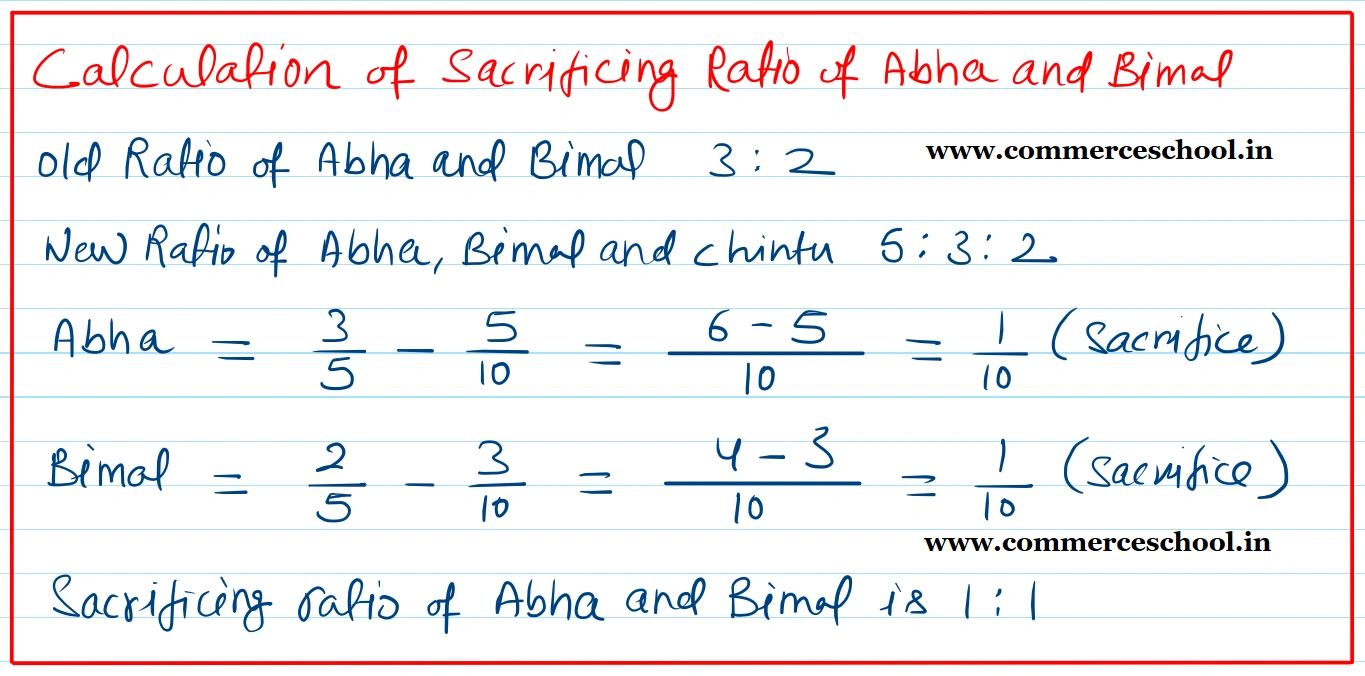

Abha and Bimal are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2015 they admitted Chintu into partnership for 1/5th share in the profits of the firm

Abha and Bimal are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2015 they admitted Chintu into partnership for 1/5th share in the profits of the firm. On that date their Balance Sheet stood as under:

Balance Sheet as at 31st March, 2015

| Liabilities | ₹ | Assets | ₹ |

|

Capitals: Abha Bimal |

1,20,000 1,00,000 | Plant and Machinery | 1,30,000 |

| General Reserve | 20,000 | Furniture | 25,000 |

| Sundry Creditors | 1,00,000 | Investments | 1,00,000 |

| Sundry Debtors | 50,000 | ||

| Bank | 35,000 | ||

| 3,40,000 | 3,40,000 |

Chintu was admitted on the following terms:

(i) He will bring ₹ 80,000 as capital and ₹ 30,000 for his share of goodwill premium.

(ii) Partners will share future profits in the ratio of 5 : 3 : 2.

(iii) Profit on revaluation of assets and reassessment of liabilities was ₹ 7,000.

