A, B and C are partners sharing profits in 4 : 3 : 3. Their Balance Sheet as at 31st March 2020 was as follows:

A, B and C are partners sharing profits in 4 : 3 : 3. Their Balance Sheet as at 31st March 2020 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 1,20,000 | Land and Building | 5,00,000 |

| General Reserve | 40,000 | Stock | 2,40,000 |

| Capital Accounts: A B C | 4,00,000 2,00,000 2,00,000 | Debtors 1,50,000 Less: Provision for Doubtful Debts 30,000 | 1,20,000 |

| Cash at Bank | 1,00,000 | ||

| 9,60,000 | 9,60,000 |

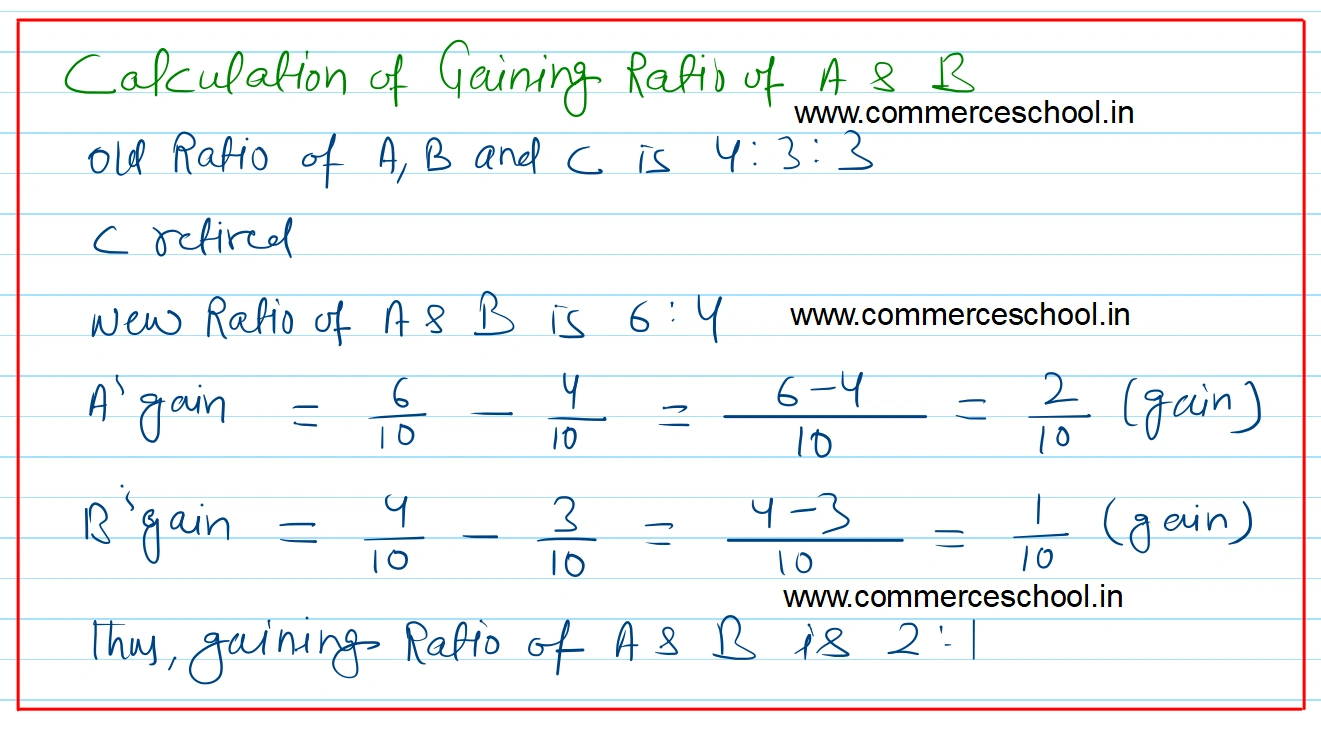

C retires on 1st April, 2020 and A and B decide to share future profits in the ratio of 6 : 4. It is agreed that:

