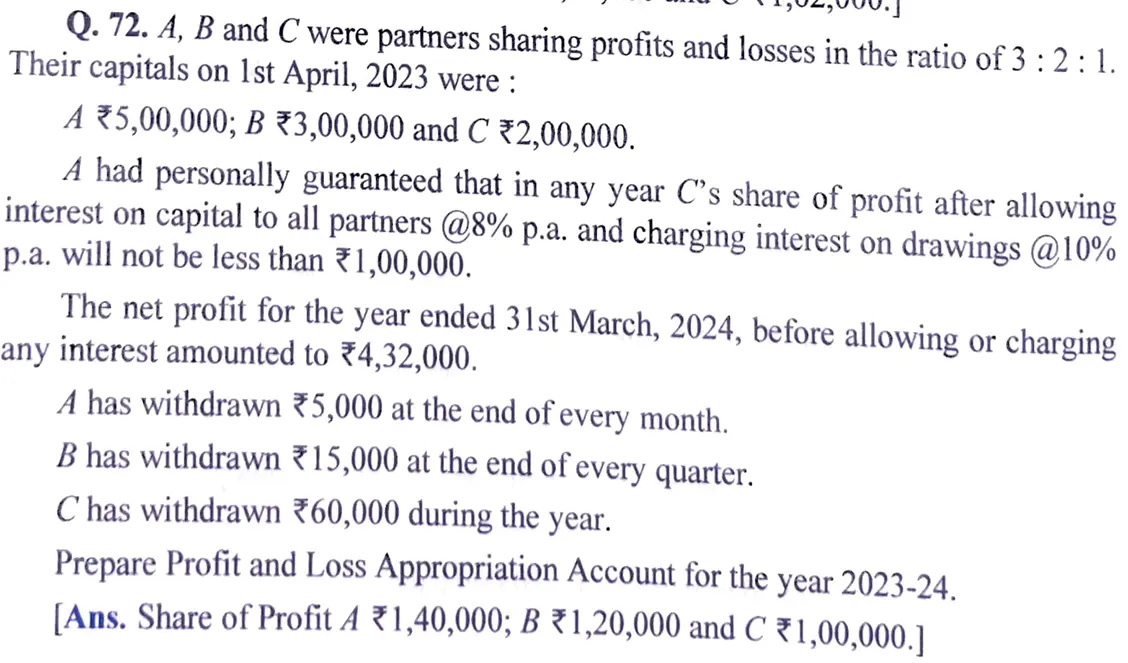

A, B and C were partners sharing profits and losses in the ratio of 3 : 2 : 1. Their capitals on 1st April, 2023 were: A ₹ 5,00,000; B ₹ 3,00,000 and C ₹ 2,00,000

A, B and C were partners sharing profits and losses in the ratio of 3 : 2 : 1. Their capitals on 1st April, 2023 were: A ₹ 5,00,000; B ₹ 3,00,000 and C ₹ 2,00,000.

A had personally guaranteed that in any year C’s share of profit after allowing interest on capital to all partners @ 8% p.a. and charging interest on drawings @ 10% p.a. will not be less than ₹ 1,00,000.

The net profit for the year ended 31st March, 2024, before allowing or charging any interest amounted to ₹ 4,32,000.

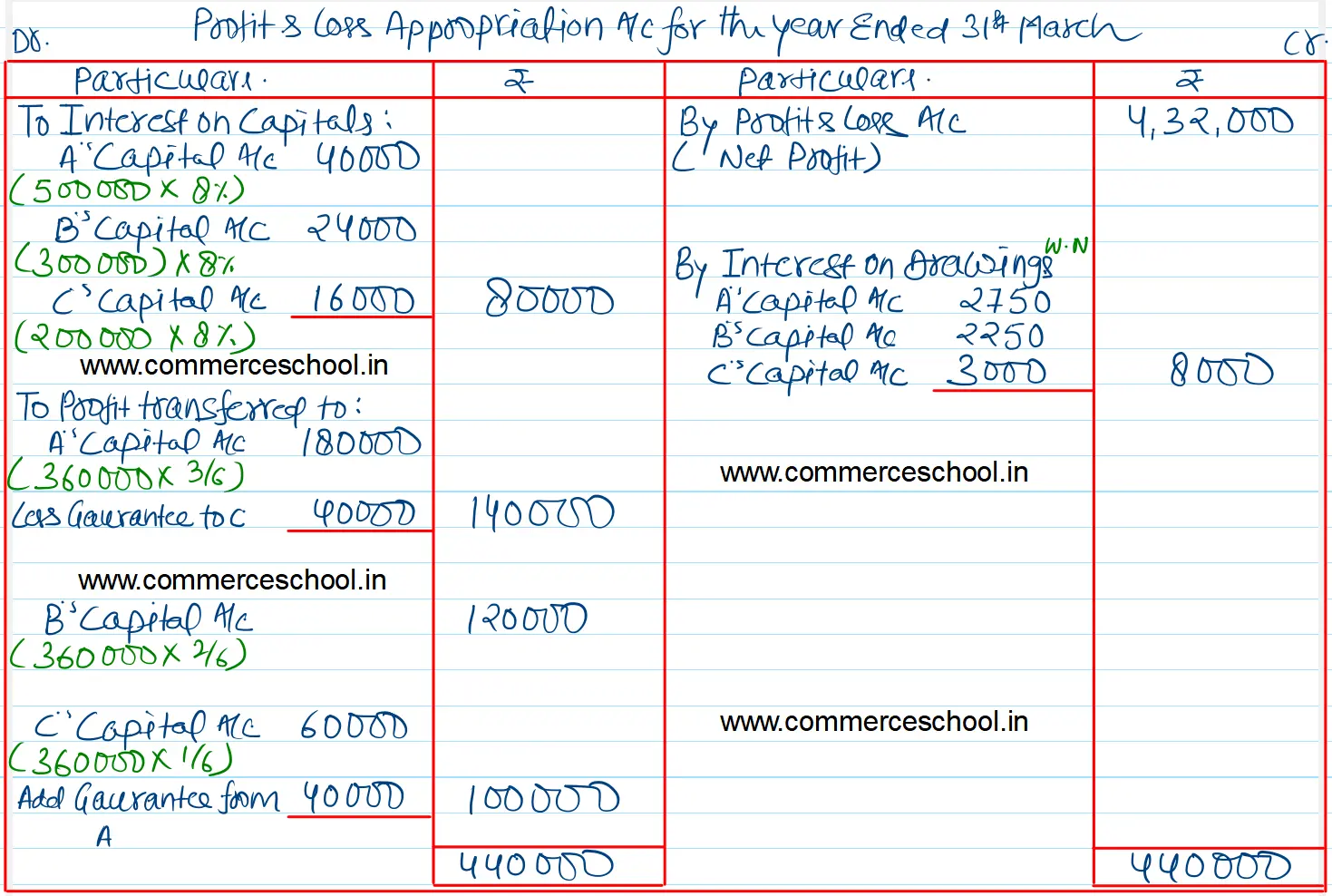

A had withdrawn ₹ 5,000 at the end of every month.

B had withdrawn ₹ 15,000 at the end of every quarter.

C has withdrawn ₹ 60,000 during the year.

Prepare Profit and Loss Appropriation Account for the year 2023-24.

[Ans. Share of Profit A ₹ 1,40,000; B ₹ 1,20,000 and C ₹ 1,00,000.]