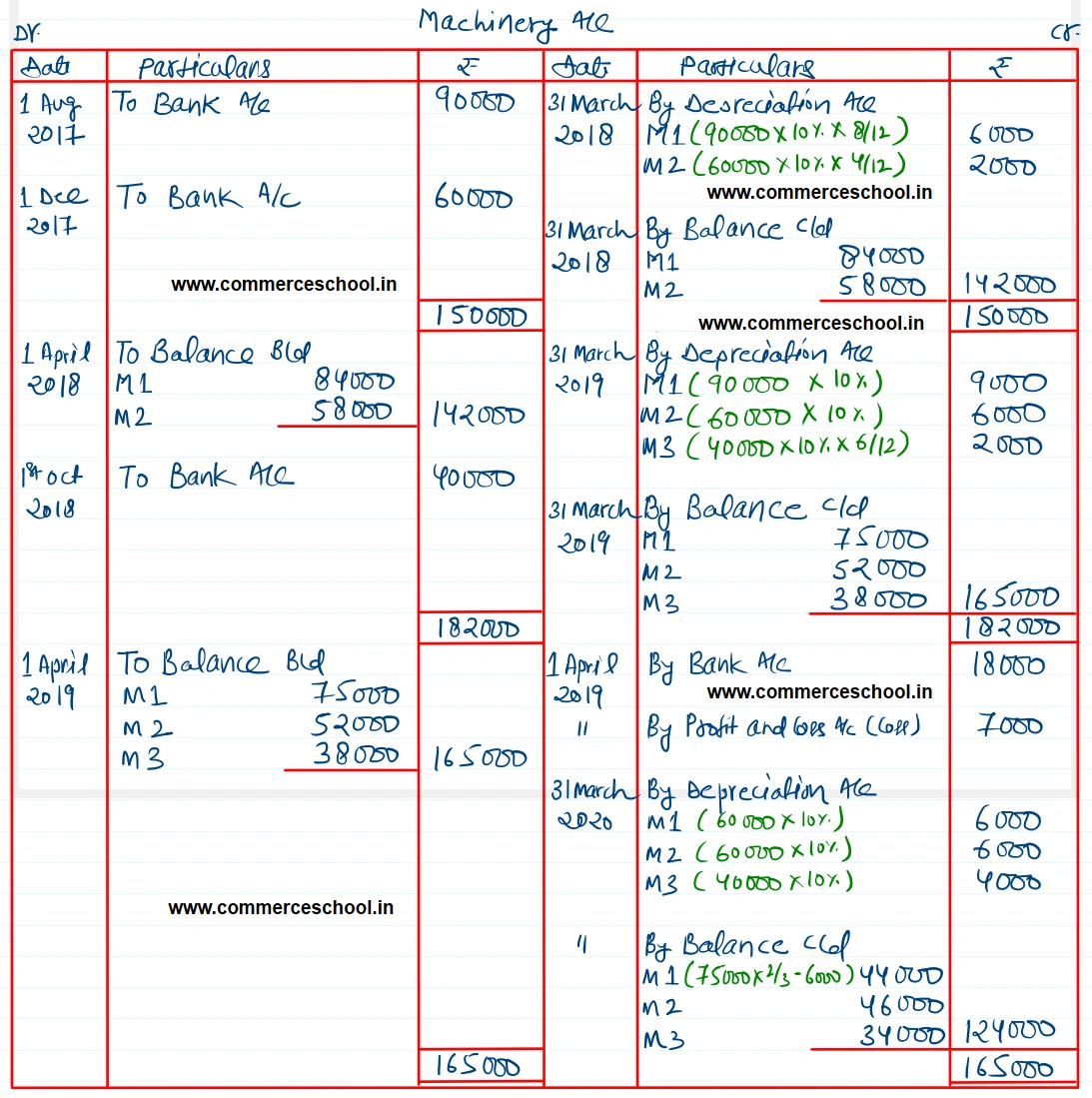

Abhinandan Ltd. bought a machinery on 1st August, 2017, costing ₹ 90,000. It purchased further machinery on 1st December, 2017 costing ₹ 60,000 and on 1st October, 2018 it bought machine costing ₹ 40,000

Abhinandan Ltd. bought a machinery on 1st August, 2017, costing ₹ 90,000. It purchased further machinery on 1st December, 2017 costing ₹ 60,000 and on 1st October, 2018 it bought machine costing ₹ 40,000.