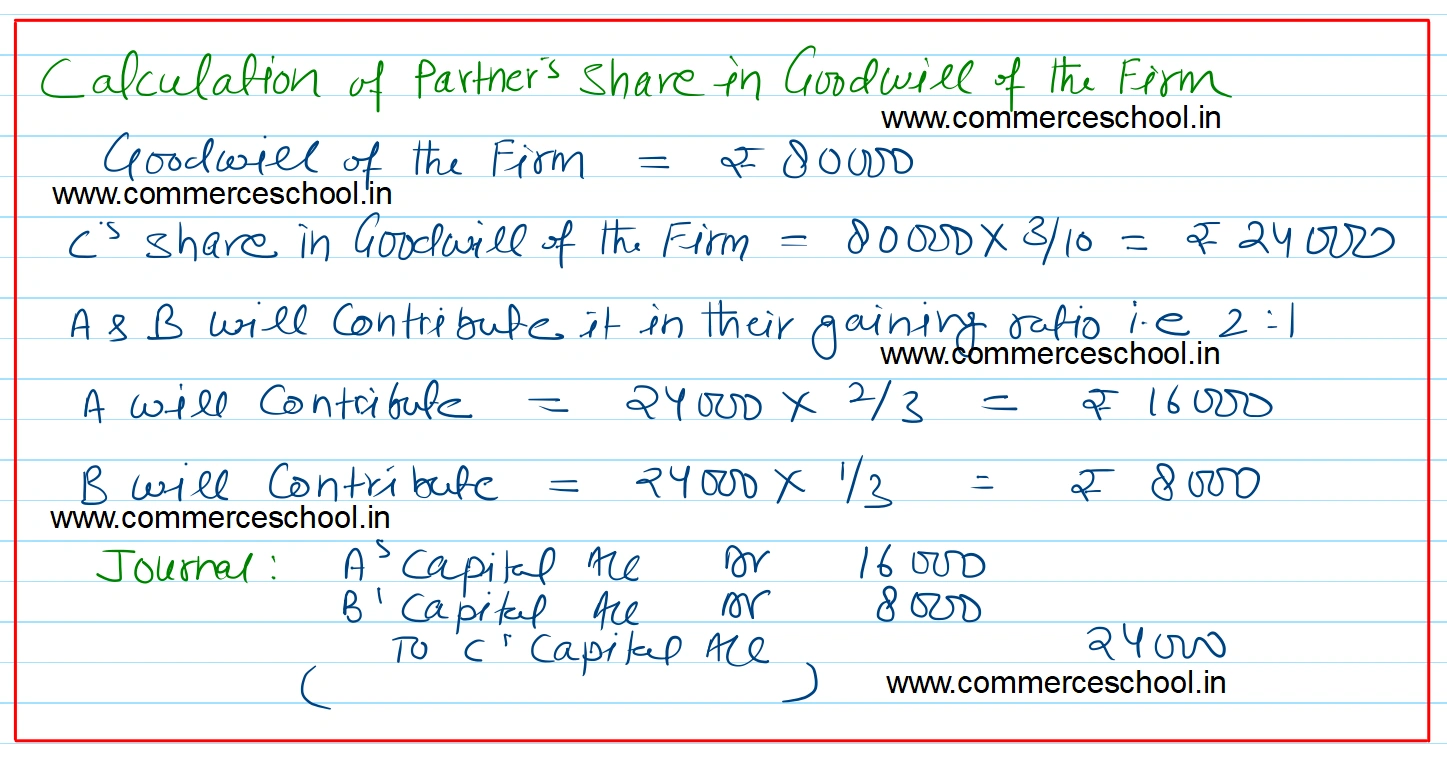

(I) Goodwill of the firm is valued at ₹ 80,000.

(ii) Land & Building is undervalued by ₹ 1,00,000 and Stock is overvalued by 20%.

