A, B and C are partners sharing profits in the ratio of 4 : 3 : 2. It was provided that B’s share of profit will not be less than ₹ 1,50,000 per annum

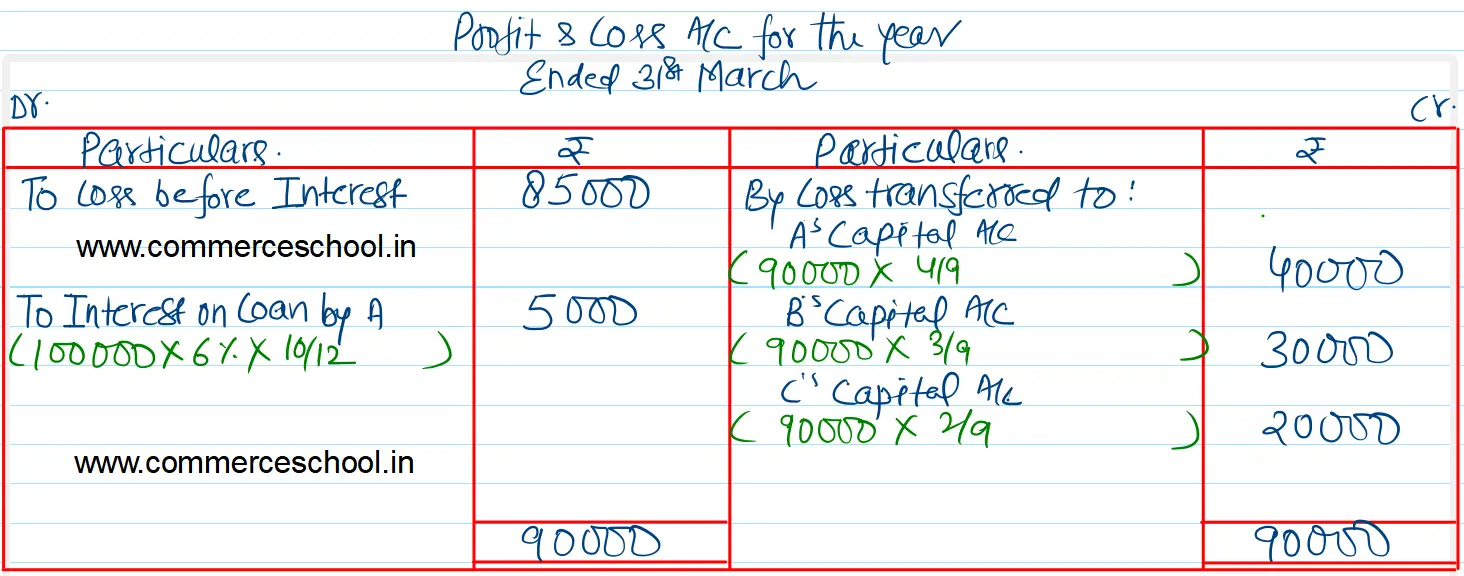

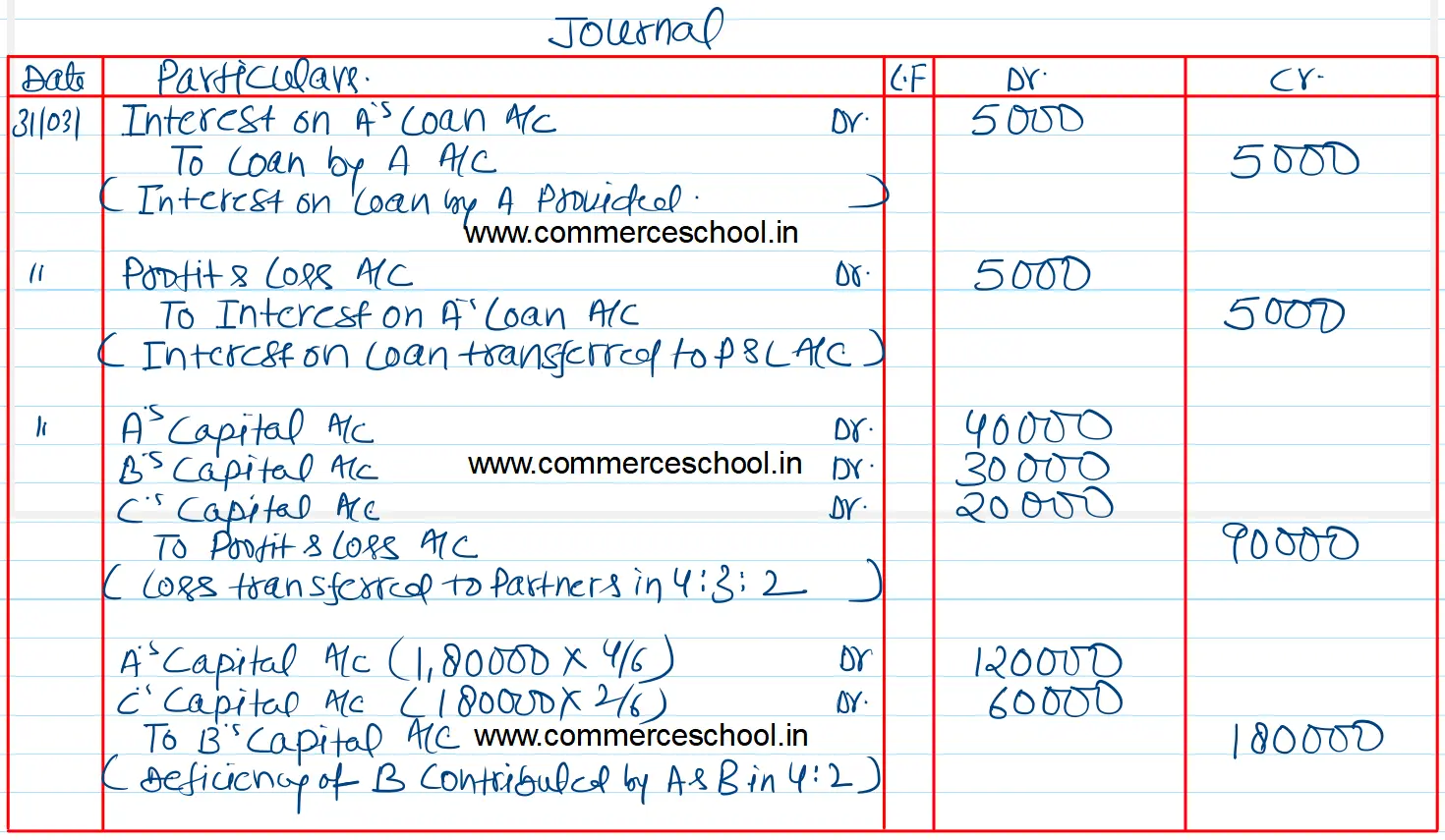

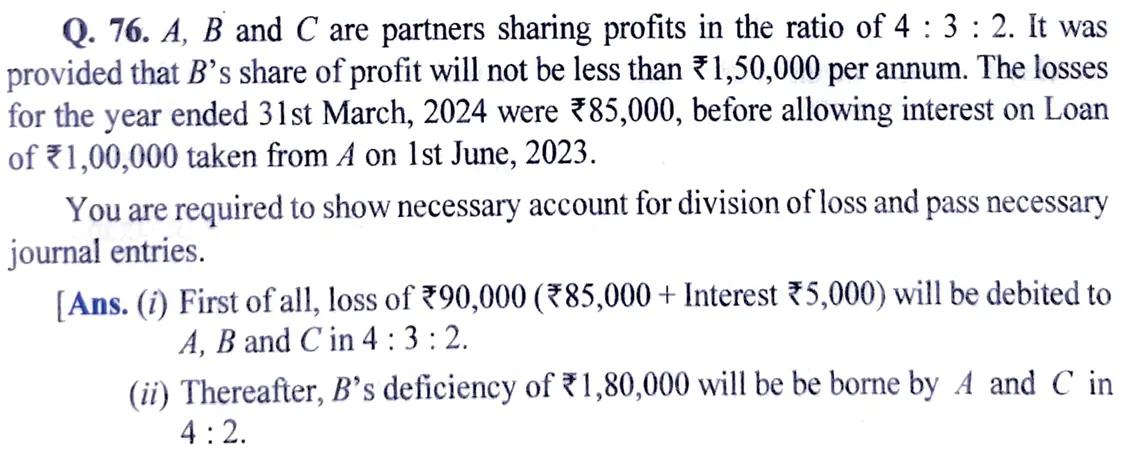

A, B and C are partners sharing profits in the ratio of 4 : 3 : 2. It was provided that B’s share of profit will not be less than ₹ 1,50,000 per annum. The losses for the year ended 31st March, 2024 were ₹ 85,000, before allowing interest on Loan of ₹ 1,00,000 taken from A on 1st June, 2023.

You are required to show necessary account for division of loss and pass necessary journal entries.

[Ans. (i) First of all, loss of ₹ 90,000 (₹ 85,000 + Interest ₹ 5,000) will be debited to A, B and C in 4 : 3 : 2.

(ii) Thereafter, B’s deficiency of ₹ 1,80,000 will be borne by A and C in 4 : 2.

Anurag Pathak Answered question