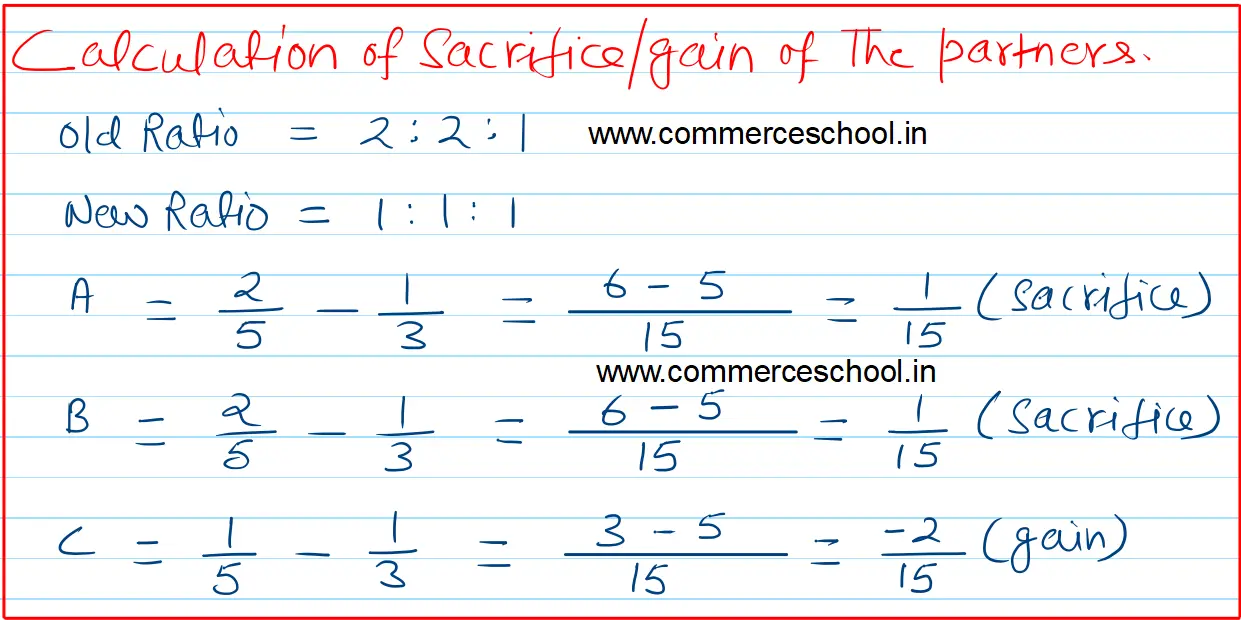

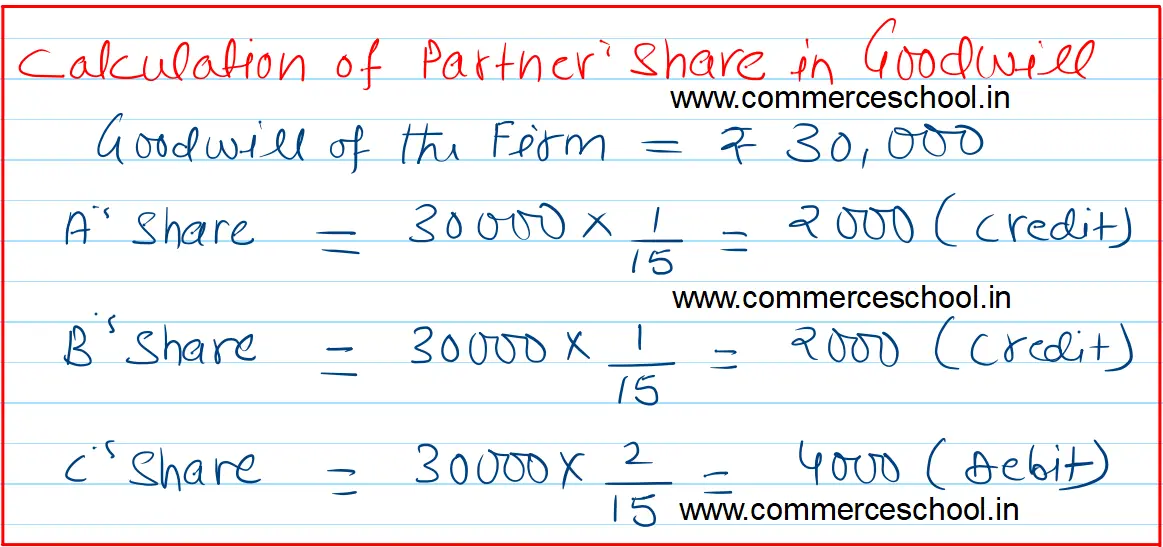

A, B and C are partners sharing profits and losses in the ratio of 2 : 2 : 1. From 1st April, 2023 they decided to share future profits and losses equally.

A, B and C are partners sharing profits and losses in the ratio of 2 : 2 : 1. From 1st April, 2023 they decided to share future profits and losses equally.

Following balances appeared in their books:

It was agreed that:

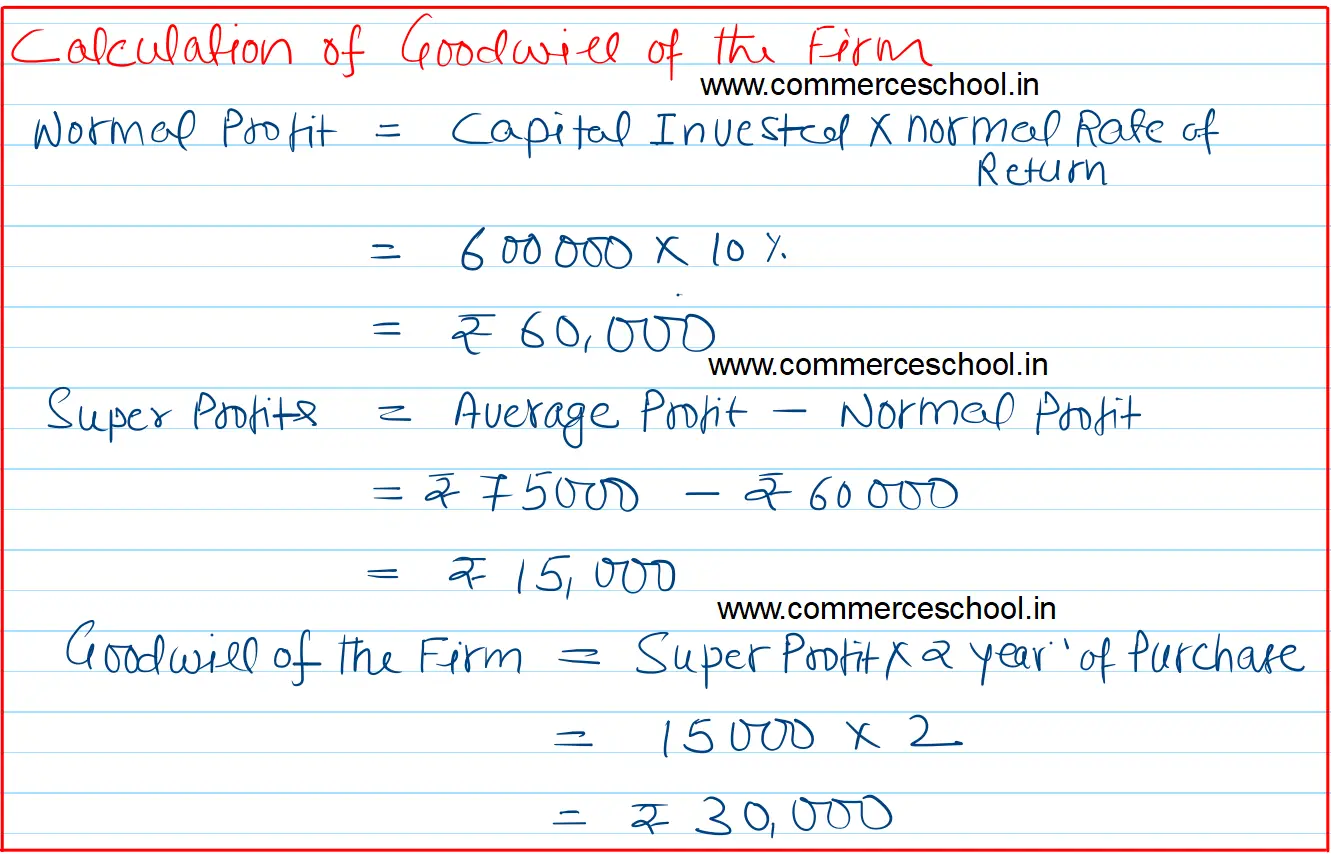

(i) Goodwill should be valued at two year’s purchase of super profits. Firm’s average profits are ₹ 75,000. Capital invested in the business is ₹ 6,00,000 and normal rate of return is 10%.