(iii) Provision for Doubtful Debts is to be decreased to ₹ 10,000.

(iv) Computer valued ₹ 30,000 was unrecorded in the books.

It was decided to pay off C by giving him this computer and the balance in annual instalments of ₹ 1,00,000 together with interest @ 10% p.a.

You are required to prepare:

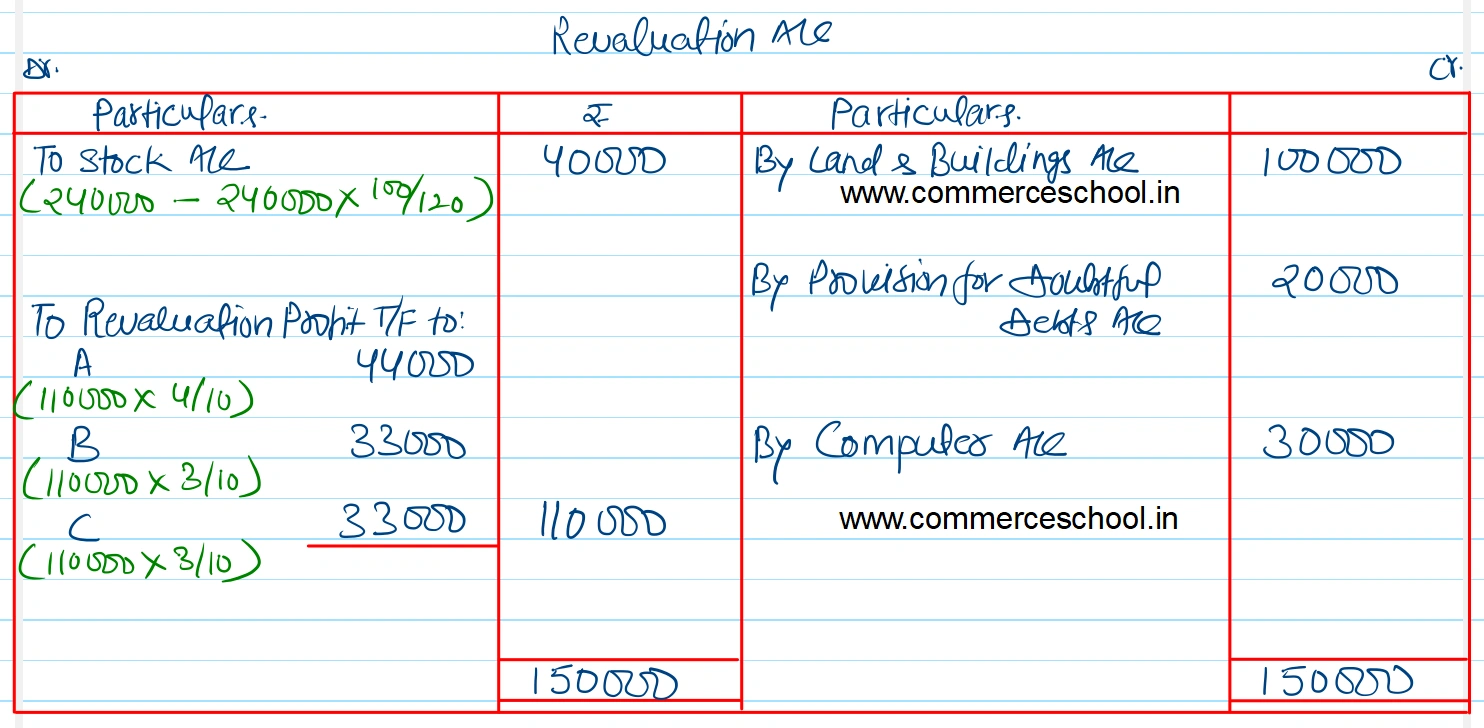

(a) Revaluation Account,

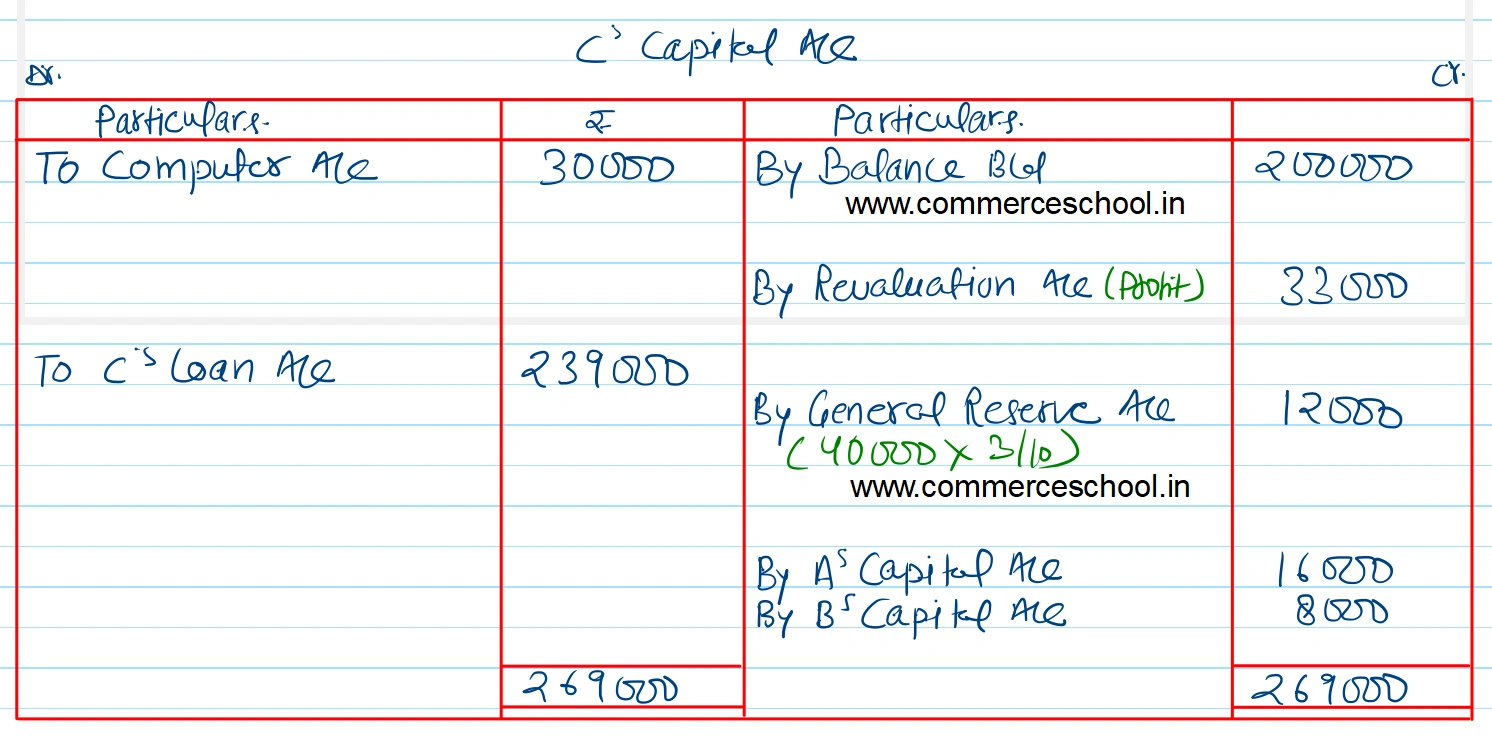

(b) C’s Capital Account, and

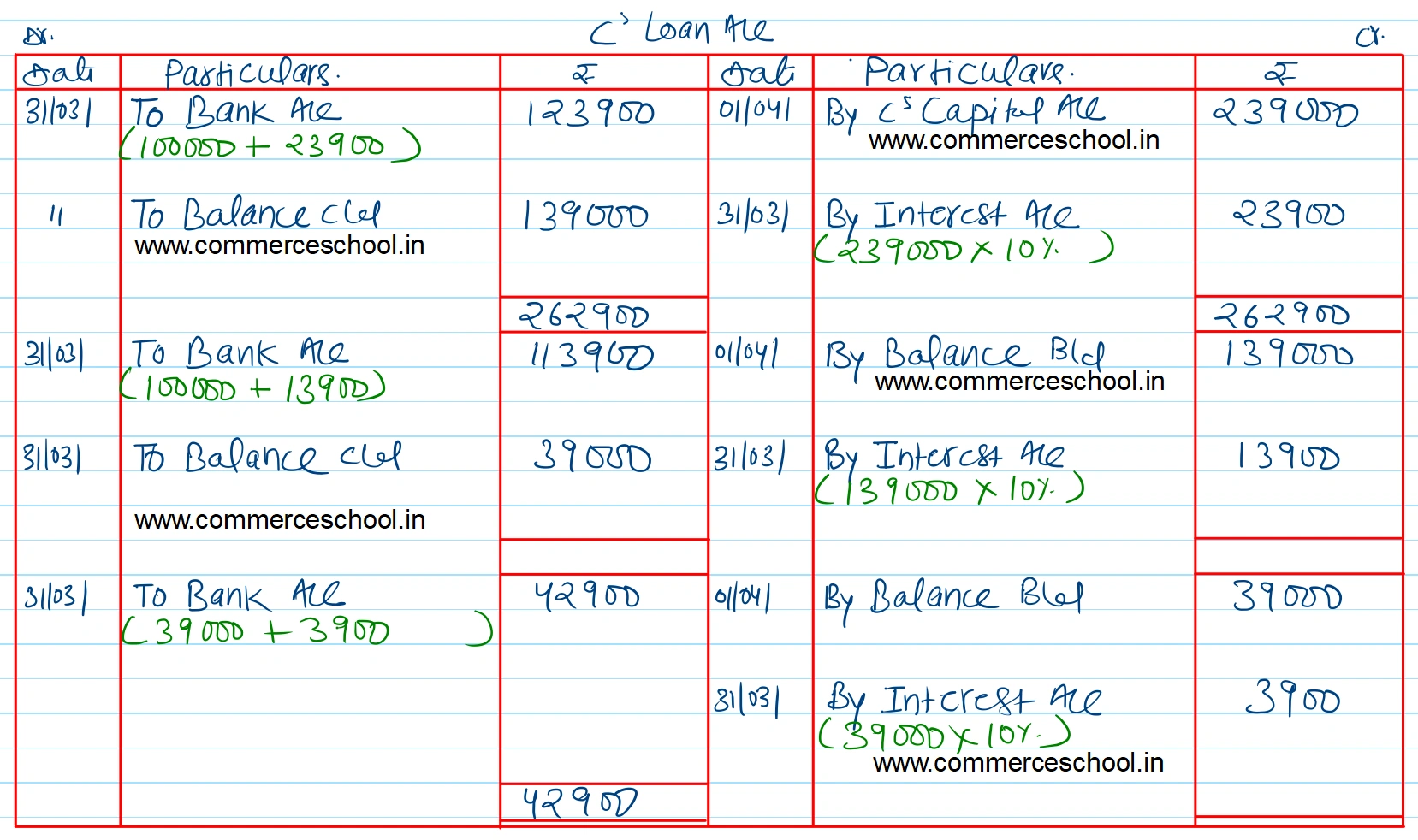

(c) C’s Loan Account till it is finally closed.

[Ans. Gain on Revaluation ₹ 1,10,000; Balance of C’s Capital A/c transferred to his Loan A/c ₹ 2,39,000. Payment made : ₹ 1,23,900 on 31st March 2021; ₹ 1,13,900 on 31st March 2022 and ₹ 42,900 on 31st March 2023.]