A and B were partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2018, was as follows:

A and B were partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2018, was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capitals:

A B Creditors Employee’s Provident Fund Workmen Compensation Reserve Contingency Reserve |

1,04,000 52,000 1,54,000 16,000 10,000 10,000 |

Cash

Sundry Debtors Stock Prepaid Insurance Plant and Machinery Building Furniture |

37,600

|

8,000 36,000 60,000 6,000 76,000 1,40,000 20,000 |

| 3,46,000 | 3,46,000 |

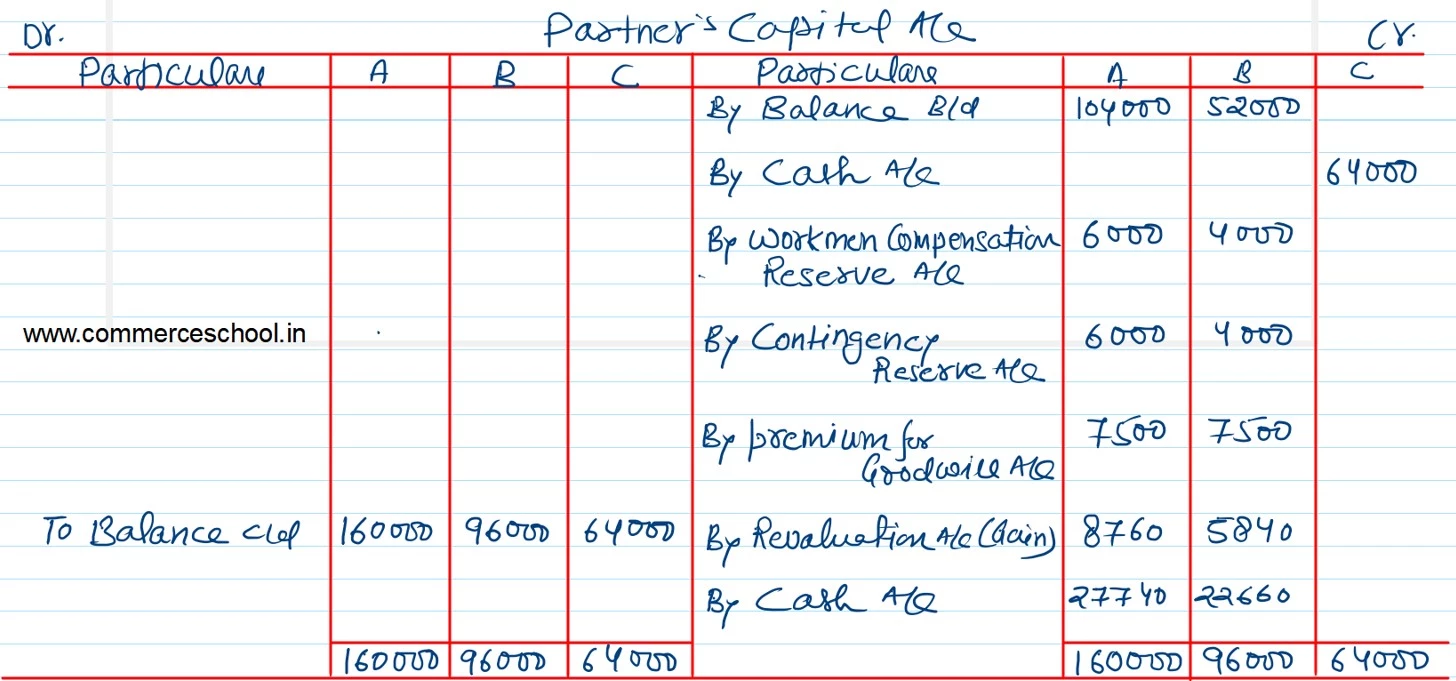

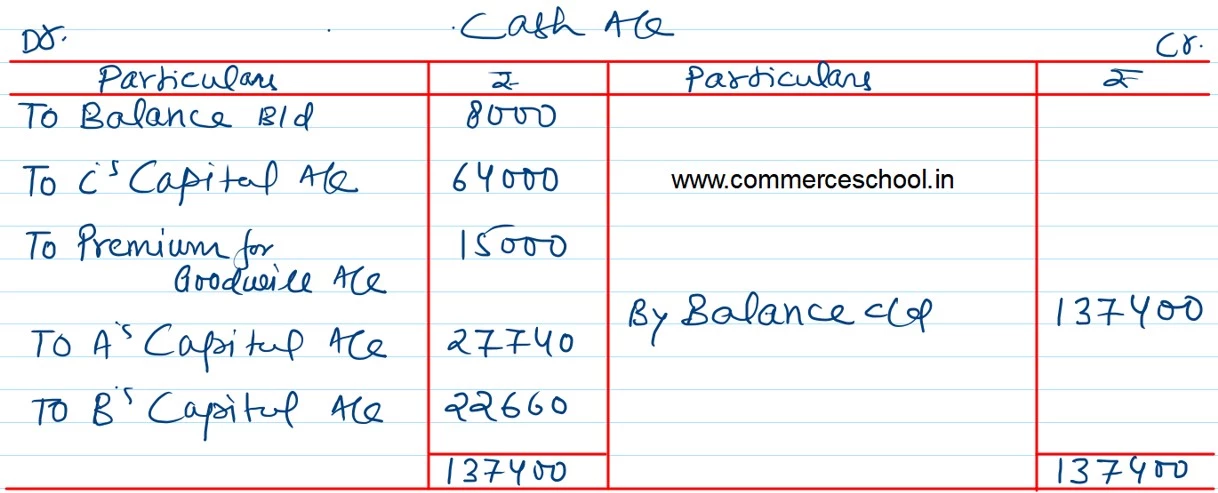

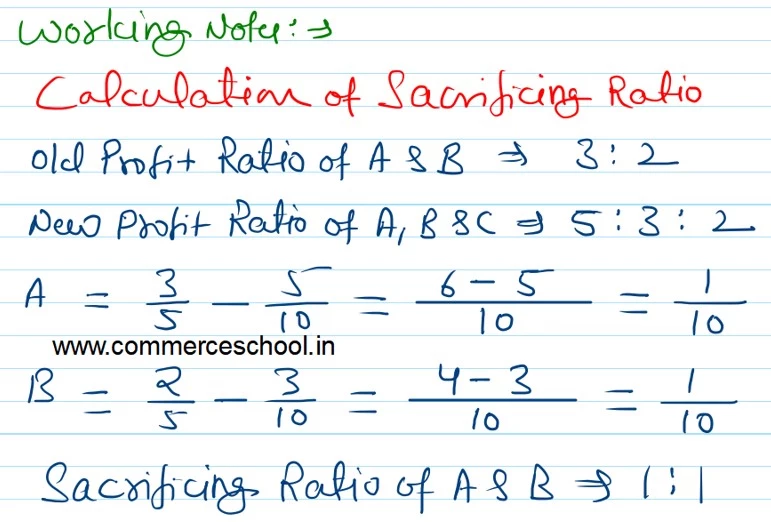

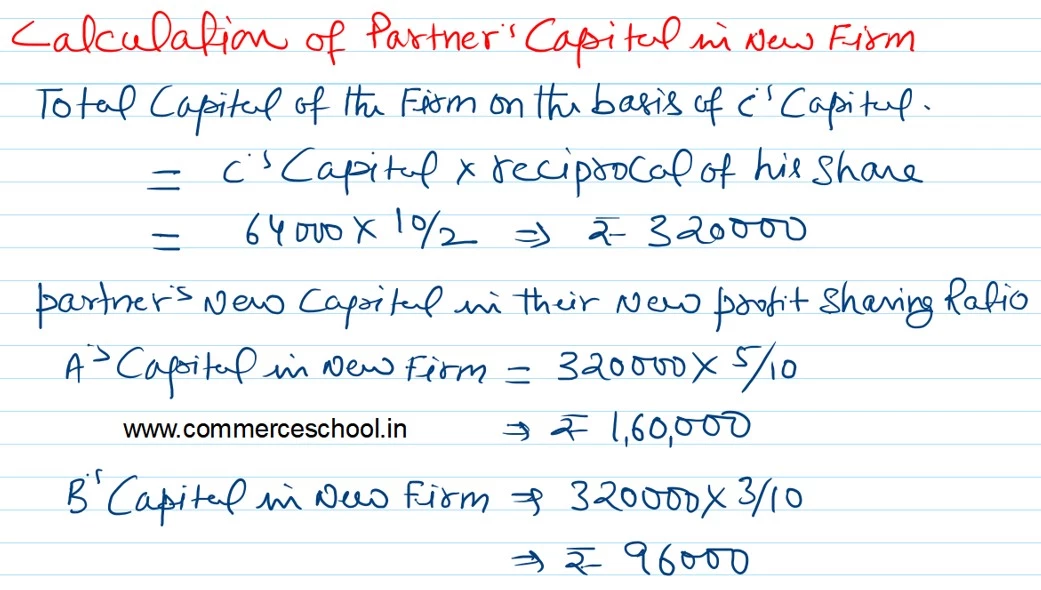

C was admitted as a new partner and brought ₹ 64,000 as capital and ₹ 15,000 for his share of goodwill premium. The new profit sharing ratio was 5 : 3 : 2. On C’s admission the following was agreed upon:

