A, B and C are partners. Their fixed capitals as on 31st March, 2024 were A ₹ 2,00,000, B ₹ 3,00,000 and C ₹ 4,00,000. Profits for the year ended 31st March, 2024 amounting to ₹ 1,80,000 were distributed

A, B and C are partners. Their fixed capitals as on 31st March, 2024 were A ₹ 2,00,000, B ₹ 3,00,000 and C ₹ 4,00,000. Profits for the year ended 31st March, 2024 amounting to ₹ 1,80,000 were distributed. Give the necessary adjusting entry in each of the following alternative cases:

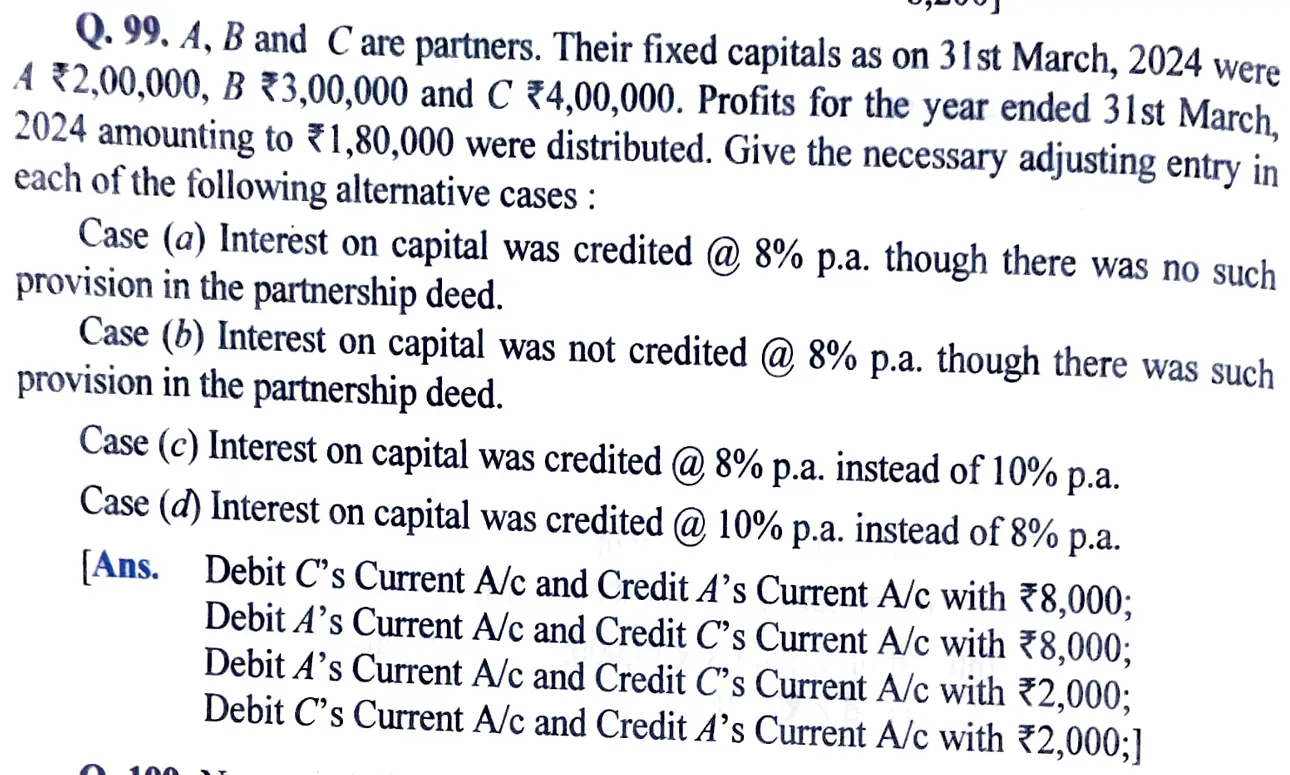

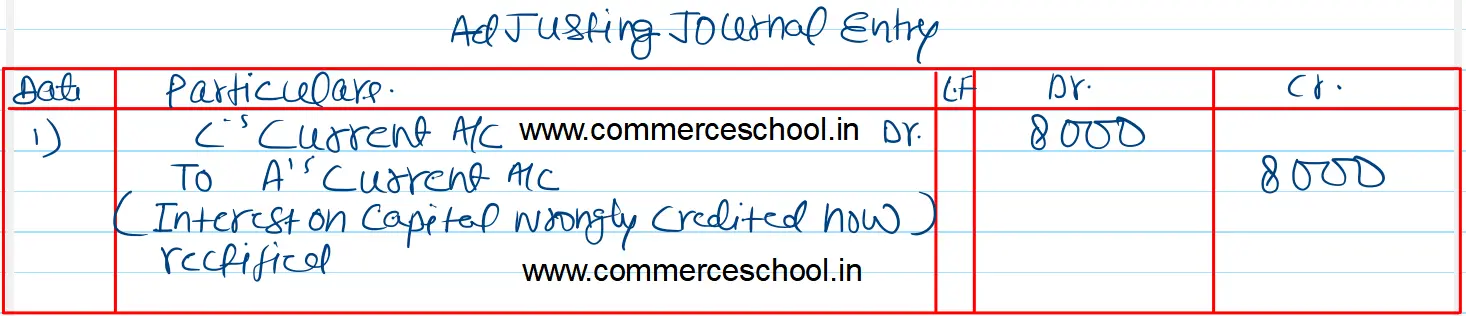

Case (a) Interest on capital was created @ 8% p.a. though there was no such provision in the partnership deed.