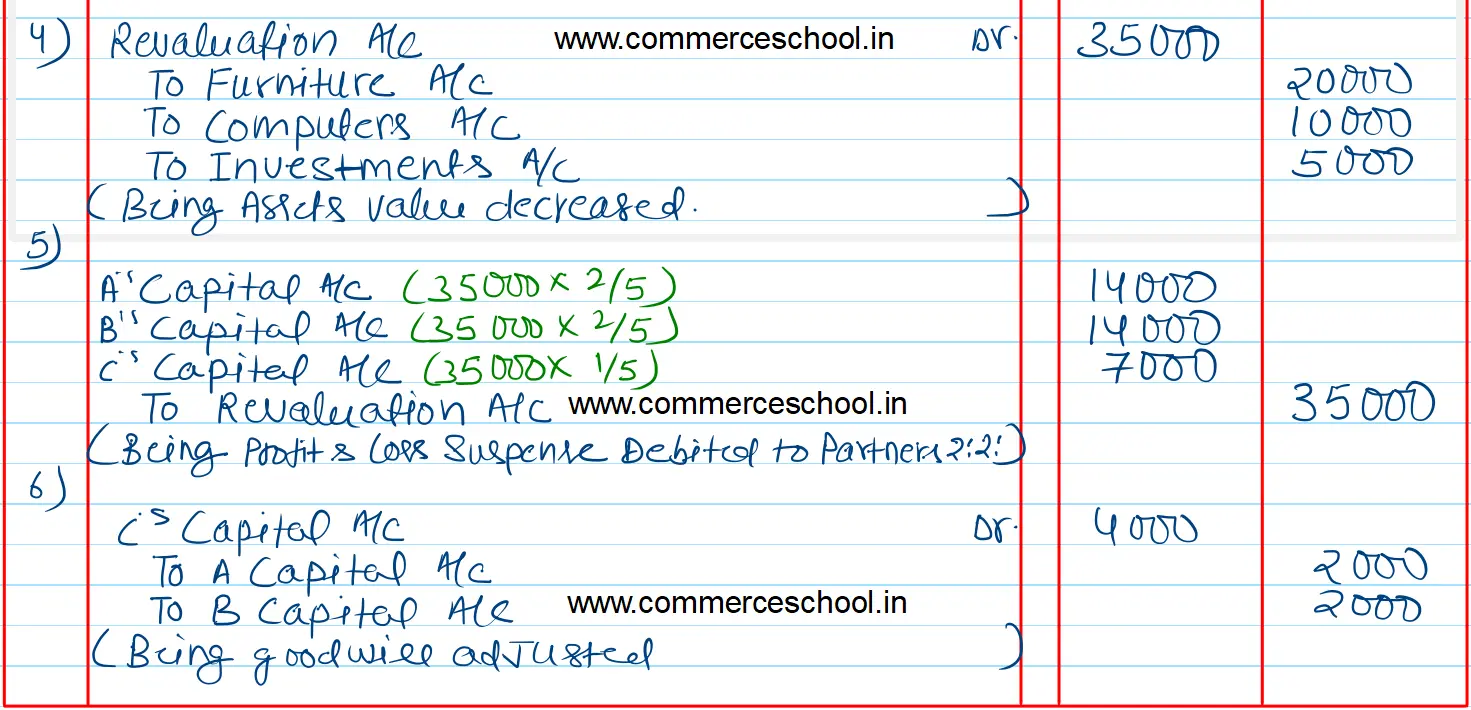

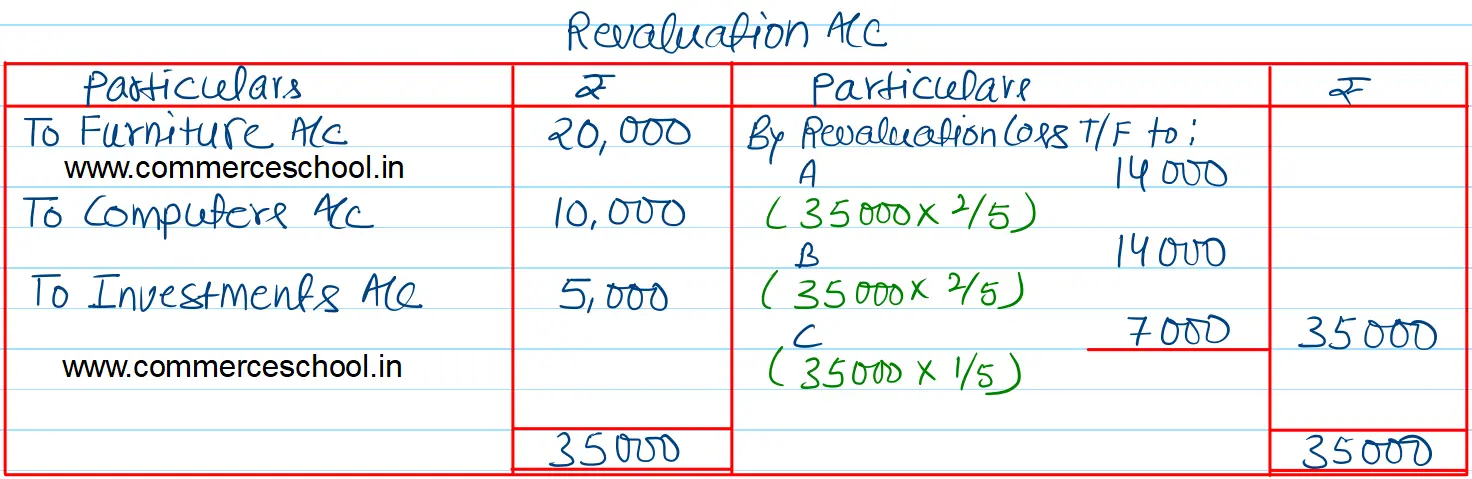

(ii) Furniture (book value of ₹ 50,000) be reduced to ₹ 30,000.

(iii) Computers (book value of ₹ 40,000) be reduced by ₹ 10,000.

(iv) Claim on account of Workmen’s Compensation amounted to ₹ 50,000.

(v) Investments (book value of ₹ 30,000) were revalued at ₹ 25,000.

