A company purchased machinery for ₹ 50,000 on 1st October, 2020. Another machine costing ₹ 10,000 was purchased on 1st December, 2021

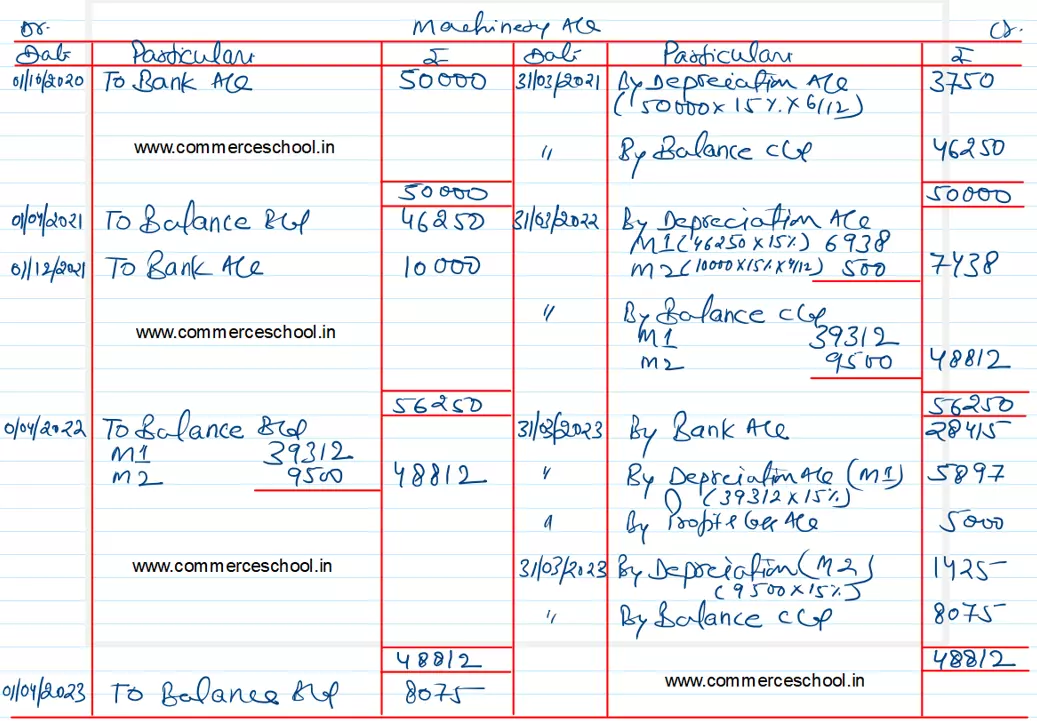

A company purchased machinery for ₹ 50,000 on 1st October, 2020. Another machine costing ₹ 10,000 was purchased on 1st December, 2021. On 31st March, 2023, the machinery purchased in 2017 was sold at a loss of ₹ 5,000. The company charges depreciation @ 15% p.a. by Diminishing Balance Method. Accounts are closed on 31st March every year.

Prepare Machinery Accounts for 3 years.

Anurag Pathak Changed status to publish