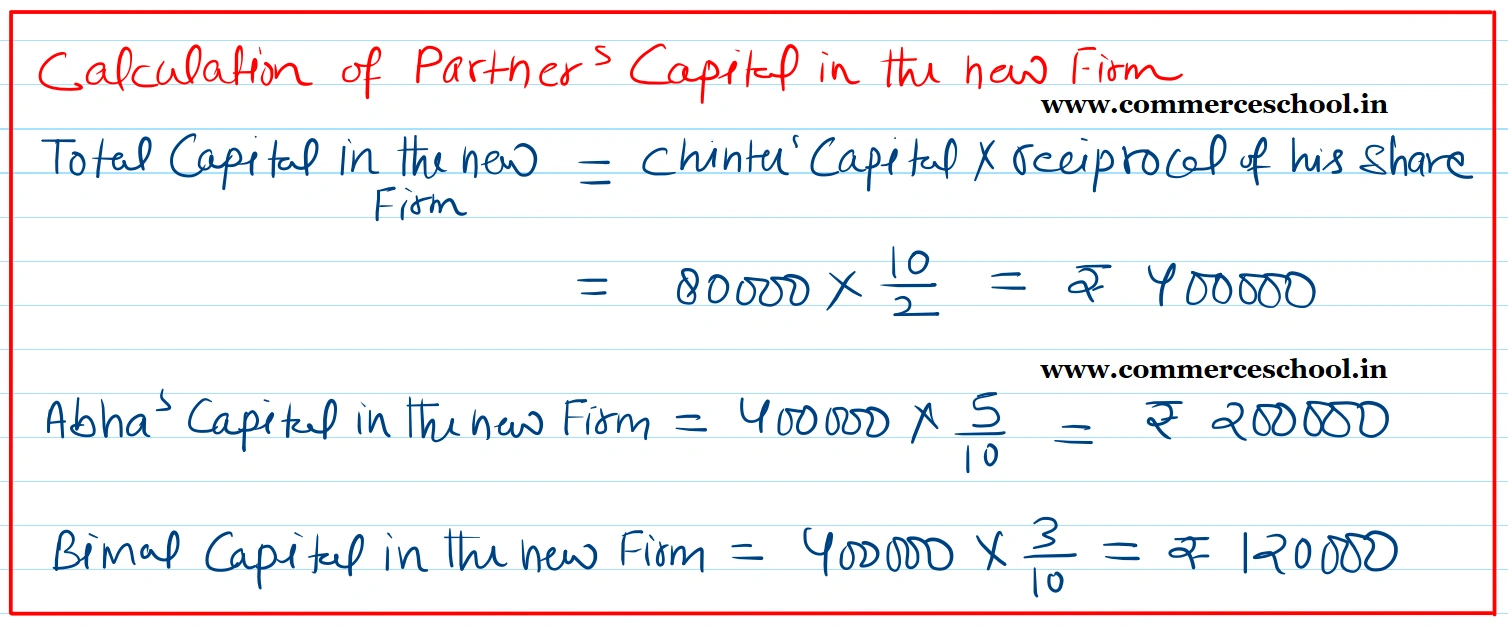

(iv) After making adjustments, the Capital Accounts of the partners will be in proportion to Chintu’s Capital. Balance to be paid off or brought in by the old partners by cheque as the case may be.