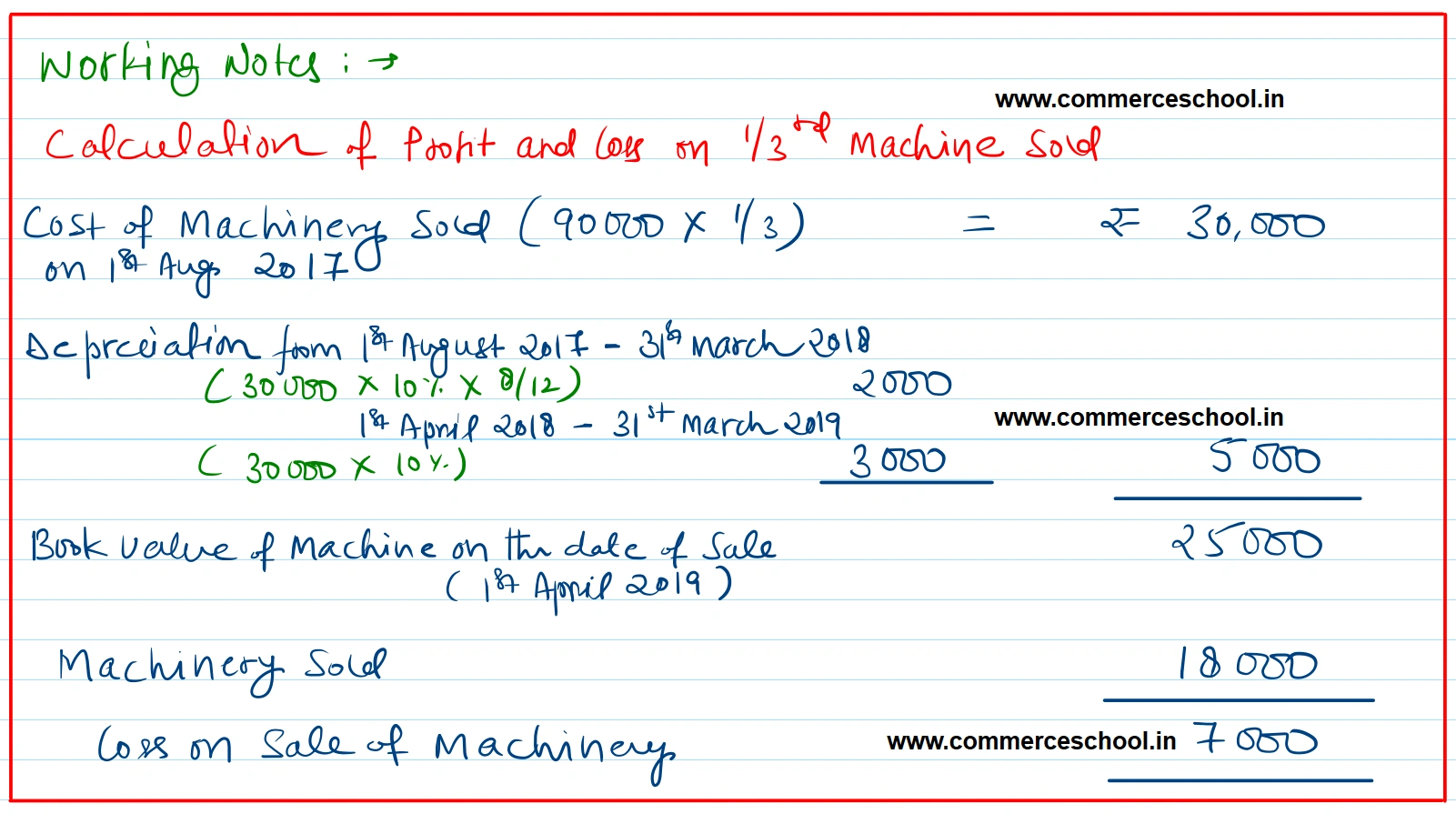

On 1st April, 2019, one third part of the machinery bought on 1st August 2017 was sold for ₹ 18,000 as it became obsolete. Show the Machinery Account for three years ended 31st March 2018 to 31st March 2020. Company is charging Depreciation @ 10% p.a. as per Straight Line Method.

[Ans. Loss on Sale of Machinery ₹ 7,000; Balance of Machinery A/c on 31st March, 2020 ₹ 1,24,000.]

Anurag Pathak Answered question