A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2015 was as follows:

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2015 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Bills Payable General Reserve Capital A/cs: A B C |

50,000 20,000 30,000 1,00,000 50,000 25,000

|

Land

Building Plant Stock Debtors Bank |

50,000 50,000 1,00,000 40,000 30,000 5,000 |

| 2,75,000 | 2,75,000 |

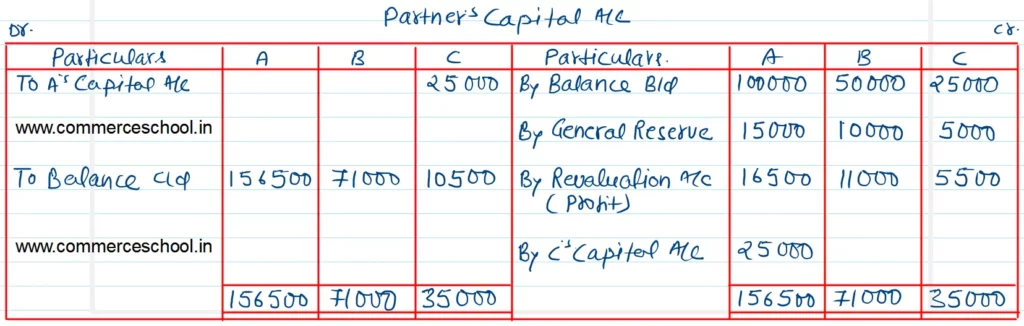

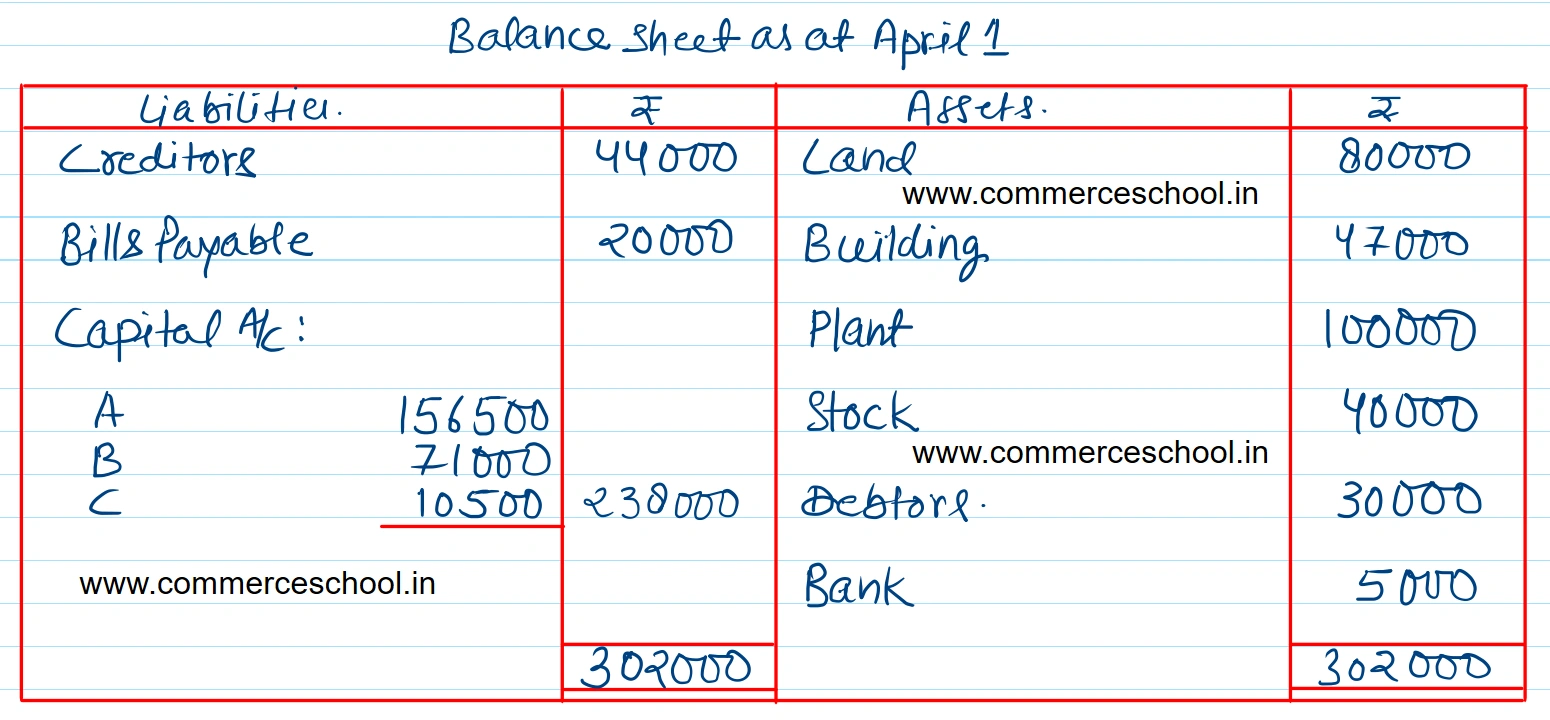

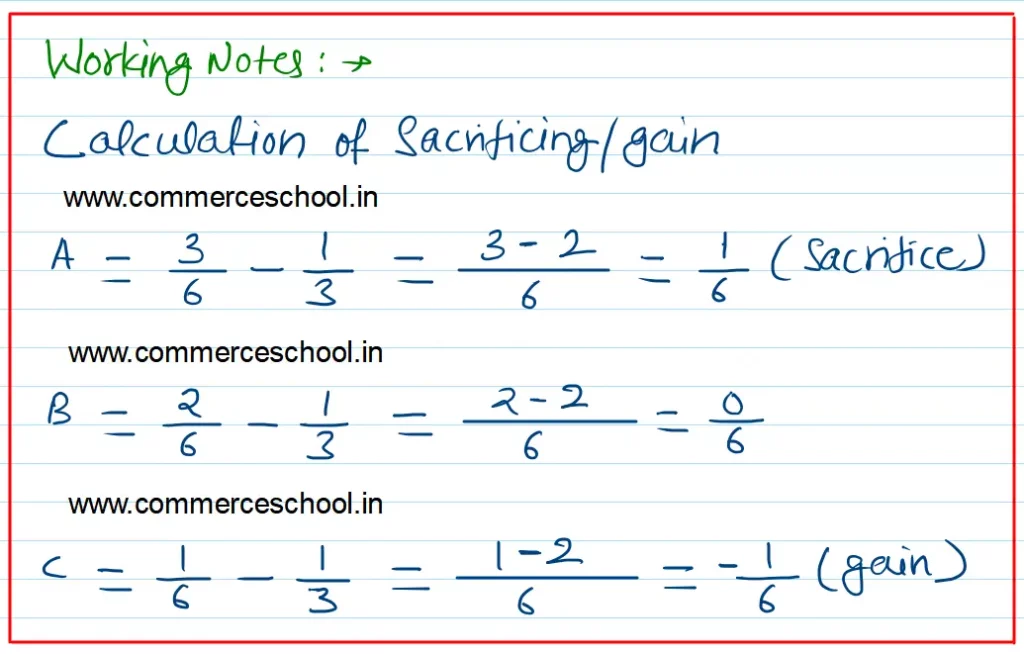

