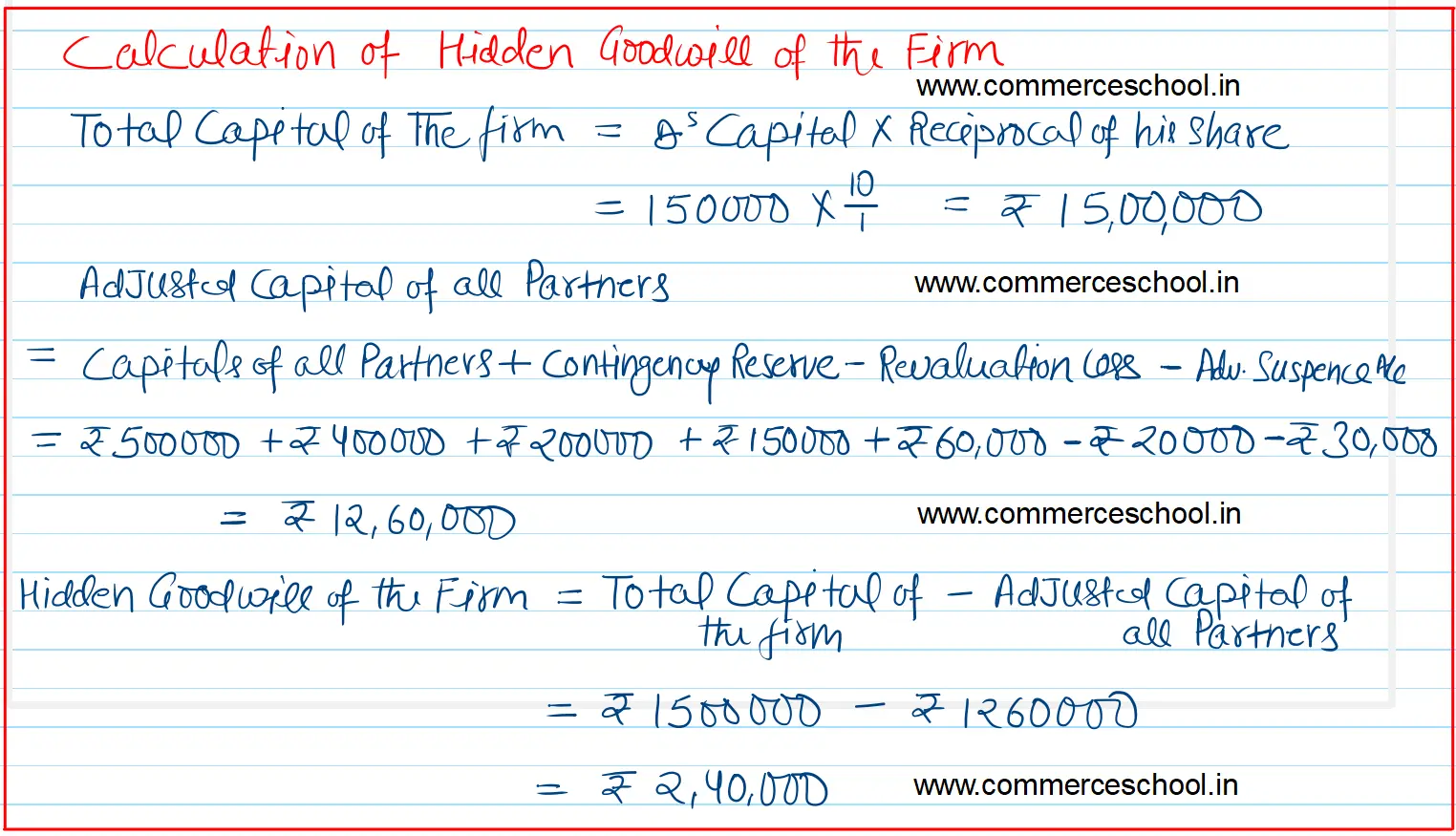

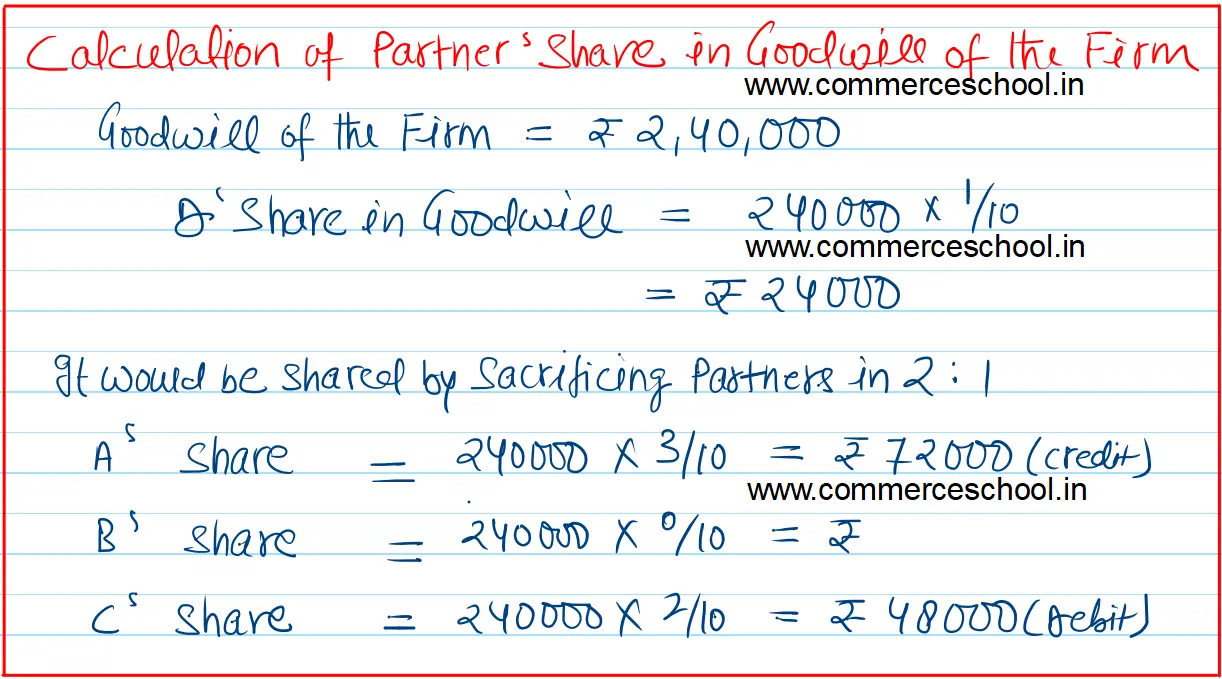

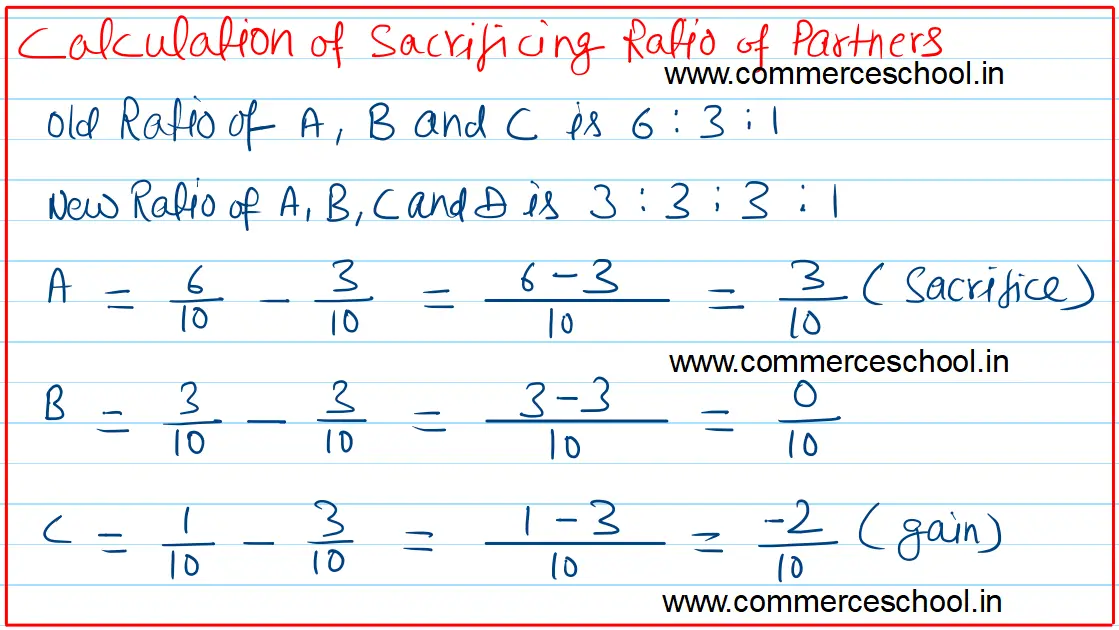

A, B and C are partners sharing profits and losses in the ratio of 6 : 3 : 1. Their respective capitals are A ₹ 5,00,000; B ₹ 4,00,000 and C ₹ 2,00,000. They decide to admit D into partnership and the new profit sharing ratio is agreed at 3 : 3 : 3 : 1

A, B and C are partners sharing profits and losses in the ratio of 6 : 3 : 1. Their respective capitals are A ₹ 5,00,000; B ₹ 4,00,000 and C ₹ 2,00,000. They decide to admit D into partnership and the new profit sharing ratio is agreed at 3 : 3 : 3 : 1.

