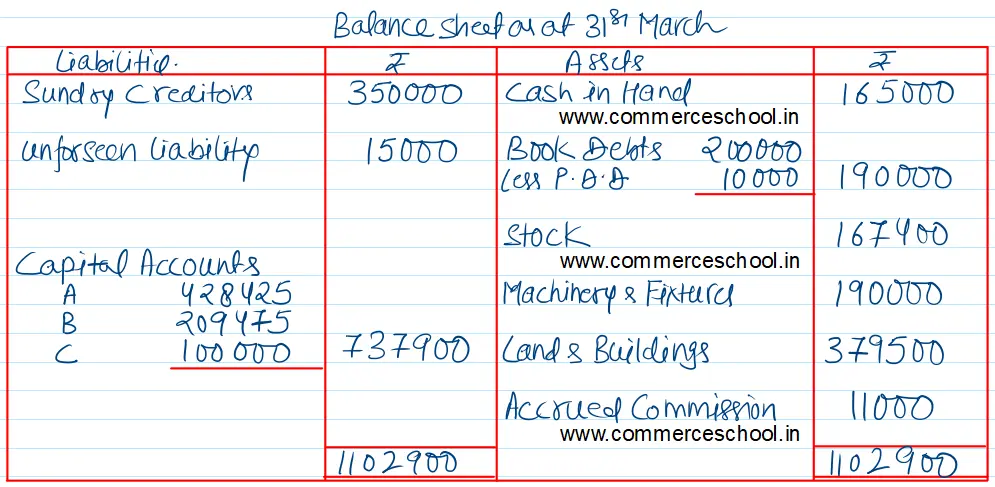

Give necessary Journal entries, ledger accounts and the balance sheet of the newly constituted firm.

[Ans. Gain on revaluation ₹ 12,900; Capital Accounts A ₹ 4,28,425; B ₹ 2,09,475; C ₹ 1,00,000, Cash Balaqnce ₹ 1,65,000 and Balance Sheet total ₹ 11,02,900.]

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 3,50,000 | Cash in Hand | 40,000 |

| Capital Accounts: A B | 4,00,000 2,00,000 | Books Debts | 2,00,000 |

| Stock | 1,80,000 | ||

| Machinery & Fixtures | 2,00,000 | ||

| Land and Building | 3,30,000 | ||

| 9,50,000 | 9,50,000 |

Anurag Pathak Answered question

Solution:-

Note:-

In the absence of any further information the sacrificing ratio is always equal to the old ratio i.e. 3 : 1

The premium for goodwill is credited to the sacrificing partners A and B in sacrificing ratio that is 3 : 1.

Anurag Pathak Changed status to publish