A, B and C are partners in a firm sharing profits and losses equally. On 1st April, 2023 their fixed capitals were ₹ 8,00,000, ₹ 6,00,000 and ₹ 6,00,000 respectively. On 1st October 2023, A advanced ₹ 1,00,000 to the firm whereas C took a loan of ₹ 1,50,000 from the firm on the same date

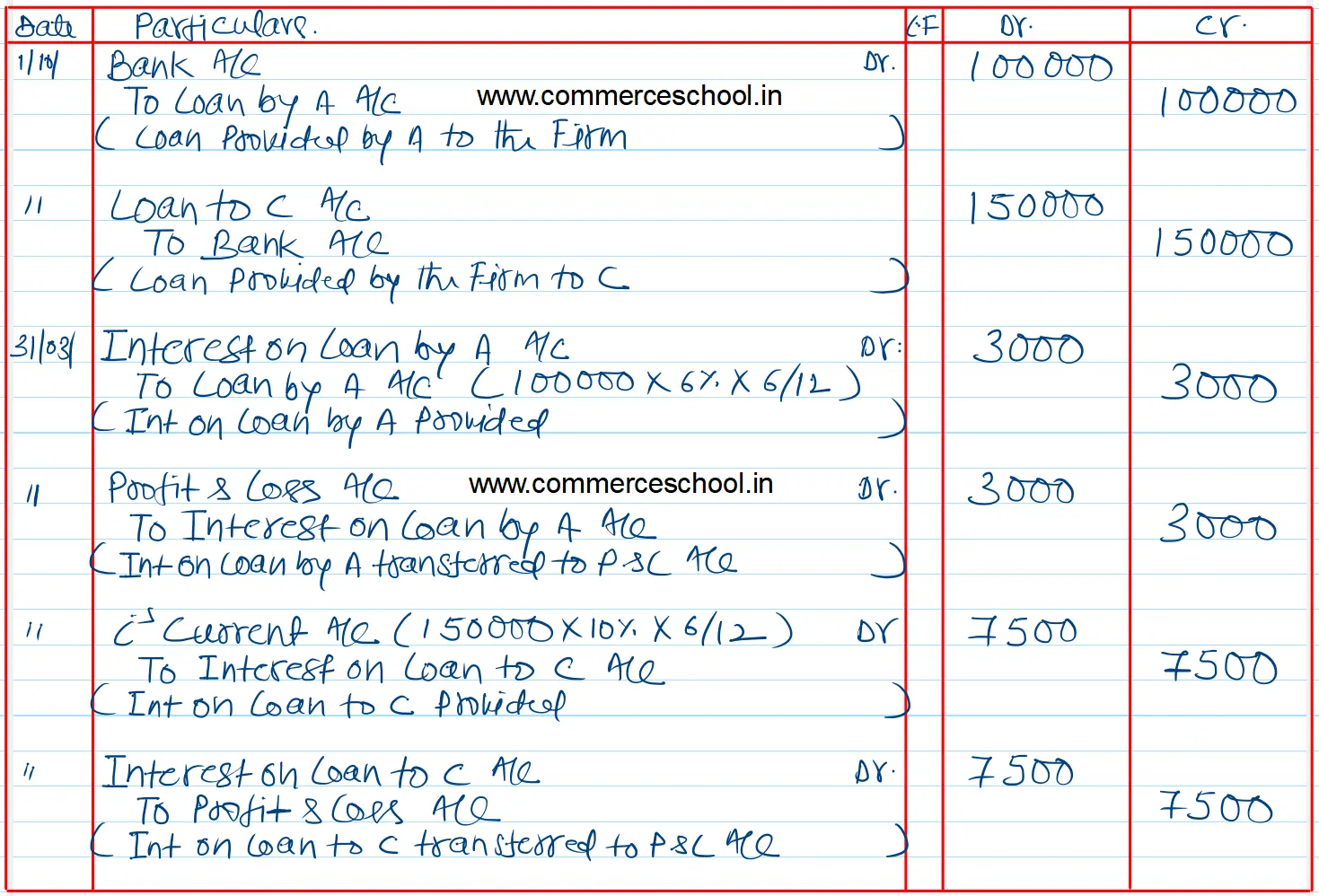

A, B and C are partners in a firm sharing profits and losses equally. On 1st April, 2023 their fixed capitals were ₹ 8,00,000, ₹ 6,00,000 and ₹ 6,00,000 respectively. On 1st October 2023, A advanced ₹ 1,00,000 to the firm whereas C took a loan of ₹ 1,50,000 from the firm on the same date. It was agreed among the partners that C will pay interest @ 10% p.a.