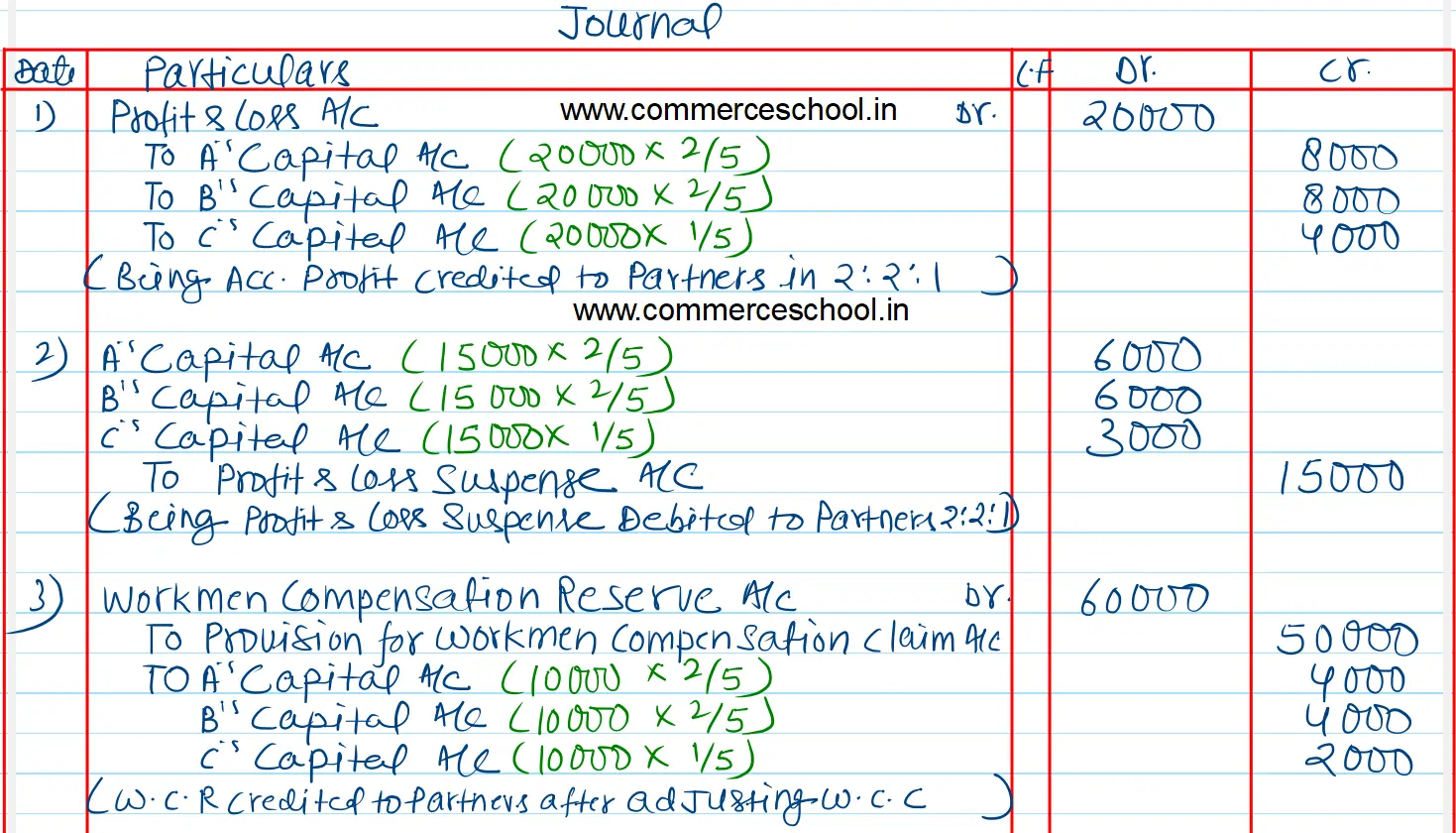

Pass necessary journal entries for the above.

[Ans. Adjustment for Goodwill : Dr. C by ₹ 4,000 and Cr. A and B by ₹ 2,000 each; Revaluation Loss ₹ 35,000.]

| Profit and Loss a/c (Cr.) | 20,000 |

| Advertisement Suspense A/c (Dr.) | 15,000 |

| Workmen Compensation Reserve | 60,000 |

Anurag Pathak Answered question