A, B and C were partners in a firm. Their capitals were A ₹ 1,00,000, B ₹ 2,00,000 and C ₹ 3,00,000 respectively on 1st April, 2023. According to the partnership deed they were entitled to an interest on capital @ 5% p.a

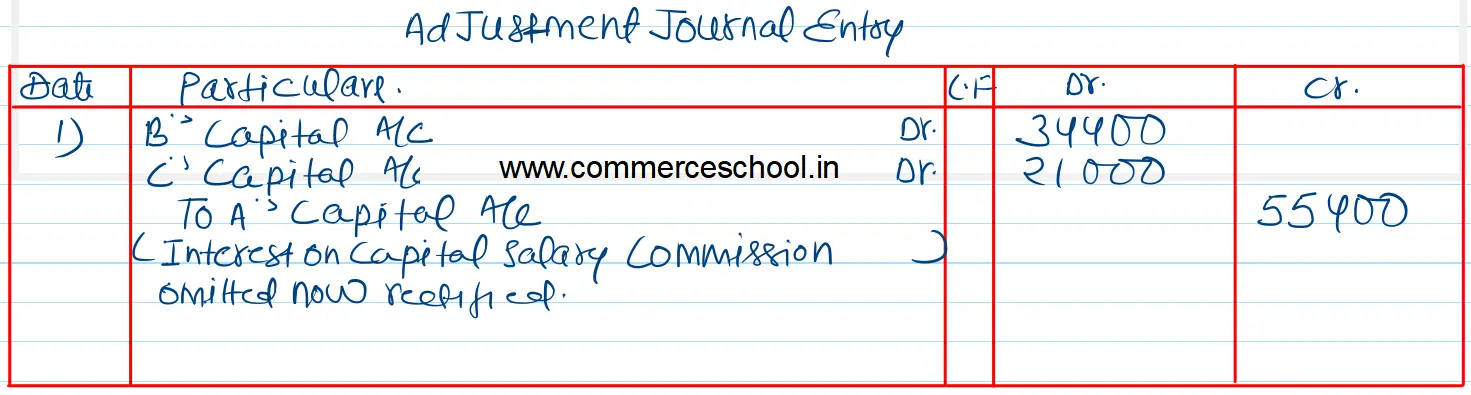

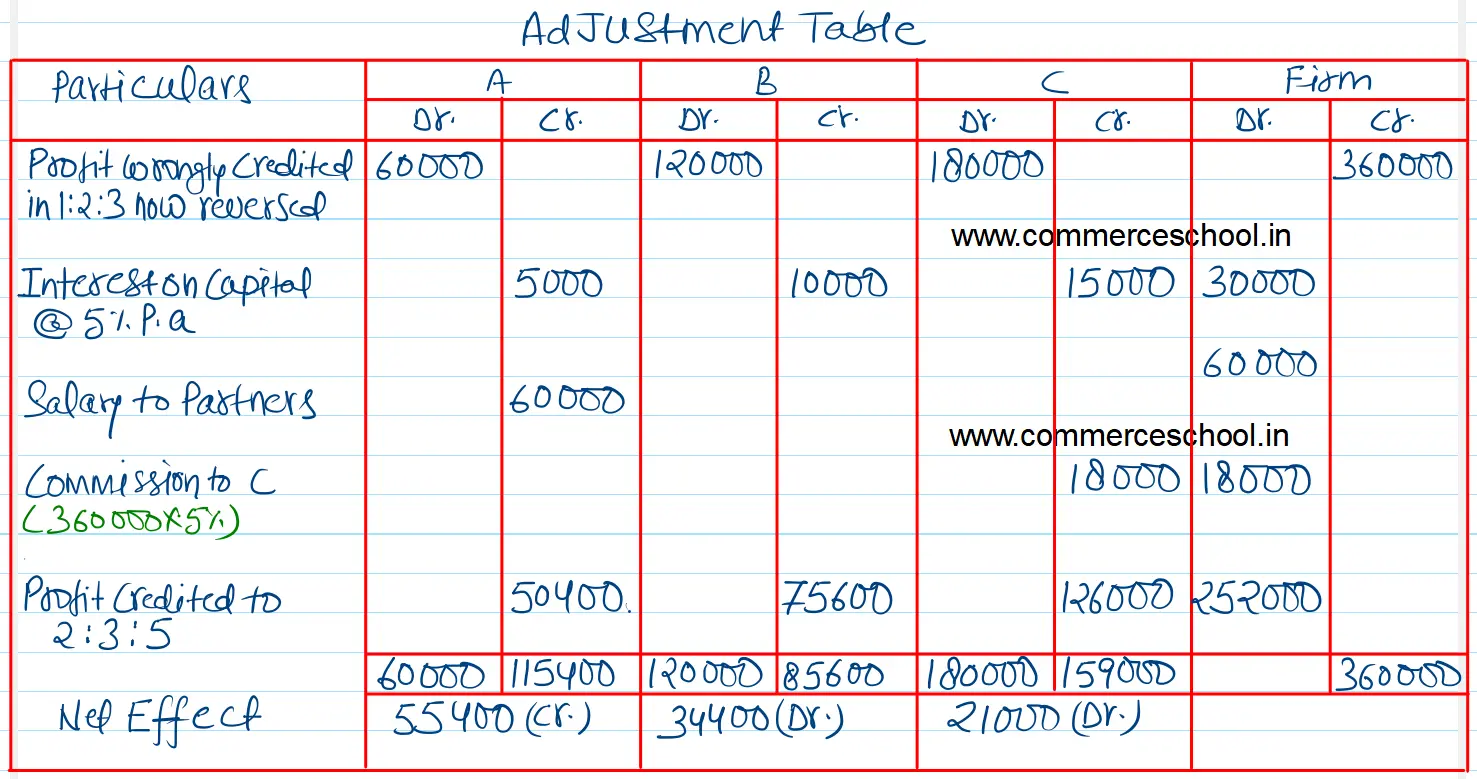

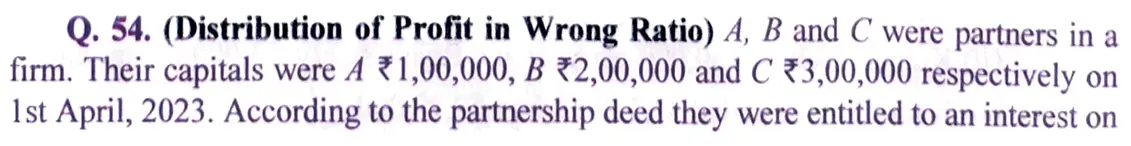

A, B and C were partners in a firm. Their capitals were A ₹ 1,00,000, B ₹ 2,00,000 and C ₹ 3,00,000 respectively on 1st April, 2023. According to the partnership deed they were entitled to an interest on capital @ 5% p.a. In