A, B and C were partners in a firm sharing profits in the ratio of 2 : 1 : 1. Their respective capitals were A ₹ 3,00,000; B ₹ 2,00,000 and C ₹ 1,80,000. On 1st April, 2024 they admitted D as a new partner

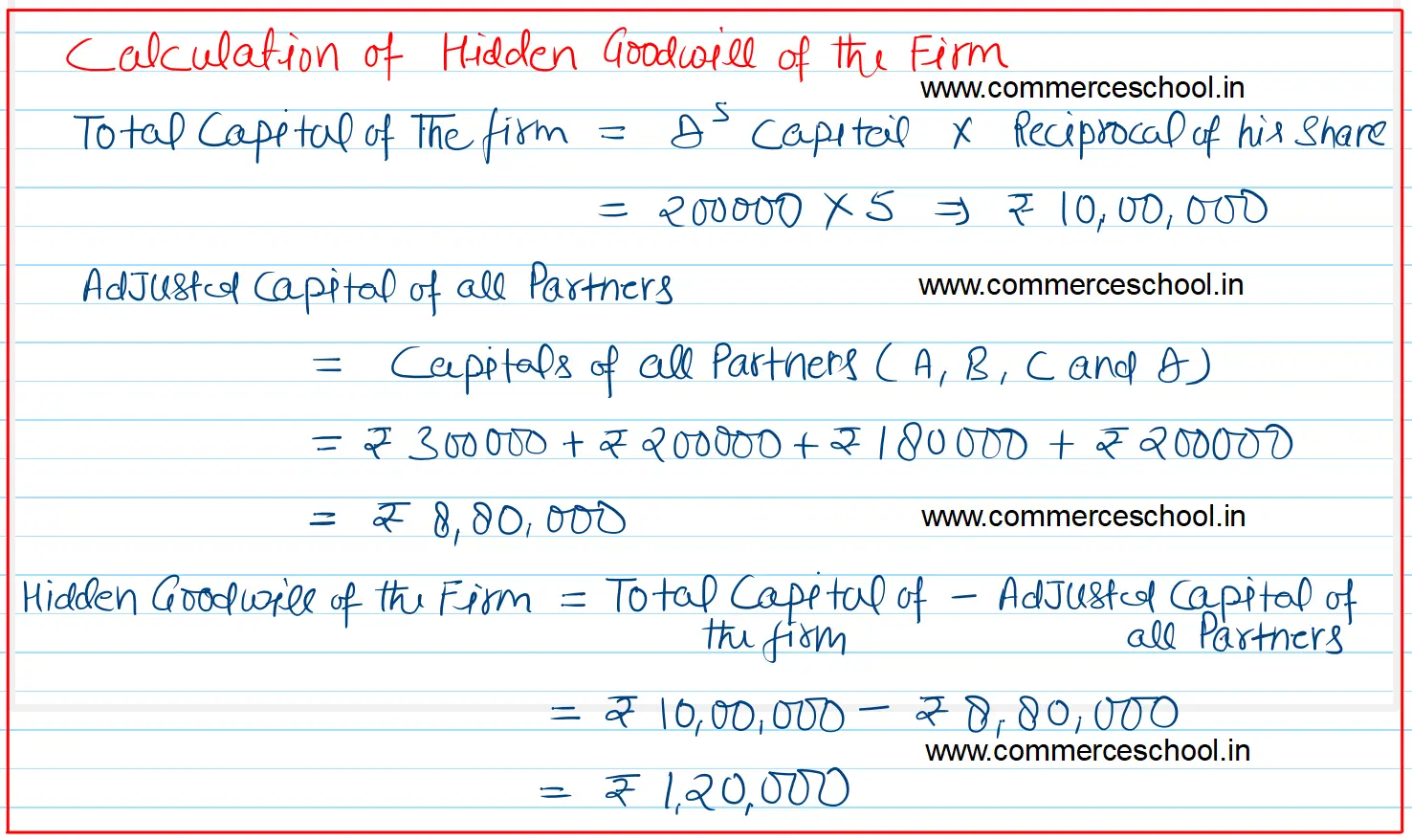

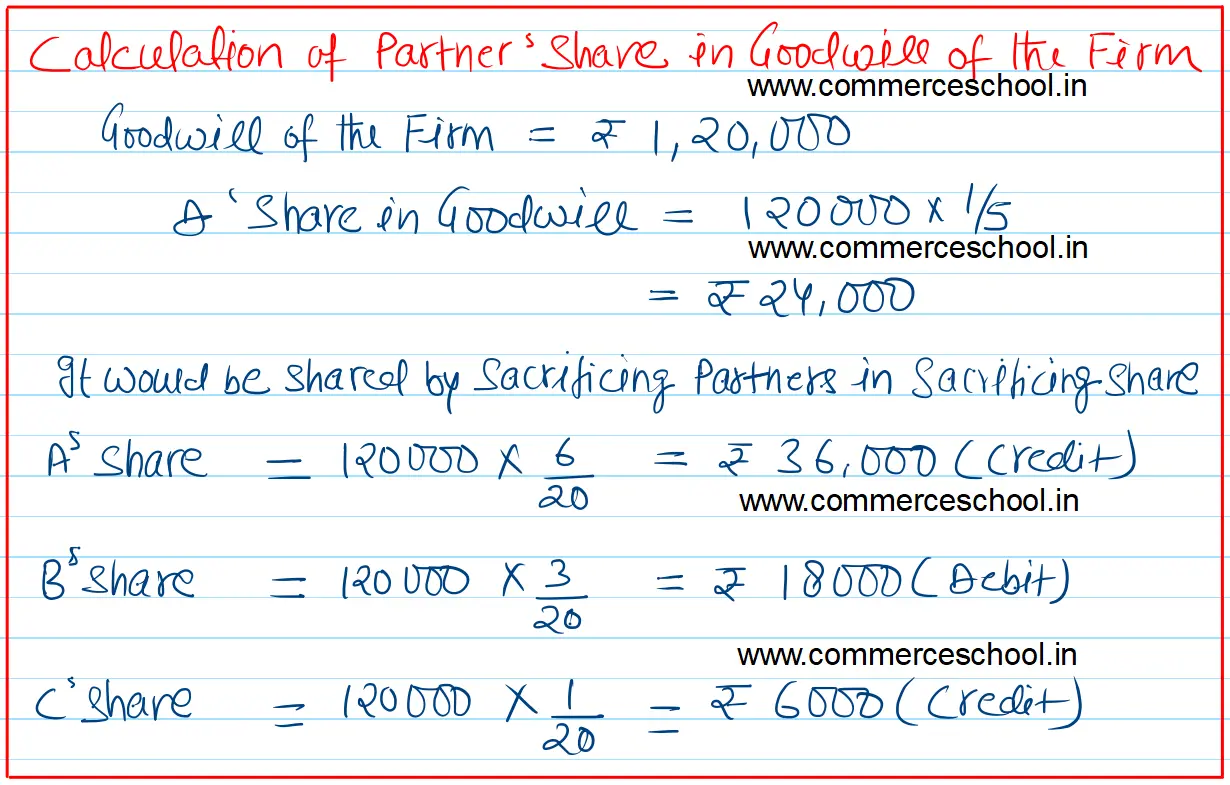

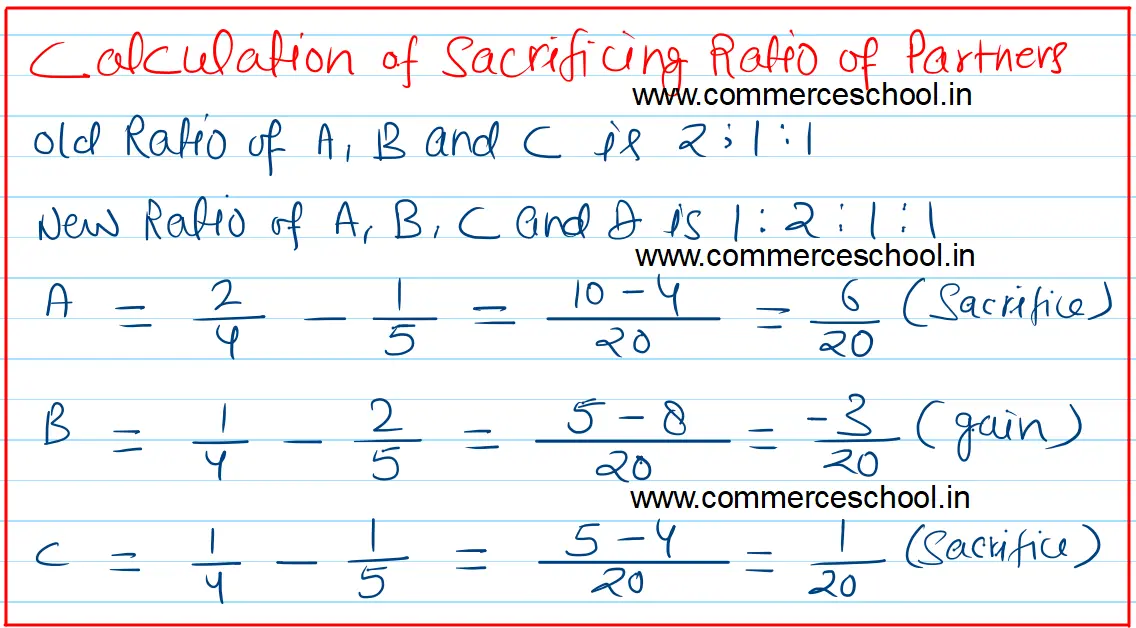

A, B and C were partners in a firm sharing profits in the ratio of 2 : 1 : 1. Their respective capitals were A ₹ 3,00,000; B ₹ 2,00,000 and C ₹ 1,80,000. On 1st April, 2024 they admitted D as a new partner. D brought ₹ 2,00,000 for his capital and necessary amount for his share of goodwill premium. The new profit sharing ratio between A, B, C and D will be 1 : 2 : 1 : 1.

Pass necessary journal entries for the above transactions in the books of the firm on D’s admission.

[Ans. Hidden Goodwill ₹ 1,20,000]

Anurag Pathak Answered question