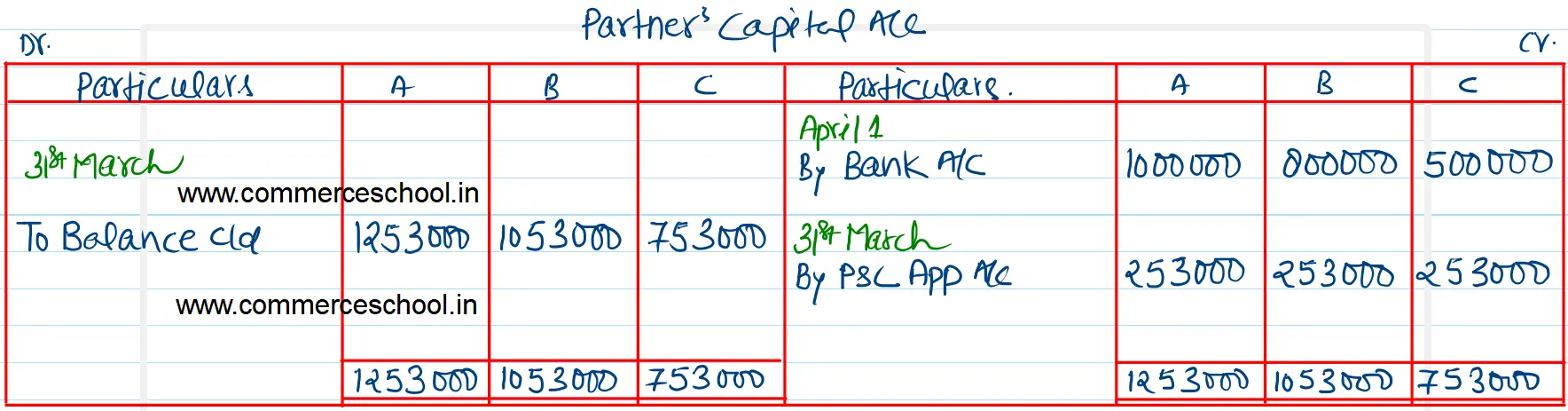

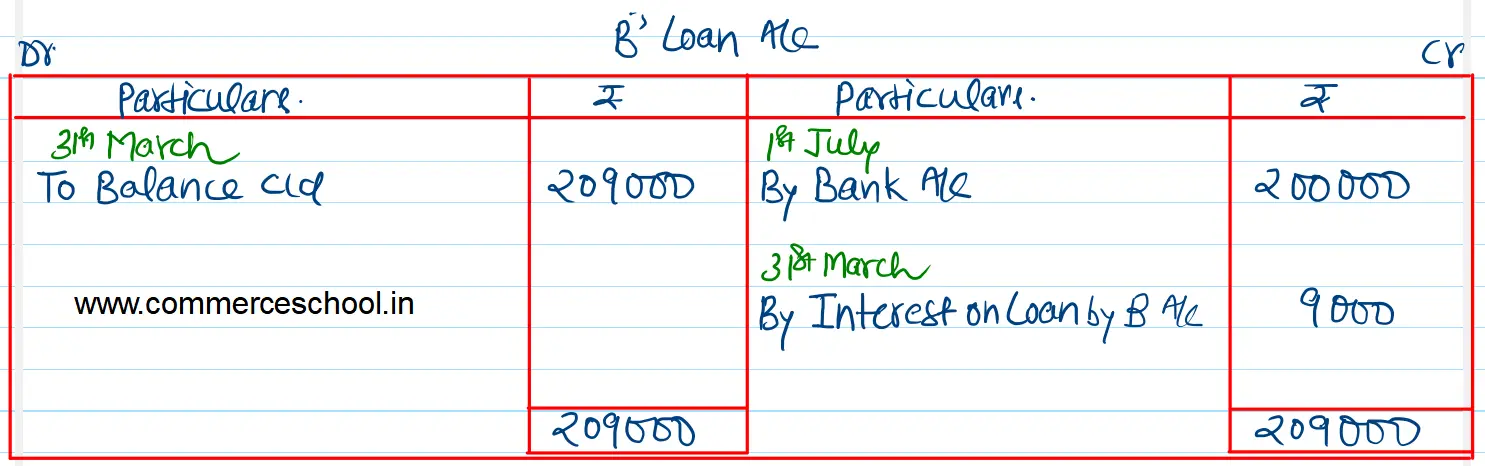

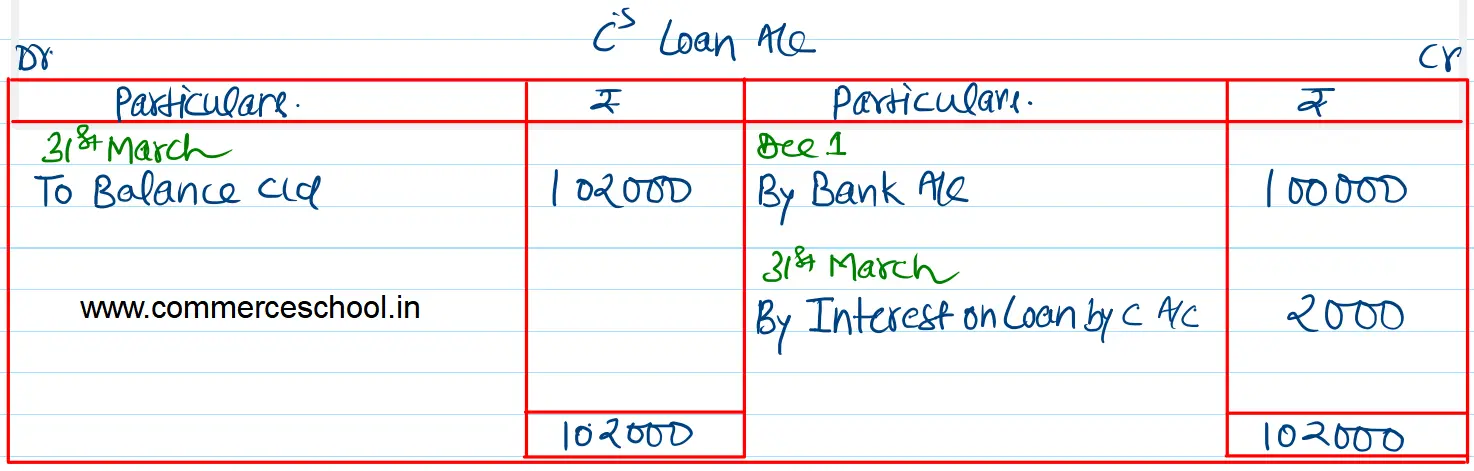

A, B and C entered into partnership on 1st April 2022 with capitals of ₹ 10,00,000, ₹ 8,00,000 and ₹ 5,00,000 respectively. On 1st July 2022, B advanced ₹ 2,00,000 and on 1st December 2022 C advanced ₹ 1,00,000 by way of loans to the firm

A, B and C entered into partnership on 1st April 2022 with capitals of ₹ 10,00,000, ₹ 8,00,000 and ₹ 5,00,000 respectively. On 1st July 2022, B advanced ₹ 2,00,000 and on 1st December 2022 C advanced ₹ 1,00,000 by way of loans to the firm.

The Profit and Loss Account for the year ended 31.3.2023 disclosed a profit of ₹ 7,70,000 but the partners could not agree upon the rate of interest on loans and the profit sharing ratio. Prepare partner’s Capital A/cs and Loan A/cs.

[Ans. Balance of Capital A/cs A ₹ 12,53,000, B ₹ 10,53,000 and C ₹ 7,53,000.]

Anurag Pathak Answered question