From 1st April 2015, A, B, and C decided to share profits equally. For this, it was agreed that:

i) Goodwill of the firm will be valued at ₹ 1,50,000.

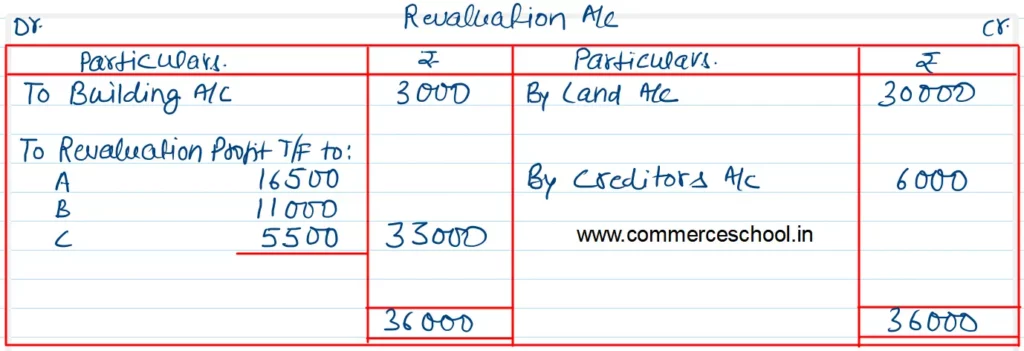

ii) Land will be revalued at ₹ 80,000 and the building be depreciated by 6%

iii) Creditors of ₹ 6,000 were not likely to be claimed and hence should be written off.

Prepare the Revaluation Account, Partner’s Capital Accounts, and Balance Sheet of the reconstituted firm.

Anurag Pathak Changed status to publish