A, B and C were partners in a firm. On 1-4-2022 their capitals stood at ₹ 5,00,000, ₹ 2,50,000 and ₹ 2,50,000 respectively. As per the provisions of the partnership deed

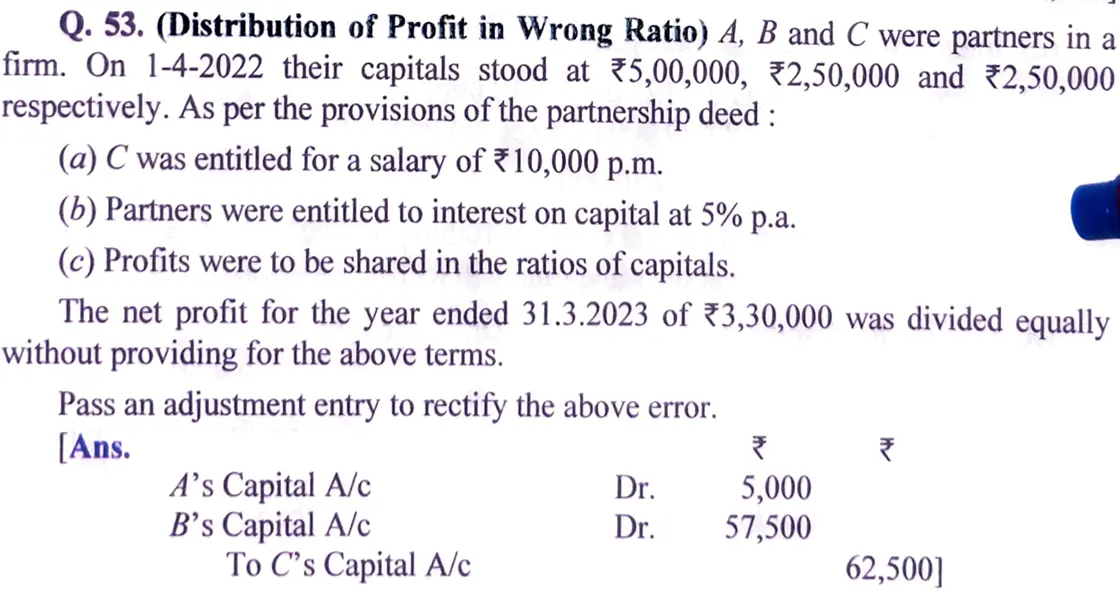

A, B and C were partners in a firm. On 1-4-2022 their capitals stood at ₹ 5,00,000, ₹ 2,50,000 and ₹ 2,50,000 respectively. As per the provisions of the partnership deed:

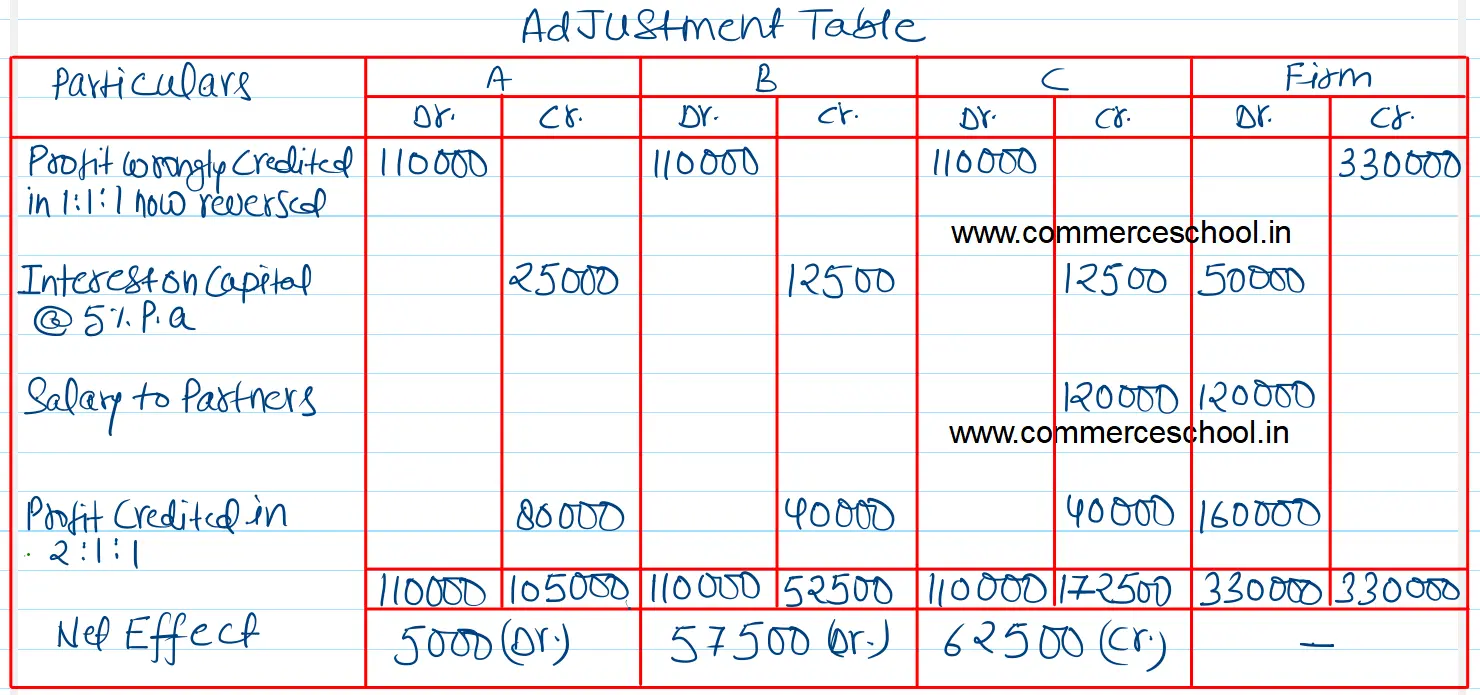

(a) C was entitled for a salary of ₹ 10,000 p.m.

(b) Partnersh were entitled to interest on capital at 5% p.a.

(c) Profits were to be shared in the ratios of capitals.

The net profit for the year ended 31.3.2023 of ₹ 3,30,000 was divided equally without providing for the above terms.

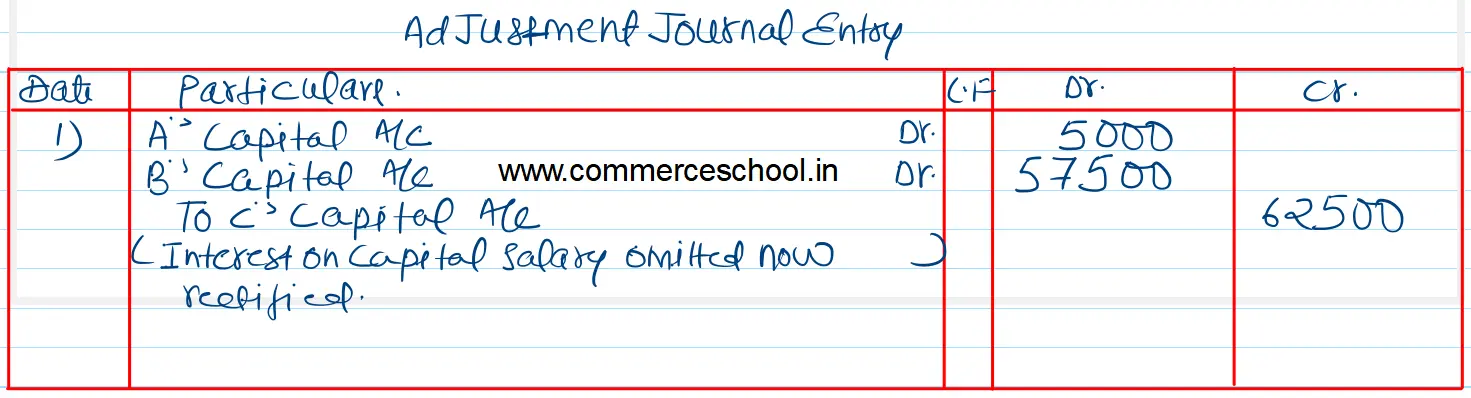

Pass an adjustment entry to rectify the above error.

Ans:

A’s Capital A/c Dr. 5,000

B’s Capital A/c Dr. 57,500

To C’s Capital A/c 62,500

Anurag Pathak Answered question