A, B and C were partners sharing profits and losses in the ratio of 5 : 3 : 2. Following was their Balance Sheet as at 31st March, 2023:

A, B and C were partners sharing profits and losses in the ratio of 5 : 3 : 2. Following was their Balance Sheet as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 1,20,000 | Cash at Bank | 34,000 |

|

Capital A/cs: A B C |

4,00,000 2,50,000 1,50,000 |

Sundry Debtors 1,50,000 Less: Provision for Doubtful Debts 9,000 |

1,41,000 |

| Stock | 1,45,000 | ||

| Plant | 2,00,000 | ||

| Land and Building | 4,00,000 | ||

| 9,20,000 | 9,20,000 |

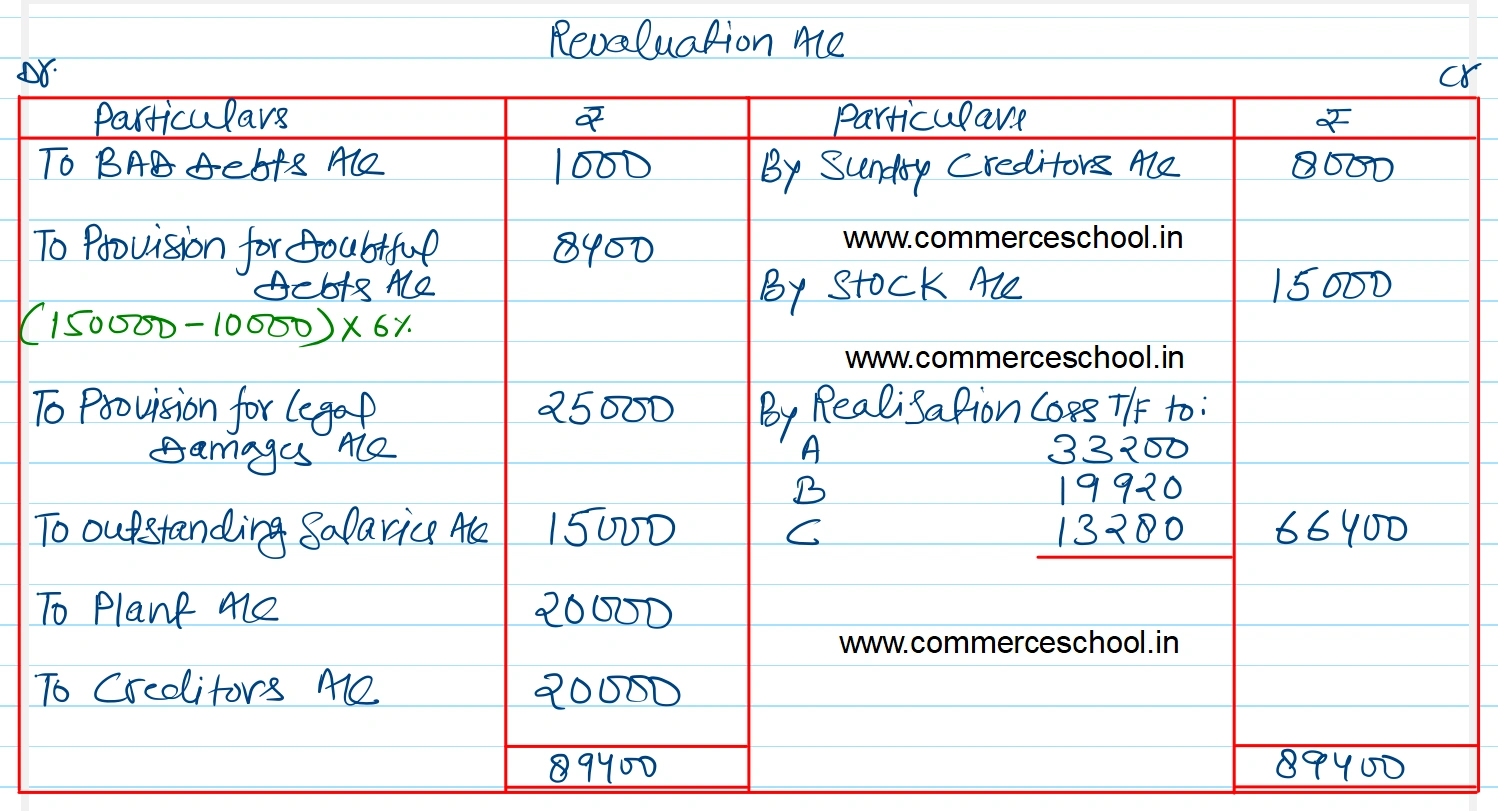

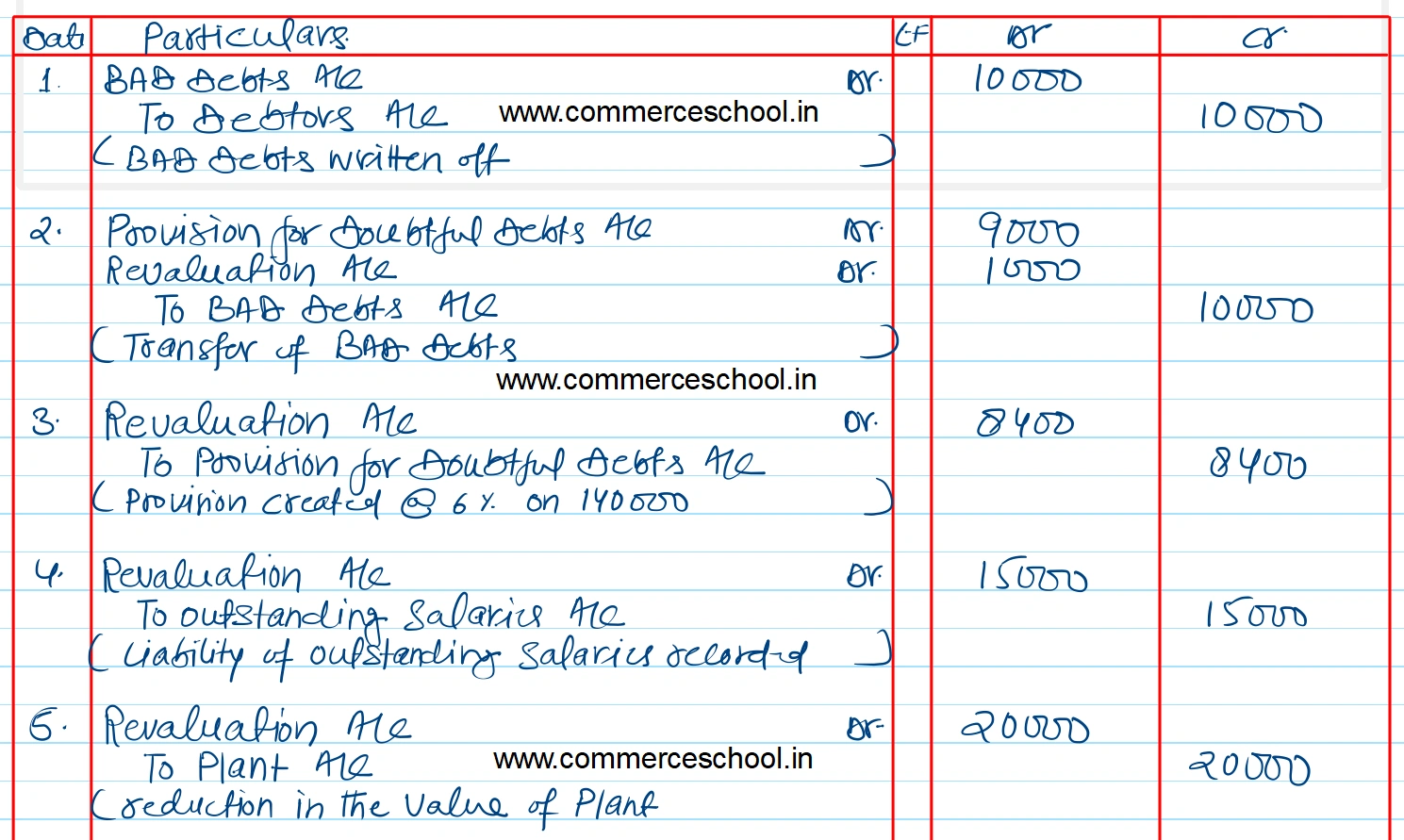

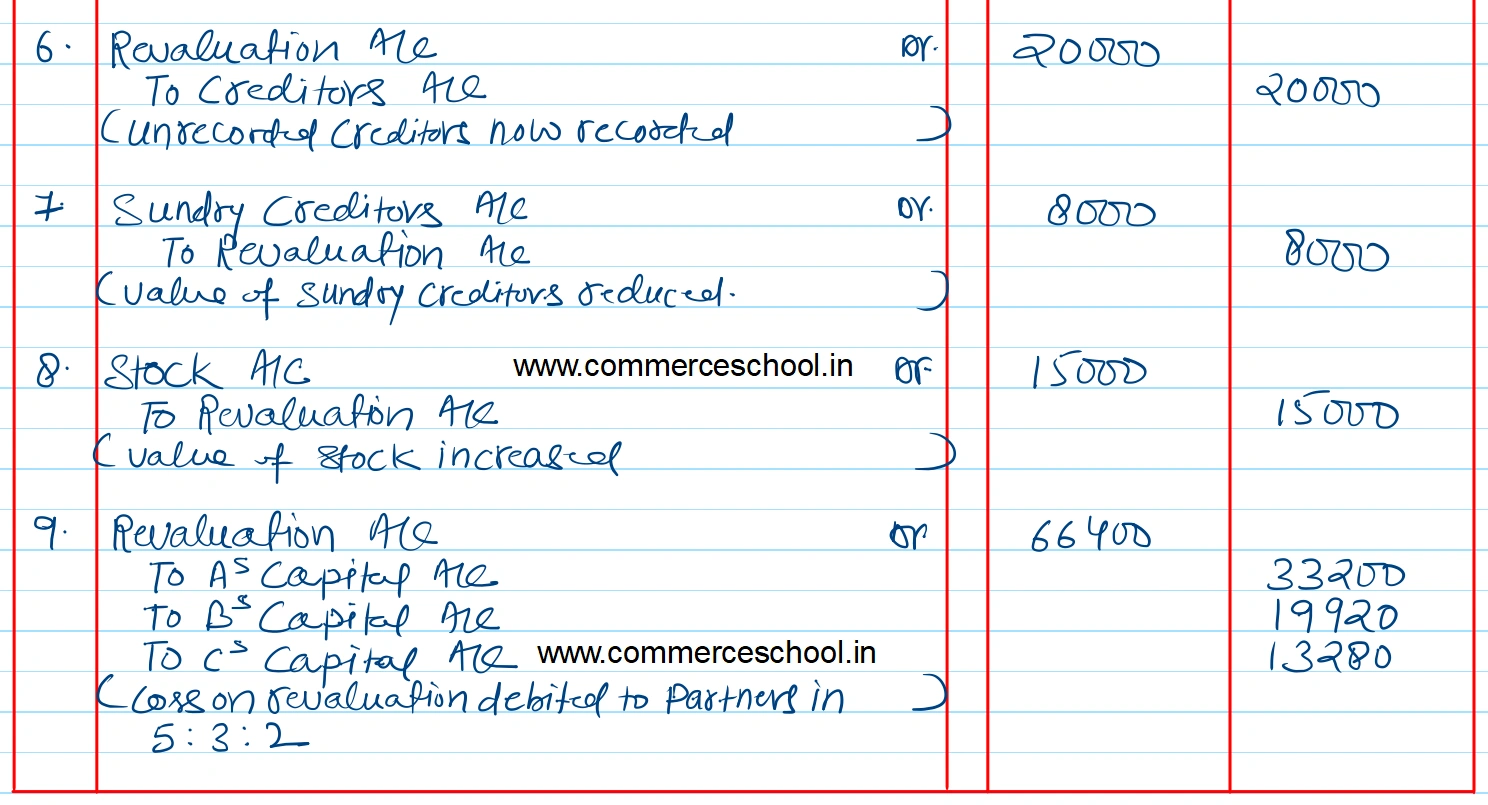

