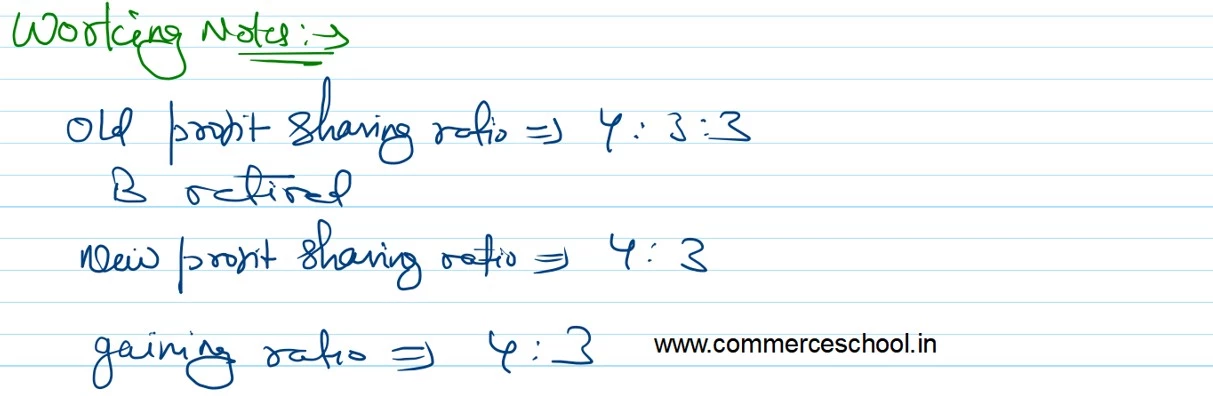

A, B and C are partners sharing profits and losses in the ratio of 4 : 3 : 3. Their Balance sheet as at 31st March, 2023 is:

A, B and C are partners sharing profits and losses in the ratio of 4 : 3 : 3. Their Balance sheet as at 31st March, 2023 is:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Bills Payable General Reserve Capital A/cs: A B C |

