A firm purchased a second-hand machine on 1st April, 2019 and paid ₹ 1,40,000 for it. It spent on its overhauling and installation ₹ 20,000

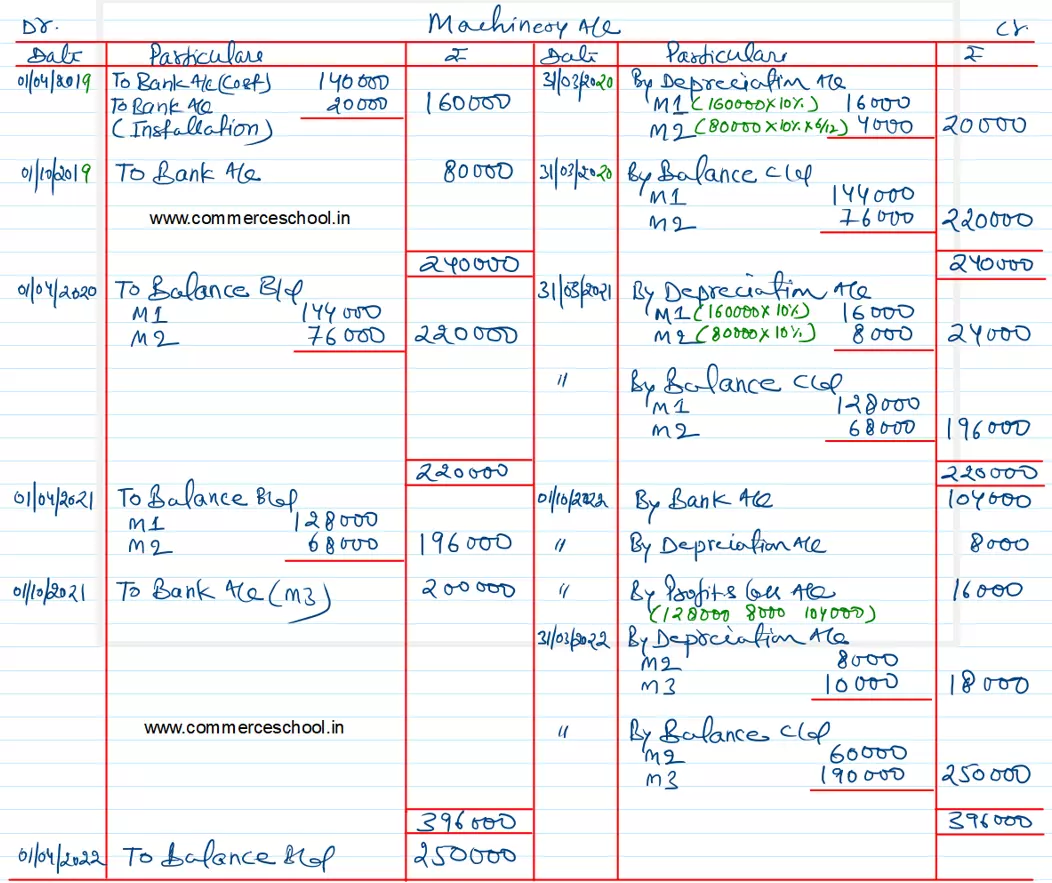

A firm purchased a second-hand machine on 1st April, 2019 and paid ₹ 1,40,000 for it. It spent on its overhauling and installation ₹ 20,000. On 1st October, 2019, another machine costing ₹ 80,000 was purchased. On 1st October, 2021, the machine purchased on 1st April, 2019 was sold for ₹ 1,04,000 and a new machine costing ₹ 2,00,000 was installed. Depreciation was provided @ 10% p.a. by the Straight Line Method. Give the Machinery Account and Depreication Account for 3 years. Firm’s books are closed on 31st March.

Anurag Pathak Changed status to publish