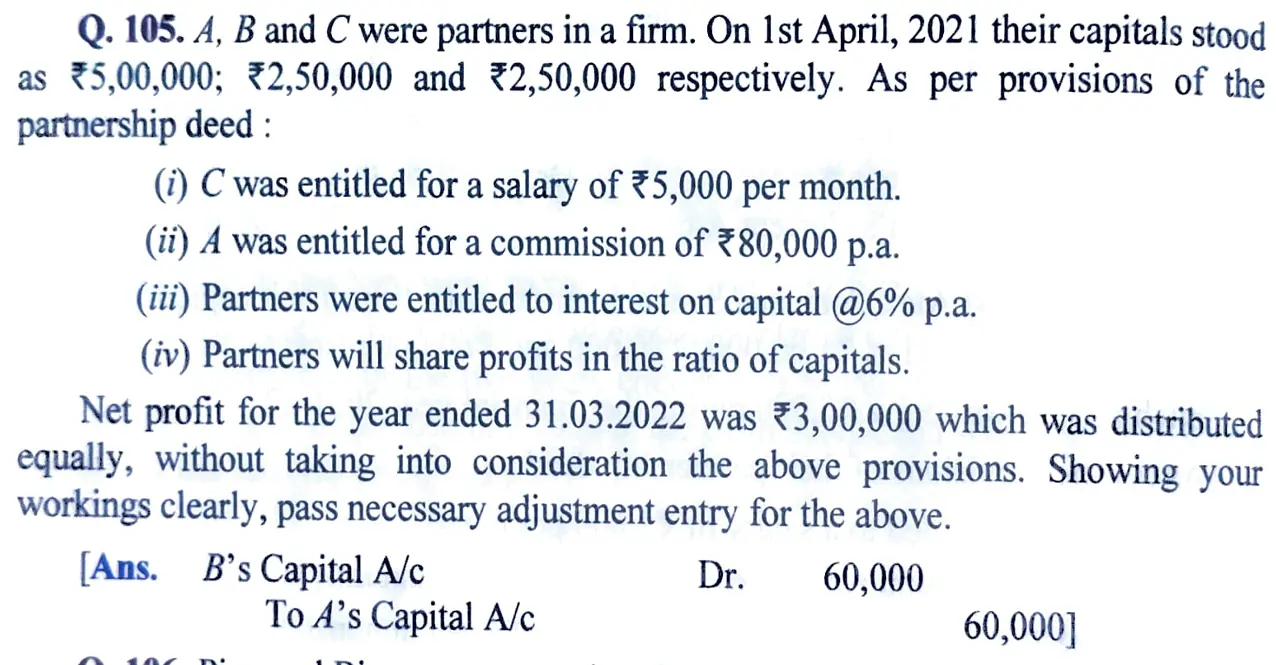

A, B and C were partners in a firm. On 1st April, 2021 their capitals stood as ₹ 5,00,000; ₹ 2,50,000 and ₹ 2,50,000 respectively. As per provisions of the partnership deed

A, B and C were partners in a firm. On 1st April, 2021 their capitals stood as ₹ 5,00,000; ₹ 2,50,000 and ₹ 2,50,000 respectively. As per provisions of the partnership deed:

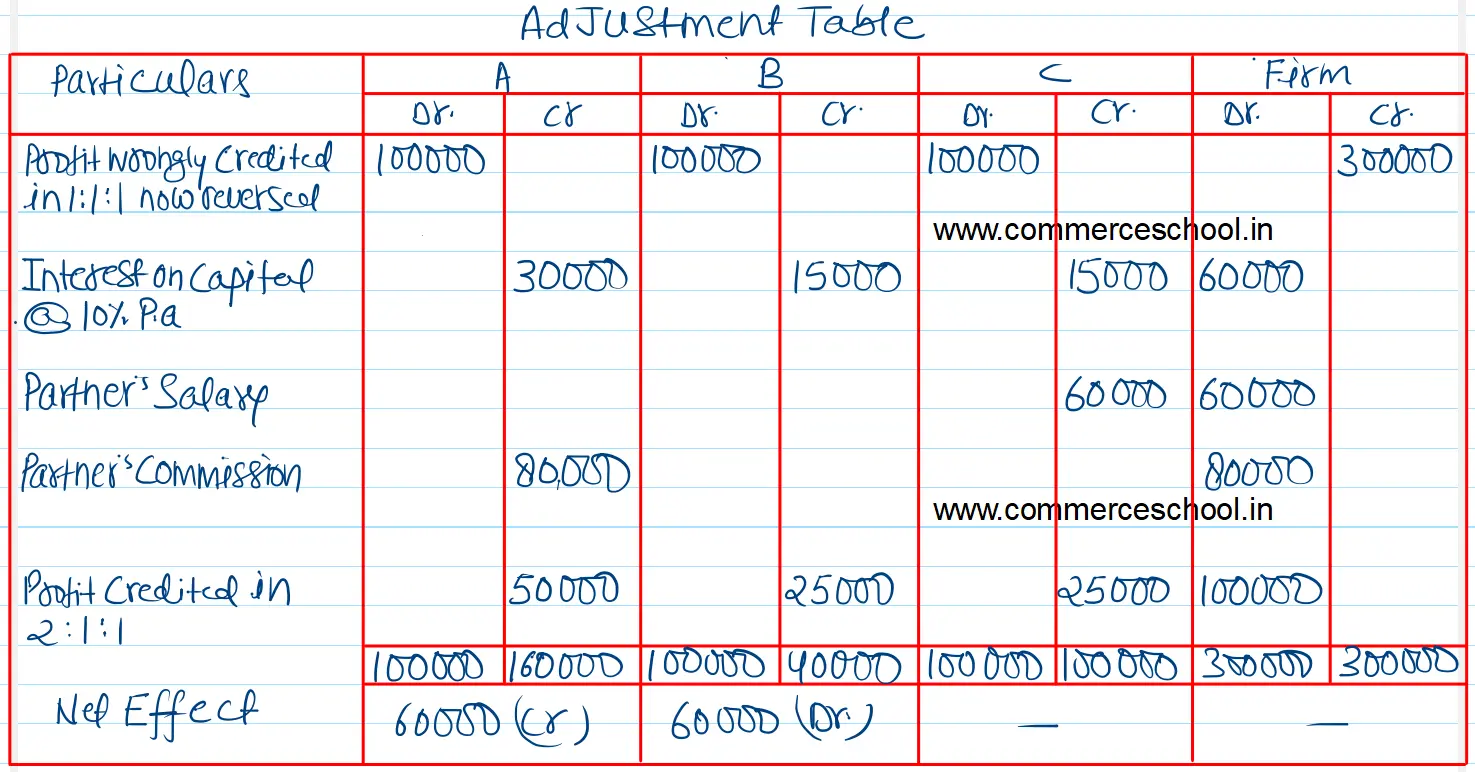

(I) C was entitled for a salary of ₹ 5,000 per month.

(ii) A was entitled for a commission of ₹ 80,000 p.a.

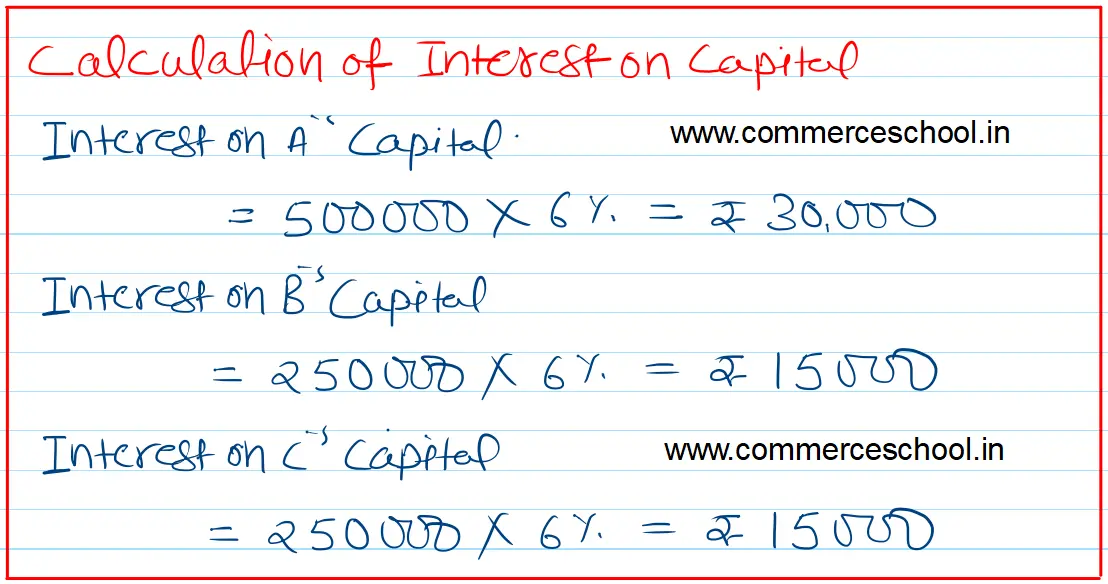

(iii) Partners were entitled to interest on capital @ 6% p.a.

(iv) Partners will share profits in the ratio of capitals.

Net profit for the year ended 31.03.2022 was ₹ 3,00,000 which was distributed equally, without taking into consideration the above provisions. Showing your workings clearly, pass necessary adjustment entry for the above.

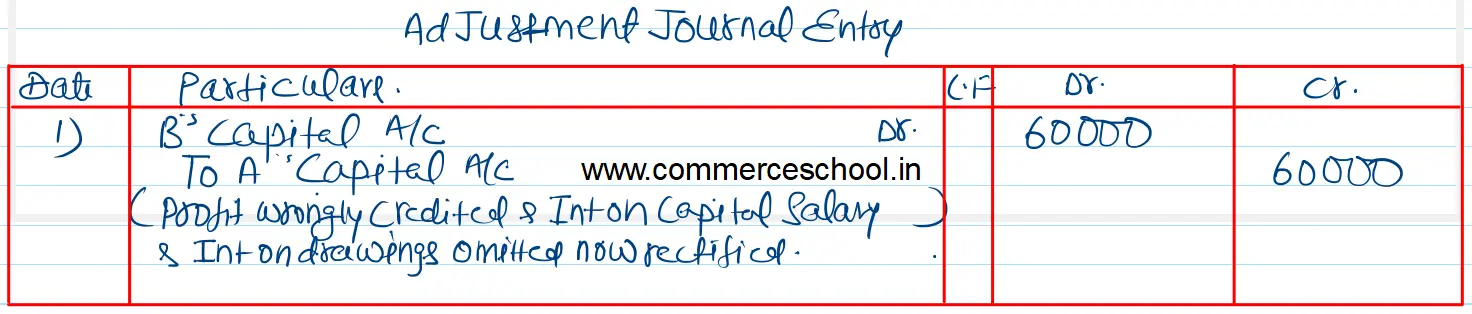

[Ans.]

B’s Capital A/c Dr. 60,000

To A’s Capital A/c 60,000

Anurag Pathak Answered question