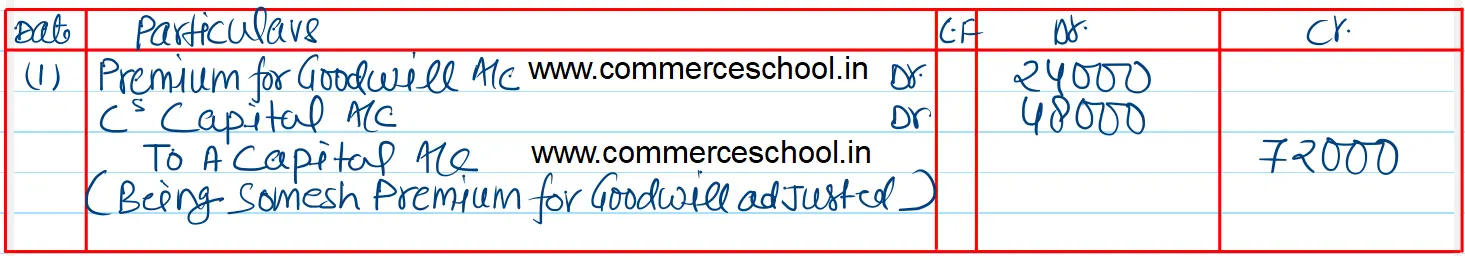

D brings ₹ 1,50,000 as his capital and his share of goodwill in cash. At the time of D’s admission.

(a) The firm had a Workmen Compensation Reserve of ₹ 1,00,000 against which there was a claim of ₹ 1,20,000.

(b) Advertisement Suspense A/c (Dr.) balance appeared in their books at ₹ 30,000.

(c) Contingency Reserve appeared at ₹ 60,000.

You are required to prepare necessary journal entries.

Anurag Pathak Answered question