A and B were partners with fixed capitals of ₹ 3,70,000 each. They admitted C as a new partner for 1/4th share of profits. C brought ₹ 3,00,000 as his capital and the necessary amount of goodwill premium for his share of goodwill

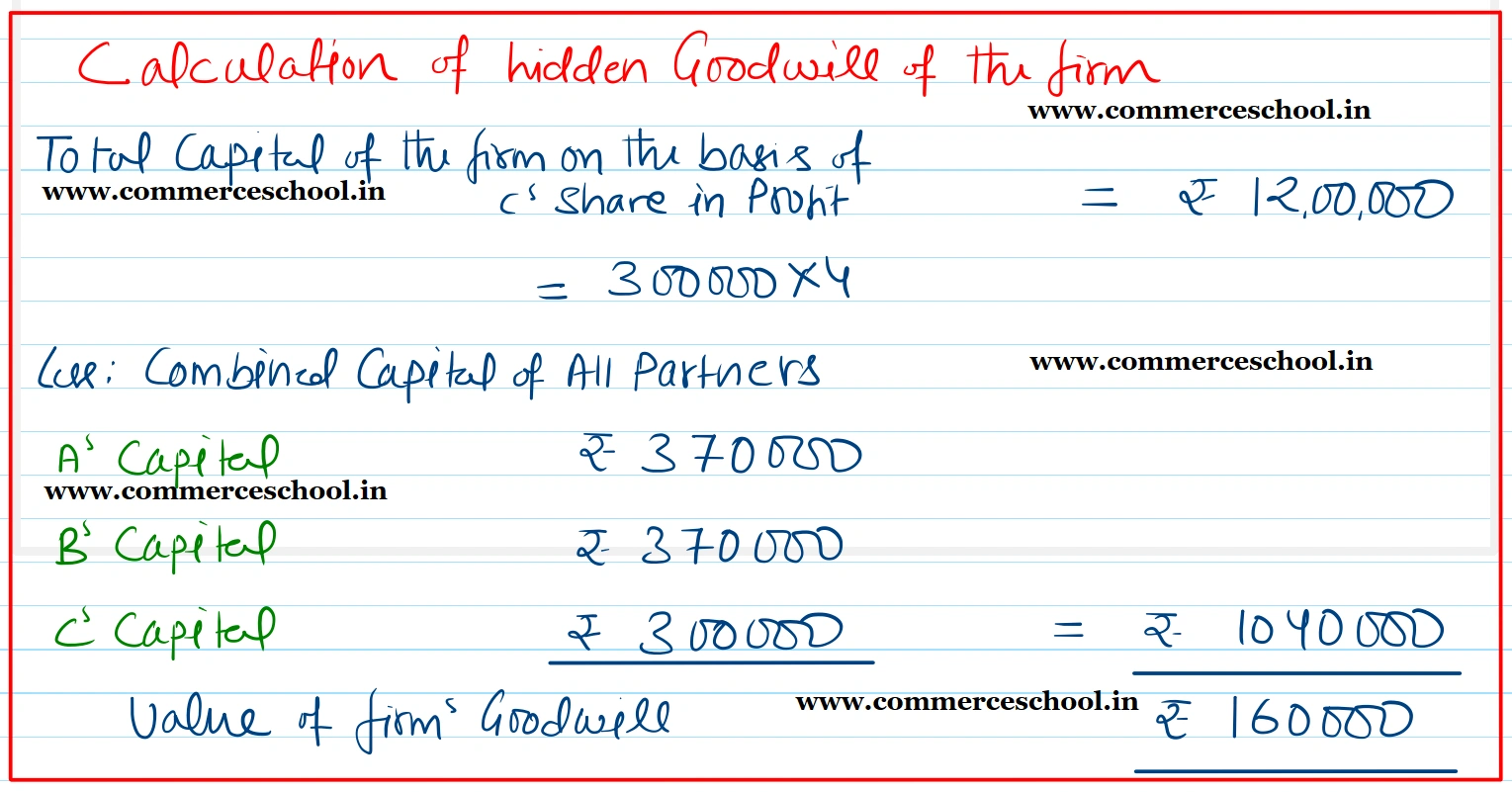

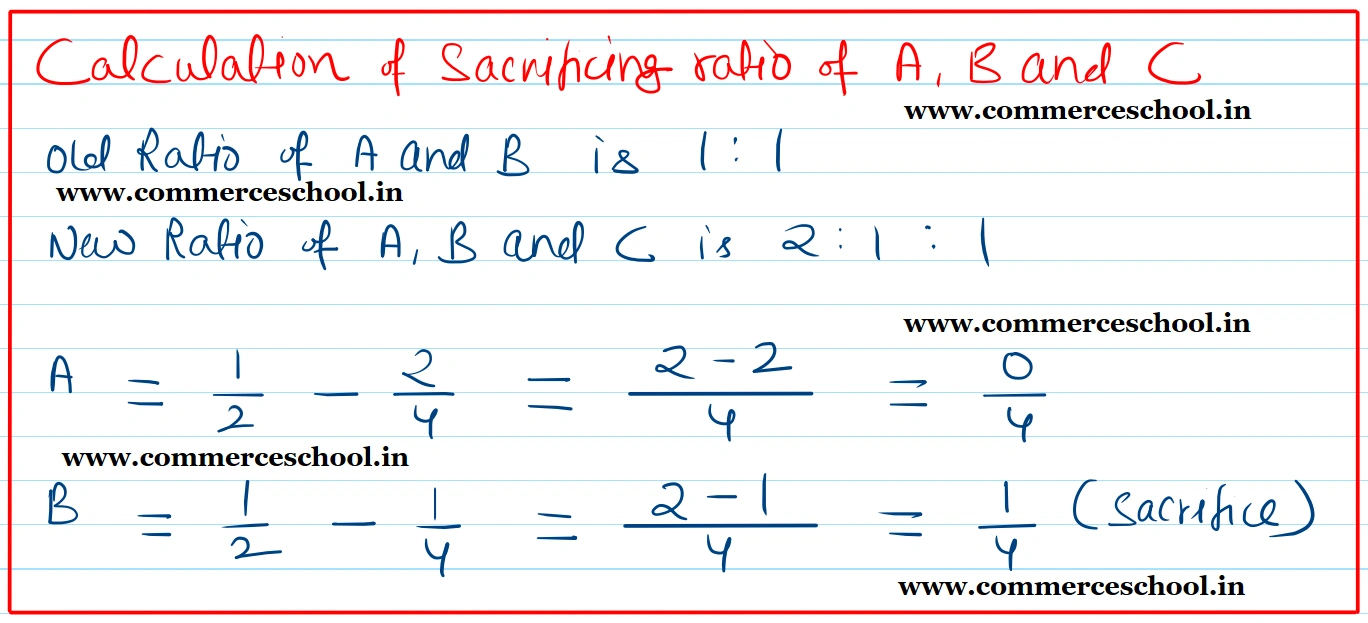

A and B were partners with fixed capitals of ₹ 3,70,000 each. They admitted C as a new partner for 1/4th share of profits. C brought ₹ 3,00,000 as his capital and the necessary amount of goodwill premium for his share of goodwill. The new profit-sharing ratio will be 2 : 1 : 1.

