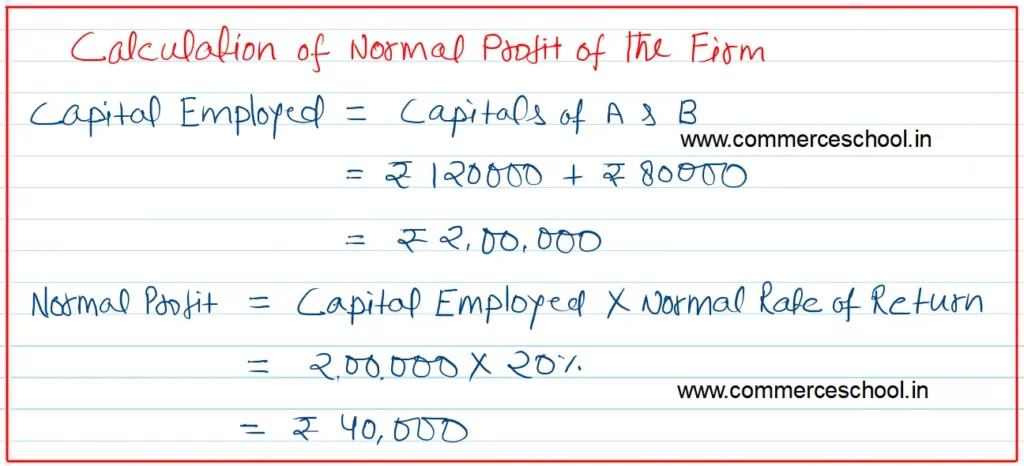

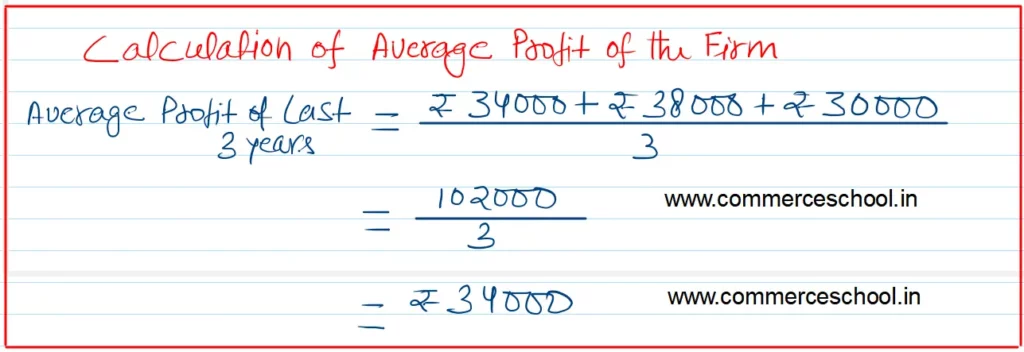

A and B were partners in a firm sharing profits equally. Their capitals were: A – ₹ 1,20,000 and B – ₹ 80,000. The annual rate of interest is 20%. Profits of the firm for the last three years were ₹ 34,000; ₹ 38,000 and ₹ 30,000

A and B were partners in a firm sharing profits equally. Their capitals were: A – ₹ 1,20,000 and B – ₹ 80,000. The annual rate of interest is 20%. Profits of the firm for the last three years were ₹ 34,000; ₹ 38,000 and ₹ 30,000. They admitted C as a new partner. On C’s admission the goodwill of the firm was valued at 2 year’s purchase of the super profits.

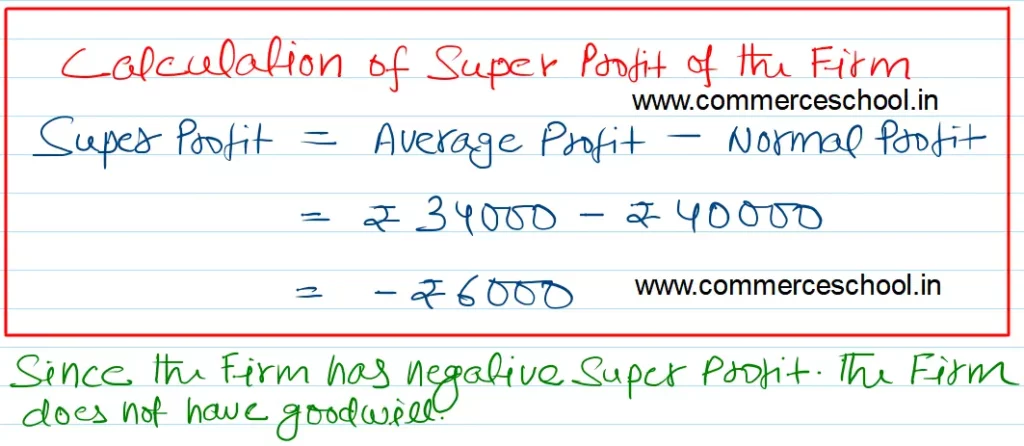

Calculate the value of goodwill of the firm on C’s admission.

[Ans.: Since the firm has negative super profit, the firm does not have goodwill.]

Anurag Pathak Changed status to publish