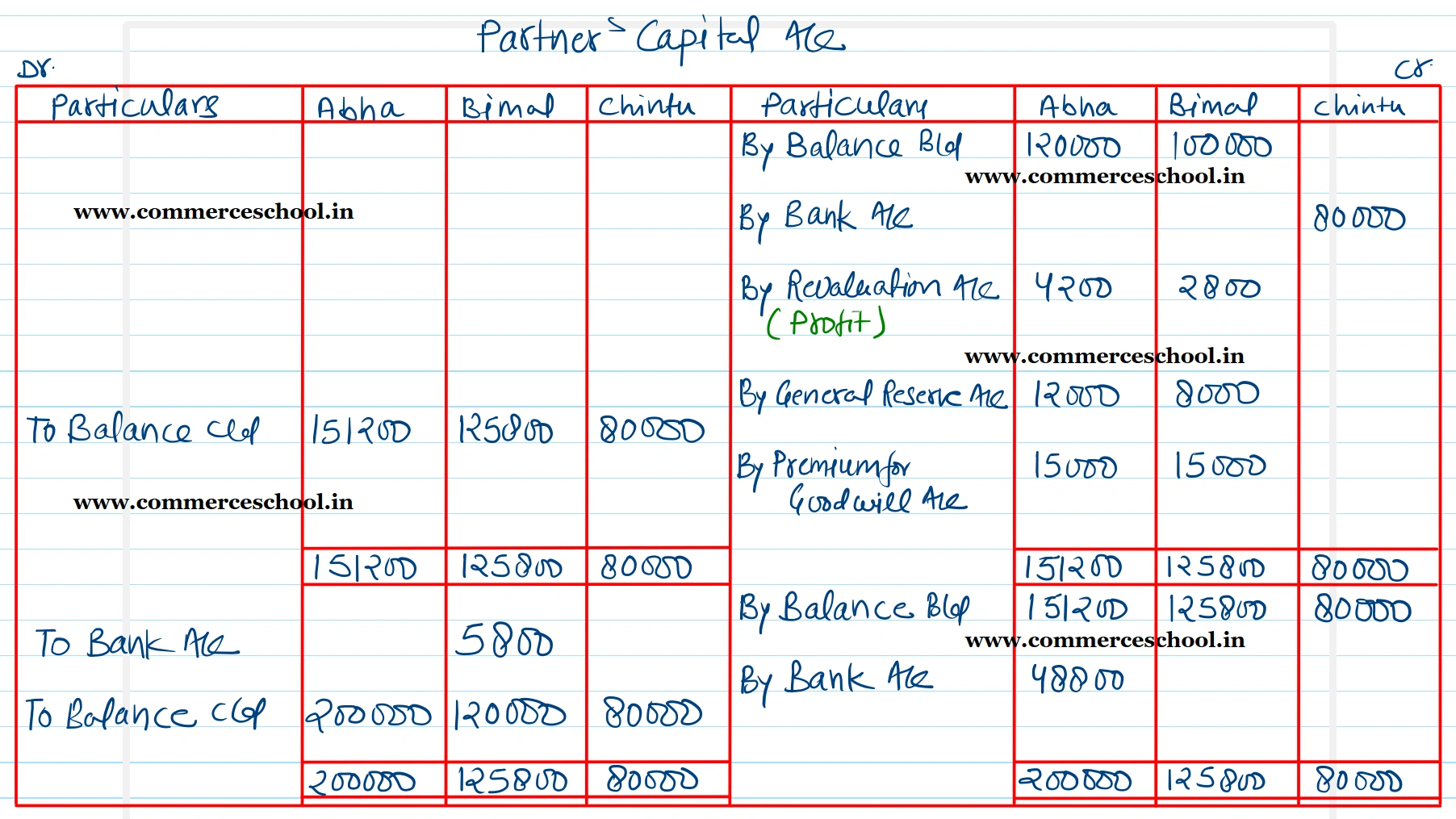

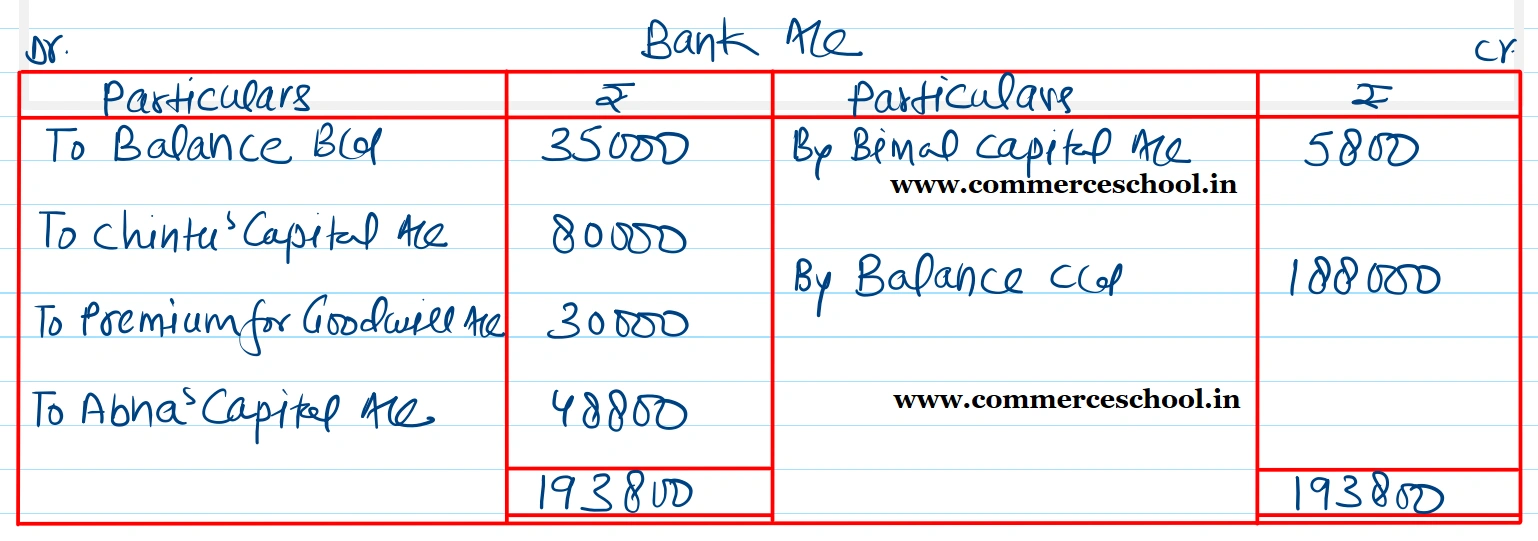

Prepare the Capital Accounts of the partners and Bank Account.

[Ans. Final Capitals: Abha ₹ 2,00,000, Bimal ₹ 1,20,000 and Chintu ₹ 80,000. Abha brings in ₹ 48,800 and Bimal withdraws ₹ 5,800. Bank Balance ₹ 1,88,000.]