7,000 3,000 20,000 32,000 24,000 20,000 |

Land and Building

Plant and Machinery Computer Printer Stock Sundry Debtors Bank |

14,000

|

36,000 28,000 8,000 20,000 12,000 2,000 |

| 1,06,000 | 1,06,000 |

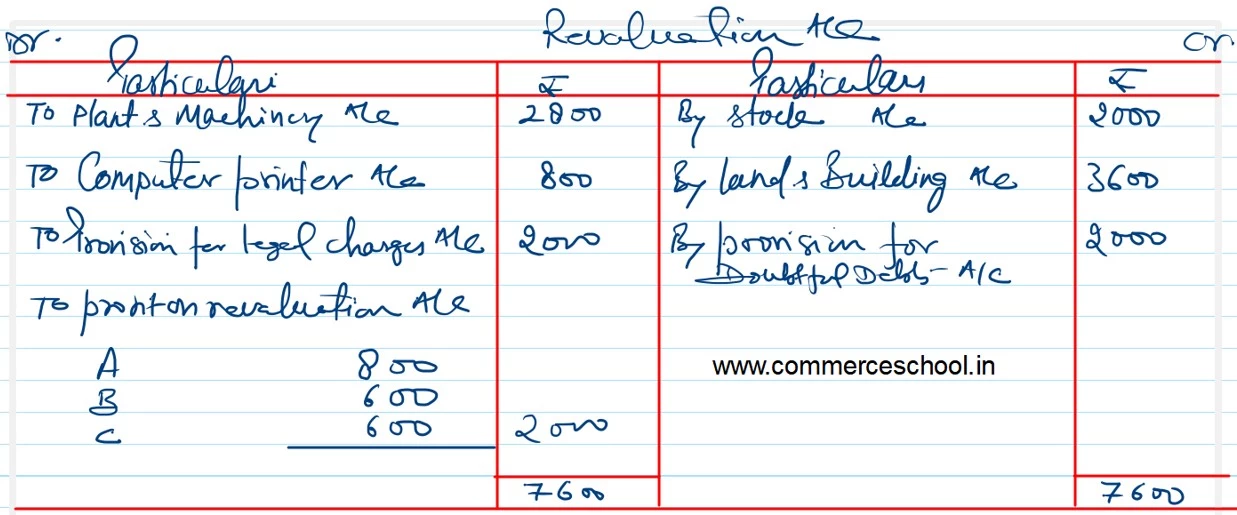

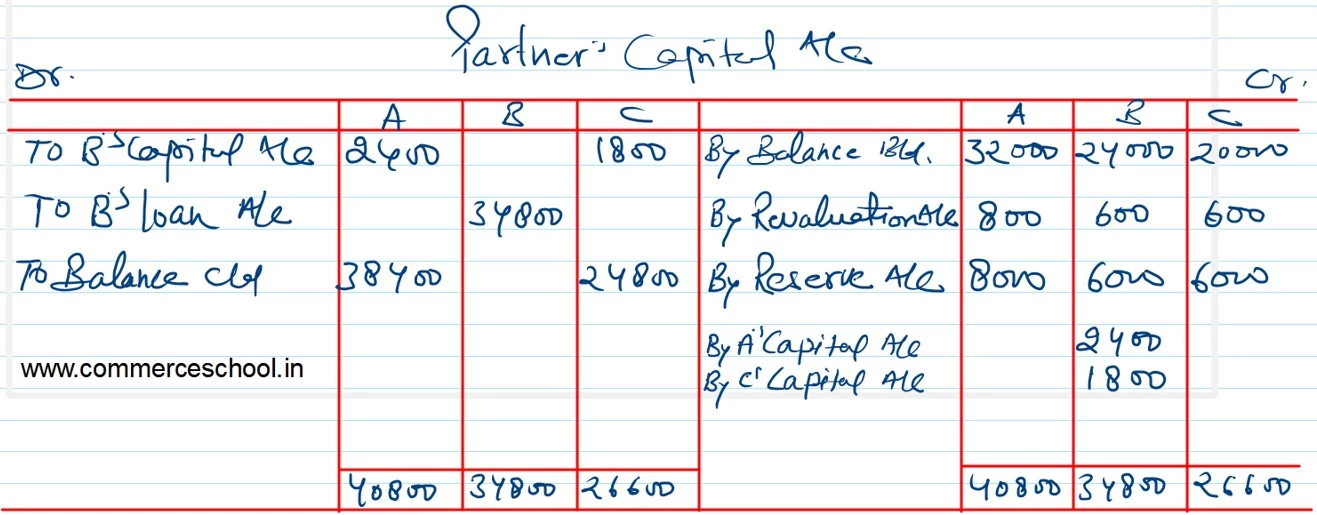

On 1st April, 2023, B retired from the firm on the following terms:

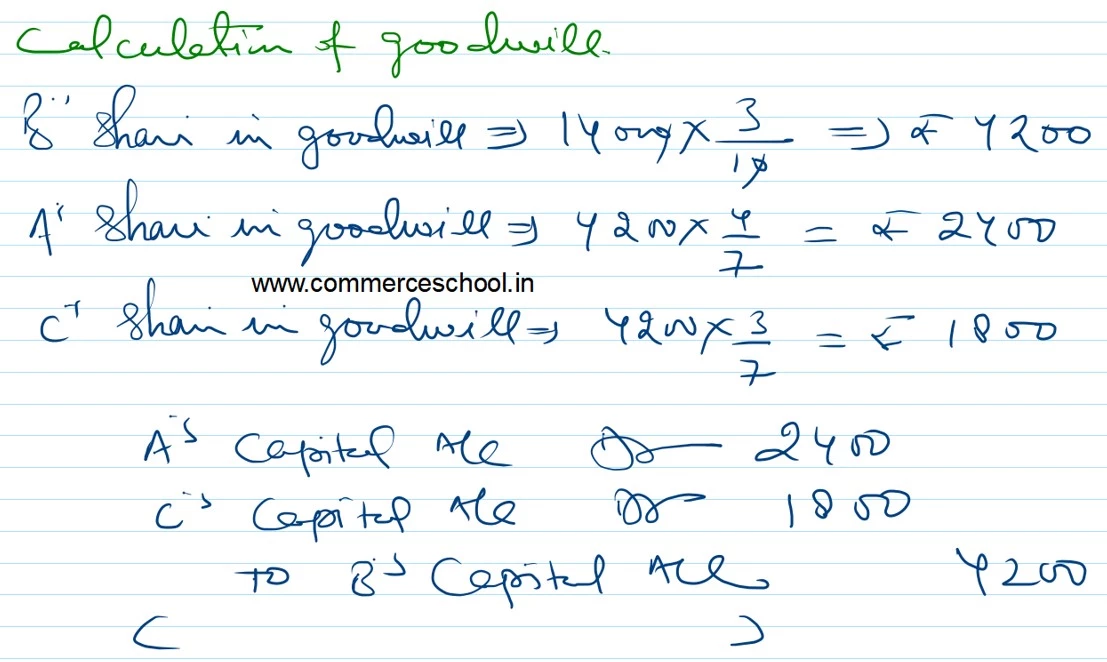

a) Goodwill of the firm is to be valued at ₹ 14,000.

b) Stock, Land and Building are to be appreciated by 10%.

c) Plant and Machinery and Computer Printer are to be reduced by 10%.

d) Sundry Debtors are considered to be good.

e) Provision for legal charges to be made at ₹ 2,000.

f) Amount payable to B is to be transferred to his loan account.

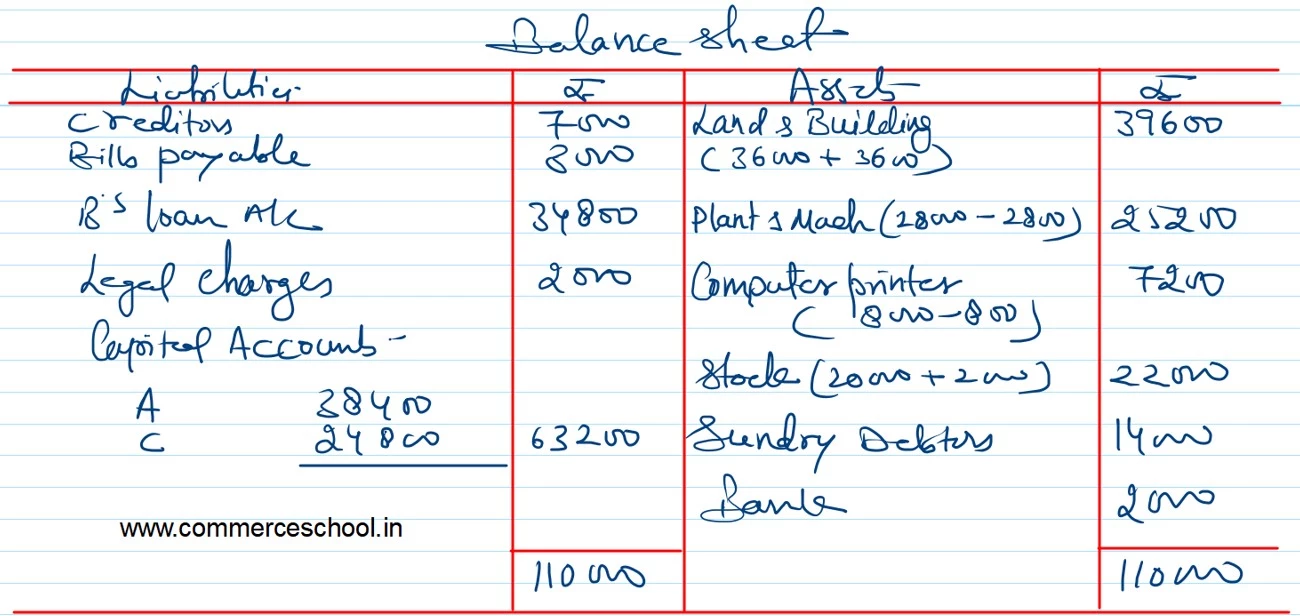

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of A and C after B’s retirement.