A, B and C were partners sharing profits in the ratio of 3 : 2 : 1 respectively. B retired on 31st March, 2024. On that date the capitals of A, B and C after all adjustments were ₹ 5,10,000; ₹ 3,30,000 and ₹ 1,80,000 respectively.

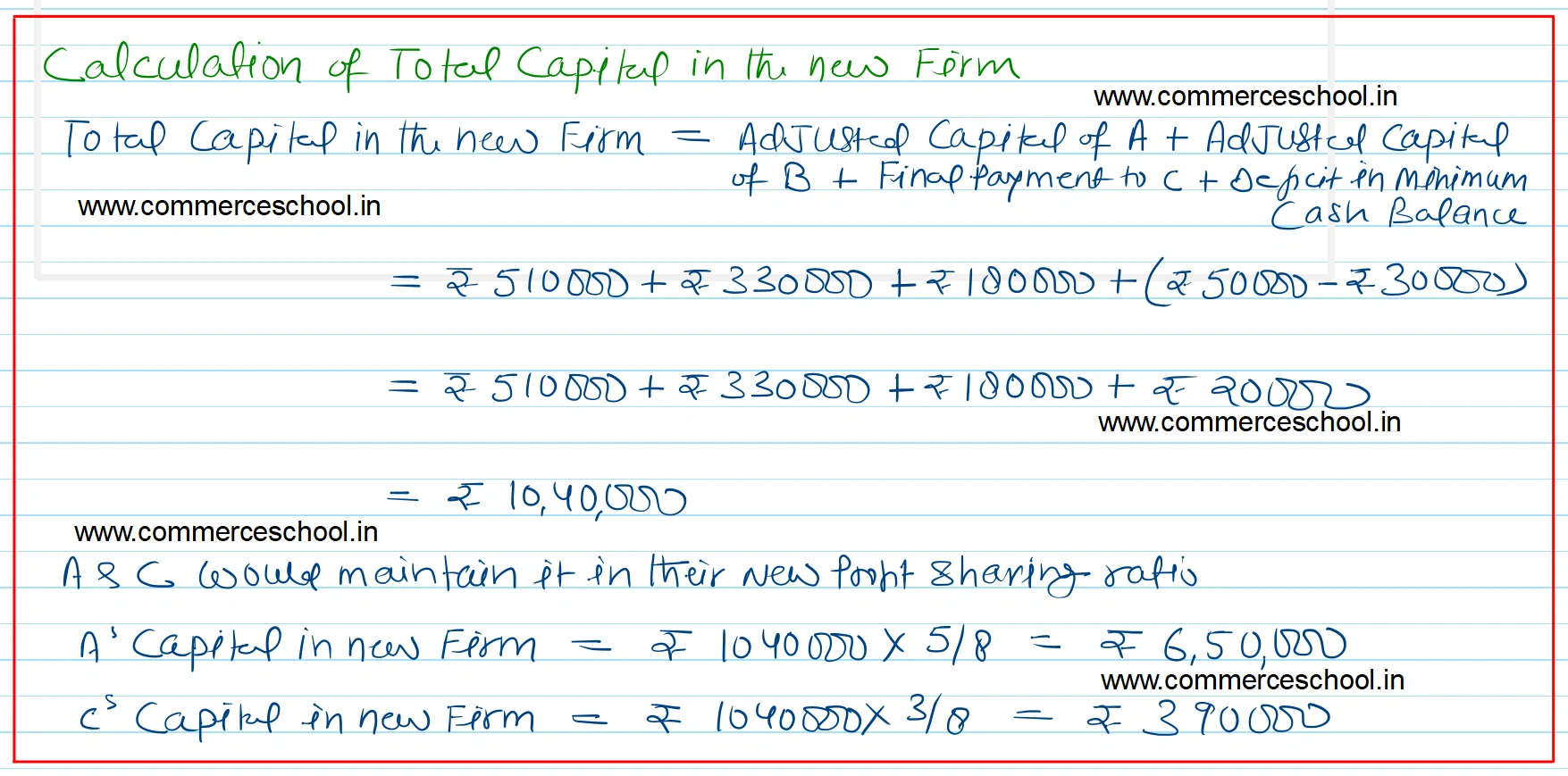

A, B and C were partners sharing profits in the ratio of 3 : 2 : 1 respectively. B retired on 31st March, 2024. On that date the capitals of A, B and C after all adjustments were ₹ 5,10,000; ₹ 3,30,000 