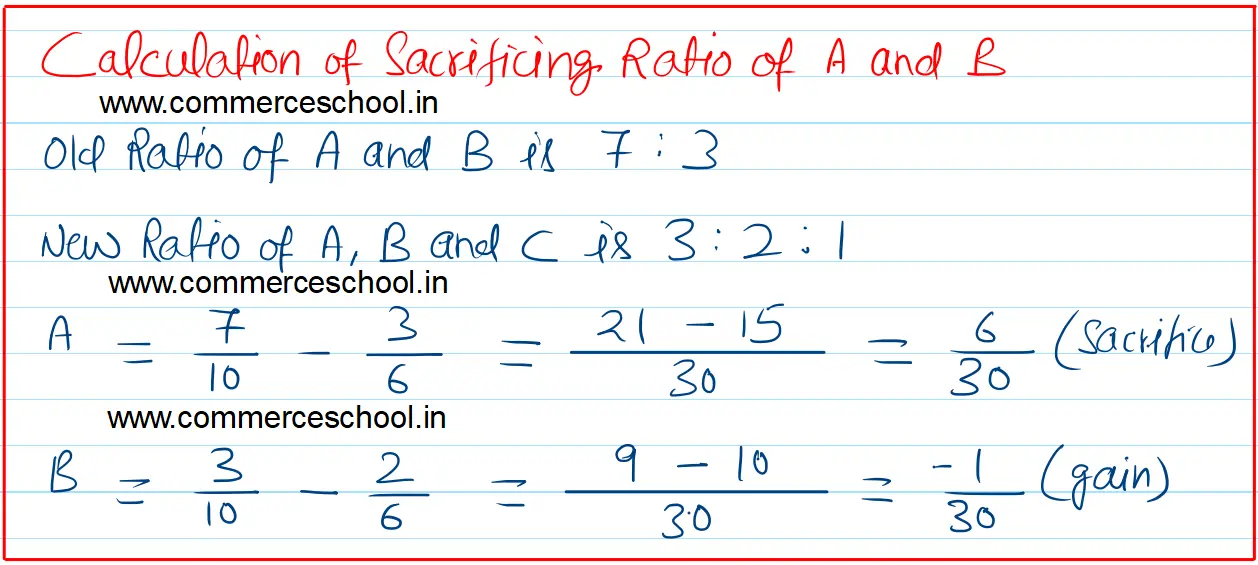

A and B were partners in a firm sharing profits in the ratio of 7 : 3. On 1-3-2024, they admitted C as a new partner for 1/6th share in the profits of the firm. They fixed the new profit sharing ratio as 3 : 2 : 1

