A company purchased second-hand machinery on 1st May, 2019 for ₹ 5,85,000 and immediately spent ₹ 15,000 on its erection. On 1st October, 2020, it purchased another machine for ₹ 4,00,000

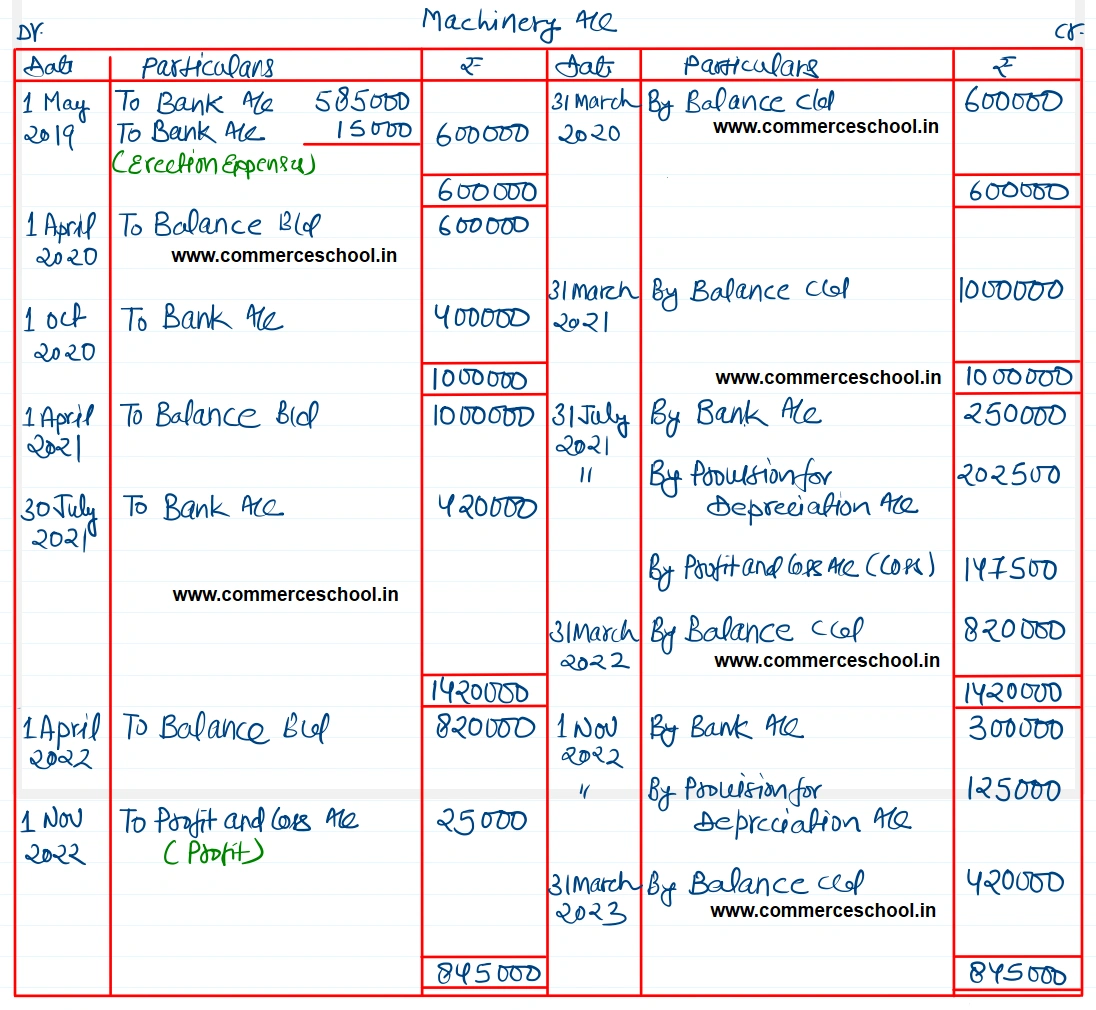

A company purchased second-hand machinery on 1st May, 2019 for ₹ 5,85,000 and immediately spent ₹ 15,000 on its erection. On 1st October, 2020, it purchased another machine for ₹ 4,00,000. On 31st July, 2021, it sold off the first machine for ₹ 2,50,000 and bought another for ₹ 4,20,000. On 1st November, 2022, the second machine was also sold off for ₹ 3,00,000. Depreciation was provided on the machinery @ 15% p.a. on Equal Instalment Method.

Show the Machinery Account, Depreciation Account and Provision for Depreciation Account assuming that the books are closed on 31st March every year.

[Ans. Balance of Machinery A/c on 31st March, 2023 ₹ 4,20,000; Balance of Provision for Depreciation A/c on 31st March, 2023 ₹ 1,05,000; Loss on sale of first machine ₹ 1,47,500; Gain on sale of second machine ₹ 25,000.]