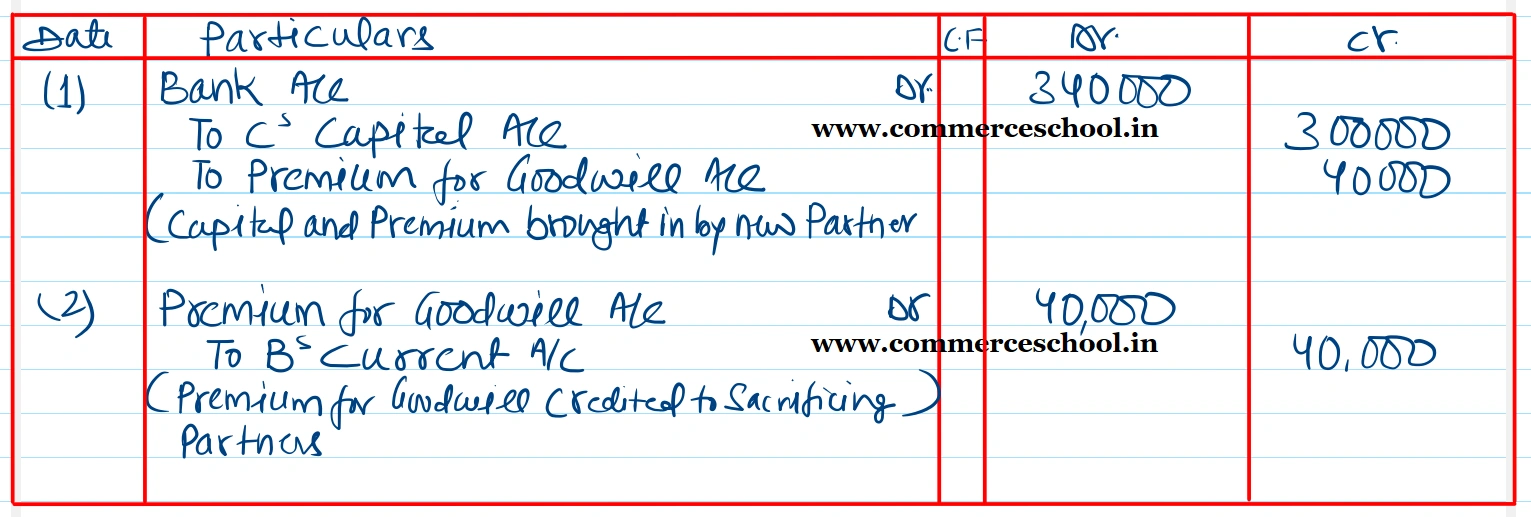

Pass necessary journal entries for the above transactions in the books of the firm.

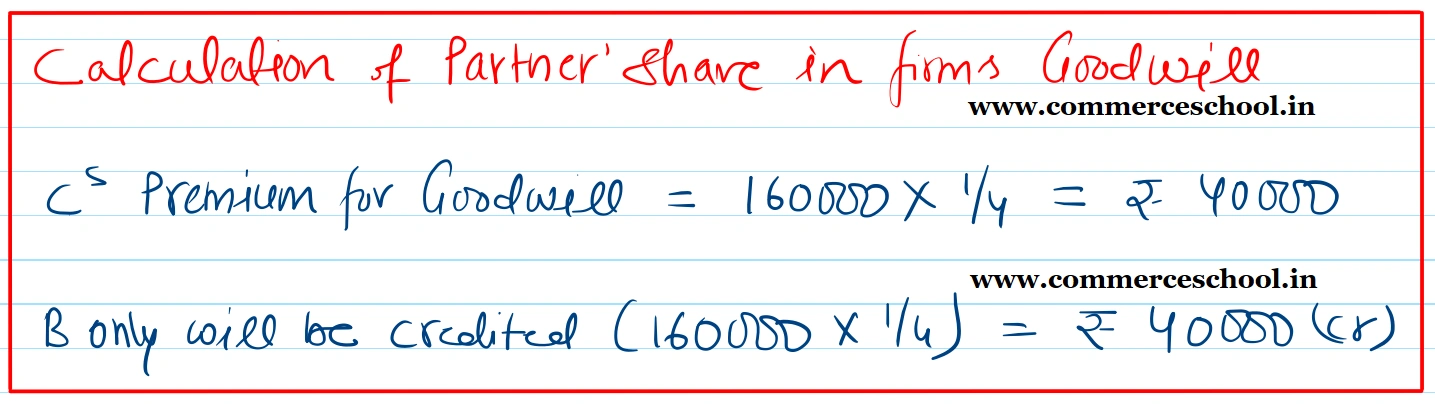

[Ans. Hidden Goodwill ₹ 1,60,000. Entire amount of goodwill ₹ 40,000 brought in be C will be credited to B’s Current A/c since he alone has sacrificed.]

Anurag Pathak Answered question