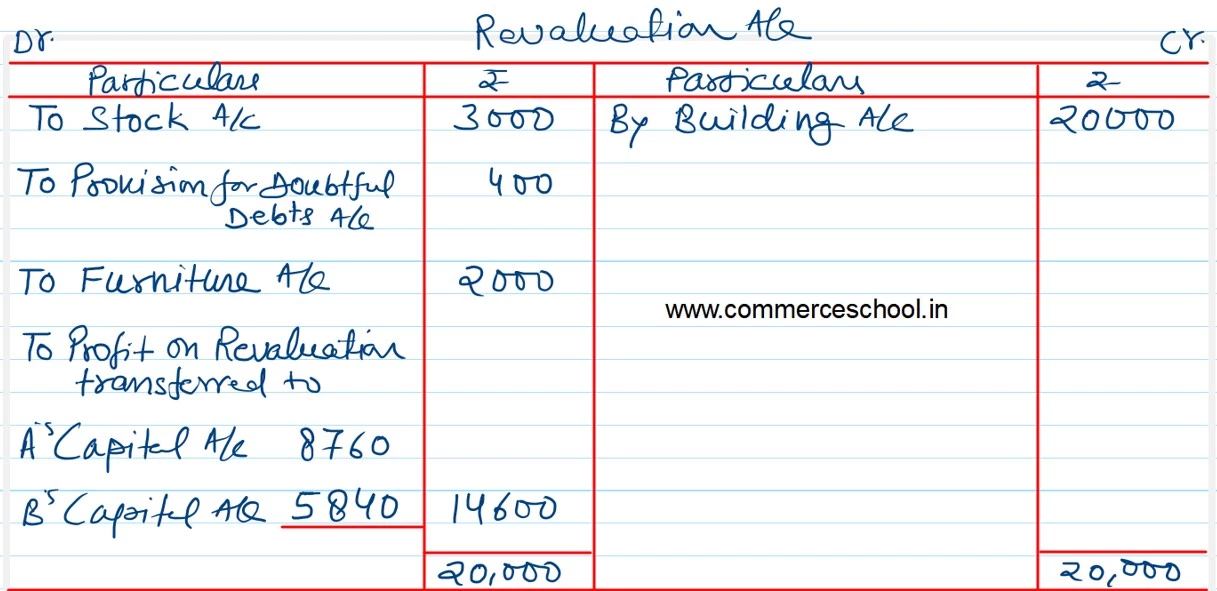

i) Stock was to be depreciated by 5%.

ii) Provision for doubtful debts was to be made at ₹ 2,000.

iii) Furniture was to be depreciated by 10%

iv) Building was valued at ₹ 1,60,000.

v) Capitals of A and B were to be adjusted on the basis of C’s Capital by bringing or paying in cash as the case may be:

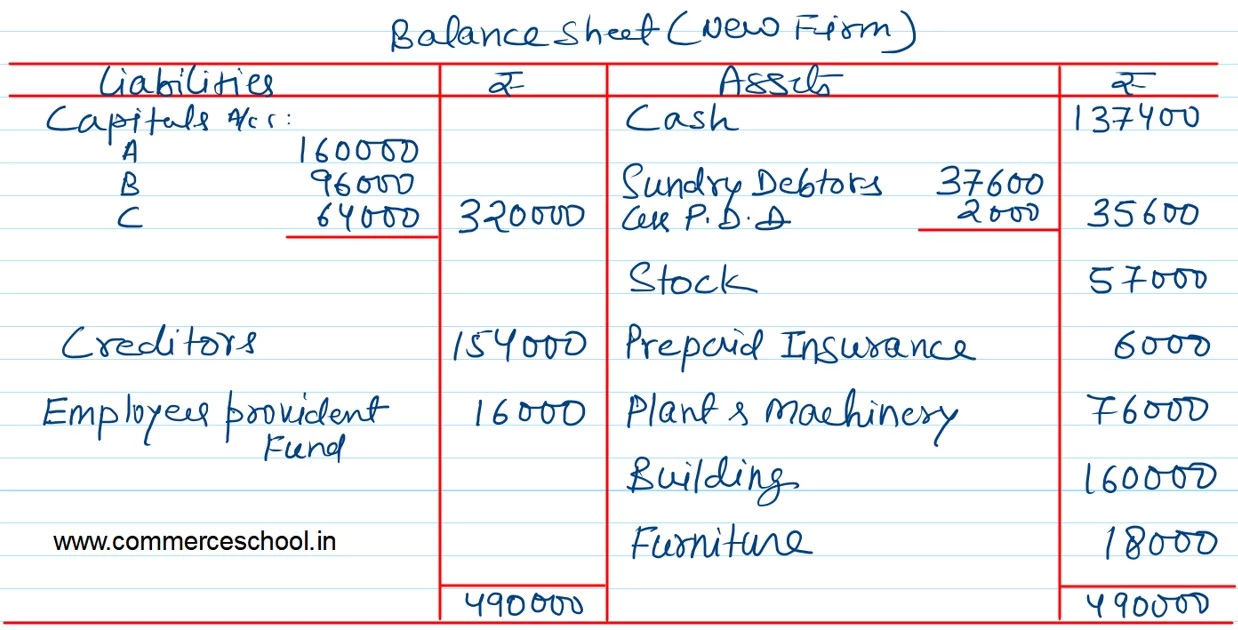

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of reconstituted firm.

[Ans: Gain (Profit) on Revaluation = ₹ 14,600; Capital Accounts: A – ₹ 1,60,000; B – ₹ 96,000; C – ₹ 64,000; A bring bring cash of ₹ 27,740; B will bring ₹ 22,600; Cash Balance = ₹ 1,37,400; Balance Sheet Total – ₹ 4,90,000.]