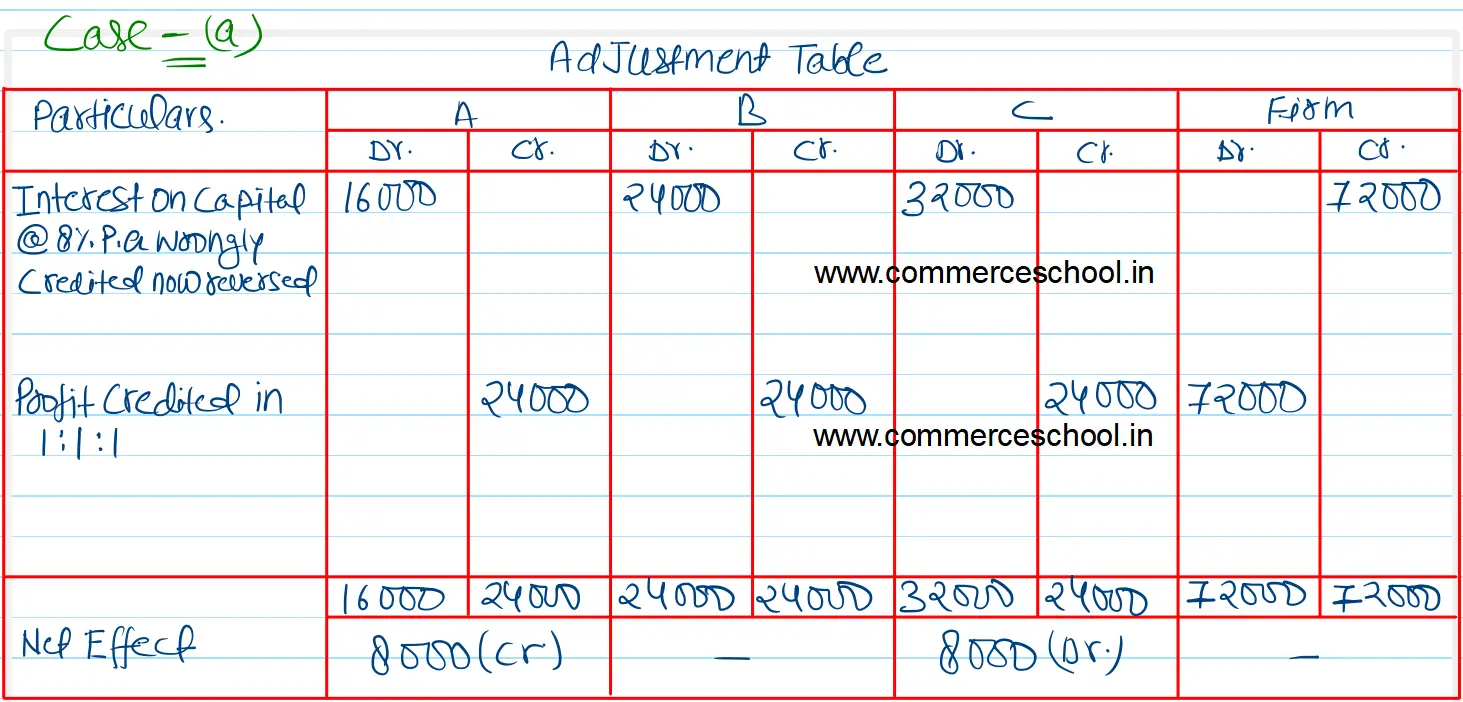

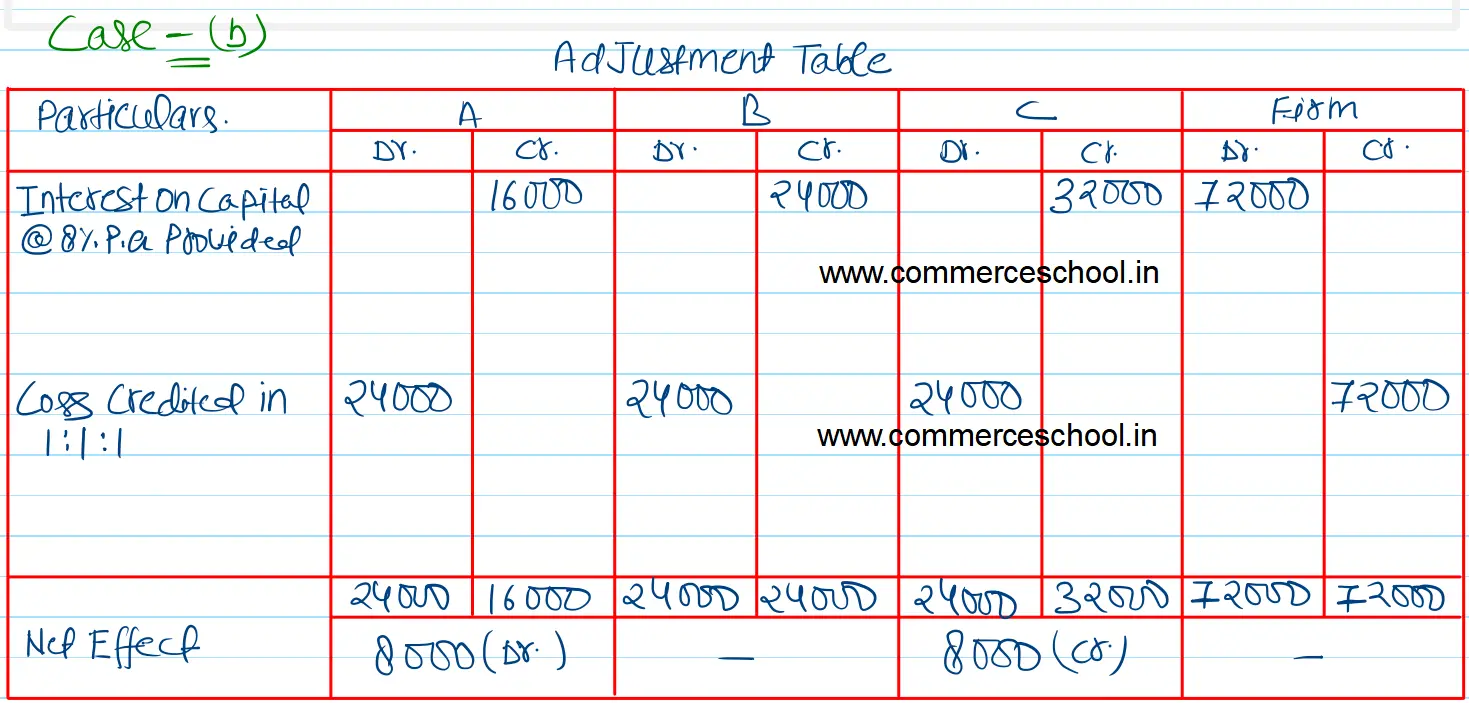

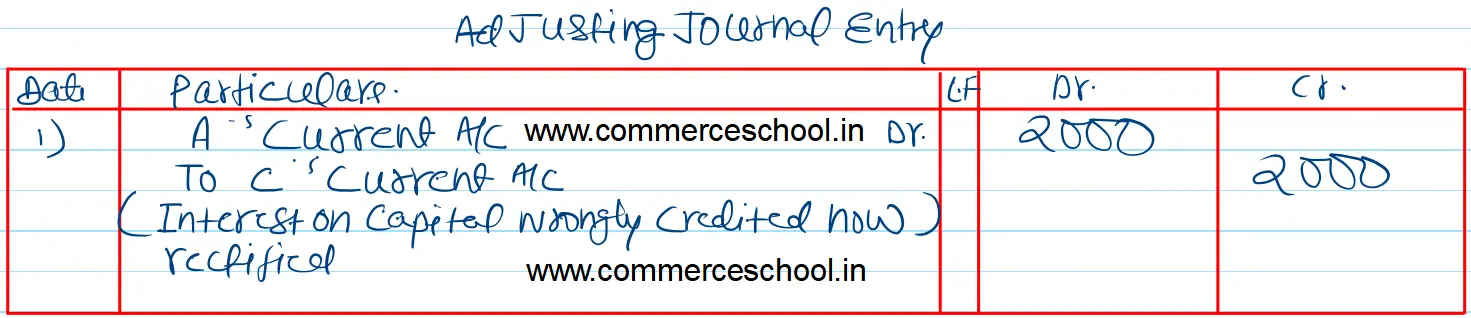

Case (b) Interest on capital was not credited @ 8% p.a. though there was such provision in the partnership deed.

