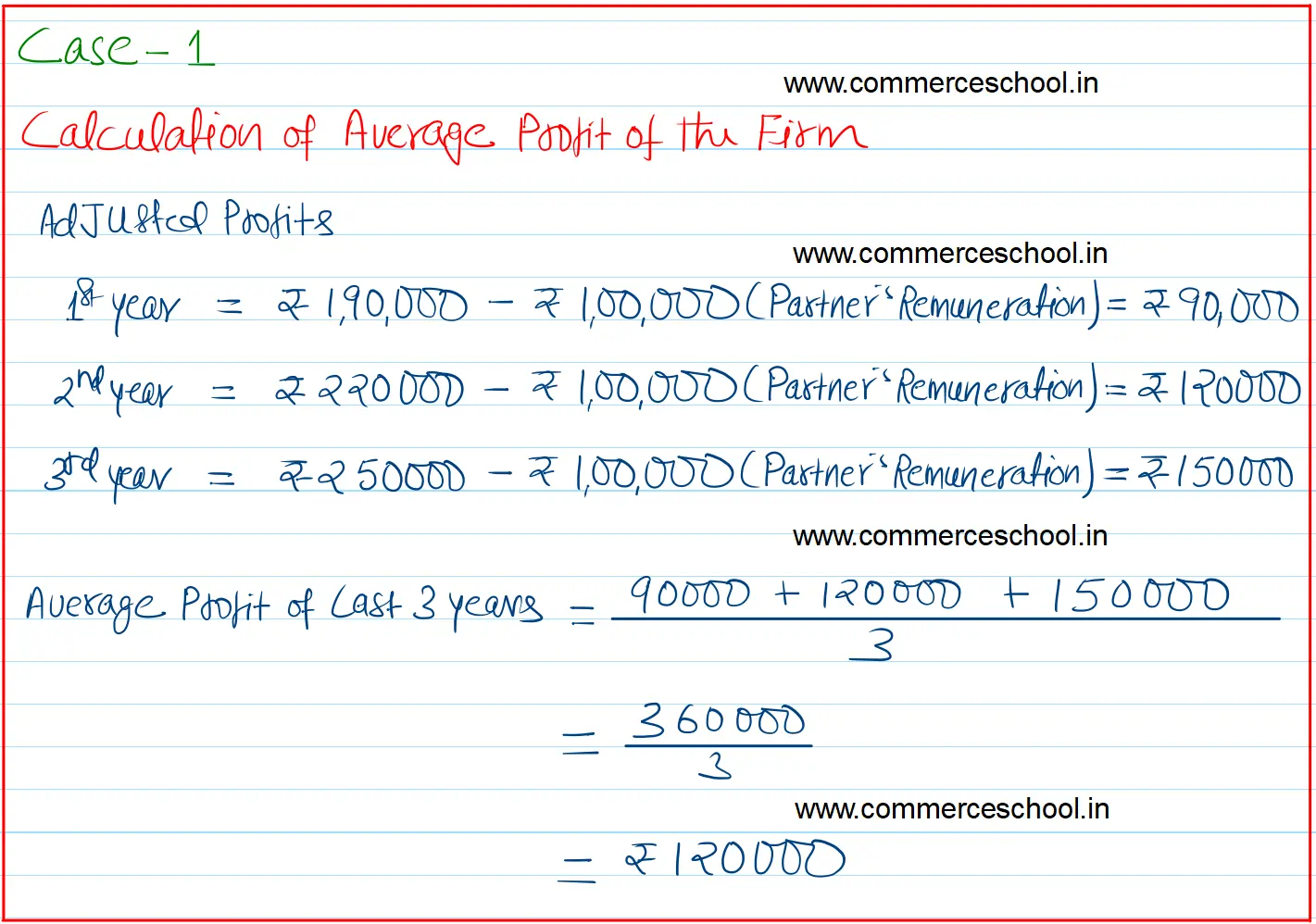

A partnership firm earned net profits during the last three years as follows: 2021 – 22 ₹ 1,90,000 2022 – 23 ₹ 2,20,000

A partnership firm earned net profits during the last three years as follows:

