A Company, which closes its books on 31st March every year, purchased on 1st July, 2017, machinery costing ₹ 30,000. It purchased further machinery on 1st January, 2018, costing ₹ 20,000

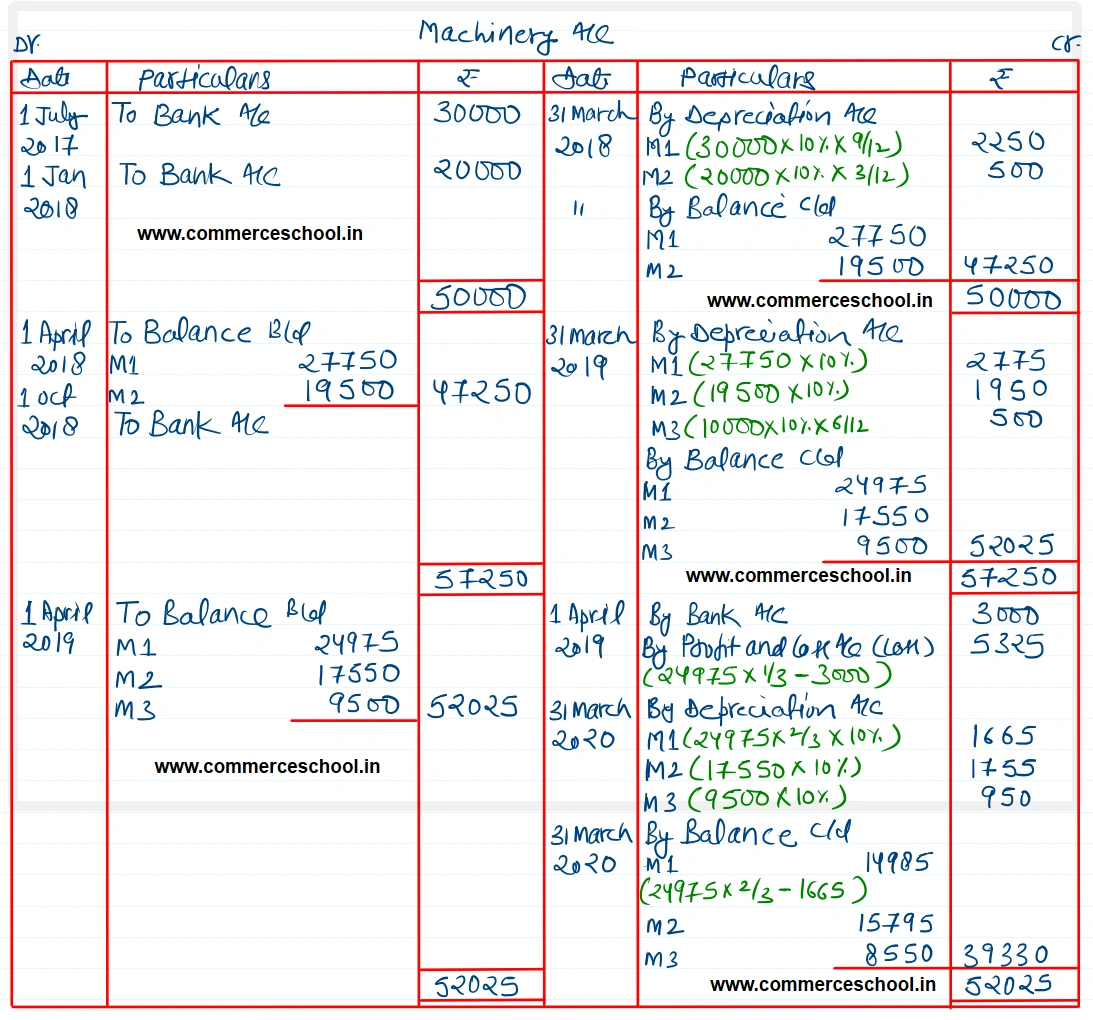

A Company, which closes its books on 31st March every year, purchased on 1st July, 2017, machinery costing ₹ 30,000. It purchased further machinery on 1st January, 2018, costing ₹ 20,000 and on 1st October, 2018, costing ₹ 10,000. ON 1st April, 2019, one-third of the machinery installed on 1st July, 2017, became obsolete and was sold for ₹ 3,000.

Show how the machinery account would appear in the books of the Company, it being given that machinery was depreciated by Diminishing Balance Method at 10% per annum. What would be the balance of Machinery Account on 1st April, 2020?

[Ans. Loss on sale of Machinery ₹ 5,325; Balance on 1st April, 2020, ₹ 39,330. Dep for 2017-18 ₹ 2,750; for 2018-19 ₹ 5,225 and for 2019-20 ₹ 4,370.]