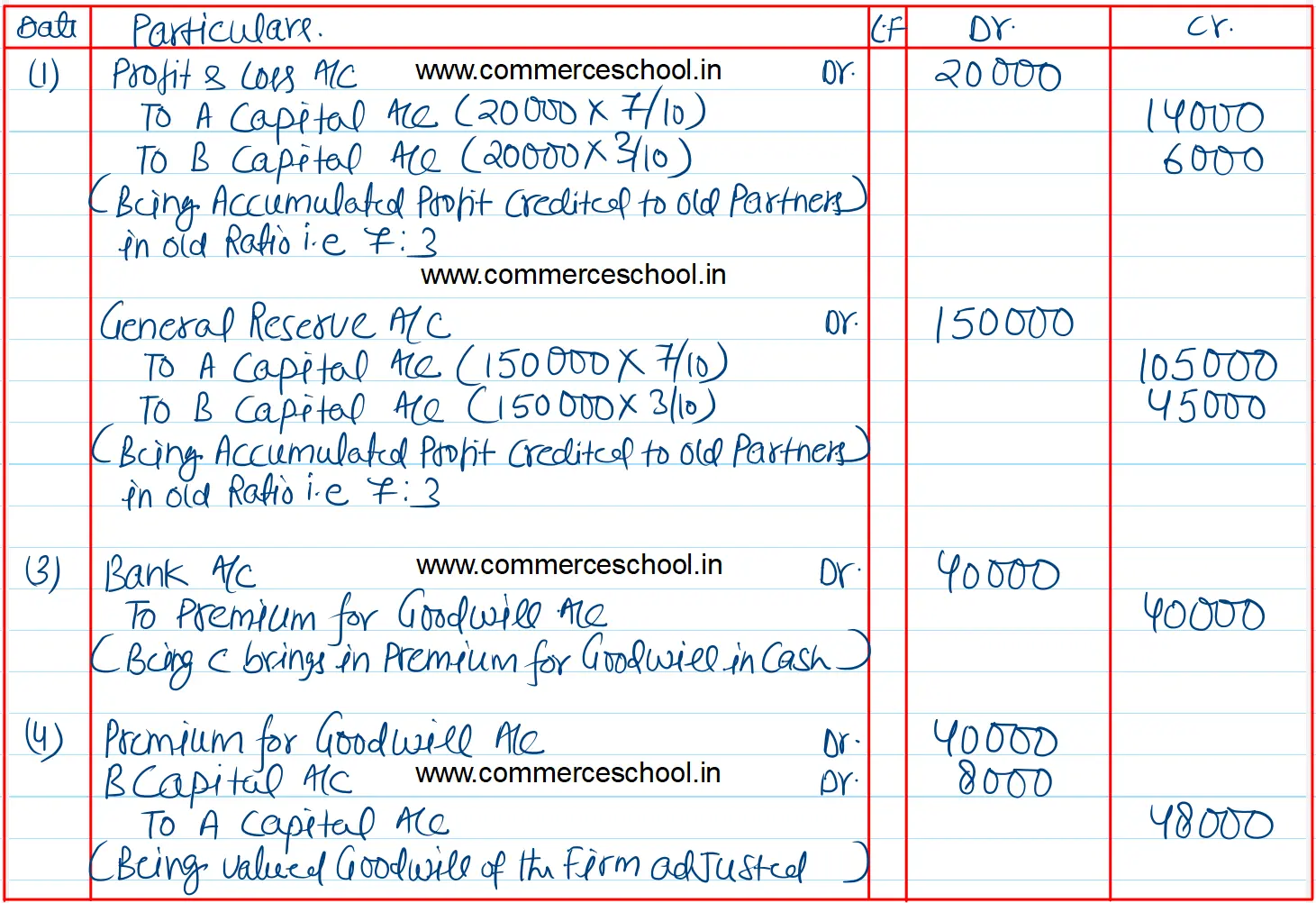

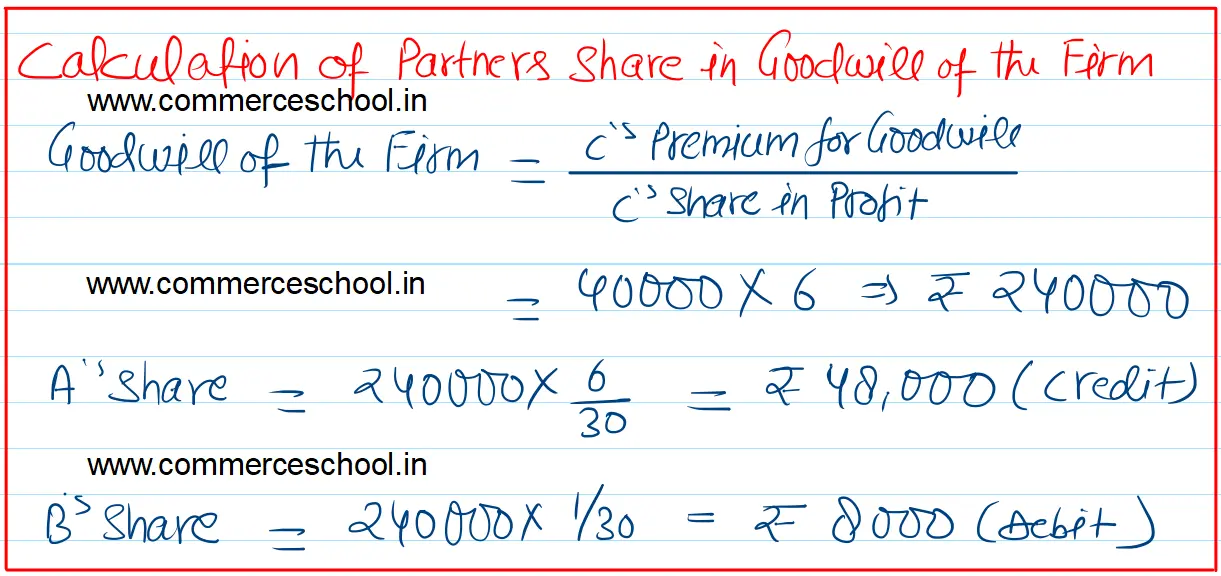

A and B were partners in a firm sharing profits in the ratio of 7 : 3. On 1-3-2024, they admitted C as a new partner for 1/6th share in the profits of the firm. They fixed the new profit sharing ratio as 3 : 2 : 1. The P & L A/c on the date of admission showed a balance of ₹ 20,000 (Cr.) The firm also had a reserve of ₹ 1,50,000. C is to bring ₹ 40,000 as premium for his share of goodwill.

Showing your calculations clearly, pass necessary journal entries to record the above transactions.

[Ans. (i) P & L A/c and Reerve A/c will be debited and old partners will be credited in their old ratio. (ii) A sacrifices 6/30 whereas B gains 1/30 and C gains 5/30. Hence Premium for Goodwill A/c will be debited by ₹ 40,000 and B’s Capital A/c will be debited by ₹ 8,000 and A’s Capital A/c will be credited by ₹ 48,000.]