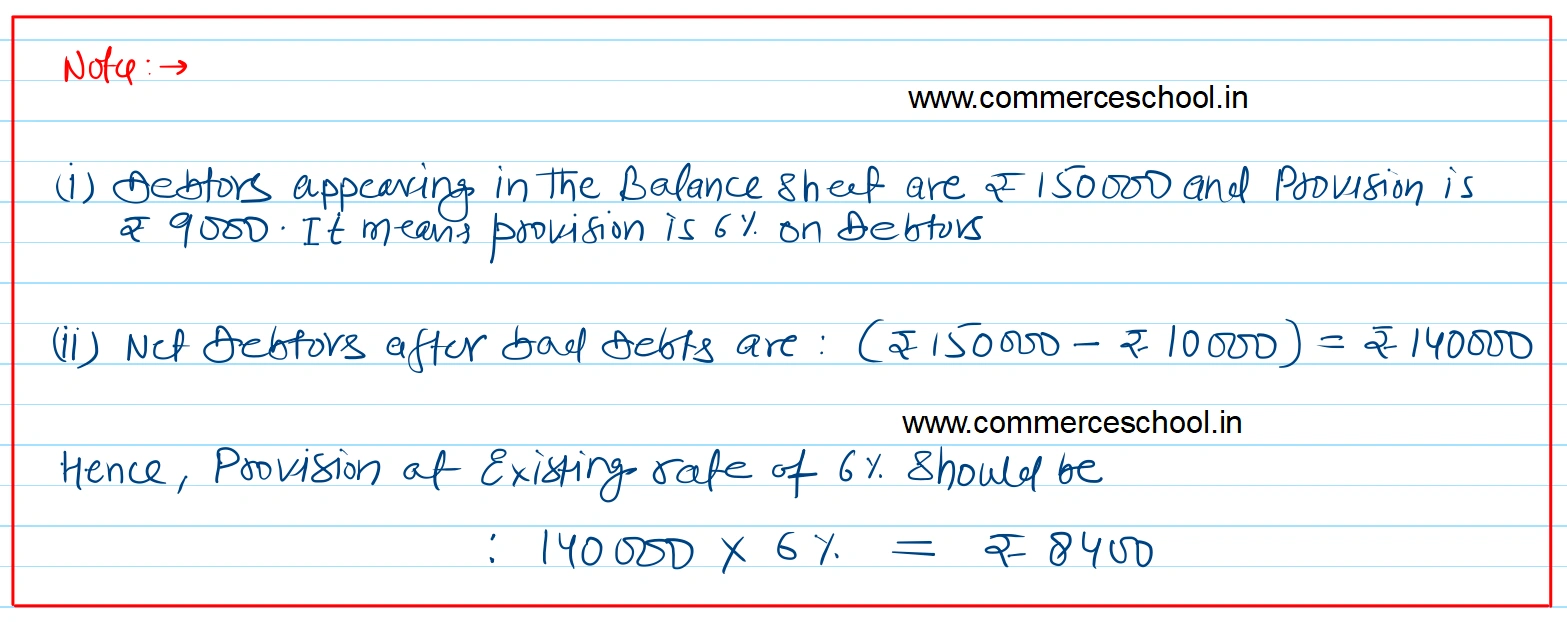

A retires on this date and the following adjustments were agreed upon: (i) Bad Debts amounting to ₹ 10,000 were to be written off and provision for doubtful debts be maintained at existing rate. (ii) An unrecorded creditor of ₹ 20,000 will be taken into account. (iii) Provision is to be made for legal damages amounting to ₹ 25,000. (iv) There is a liability for ₹ 15,000 for outstanding salaries. (v) Sundry creditors be reduced by ₹ 8,000 being a liability not payable. (vi) Stock be increased by ₹ 15,000 and Plant is to be reduced to ₹ 1,80,000. Pass journal entries to give effect to above adjustments and prepare Revaluation Account. [Ans. Loss on Revaluation ₹ 66,400.]