A, B and C were partners in a firm having capitals of ₹ 50,000; ₹ 50,000, and ₹ 1,00,000 respectively

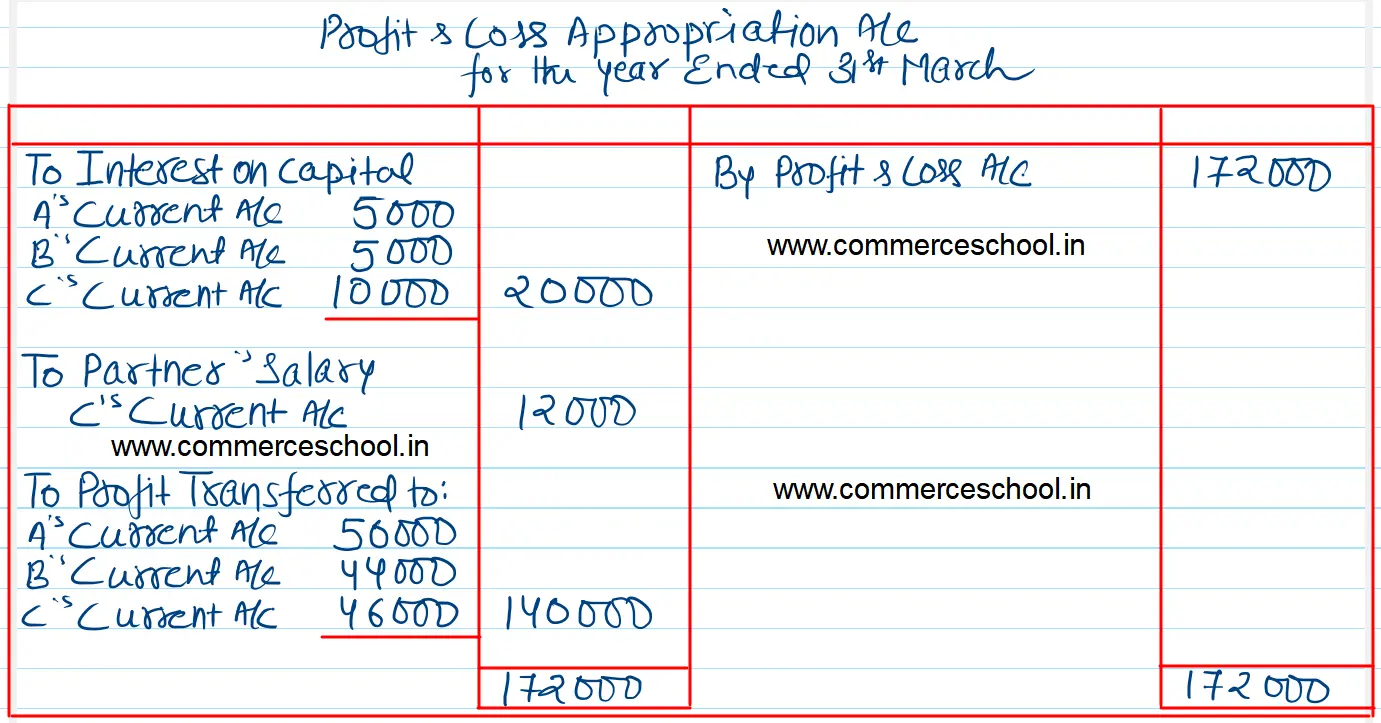

A, B, and C were partners in a firm having capitals of ₹ 50,000; ₹ 50,000, and ₹ 1,00,000 respectively. Their Current Account balances were A: ₹ 10,000; B: ₹ 5,000 and C: ₹ 2,000 (Dr.). According to the Partnership Deed, the partners were entitled to an interest on capital @ 105 p.a. C being the working partner was also entitled to a salary of ₹ 12,000 p.a. The profits were to be distributed as:

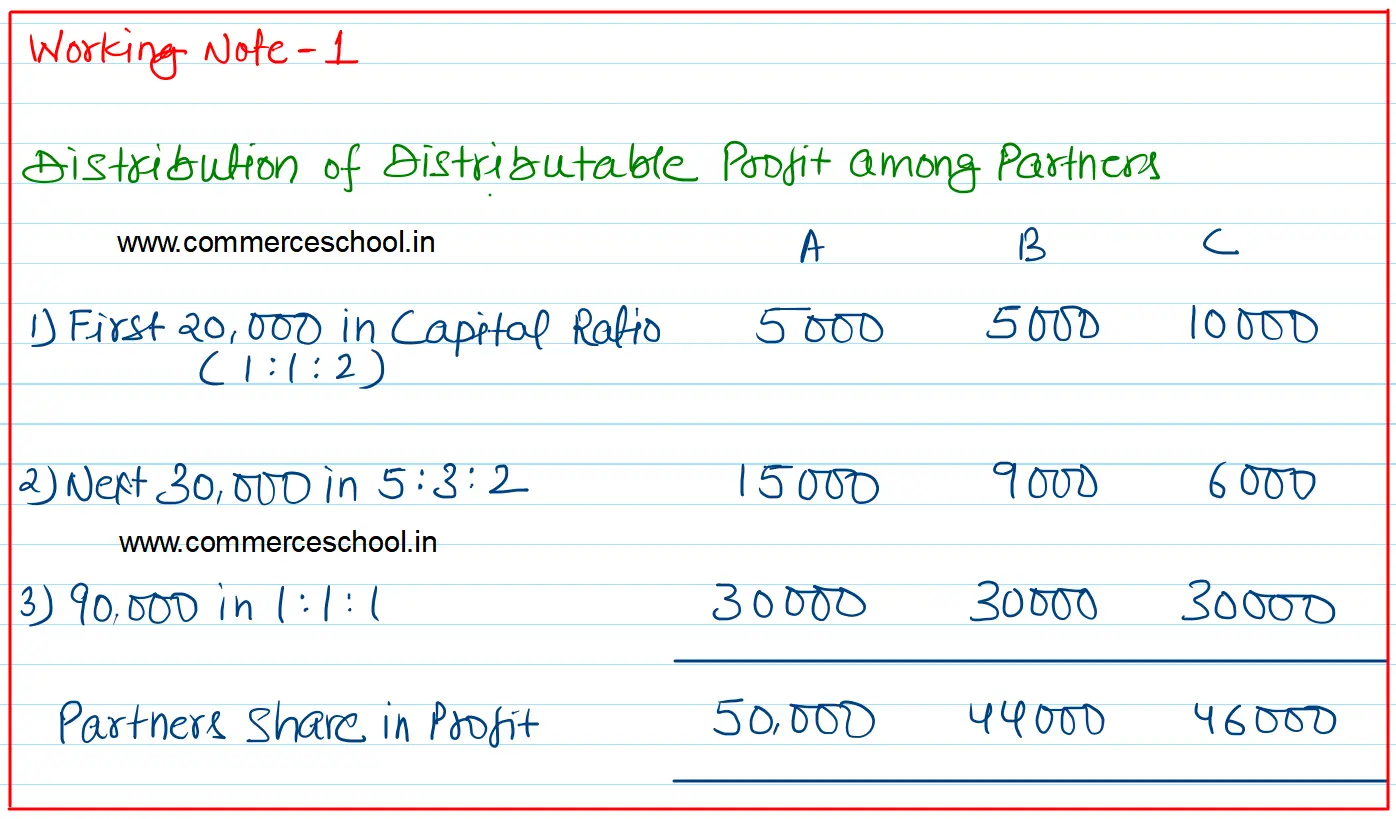

(a) The first ₹ 20,000 in proportion to their capitals.

(b) Net ₹ 30,000 in the ratio of 5 : 3 : 2.

(c) Remaining profits to be shared equally.

The firm earned a net profit of ₹ 1,72,000 before charging any of the above items.

Prepare a Profit and Loss Appropriation Account and Pass the necessary Journal entry for the appropriation of profits.

[Ans: Divisible Profit – ₹ 1,40,000; A’s Share – ₹ 50,000; B’s Share – ₹ 44,000; C’s Share – ₹ 46,000.]