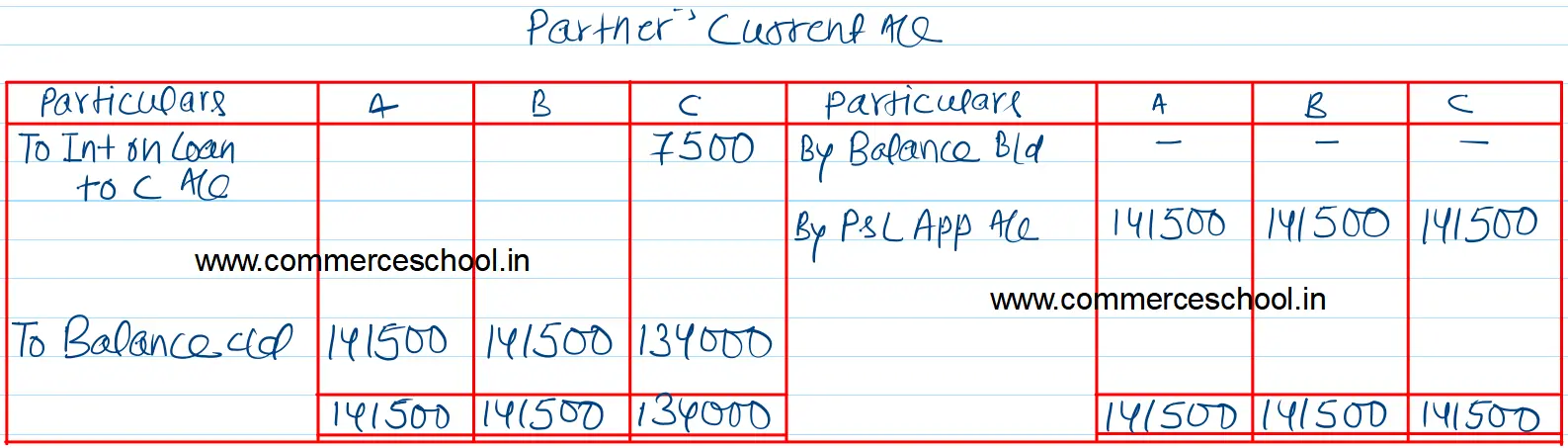

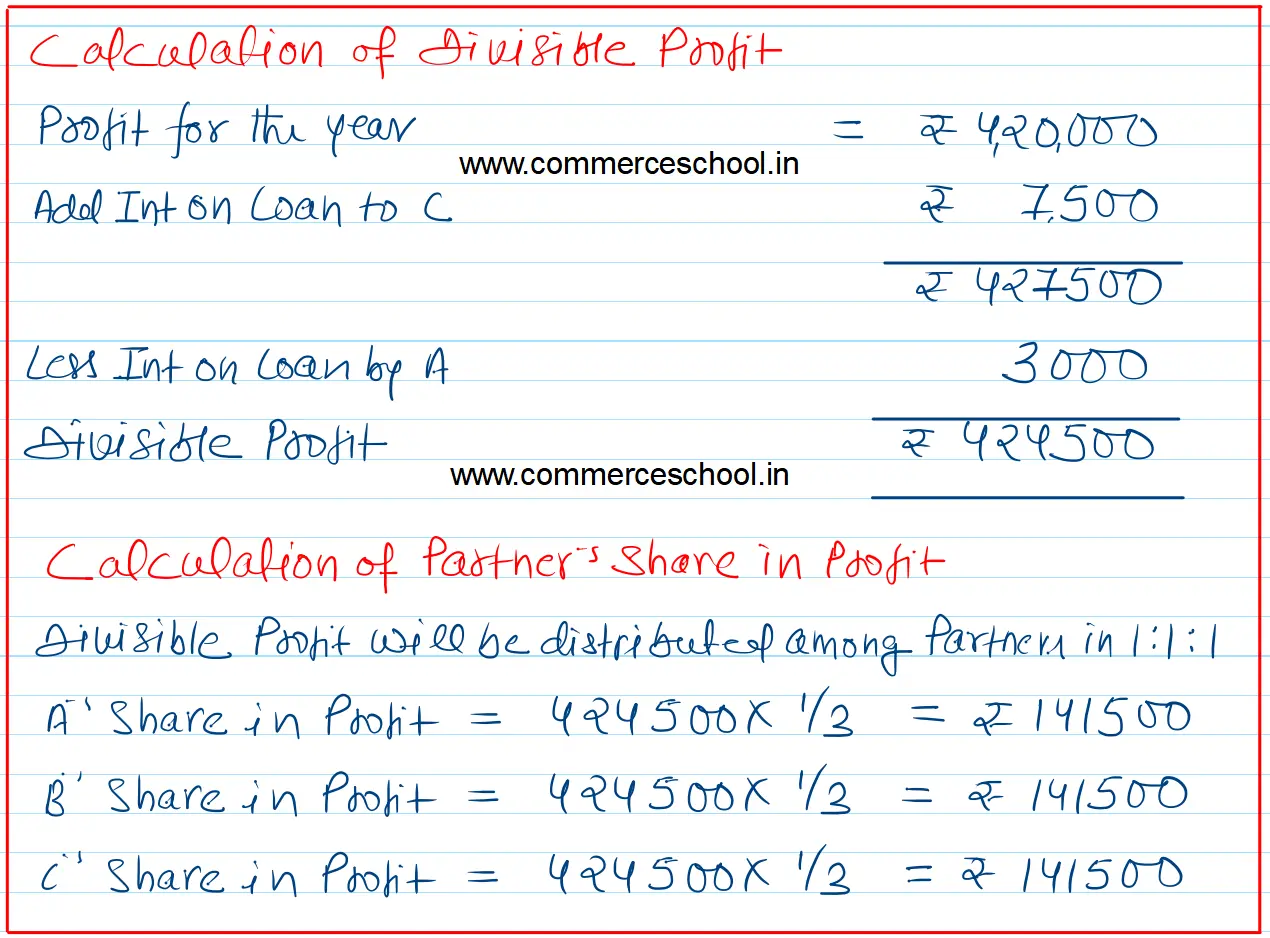

Profit for the year ended 31st March, 2024 amounted to ₹ 4,20,000 before allowing or charging interest on loans. Pass Journal entries for interest on loans and prepare Current Accounts of the partners.

[Ans. Divisible Profit ₹ 4,24,500; Current Account Balances : A ₹ 1,41,500 (Cr.); B ₹ 1,41,500 (Cr). and C ₹ 1,34,000 (Cr.)]

Hint. Interest on Loan by A will not be credited to his Current Account. It will be credited to his Loan A/c.