and ₹ 1,80,000 respectively. Cash and bank balances on 31st March, 2024 were ₹ 30,000. B was to be paid through cash brought by A and C in a manner that their capitals are proportionate to their new profit-sharing ratio which was to be 5 : 3. Firm wants to maintain a minimum cash balance of ₹ 50,000.

Pass necessary journal entries.

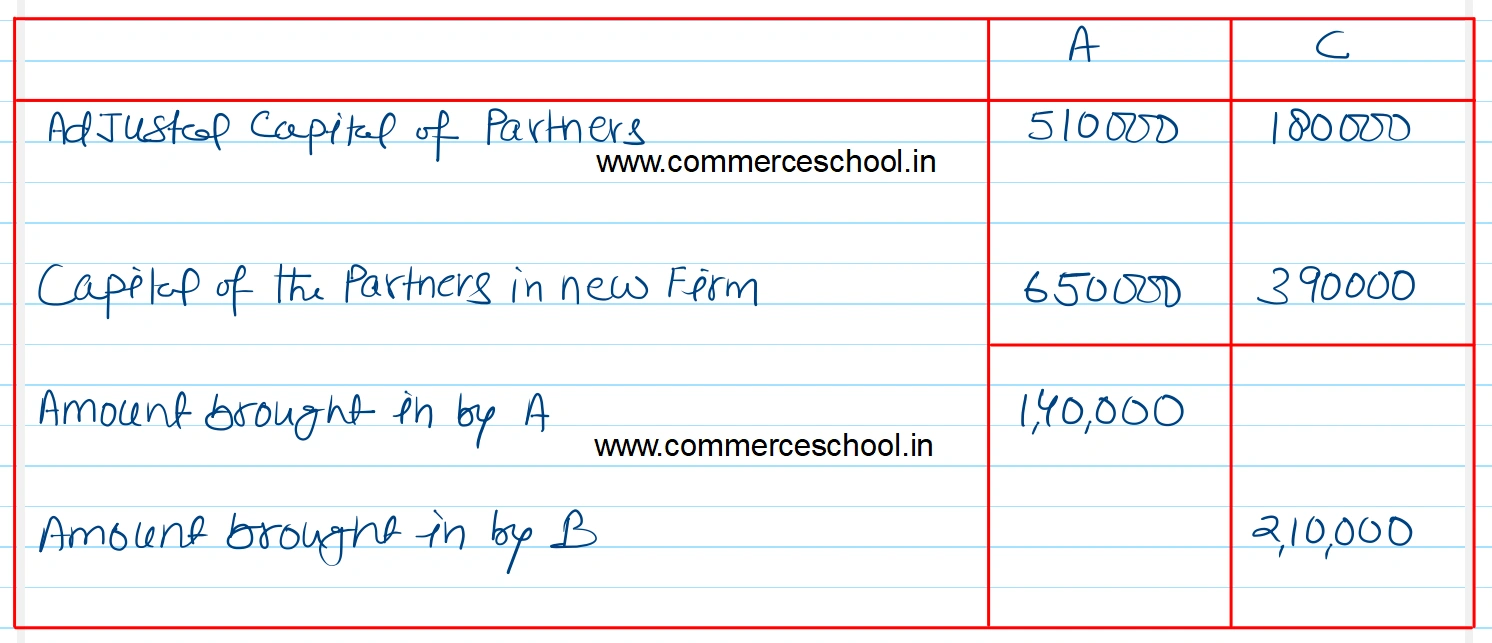

[Ans. Amount brought in by A ₹ 1,40,000 and C ₹ 2,10,000.]

Anurag Pathak Answered question