addition A was also entitled to draw a salary of ₹ 5,000 per month. C was entitled to a commission of 5% on net profits. The net profits for the year ending 31st March, 2024 were ₹ 3,60,000 distributed in the ratio of their capitals without providing for any of the above adjustments. The profits were to be shared in the ratio 2 : 3 : 5. Pass the necessary adjustment entry showing the workings clearly.

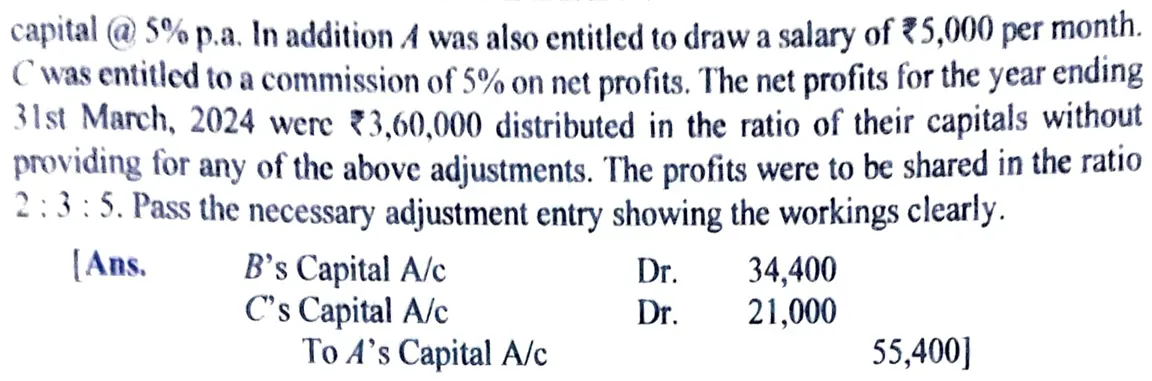

Ans:

B’s Capital A/c Dr. 34,400

C’s Capital A/c Dr. 21,000

To A’s Capital A/c 55,400

Anurag Pathak Answered question