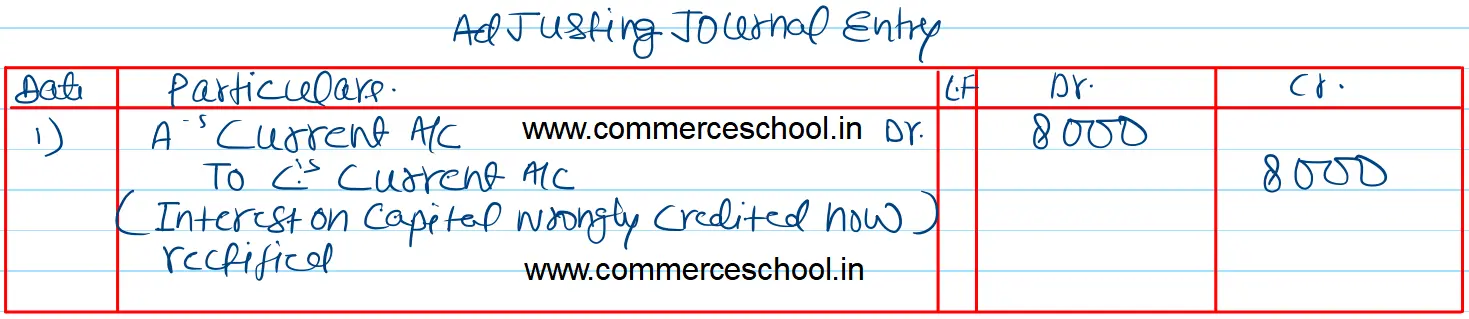

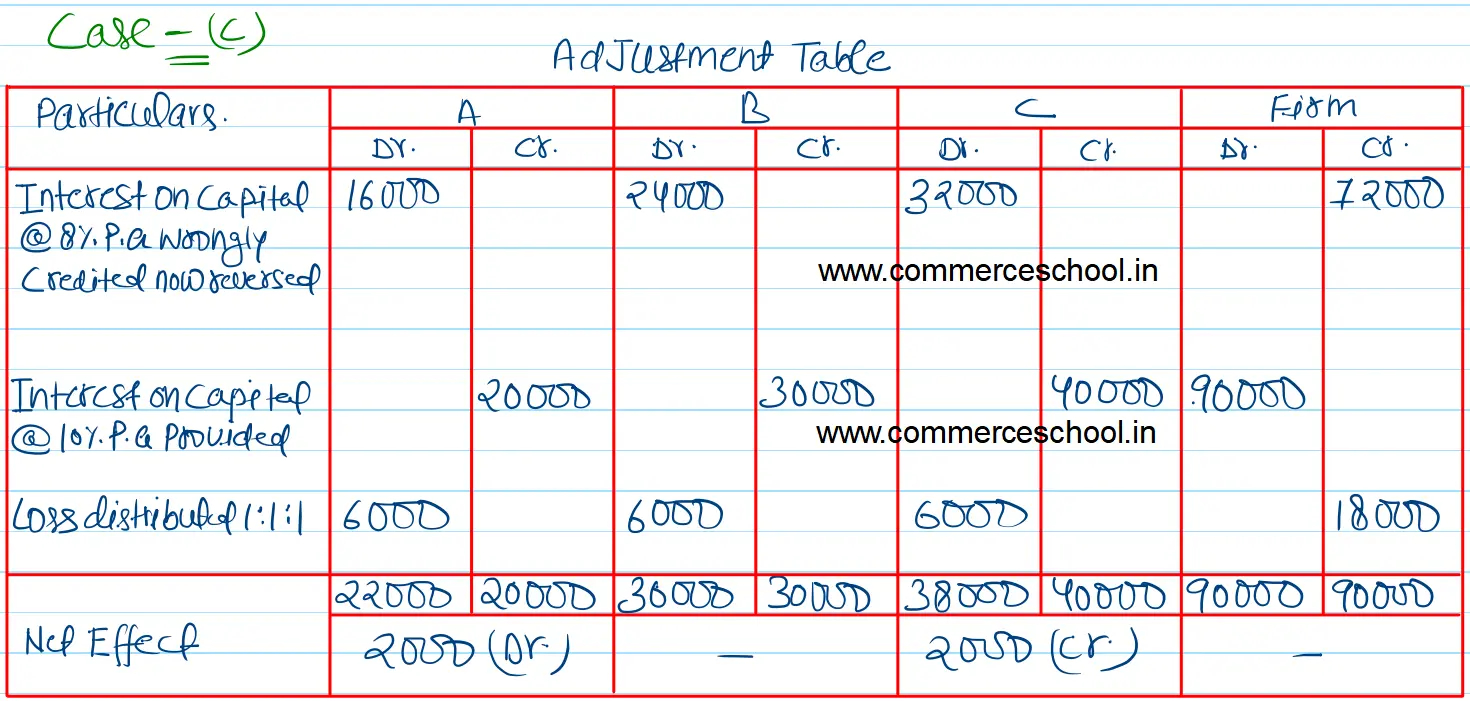

