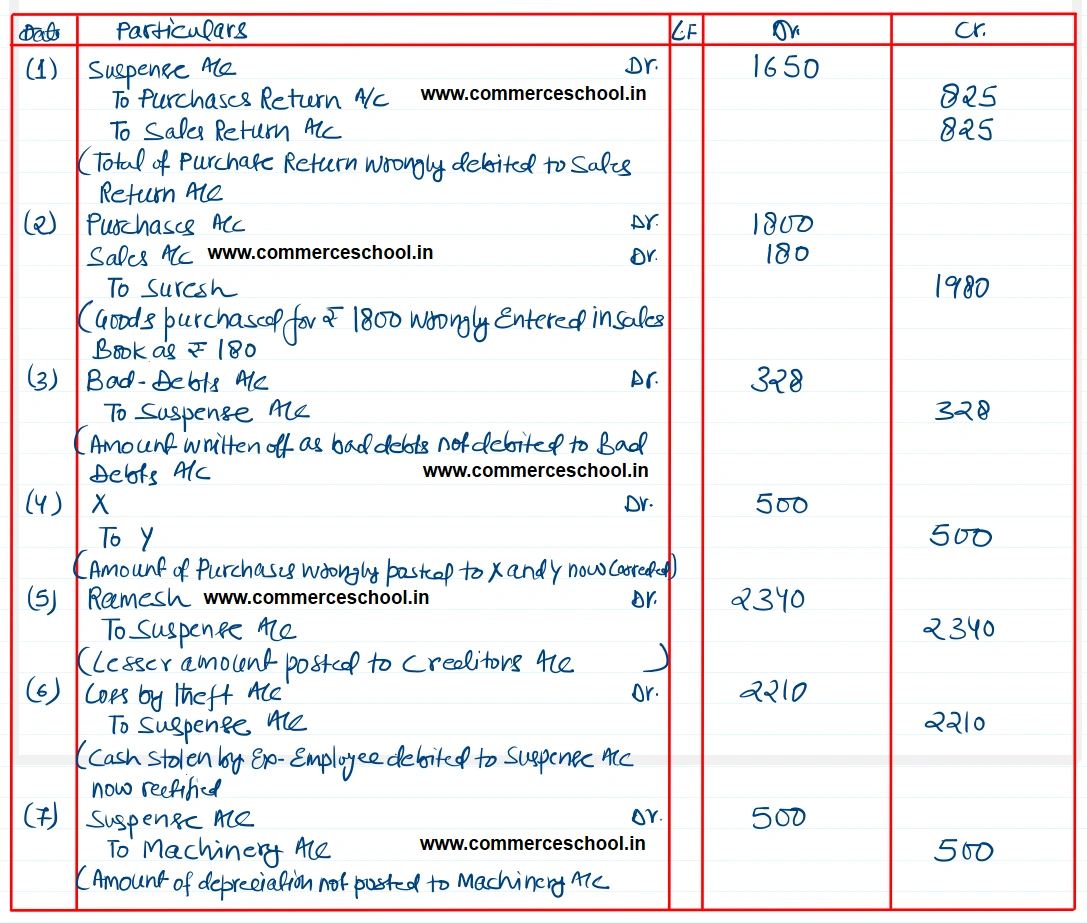

A Trial Balance showed excess credit of ₹ 2,728, which were placed in a suspense account. Later on the following errors were located. Pass rectifying entries and prepare Suspense A/c

A Trial Balance showed excess credit of ₹ 2,728, which were placed in a suspense account. Later on the following errors were located. Pass rectifying entries and prepare Suspense A/c.

(1) ₹ 825, the total of purchase return book has been posted to the debit of sales return account.

(2) Goods purchased from Suresh ₹ 1,800 recorded in Sales Book as ₹ 180.

(3) An item of ₹ 328 written off as a bad debt from Ajay Sharma has not been debited to Bad Debts Account.

(4) Goods purchased from X ₹ 3,500 and from Y ₹ 4,000, but were recorded in the purchase book as X ₹ 4,000 and Y ₹ 3,500k.

(5) Goods returned to Ramesh for ₹ 2,600 was correctly recorded in the return outward book but was wrongly posted to his account as ₹ 260.

(6) A sum of ₹ 2,210 stolen by an ex-employee stand debited to Suspense A/c.

(7) A sim of ₹ 500 written off as depreciation on Machinery, were not posted to Machinery account.

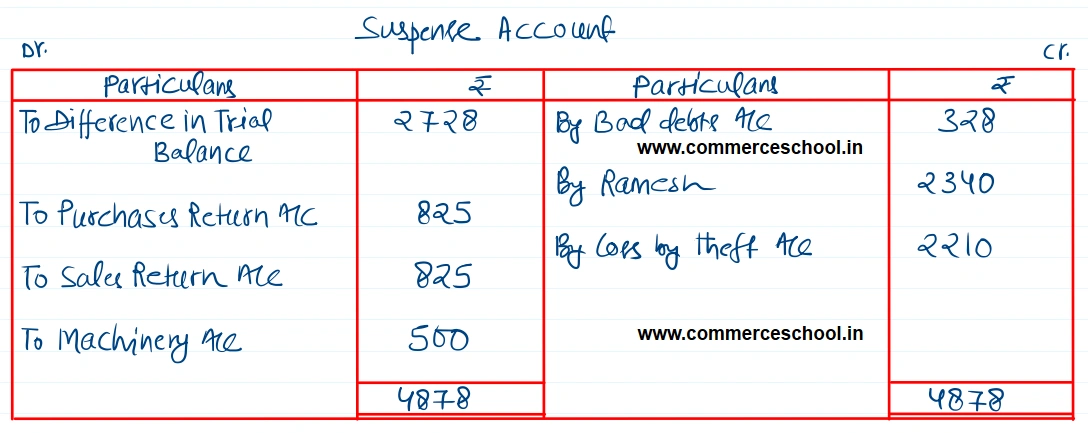

[Ans. Suspense A/c tallies, Total of Both sides of Suspense A/c ₹ 4,878. Item No. 2 & 4 do not affect Suspense A/c]