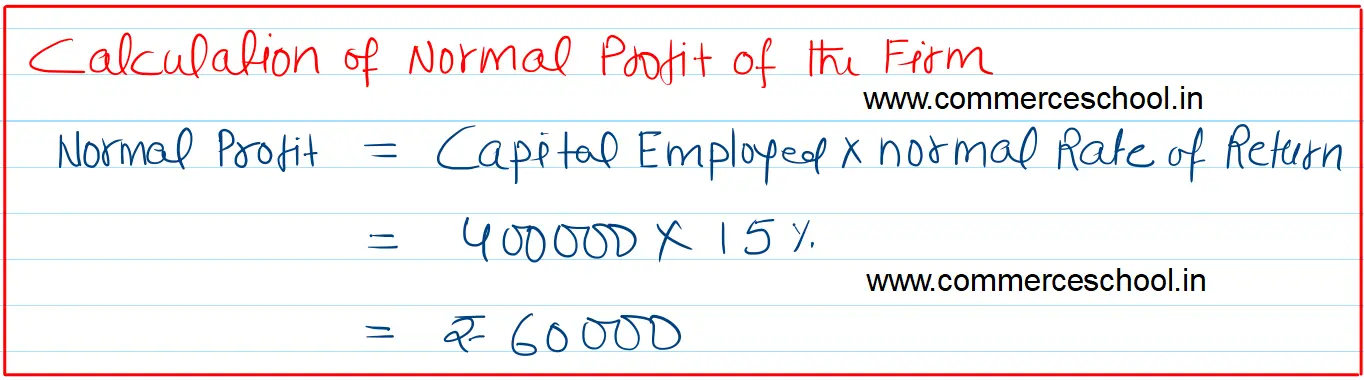

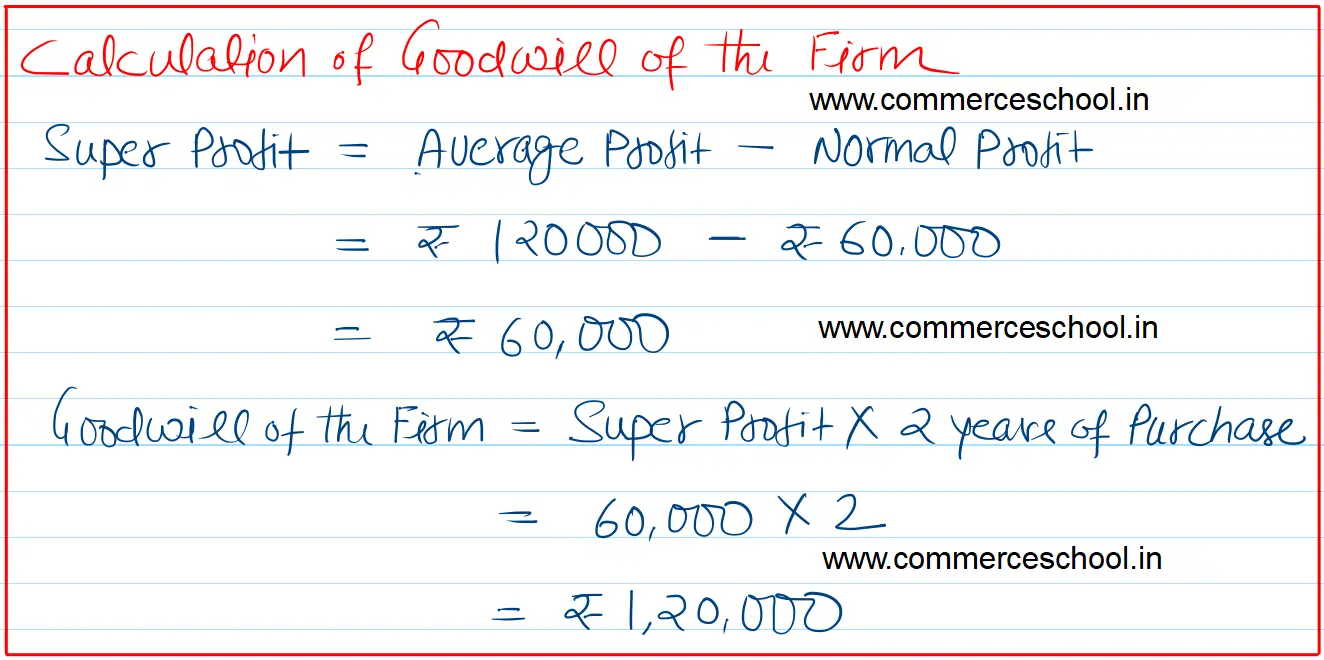

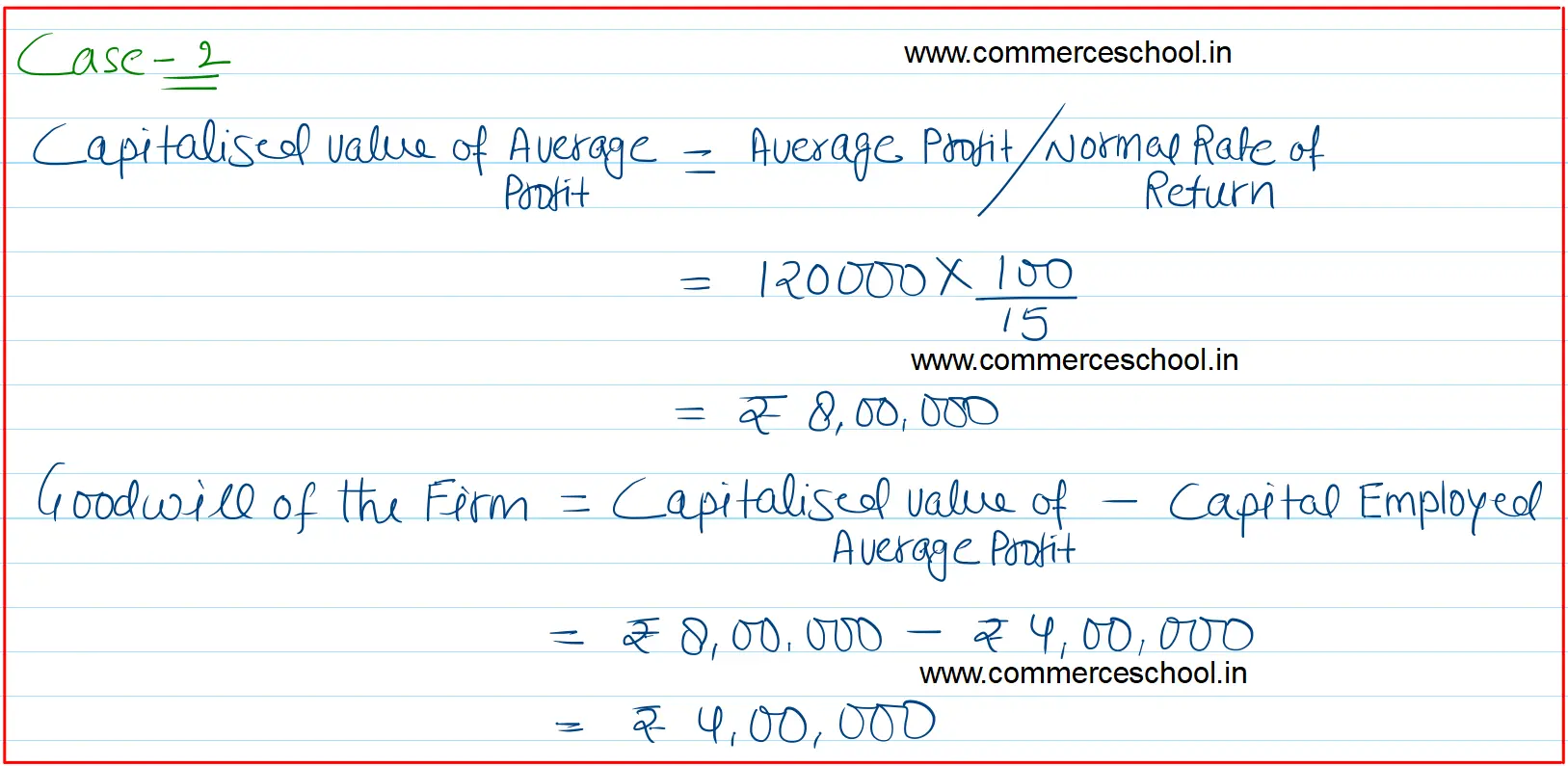

The capital employed in the firm throughout the above mentioned period has been ₹ 4,00,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. The remuneration of all the partners this period is estimated to be ₹ 1,00,000 per annum.

Calculate the value of goodwill on the basis of (i) two year’s purchase of super profits on average basis during the above mentioned three years and (ii) by capitalisation of average profits method.

[Ans. (i) As per Super Profits ₹ 1,20,000. (ii) As per Capitalisation of Average Profits ₹ 4,00,000.]

| Years | Net Profit (₹) |

| 2021 – 22 | 1,90,000 |

| 2022 – 23 | 2,20,000 |

| 2023 – 24 | 2,50,000 |

Anurag Pathak Answered question