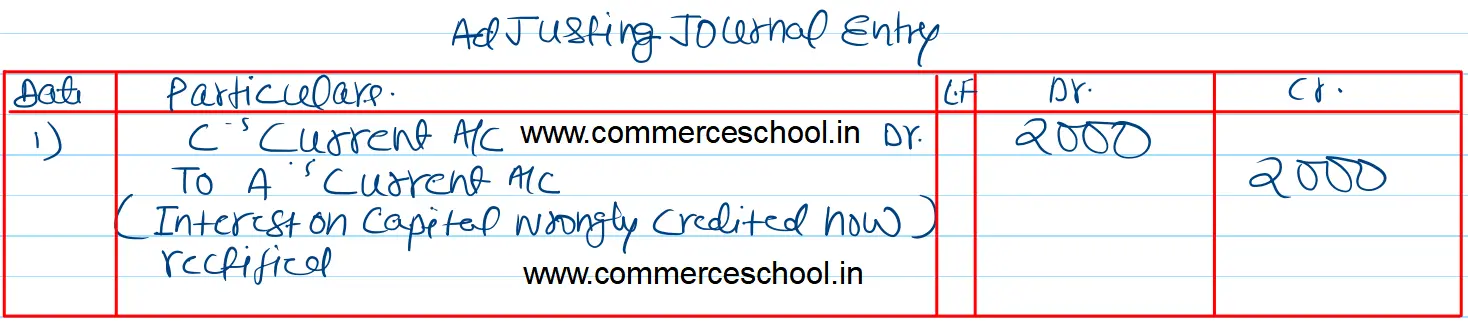

Case (c) Interest on capital was credited @ 8% p.a. instead of 10% p.a.

