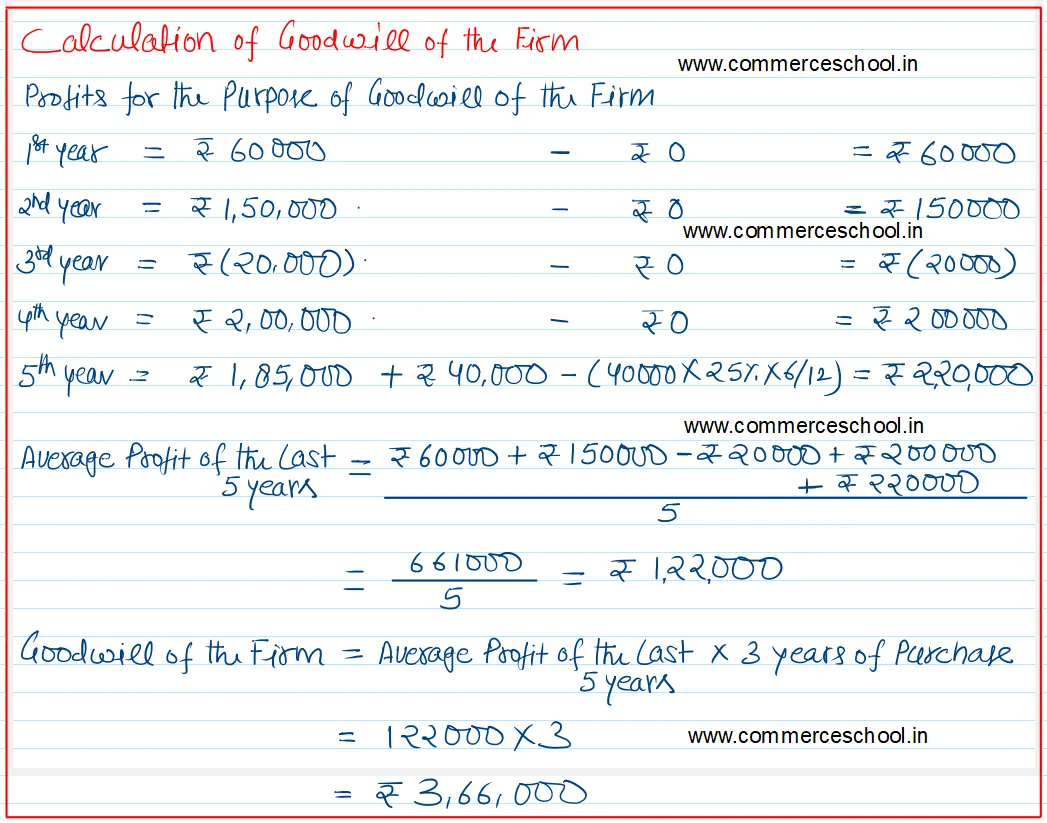

A, B and C are partners sharing profits and losses equally. They agree to admit D for equal share. For this purpose goodwill is to be valued at 3 year’s purchase of average profits of last 5 years which were as follows:

A, B and C are partners sharing profits and losses equally. They agree to admit D for equal share. For this purpose goodwill is to be valued at 3 year’s purchase of average profits of last 5 years which were as follows:

| ₹ | |

| Year ending on 31st March 2018 | 60,000 |

| Year ending on 31st March 2019 | 1,50,000 |

| Year ending on 31st March 2020 | (20,000) |

| Year ending on 31st March 2021 | 2,00,000 |

| Year ending on 31st March 2022 | 1,85,000 |

On 1st October, 2021 a computer costing ₹ 40,000 was purchased and debited to office expenses account on which depreciation is to be charged @ 25% p.a. Calculate the value of goodwill.

[Ans. Goodwill ₹ 3,66,000.]

Anurag Pathak Answered question