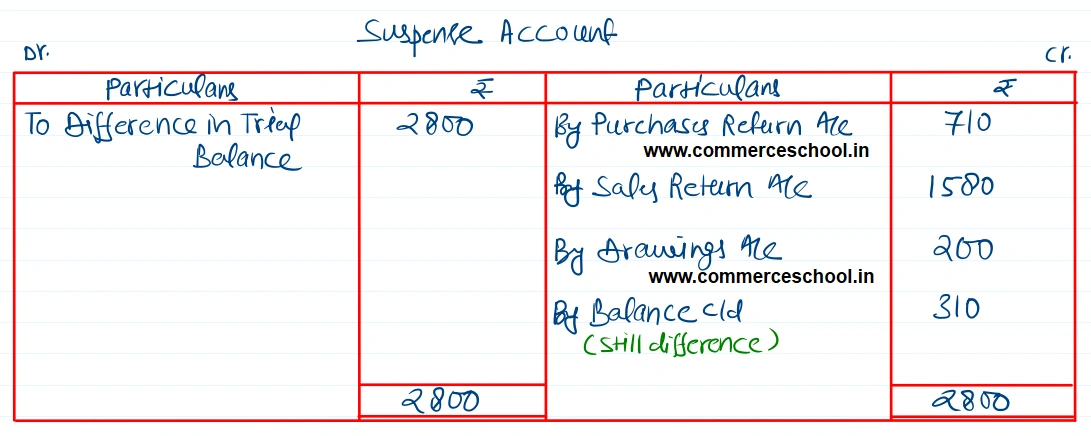

A Book-keeper finds that the totals of his trial balance disagree by ₹ 2,800. He temporarily debits a Suspense Account with this amount and closes the books. On an examination of the books, the following errors are discovered:

A Book-keeper finds that the totals of his trial balance disagree by ₹ 2,800. He temporarily debits a Suspense Account with this amount and closes the books. On an examination of the books, the following errors are discovered:-

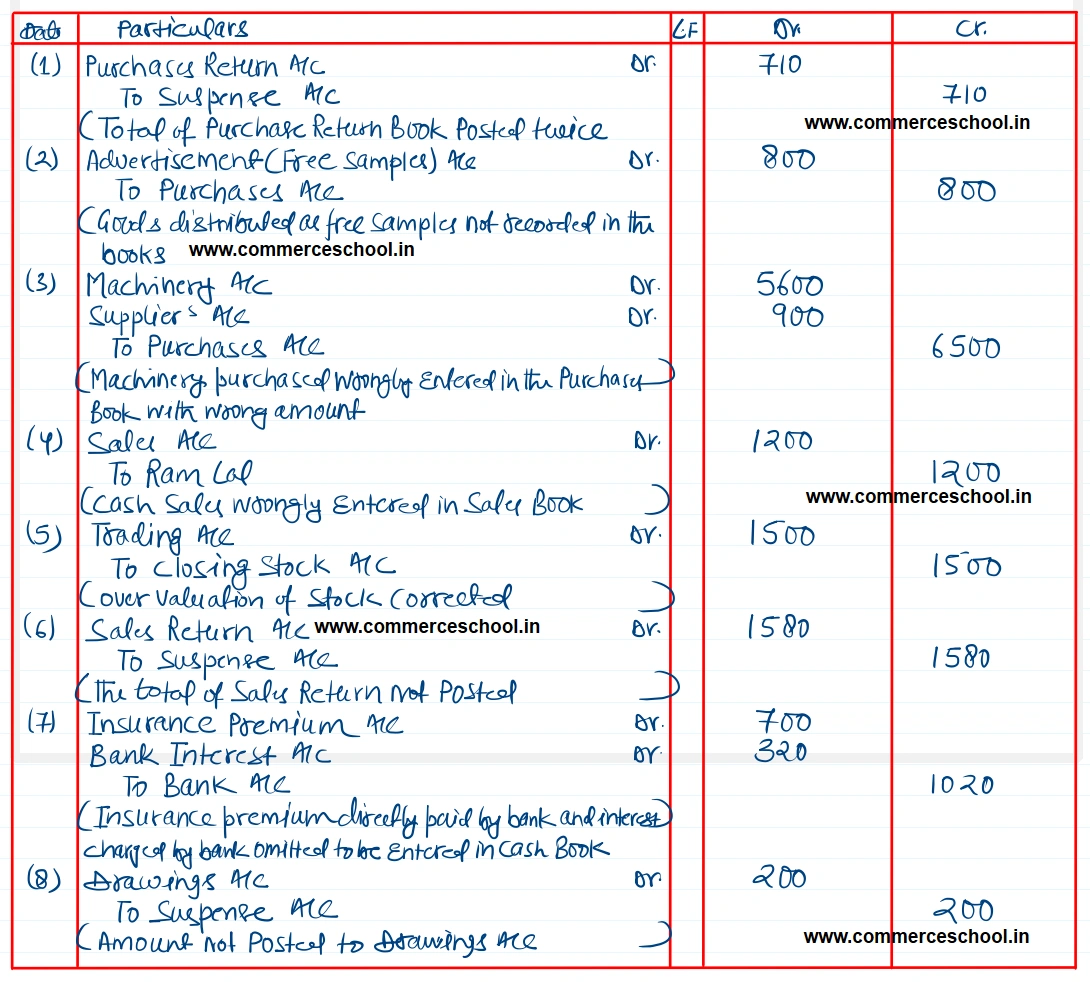

(1) The total of Purchase Return Book ₹ 710 was posted Twice.

(2) Goods costing ₹ 800 were distributed as free samples but no entry was passed in the books.

(3) Purchase of Machinery for ₹ 5,600 on credit was recorded in Purchase Book as ₹ 6,500.

(4) Cash Sales to Ram Lal for ₹ 1,200 were recorded in Cash Book as well as in Sales Book and were posted from both.

(5) Closing Stock has been overvalued by ₹ 1,500.

(6) Sales Return Book was untotalled, though personal accounts were posted ₹ 1,580.

(7) No entries have been made in the Cash Book for the Insurance Premium directly paid by bank ₹ 700 and interest charged on overdraft ₹ 320.

(8) A sum of ₹ 200 for Drawings on the Credit Side of Cash Book was not posted to the Drawings Account.

Pass entries to rectify the above errors. Close the Suspense Account already opened.

[Ans. All errors have not been discovered, as Suspense A/c still shows a Dr. balance of ₹ 310.

Solution:-