cheque for ₹ 20,000 was received from Ranjan on which ₹ 200 Discount was allowed. The cheque was not honoured on due date and the amount of discount was credited to Discount Received Account

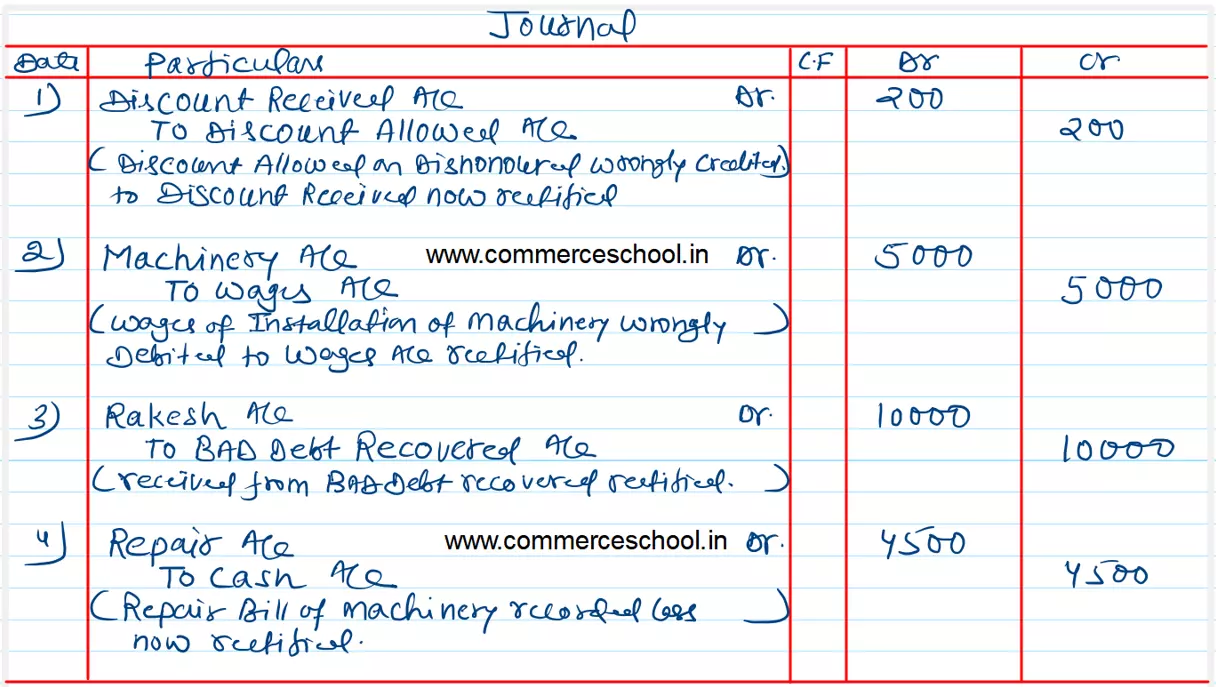

Pass Journal entries rectifying the following errors:

(i) A cheque for ₹ 20,000 was received from Ranjan on which ₹ 200 Discount was allowed. The cheque was not honoured on due date and the amount of discount was credited to Discount Received Account.

(ii) ₹ 5,000 paid as wages for machinery installation was debited to Wages Account.

(iii) ₹ 10,000 received from Rakesh were credited to his Personal Account. The amount had been written off as bad debts earlier.

(iv) Repair bill of machinery was recorded as ₹ 500 against the bill amount of ₹ 5,000.

Anurag Pathak Changed status to publish