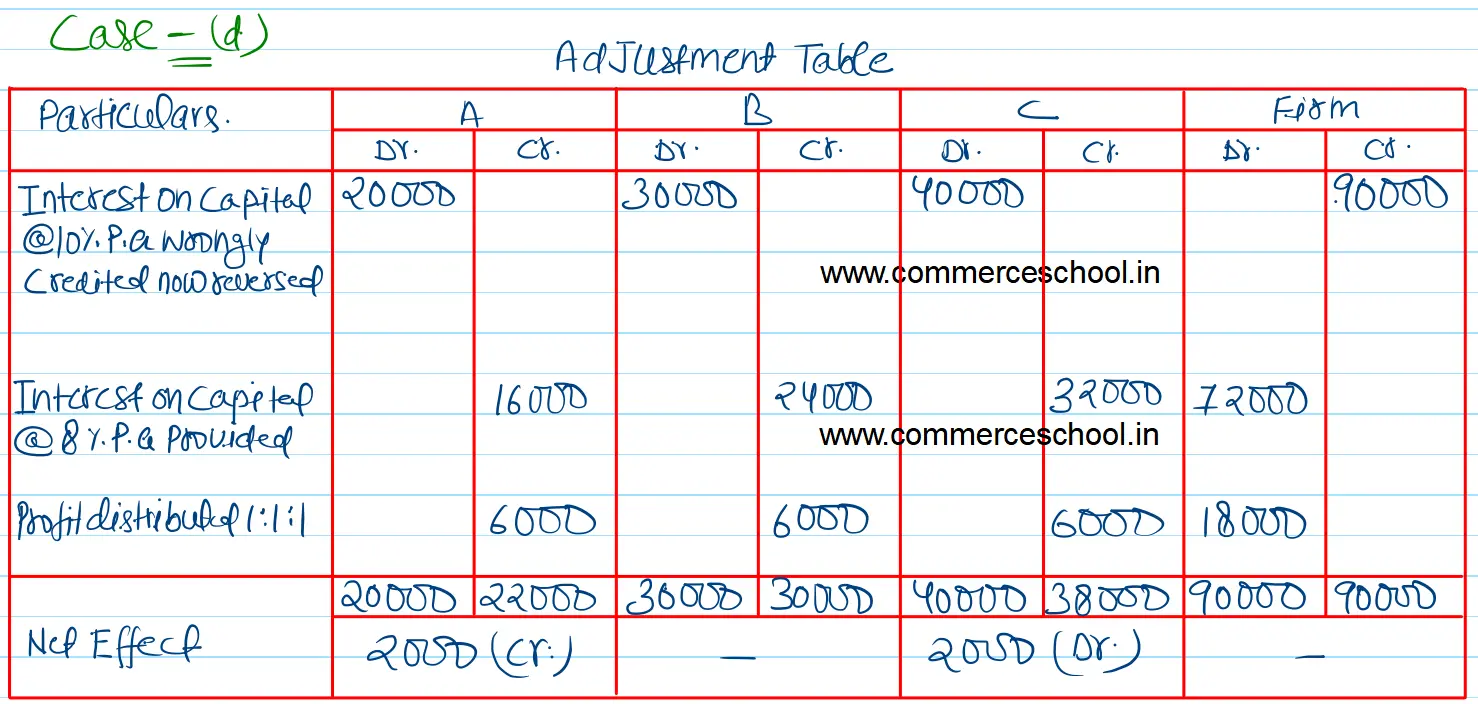

Case (d) Interest on capital was credited @ 10% p.a. instead of 8% p.a.

Ans.

Debit C’s Current A/c and Credit A’s Current A/c with ₹ 8,000;

Debit A’s Current A/c and Credit C’s Current A/c with ₹ 8,000;

Debit A’s Current A/c and Credit C’s Current A/s with ₹ 2,000;

Debit C’s Current A/c and Credit A’s Current A/c with ₹ 2,000;