A firm purchased on 1st April, 2021, a second-hand Machinery for ₹ 3,20,000 and spent ₹ 40,000 on its installation. However, it started functioning on 1st June, 2021

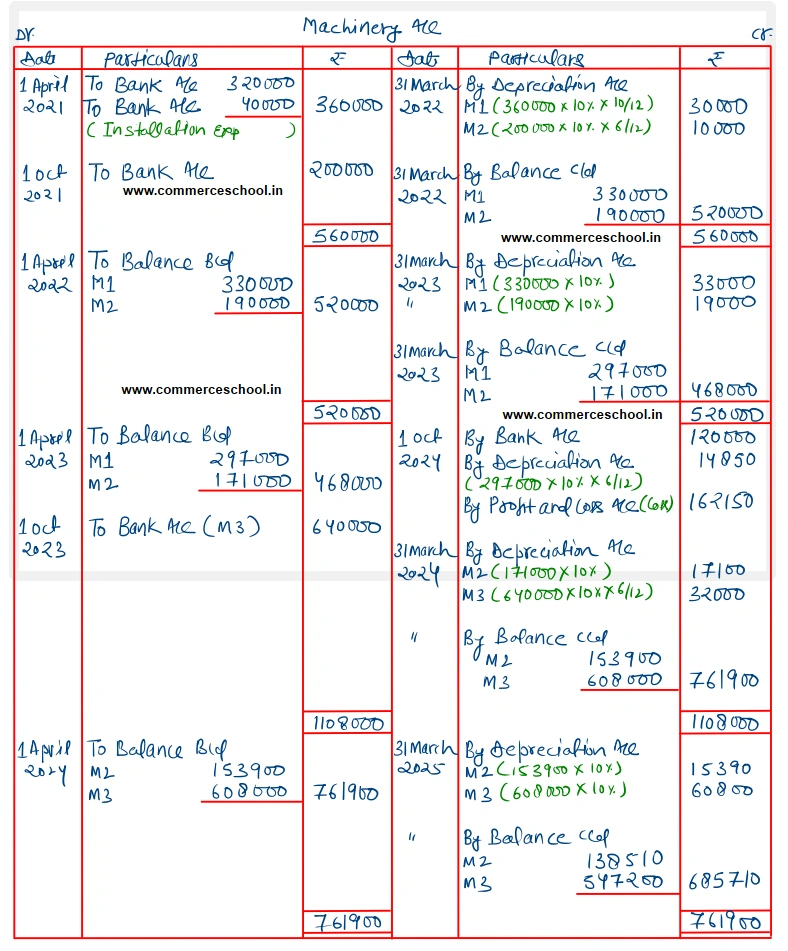

A firm purchased on 1st April, 2021, a second-hand Machinery for ₹ 3,20,000 and spent ₹ 40,000 on its installation. However, it started functioning on 1st June, 2021. On 1st oct. in the same year another Machinery costing ₹ 2,00,000 was purchased.

On 1st Oct., 2023, the Machinery bought on 1st April, 2021 was sold off for ₹ 1,20,000 and on the same date a fresh Machine was purchased for ₹ 6,40,000. Depreciation is provided annually on 31st March, @ 10% p.a. on the Written Down Value Method. Show the Machine A/c from 1st April, 2021 to 31st March, 2025.

[Ans. Loss on sale of Machinery ₹ 1,62,150; Balance of Machinery A/c on 31st March, 2020, ₹ 6,85,710.]

Anurag Pathak Answered question